Earnings summaries and quarterly performance for Runway Growth Finance.

Executive leadership at Runway Growth Finance.

Board of directors at Runway Growth Finance.

Research analysts who have asked questions during Runway Growth Finance earnings calls.

Melissa Wedel

JPMorgan Chase & Co.

4 questions for RWAY

Erik Zwick

Lucid Capital Markets

3 questions for RWAY

Mickey Schleien

Ladenburg Thalmann

3 questions for RWAY

Casey Alexander

Compass Point Research & Trading, LLC

2 questions for RWAY

Cory Johnson

UBS

2 questions for RWAY

Finian O'Shea

Wells Fargo Securities

2 questions for RWAY

Douglas Harter

UBS

1 question for RWAY

Sean-Paul Adams

Not Provided in Transcript

1 question for RWAY

Recent press releases and 8-K filings for RWAY.

- Runway Growth Finance Corp. (Nasdaq: RWAY) announced a first quarter 2026 cash distribution of $0.33 per share.

- The declaration date for this dividend was February 25, 2026, with a record date of March 10, 2026, and a payment date of March 24, 2026.

- The company generally intends to distribute substantially all of its available earnings quarterly, subject to Board discretion and regulatory compliance.

- Runway Growth maintains an "opt out" dividend reinvestment plan, where stockholders who have not opted out will have their cash dividends automatically reinvested in additional shares.

- On February 3, 2026, Runway Growth Finance Corp. issued $103,250,000 in aggregate principal amount of its 7.25% Notes due 2031.

- These unsecured Notes will mature on February 3, 2031, and bear an interest rate of 7.25% per year, payable quarterly in arrears commencing March 1, 2026.

- The Company has the option to redeem the Notes, in whole or in part, on or after February 3, 2028, at a redemption price of $25 per Note plus accrued and unpaid interest.

- The net proceeds from this offering are intended to repay outstanding indebtedness, including the redemption of all 8.00% Notes and a portion of the 7.50% Notes, and for other general corporate purposes.

- Runway Growth Finance Corp. entered an underwriting agreement on January 27, 2026, to issue $100.0 million in 7.25% Notes due 2031.

- The offering includes a 30-day option for underwriters to purchase up to an additional $15.0 million in notes, with the closing expected on February 3, 2026.

- The company plans to use the net proceeds to repay outstanding indebtedness, including its 8.00% Notes due 2027 and a portion of its 7.50% Notes due 2027, and for general corporate purposes.

- Runway Growth Finance Corp. has priced an underwritten public offering of $100.0 million aggregate principal amount of notes due 2031.

- The notes will bear an annual interest rate of 7.25%, with net proceeds to the company estimated at approximately $97.0 million.

- The company plans to use the proceeds primarily to repay existing indebtedness, including $51.75 million of 8.00% Notes due 2027 and $80.5 million of 7.50% Notes due 2027.

- The offering is expected to close on February 3, 2026, and the notes are intended to be listed on the Nasdaq Global Select Market under the symbol "RWAYI".

- Runway Growth Finance Corp. has commenced an underwritten offering of unsecured notes.

- The company intends to use the net proceeds to repay outstanding indebtedness, including redeeming all or a portion of its 8.00% Notes due 2027, to finance the acquisition of SWK Holdings Corporation, and for general corporate purposes.

- As of January 23, 2026, the company had $51.75 million of indebtedness outstanding under the December 2027 Notes.

- The company has applied for the Notes to be listed and trade on the Nasdaq Global Select Market.

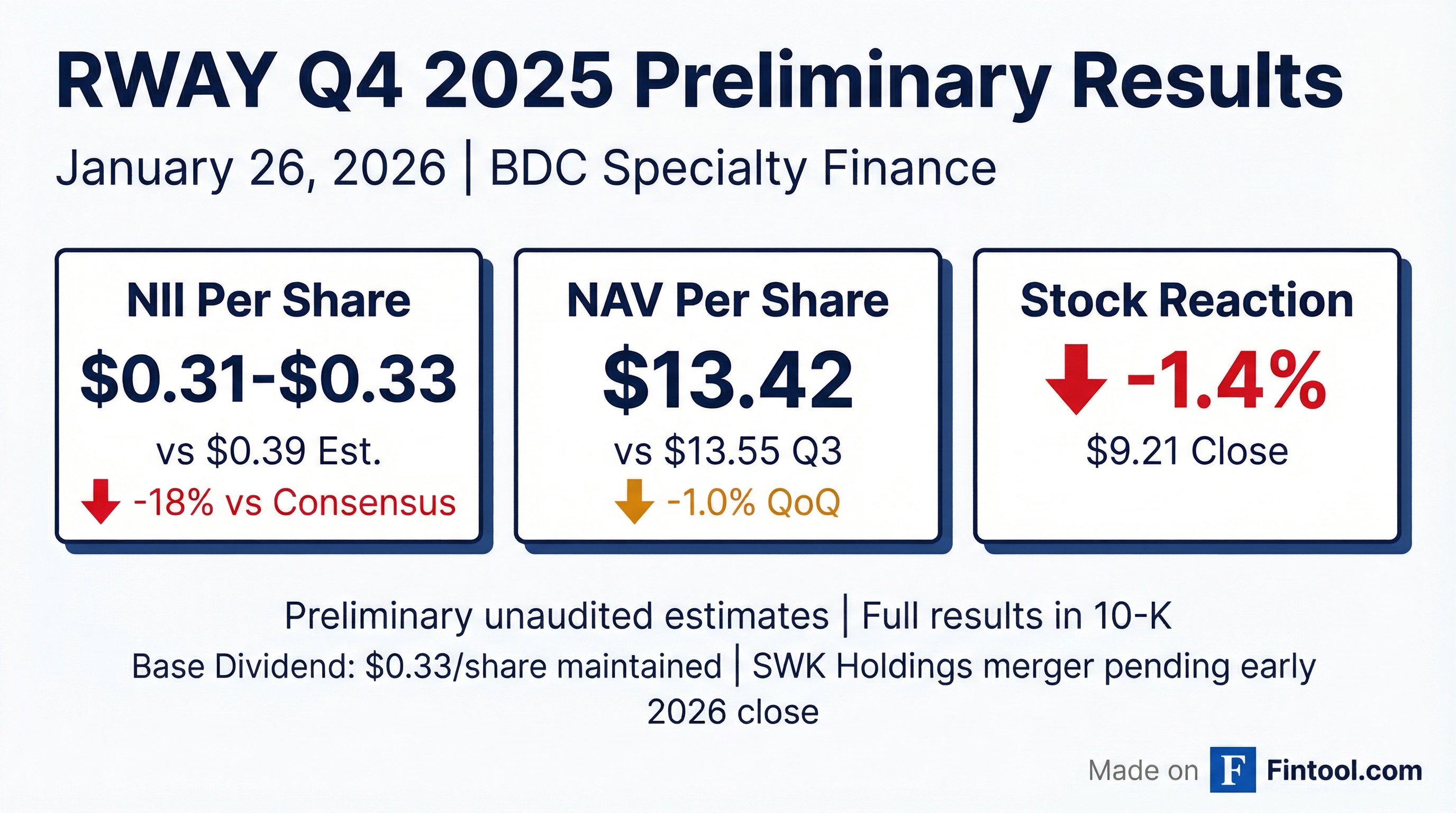

- Runway Growth Finance Corp. funded $42.9 million in seven investments during the fourth quarter of 2025, comprising three new and four existing portfolio companies.

- The company experienced $77.8 million in liquidity events from its investment portfolio in Q4 2025, including full principal repayments from Dejero Labs, Inc. and Synack, Inc..

- As of December 31, 2025, Runway Growth's portfolio included 40 debt investments to 31 companies and 72 equity investments in 48 companies.

- The acquisition of SWK Holdings Corporation is on schedule to close late in the first quarter of 2026, pending regulatory approvals.

- For Q3 2025, Runway Growth Finance Corp. reported net investment income per share of $0.43, with total investment income at $36,747 thousand and total operating expenses at $21,011 thousand.

- The company announced a definitive merger agreement with SWK Holdings on October 9, 2025, which is anticipated to generate mid single-digit run-rate Net Investment Income (NII) accretion during the first full quarter following closing.

- As of Q3 2025, total investments at fair value were $945,964 thousand, and the net asset value per share was $13.55.

- The portfolio's weighted average risk rating for Q3 2025 was 2.33, with 92% of the portfolio having a weighted average risk rating of 3 or better (on a 1-5 scale where lower is higher credit quality).

- Runway Growth Finance reported total investment income of $36.7 million and net investment income of $15.7 million for the third quarter of 2025, resulting in net investment income per share of $0.43.

- The company announced a definitive merger agreement to acquire SWK Holdings, which is expected to immediately scale the portfolio by an estimated $242 million and increase healthcare and life sciences exposure to approximately 31% of the overall portfolio. The transaction is anticipated to close in early 2026.

- During Q3 2025, Runway completed 11 investments totaling $128.3 million in funded loans. The weighted average portfolio risk rating increased to 2.42 from 2.33 in the prior quarter, and the dollar-weighted average annualized yield was 16.8%.

- The board declared a regular distribution for the fourth quarter of $0.33 per share. Additionally, Runway repurchased 397,983 shares during the third quarter of 2025 under its $25 million stock repurchase program.

- Runway Growth Finance reported total investment income of $36.7 million and net investment income of $15.7 million for Q3 2025, resulting in net investment income per share of $0.43. A Q4 dividend of $0.33 per share was declared.

- The company entered into a definitive merger agreement to acquire SWK Holdings for an estimated $220 million, a transaction expected to scale the portfolio by $242 million and increase healthcare and life sciences exposure to 31%. This acquisition is anticipated to generate mid-single-digit run-rate net investment income accretion post-close, which is projected for early 2026.

- During Q3 2025, Runway completed 11 investments in new and existing portfolio companies, funding $128.3 million in loans.

- Under its $25 million stock repurchase program, Runway repurchased 397,983 shares in the third quarter.

- Runway Growth Finance reported total investment income of $36.7 million and net investment income of $15.7 million for Q3 2025, with net investment income per share of $0.43. The company declared a Q4 dividend of $0.33 per share.

- The company announced a definitive merger agreement to acquire SWK Holdings, a specialty finance company, for an estimated $220 million. This acquisition is expected to scale Runway's portfolio by an estimated $242 million, increasing its exposure to the healthcare and life sciences sector to approximately 31% of the overall portfolio at fair value.

- The SWK Holdings transaction is anticipated to close in early 2026 and generate mid-single-digit run-rate net investment income accretion in the first full quarter following the close.

- During Q3 2025, Runway completed 11 investments totaling $128.3 million in funded loans across new and existing portfolio companies. The total investment portfolio had a fair value of $946 million as of September 30, 2025, and the company repurchased 397,983 shares under its $25 million stock repurchase program.

Quarterly earnings call transcripts for Runway Growth Finance.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more