Earnings summaries and quarterly performance for SILICOM.

Research analysts who have asked questions during SILICOM earnings calls.

Ryan Koontz

Needham & Company, LLC

3 questions for SILC

Also covers: AAOI, ADTN, ANET +27 more

GW

Greg Weaver

Invicta Capital

2 questions for SILC

Also covers: ACFN

Jeffrey Hopson

Needham & Company

2 questions for SILC

Also covers: ANET, BLZE, CRWD +2 more

CB

Christopher Bornzan

D&B

1 question for SILC

DM

Donald McKiernan

Landolt Securities

1 question for SILC

JH

Jeff Hopson

Needham

1 question for SILC

JM

Jeff Meyers

Cobia Capital

1 question for SILC

Recent press releases and 8-K filings for SILC.

Silicom announces cyber security leader selects its Edge system for next-generation platform

SILC

New Projects/Investments

Revenue Acceleration/Inflection

- Silicom Ltd. announced on February 9, 2026, that a Tier-1 cyber security leader selected one of its Edge systems as the platform for a next-generation high-end product line.

- Initial orders totaling over $1 million have been received for delivery in 2026, with quantities expected to ramp to approximately $2 million per year.

- This selection expands an existing customer relationship, building on a previous design win for an Edge system last year.

- Discussions are ongoing regarding additional products for the customer's other product lines.

Feb 9, 2026, 1:15 PM

Silicom Reports Strong Q4 2025 Results and Positive 2026 Outlook

SILC

Earnings

Guidance Update

New Projects/Investments

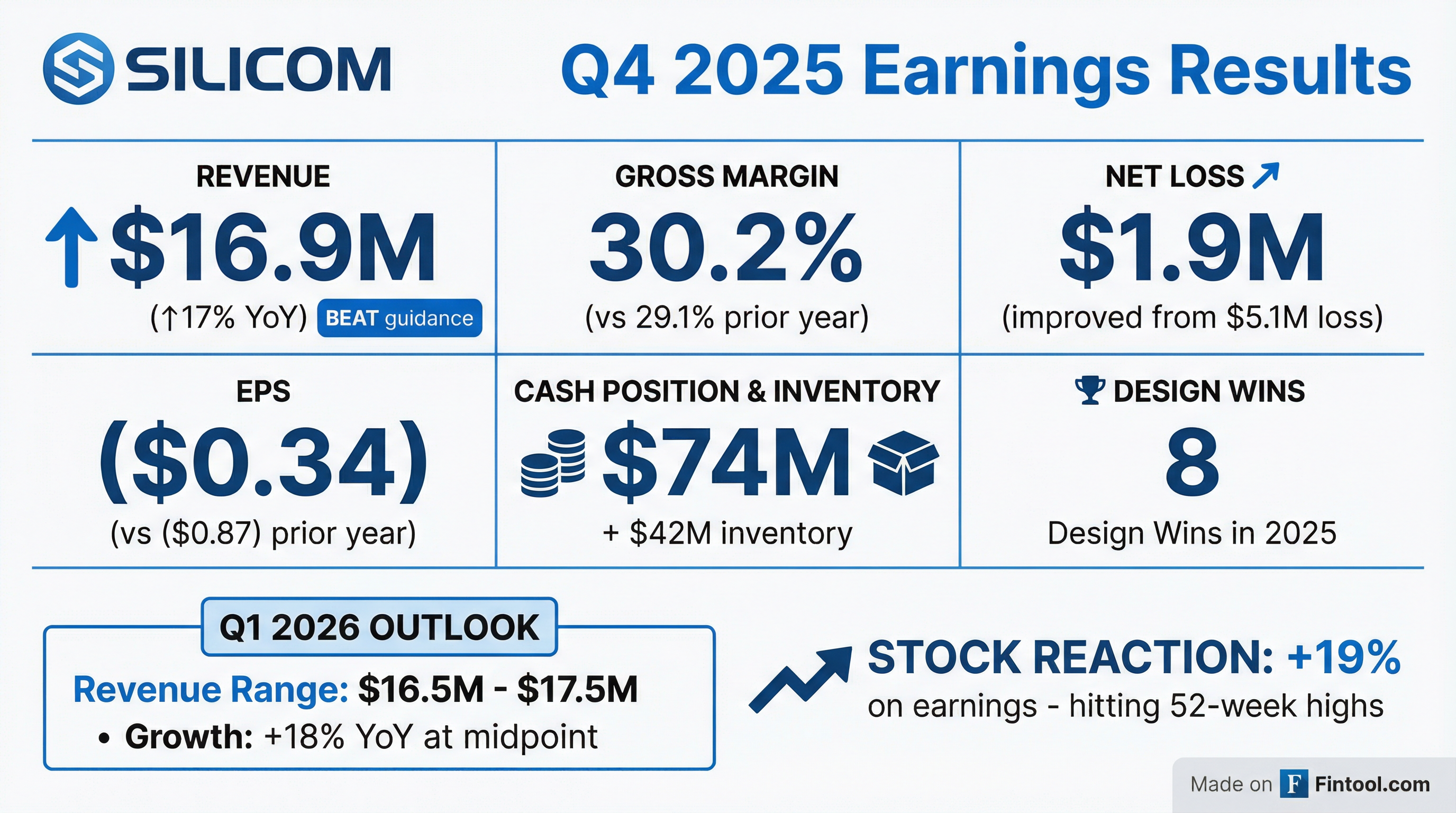

- Silicom reported Q4 2025 revenues of $16.9 million, a 17% increase year-over-year, exceeding their guidance range.

- The company projects Q1 2026 revenues to be between $16.5 million and $17.5 million, representing 18% year-over-year growth at the midpoint, and expects accelerated double-digit revenue growth for the full year 2026 and beyond.

- Silicom's balance sheet remains strong, with working capital and marketable securities totaling $111 million at year-end 2025, including $74 million in cash, deposits, and highly rated bonds, with no debt.

- The company is pursuing three new potential growth engines: AI inference networking, post-quantum cryptography, and white label switching, which are expected to provide venture-style upside potential.

Jan 29, 2026, 2:00 PM

Silicom Announces Q4 2025 Results and 2026 Growth Expectations

SILC

Earnings

Guidance Update

New Projects/Investments

- Silicom reported Q4 2025 revenues of $16.9 million, a 17% year-over-year increase, and a net loss of $1.9 million with a loss per share of $0.34.

- The company provided Q1 2026 revenue guidance of $16.5-$17.5 million, projecting 18% year-over-year growth at the midpoint, and expects accelerated double-digit revenue growth for the full year 2026.

- In 2025, Silicom secured eight major new design wins and is targeting 7 to 9 additional design wins in 2026, with strong visibility for continued growth.

- Silicom is focusing on three new potential growth engines: AI inference networking, post-quantum cryptography, and white label switches, which are in early stages but are expected to become massive growth drivers.

- The company maintains a strong balance sheet with $111 million in working capital and marketable securities, including $74 million in cash, deposits, and highly rated bonds, and no debt as of December 31, 2025.

Jan 29, 2026, 2:00 PM

Silicom Reports Q4 2025 Results and Provides 2026 Outlook

SILC

Earnings

Guidance Update

New Projects/Investments

- Silicom reported Q4 2025 revenues of $16.9 million, a 17% year-over-year increase, surpassing its guidance range of $15 million to $16 million. The company recorded a net loss of $1.9 million and a loss per share of $0.34 for the quarter.

- The company projects Q1 2026 revenues to be between $16.5 million and $17.5 million, indicating 18% year-over-year growth at the midpoint, and anticipates accelerated double-digit revenue growth for 2026.

- Silicom maintains a strong financial position with $111 million in working capital and marketable securities, including $74 million in cash and no debt, as of December 31, 2025.

- The company is actively pursuing new growth opportunities in AI inference networking, post-quantum cryptography, and white label switches, which are identified as significant venture-style upside engines.

Jan 29, 2026, 2:00 PM

Silicom Ltd. Highlights Strategic Growth in AI Inference, PQC, and White-Label Switching Markets

SILC

New Projects/Investments

Guidance Update

Revenue Acceleration/Inflection

- Silicom Ltd. is strategically positioning itself for venture-style upside in three high-growth markets: AI inference, with a projected $80-100 billion TAM by 2030; Post-Quantum Cybersecurity (PQC), with a $3-4 billion TAM by 2030; and White-Label Switching (WLS), with a $6-7 billion TAM by 2030.

- The company reported a strong financial position as of December 31, 2025, including $74 million in cash, $111 million in working capital and marketable securities (approximately $20 per share), and no debt.

- Silicom's core business exceeded expectations in 2025 and is planning for double-digit growth in 2026, with the new strategic opportunities serving as incremental growth engines.

- The company has demonstrated early execution traction in these new areas, including first orders for its AI inference solution, selection by two leading customers for PQC deployments, and initial shipments of White-Label Switching platforms to a security customer.

Jan 29, 2026, 1:15 PM

Silicom Reports Q4 and Full Year 2025 Results and Provides 2026 Guidance

SILC

Earnings

Guidance Update

New Projects/Investments

- Silicom reported revenues of $16.9 million for the fourth quarter of 2025, a 17% increase compared to Q4 2024, and full year 2025 revenues of $61.9 million, an increase of 7% over 2024.

- The company posted a GAAP net loss of $2.5 million (or $0.44 per ordinary share) for Q4 2025 and a GAAP net loss of $11.5 million (or $2.01 per ordinary share) for the full year 2025.

- Management projects revenues for the first quarter of 2026 to range from $16.5 million to $17.5 million, representing 18% growth year-over-year at the mid-range, and anticipates double-digit annual growth in 2026.

- Silicom is pursuing venture-scale opportunities in AI Inference, Post-Quantum Cryptography (PQC), and White-Label Switching markets, which are projected to reach $80+ billion, $3+ billion, and $6+ billion respectively by 2030.

Jan 29, 2026, 12:45 PM

Attindas Acquires SILC S.p.A.

SILC

M&A

New Projects/Investments

- Attindas Hygiene Partners has acquired 100% of the shares of Società Italiana Lavorazione Cellulosa (SILC S.p.A.), an Italian family-owned company with 53 years of history.

- This acquisition is a significant step in Attindas's growth strategy, aiming to expand its presence in Europe and efficiently supply the European and export markets with high-quality absorbent hygiene and skincare products.

- SILC, based in Trescore Cremasco, Italy, designs, manufactures, and markets products such as adult incontinence products, feminine hygiene pads, baby diapers, personal care cosmetics, and pet hygiene products.

Jan 10, 2026, 2:50 AM

Attindas Hygiene Partners acquires SILC S.p.A.

SILC

M&A

- Attindas Hygiene Partners has acquired Società Italiana Lavorazione Cellulosa (SILC S.p.A.), a 53-year-old family-owned company.

- This acquisition represents a significant step in Attindas' growth strategy, aimed at meeting the increasing demand for essential hygiene products in North America and Europe.

- SILC, which manufactures absorbent hygiene and skincare products for customers across Europe, will be integrated into Attindas Hygiene Partners in the coming months.

Jan 10, 2026, 2:50 AM

SILC Acquired by Attindas Hygiene Partners

SILC

M&A

New Projects/Investments

- Attindas Hygiene Partners acquired Società Italiana Lavorazione Cellulosa (SILC S.p.A.) by signing a stock purchase agreement for all shares of the 53-year-old family company on January 10, 2026.

- This acquisition is a significant step in Attindas's growth strategy, expanding its European presence and opening new opportunities for serving European and export markets efficiently.

- SILC S.p.A., headquartered in Trescore Cremasco, Italy, designs, manufactures, and markets absorbent hygiene and skincare products, complementing Attindas's strong presence in northern and southern Europe.

Jan 10, 2026, 2:50 AM

Attindas Hygiene Partners Acquires SILC S.p.A.

SILC

M&A

- Attindas Hygiene Partners acquired Società Italiana Lavorazione Cellulosa (SILC S.p.A.) on January 10, 2026.

- SILC S.p.A., a 53-year-old family business, provides high-quality absorbent hygiene and skincare products to customers across Europe, manufactured in Trescore Cremasco, Italy.

- This acquisition is a significant step in Attindas' growth strategy, accelerating its growth pace and complementing its strong presence in Europe, creating new opportunities for serving European and export markets.

- During the integration period, SILC's business operations will continue as usual for its customers, suppliers, and partners.

Jan 10, 2026, 2:50 AM

Quarterly earnings call transcripts for SILICOM.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more