Earnings summaries and quarterly performance for Reservoir Media.

Executive leadership at Reservoir Media.

Board of directors at Reservoir Media.

Research analysts who have asked questions during Reservoir Media earnings calls.

Recent press releases and 8-K filings for RSVR.

Reservoir Media Reports Q3 FY2026 Results and Raises Full-Year Guidance

RSVR

Earnings

Guidance Update

M&A

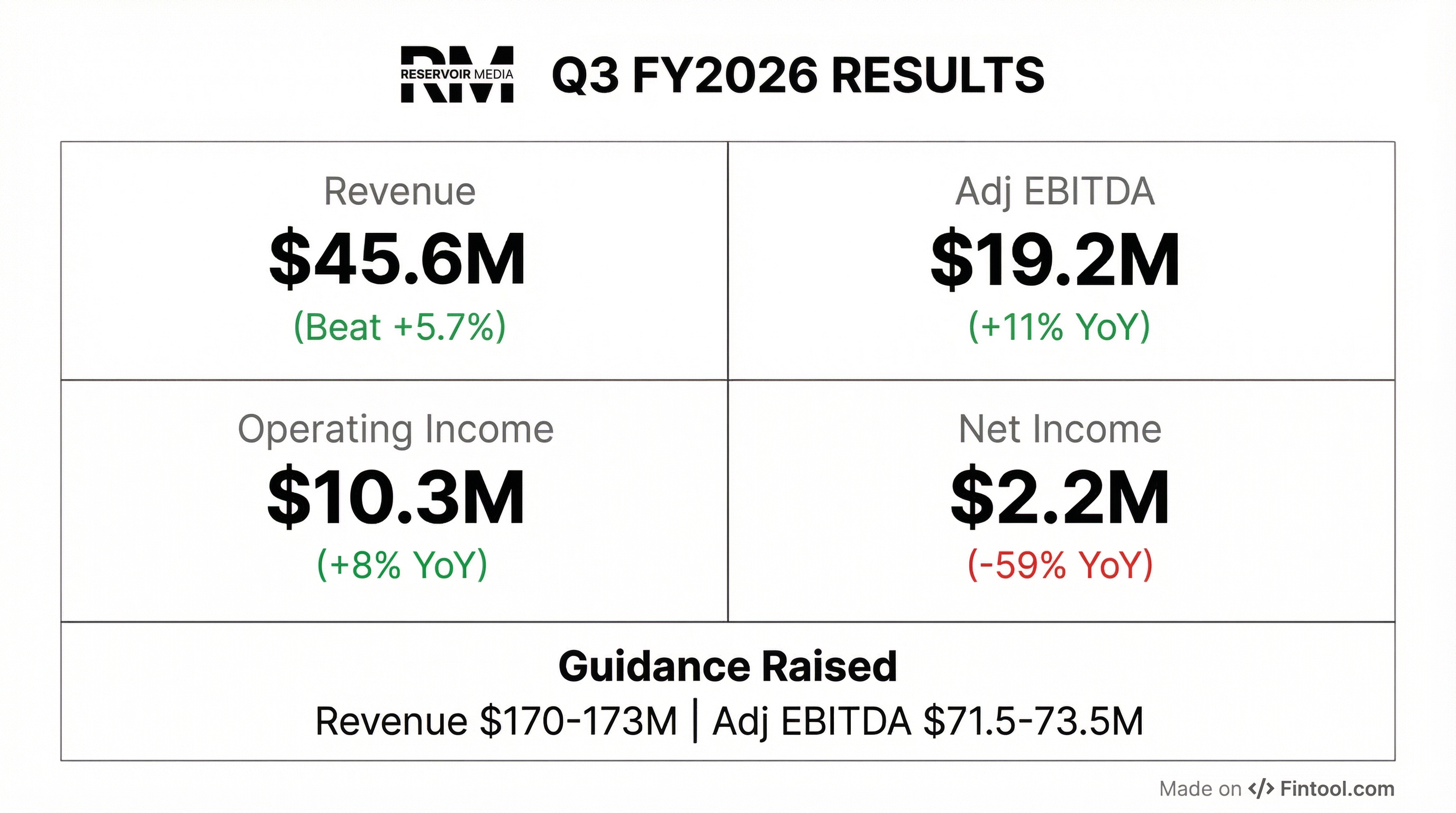

- Reservoir Media reported Q3 FY2026 revenue of $45.6 million, an 8% increase year-over-year, driven by 12% growth in music publishing revenue and 8% growth in recorded music revenue.

- Adjusted EBITDA rose 11% year-over-year to $19.2 million, though earnings per share (EPS) declined to $0.03 from $0.08 in the prior year, primarily due to a loss on fair value of swaps and increased interest expense.

- The company raised its full-year fiscal 2026 revenue guidance to $170 million - $173 million and Adjusted EBITDA guidance to $71.5 million - $73.5 million.

- Strategic activities included the acquisition of Bertie Higgins' catalog and new partnerships with Gladys Knight and T.I., with a continued focus on emerging markets offering favorable acquisition multiples. Management expects M&A activity to continue at an elevated pace in Q4.

3 days ago

Reservoir Media Reports Q3 FY 2026 Results and Raises Full-Year Guidance

RSVR

Earnings

Guidance Update

M&A

- Reservoir Media reported Q3 FY 2026 revenue of $45.6 million, an 8% year-over-year increase (5% organic), with music publishing revenue up 12% and recorded music revenue up 8%.

- For Q3 FY 2026, OIBDA increased 11% to $18.1 million and Adjusted EBITDA also rose 11% to $19.2 million.

- The company raised its full-year fiscal 2026 revenue guidance to $170 million-$173 million and Adjusted EBITDA guidance to $71.5 million-$73.5 million.

- Net income for the quarter was $2.2 million, down from $5.3 million in the prior year, primarily due to a loss on fair value of swaps and increased interest expense, leading to EPS of $0.03.

- Strategic activities included continued catalog acquisitions (e.g., Bertie Higgins, Miles Davis, Gladys Knight, T.I.) and expansion into high-growth emerging markets such as India and Jamaica, noting favorable acquisition multiples in these regions.

3 days ago

Reservoir Media Announces Q3 Fiscal Year 2026 Results and Raises Full-Year Guidance

RSVR

Earnings

Guidance Update

M&A

- Reservoir Media reported Q3 Fiscal Year 2026 revenue of $45.6 million, an 8% increase year-over-year including acquisitions, driven by 12% growth in music publishing and 8% growth in recorded music.

- Adjusted EBITDA increased 11% year-over-year to $19.2 million, though net income decreased to $2.2 million ($0.03 EPS) compared to $5.3 million ($0.08 EPS) in the prior year.

- The company raised its full-year fiscal 2026 revenue guidance to $170 million-$173 million and Adjusted EBITDA guidance to $71.5 million-$73.5 million.

- Strategic highlights for the quarter ended December 31, 2025, included the acquisition of Bertie Higgins' catalog, new partnerships with Gladys Knight and T.I., and continued expansion in emerging markets, with M&A activity expected to remain elevated.

3 days ago

Reservoir Media Announces Third Quarter Fiscal 2026 Results and Raises Full-Year Outlook

RSVR

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Reservoir Media, Inc. reported Q3 FY26 revenue of $45.6 million, an 8% increase year-over-year, and Adjusted EBITDA of $19.2 million, up 11%.

- Despite top-line growth, Net Income decreased by 59% to $2.2 million, or $0.03 per share, primarily due to a loss on fair value of swaps and increased interest expense.

- The company raised its fiscal year 2026 outlook, now projecting Revenue between $170 million and $173 million and Adjusted EBITDA between $71.5 million and $73.5 million.

- As of December 31, 2025, total available liquidity was $114.8 million, with Net Debt at $431.7 million.

3 days ago

Reservoir Media, Inc. reports Q2 Fiscal Year 2026 results and updates Fiscal Year 2026 outlook

RSVR

Earnings

Guidance Update

M&A

- Reservoir Media, Inc. reported Q2 Fiscal Year 2026 results with 12% total revenue growth year-over-year and 10% Adjusted EBITDA growth year-over-year.

- The company provided a Fiscal Year 2026 outlook, narrowing its revenue guidance to $167 - $170 million (6% growth at mid-point) and Adjusted EBITDA guidance to $70 - $72 million (8% growth at mid-point).

- As of September 30, 2025, Reservoir Media, Inc. had a market capitalization of $534 million with 66 million shares outstanding, and reported $422 million in total debt and $28 million in cash.

- The company has a proven M&A platform, deploying $918 million in capital since inception and identifying 100+ M&A targets totaling over $1 billion in its current pipeline as of September 30, 2025.

Nov 17, 2025, 9:06 PM

Reservoir Media Reports Strong Q2 FY2026 Results and Raises Full-Year Guidance

RSVR

Earnings

Guidance Update

M&A

- Reservoir Media reported strong Q2 Fiscal Year 2026 results, with revenue increasing 12% year-over-year to $45.4 million and diluted earnings per share of $0.03 compared to $0.00 in the prior year quarter ended September 30, 2025.

- Adjusted EBITDA grew 10% year-over-year to $19.4 million for the quarter.

- The company raised and narrowed its Fiscal Year 2026 revenue guidance to a range of $167 million to $170 million and its Adjusted EBITDA guidance to $70 million to $72 million.

- Strategic developments include the acquisition of the Miles Davis publishing catalog and rights, expansion into the MENA region, and an option granted to Miramax for a "Monster Mash" animated film.

Nov 4, 2025, 3:00 PM

Reservoir Media Reports Strong Q2 FY2026 Results, Raises Full-Year Guidance, and Acquires Miles Davis Catalog

RSVR

Earnings

Guidance Update

M&A

- Reservoir Media reported Q2 Fiscal 2026 revenue of $45.4 million, marking a 12% year-over-year increase, with 7% organic growth and 5% from acquisitions. Adjusted EBITDA grew 10% to $19.4 million, and diluted earnings per share (EPS) reached $0.03.

- The company raised and narrowed its full-year Fiscal 2026 guidance, with revenue now projected between $167 million and $170 million (up from $164 million to $169 million) and adjusted EBITDA between $70 million and $72 million (up from $68 million to $72 million).

- Key strategic moves included the acquisition of the Miles Davis publishing catalog, recorded music rights, and name/likeness, with plans for significant 100th-anniversary celebrations in 2026.

- Reservoir Media also expanded its portfolio by extending its publishing deal for Nick Drake and securing a new deal for Molly Drake's catalog, alongside new agreements in the MENA region with HFM Production, Essa Almarzug, and 88 Young.

Nov 4, 2025, 3:00 PM

Reservoir Media Reports Q2 Fiscal 2026 Results with Revenue Growth and Raised Full-Year Guidance

RSVR

Earnings

Guidance Update

M&A

- Reservoir Media reported a 12% increase in Q2 fiscal 2026 revenue, driven by organic growth and acquisitions, including the significant purchase of the Miles Davis catalog.

- Net income for Q2 significantly rose to $2.26 million from $0.185 million a year ago, despite missing earnings per share estimates, posting $0.03 versus the expected $0.05.

- The company has raised its full-year revenue guidance to $167 million to $170 million.

- The CEO emphasized a strategic focus on disciplined catalog investments and partnerships to sustain long-term value.

- Reservoir Media's stock has underperformed relative to the S&P 500 this year, losing about 18.5% compared to the index's gain of 16.5%.

Nov 4, 2025, 1:56 PM

Reservoir Media Announces Second Quarter Fiscal 2026 Results and Raises Fiscal 2026 Outlook

RSVR

Earnings

Guidance Update

M&A

- Reservoir Media, Inc. reported Q2 fiscal 2026 total revenue of $45.4 million, an increase of 12% year-over-year, and net income of $2.2 million, or $0.03 per share for the quarter ended September 30, 2025.

- Adjusted EBITDA for the second quarter of fiscal 2026 increased 10% year-over-year to $19.4 million.

- The company raised its fiscal year 2026 outlook for revenue to between $167 million and $170 million and Adjusted EBITDA to between $70 million and $72 million.

- Strategic highlights include the acquisition of the Miles Davis publishing catalog and recorded music rights, along with new publishing deals and emerging market expansions.

Nov 4, 2025, 1:00 PM

Quarterly earnings call transcripts for Reservoir Media.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more