Earnings summaries and quarterly performance for ROGERS.

Executive leadership at ROGERS.

Ali El-Haj

Interim President and Chief Executive Officer

Jessica Morton

Senior Vice President, General Counsel and Corporate Secretary

Laura Russell

Senior Vice President, Chief Financial Officer, and Treasurer

Michael Webb

Senior Vice President, Chief Administrative Officer

Board of directors at ROGERS.

Research analysts who have asked questions during ROGERS earnings calls.

Craig Ellis

B. Riley Securities

6 questions for ROG

Daniel Moore

CJS Securities, Inc.

3 questions for ROG

Dan Moore

B. Riley Securities

3 questions for ROG

David Silver

CL King & Associates

3 questions for ROG

Recent press releases and 8-K filings for ROG.

- Rogers Corporation reported Q4 2025 sales of $202 million, adjusted EPS of $0.89 per share, and adjusted EBITDA margins of 17.1%, all exceeding the top end of guidance. Sales improved 5% and adjusted EBITDA margins increased 500 basis points compared to Q4 2024.

- For the full year 2025, the company generated $71 million of free cash flow, repurchased $52 million in shares, and ended the year with $197 million of net cash. Rogers also realized $25 million in cost and operating expenses improvement in 2025.

- For Q1 2026, Rogers expects revenues between $193 million and $208 million, adjusted EBITDA ranging from $27 million to $35 million (midpoint 15.5% margin, 530 basis points improvement year-over-year), and adjusted EPS between $0.45 and $0.85.

- The company anticipates $20 million of annualized savings to be completed by the end of 2026, including $13 million in annual run rate savings from the ceramic Germany restructuring, with benefits expected in the second half of 2026. Returning to top-line growth is the highest priority for 2026, and M&A will be an area of increased emphasis.

- Rogers Corporation reported Q4 2025 sales of $202 million, adjusted EPS of $0.89 per share, and adjusted EBITDA margins of 17.1%, all exceeding the top end of guidance. Sales improved 5% compared to Q4 2024.

- The company generated $71 million of free cash flow for the full year 2025 and repurchased $14 million in shares during Q4, ending the year with $197 million of net cash.

- For Q1 2026, Rogers anticipates revenues between $193 million and $208 million (midpoint a 5% increase year-over-year), adjusted EBITDA between $27 million and $35 million (midpoint 15.5% margin), and adjusted EPS between $0.45 and $0.85 (midpoint $0.65).

- Rogers realized $25 million in cost and operating expenses improvement in 2025, with an additional $20 million of annualized savings expected by the end of 2026, including $13 million from the Curamik Germany restructuring.

- Strategic priorities for 2026 include achieving top-line growth, further improving profitability, and increasing emphasis on M&A, while also targeting data centers as a significant new market.

- Rogers Corporation reported strong Q4 2025 results, with sales of $202 million, adjusted EPS of $0.89 per share, and adjusted EBITDA margins of 17.1%, all exceeding the top end of guidance and showing significant year-over-year improvements.

- For Q1 2026, the company anticipates continued year-over-year growth and margin expansion, with sales guided between $193 million and $208 million, adjusted EBITDA between $27 million and $35 million, and adjusted EPS between $0.45 and $0.85.

- In 2025, Rogers generated $71 million in free cash flow, repurchased $52 million in shares, and ended the year with $197 million of net cash, while also realizing $25 million in cost and operating expense improvements.

- The company expects an additional $20 million in annualized savings by the end of 2026 and $13 million in annual run rate savings from the ceramic Germany restructuring, with a strategic focus on top-line growth, profitability, and M&A, including targeting data centers as a significant new market.

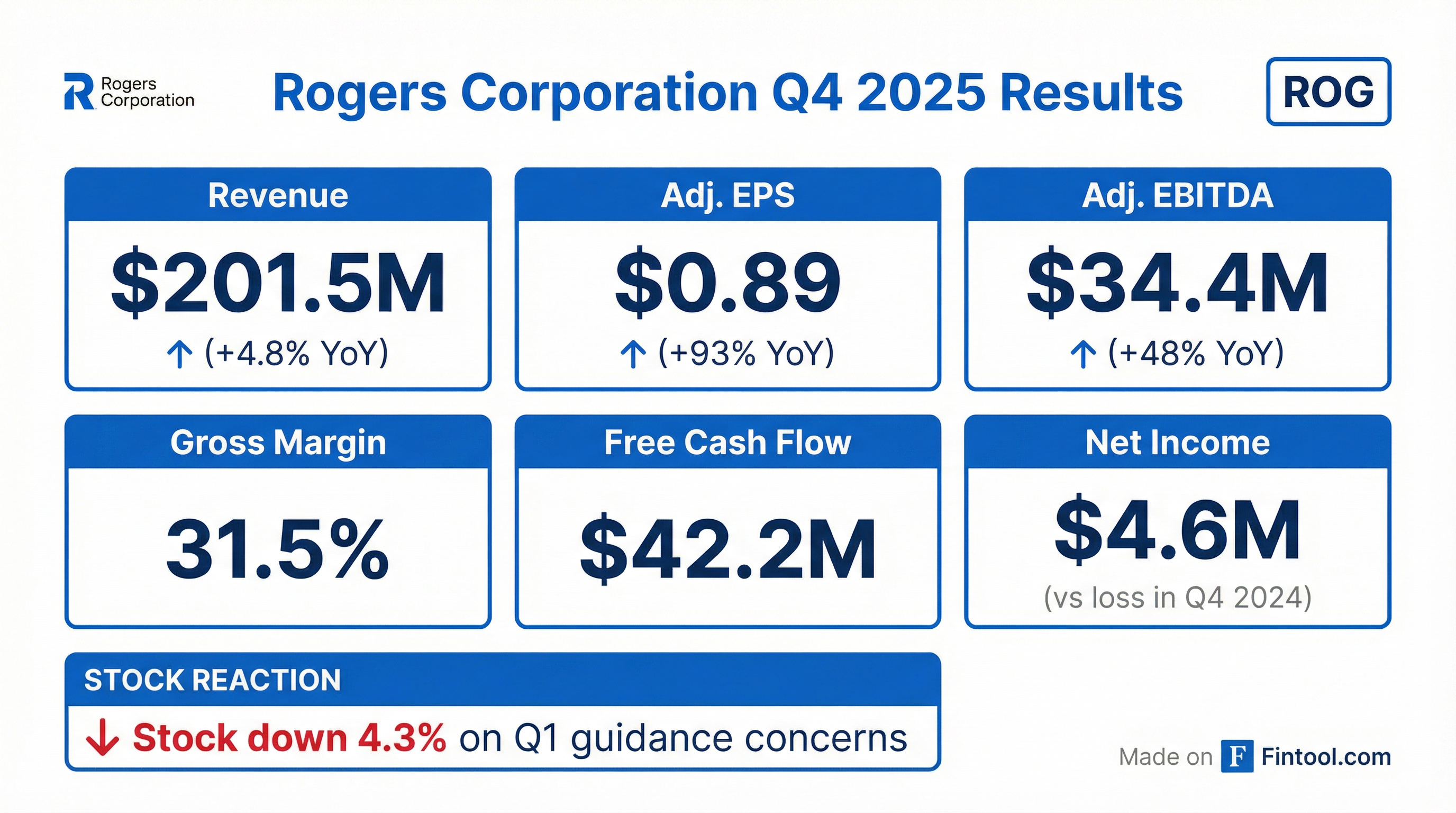

- For Q4 2025, ROGERS reported net sales of $201.5 million, adjusted earnings per diluted share of $0.89, and an adjusted EBITDA margin of 17.1%, with sales increasing 5% year-over-year and adjusted EPS increasing 93% year-over-year.

- For the full year 2025, the company achieved net sales of $810.8 million, adjusted earnings per diluted share of $2.39, generated $71.1 million in free cash flow, and ended the year with a net cash position of $197 million.

- ROGERS announced $45 million in cost reductions with full realization expected by Q4 2026 and reduced adjusted operating expenses by 8% versus the prior year.

- For Q1 2026, the company expects net sales between $193 million and $208 million and adjusted earnings per diluted share between $0.45 and $0.85, with the sales midpoint representing a 5% year-over-year increase.

- Rogers reported Q4 2025 revenue of $201.5 million, exceeding expectations, driven by stronger industrial, ADAS, and renewable energy demand.

- For full-year 2025, the company recorded $810.8 million in net sales but a GAAP net loss of $61.8 million due to nonrecurring items and restructuring, with adjusted earnings per share at $2.39.

- The company demonstrated significant margin and cash flow expansion in Q4 2025, with its operating margin improving to 3.5% and free cash flow margin rising to 20.9%.

- Rogers ended 2025 with $197.0 million in cash after executing $14.3 million of share repurchases.

- For Q1 2026, Rogers guided revenue roughly in a $193M–$208M range (midpoint near $200.5M) and provided adjusted EPS midpoint of $0.65, both below some analysts’ estimates.

- Rogers Corporation announced net sales of $201.5 million for Q4 2025 and $810.8 million for the full year 2025.

- For Q4 2025, the company reported diluted earnings per share of $0.26 and adjusted earnings per diluted share of $0.89, with adjusted EBITDA of $34.4 million.

- The company provided Q1 2026 guidance, projecting net sales between $193 million and $208 million and adjusted earnings per diluted share between $0.45 and $0.85.

- Management highlighted solid execution in Q4 2025, leading to results that met or exceeded guidance, and expressed optimism for a return to growth and improved shareholder results in 2026.

- Rogers Corporation announced net sales of $201.5 million for the fourth quarter of 2025, marking a 4.8% increase over the prior year quarter, and $810.8 million for the full year 2025.

- For Q4 2025, adjusted earnings per diluted share rose to $0.89 from $0.46 in Q4 2024, while full-year 2025 adjusted earnings per share were $2.39.

- The company issued Q1 2026 guidance, projecting net sales of $193 million to $208 million and adjusted earnings per diluted share of $0.45 to $0.85.

- In Q4 2025, share repurchases amounted to $14.3 million.

- Genentech, a member of the Roche Group (ROG), announced positive topline results from its Phase II clinical trial (CT388-103) for CT-388, an investigational dual GLP-1/GIP receptor agonist for obesity.

- The study demonstrated a statistically significant placebo-adjusted weight loss of 22.5% at 48 weeks with the highest dose (24 mg) of CT-388.

- 54% of participants on the 24 mg dose achieved resolution of obesity (BMI <30 kg/m2).

- CT-388 exhibited a safety and tolerability profile generally consistent with its drug class, with most gastrointestinal-related adverse events being mild-to-moderate and a low discontinuation rate due to adverse events.

- The Phase III clinical trial program for CT-388 in obesity is expected to start this quarter.

- Genentech, a member of the Roche Group, announced an agreement with the U.S. government to address prescription drug costs and encourage biopharmaceutical innovation.

- Under the agreement, Genentech will make many of its medicines available for state Medicaid programs at prices comparable to those in other wealthy countries and expand its direct-to-patient flu medicine program via TrumpRx.gov.

- The company reaffirmed its commitment to U.S. manufacturing, infrastructure, and R&D, building on a recent $50 billion investment that is expected to create over 11,000 jobs.

- As part of the agreement, Genentech received a three-year exemption from tariffs and will not be subject to future pricing mandates.

- Giredestrant, an experimental oral selective estrogen receptor degrader (SERD), demonstrated a 30% reduction in the risk of invasive disease recurrence or death in patients with early-stage, hormone receptor-positive, HER2-negative breast cancer, according to phase III lidERA trial results.

- The trial, presented at the 2025 San Antonio Breast Cancer Symposium, showed 92.4% of patients on giredestrant were alive and disease-free after three years, compared to 89.6% on standard therapy, and the drug also reduced distant metastasis risk by 31%.

- This marks the first time an oral SERD has shown a statistically significant and clinically meaningful disease-free survival benefit in the adjuvant setting, potentially establishing giredestrant as a new standard-of-care treatment.

- Roche and Genentech (ROG) anticipate worldwide regulatory submissions for giredestrant, with projected revenues up to $5 billion per year if approved.

Quarterly earnings call transcripts for ROGERS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more