Earnings summaries and quarterly performance for SK TELECOM CO.

Research analysts who have asked questions during SK TELECOM CO earnings calls.

JK

Joonsop Kim

KB Securities

3 questions for SKM

Also covers: KT

AK

ARam Kim

Shinhan Investment and Securities

2 questions for SKM

H.J. Kim

Daishin Securities

1 question for SKM

Also covers: KT

HK

Hoji Kim

Daishin Securities

1 question for SKM

Also covers: KT

HK

Hong-sik Kim

Hana Securities

1 question for SKM

Also covers: KT

JA

Jae-min Ahn

NH Investment & Securities

1 question for SKM

Also covers: KT

JJ

Jeong Jisoo

Meritz Securities

1 question for SKM

Also covers: KT

Seung Woong Lee

Yuanta Securities

1 question for SKM

SH

Sung Hwan Seok

Xinyang Securities

1 question for SKM

Sun Jung Lee

Bank of America

1 question for SKM

Recent press releases and 8-K filings for SKM.

SK Telecom Reports Preliminary Q4 and Full-Year 2025 Financial Results

SKM

Earnings

Demand Weakening

Profit Warning

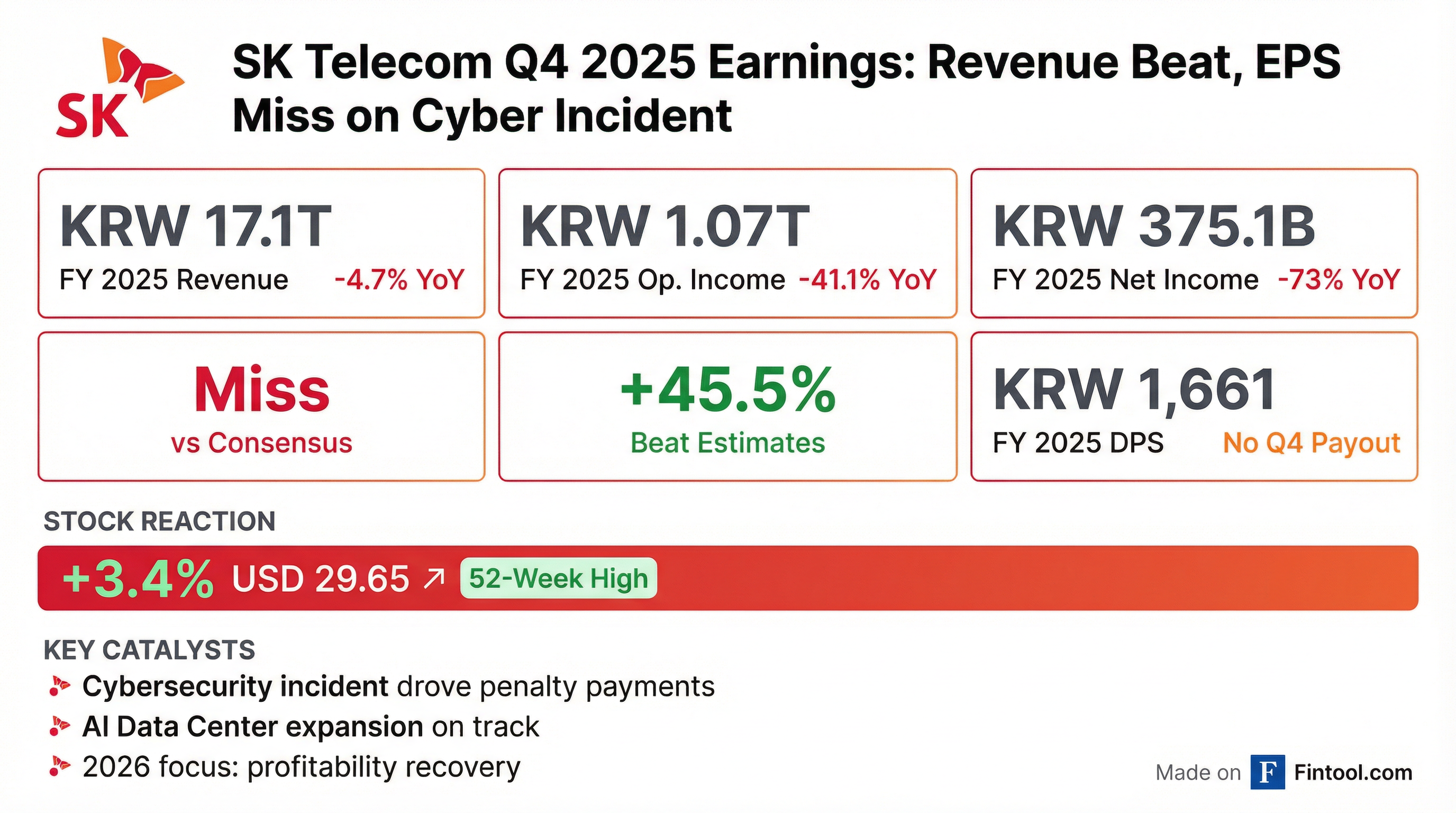

- SK Telecom Co., Ltd. reported preliminary consolidated operating revenue of 43,287 hundred millions of Won for Q4 2025, a 4.05% decrease from Q4 2024, and 170,992 hundred millions of Won for the full year 2025, down 4.69% from 2024.

- Consolidated operating income for Q4 2025 significantly decreased by 53.12% to 1,191 hundred millions of Won compared to Q4 2024, with full-year 2025 operating income also declining by 41.14% to 10,732 hundred millions of Won.

- The company's consolidated profit for the period in Q4 2025 was 970 hundred millions of Won, a 75.43% decrease from Q4 2024, while full-year 2025 profit attributable to controlling interests fell by 67.33% to 4,084 hundred millions of Won.

- These preliminary results, prepared on a consolidated and separate basis, may be subject to change based on the audit by the Company’s external auditor.

2 days ago

SK Telecom Reports Preliminary Fiscal Year 2025 Results

SKM

Earnings

Profit Warning

Demand Weakening

- SK Telecom Co., Ltd. reported a 73.0% decrease in Profit for the Period, falling to 375,084,339 thousand Won for the current fiscal year from 1,387,095,020 thousand Won in the previous fiscal year.

- Operating Income declined by 41.1% to 1,073,214,877 thousand Won from 1,823,409,370 thousand Won in the prior fiscal year.

- The company's Operating Revenue decreased by 4.7% to 17,099,212,573 thousand Won from 17,940,608,890 thousand Won.

- These declines are primarily due to a subsidiary divestiture, a decrease in wireless subscribers following a cyber security incident, and the implementation of a customer appreciation package.

- The reported results are preliminary and remain subject to audit by the external auditor.

2 days ago

SK Telecom Reports Significant FY 2025 Financial Declines and Outlines 2026 Recovery Strategy

SKM

Earnings

Dividends

Guidance Update

- For fiscal year 2025, SK Telecom reported a 4.7% year-on-year decrease in consolidated revenue to KRW 17,099.2 billion, a 41.1% year-over-year decline in operating income to KRW 1,073.2 billion, and a 73% year-over-year drop in net income to KRW 375.1 billion, primarily attributed to a cybersecurity incident, subscriber decline, and business restructuring costs.

- The company set the DPS for fiscal year 2025 at KRW 1,661 and did not pay a quarterly dividend for the fourth quarter, citing the financial impact of the cybersecurity incident and one-off restructuring costs.

- For 2026, SK Telecom aims to restore operating income to 2024 levels by improving telecom business profitability and the self-sustainability of its AI business, despite challenges in MNO revenue recovery to pre-incident levels.

- Key strategic priorities for 2026 include strengthening core competitiveness in telecom through customer value innovation, accelerating AI application across operations, and enhancing the sustainability of its AI business by expanding data center operations.

2 days ago

SK Telecom Reports Q4 and Full Year 2025 Results, Outlines 2026 Strategy

SKM

Earnings

Dividends

New Projects/Investments

- For fiscal year 2025, consolidated revenue was KRW 17,099.2 billion, a 4.7% year-over-year decrease, while operating income fell 41.1% to KRW 1,073.2 billion, and net income dropped 73% to KRW 375.1 billion, primarily due to a cybersecurity incident and business restructuring costs.

- The company decided not to pay a quarterly dividend for Q4 2025, setting the total dividend per share (DPS) for fiscal year 2025 at KRW 1,661. For 2026, the priority is to restore earnings to return to previous dividend payout levels.

- The new management's strategic priorities for 2026 include restoring earnings by improving telecom business profitability and ensuring the self-sustainability of the AI business. This involves customer value innovation, AI acceleration for productivity, and enhancing AI business sustainability through AIDC expansion.

- SK Telecom is developing A.X K1, described as Korea's first hyperscale AI model with over 500 billion parameters, which is expected to create business opportunities in both B2C and B2B sectors, including integration with ADOT, A.Biz, and manufacturing affiliates like SK Hynix.

2 days ago

SK Telecom Reports Significant FY 2025 Financial Declines and Outlines 2026 Recovery Plan

SKM

Earnings

Dividends

Management Change

- SK Telecom reported a significant decline in its fiscal year 2025 financial results, with consolidated revenue down 4.7% to KRW 17,099.2 billion, operating income down 41.1% to KRW 1,073.2 billion, and net income down 73% to KRW 375.1 billion.

- These declines were primarily attributed to a cybersecurity incident, sales of subsidiaries, a net decline in subscribers, and costs associated with business restructuring and penalty payments.

- Due to the financial impact, the company decided not to pay a quarterly dividend for Q4 2025, setting the total fiscal year 2025 dividend per share (DPS) at KRW 1,661.

- For 2026, SK Telecom aims to restore operating income to 2024 levels by improving profitability in its telecom business and enhancing the self-sustainability of its AI business, while also striving to return to previous dividend payout levels.

- The company announced new management members, including a new CFO, COO, and IRO, who will focus on strengthening competitiveness in telecom and AI, customer value innovation, and business productivity through AI acceleration.

2 days ago

SK Telecom Noted as IonQ Collaborator in Quantum Security Market Commentary

SKM

New Projects/Investments

- The document highlights the projected growth of the post-quantum cryptography market from $1.68 billion today to nearly $30 billion by 2034, driven by the urgent need to secure data against "harvest now, decrypt later" attacks.

- Annual global cybercrime costs are projected to reach $10.5 trillion in 2026, contributing to the market's expansion.

- IonQ finalized an agreement with the Korea Institute of Science and Technology Information (KISTI) to deliver a 100-qubit Tempo quantum system in South Korea. This partnership reflects IonQ's momentum across Asia-Pacific, including collaborations with SK Telecom, AIST, Toyota Tsusho, and Hyundai Motor Company.

Jan 8, 2026, 5:26 PM

SK Telecom Unveils Korea's First Hyperscale AI Language Model

SKM

Product Launch

New Projects/Investments

- SK Telecom unveiled A.X K1, Korea’s first hyperscale AI language model with 519 billion parameters, developed by an eight-organization consortium.

- The model is designed to activate approximately 33 billion parameters during inference to balance high performance and computational efficiency, aiming to improve complex reasoning and multilingual understanding.

- SK Telecom plans to distribute A.X K1 capabilities through existing consumer services, leveraging a 20-million-user service foundation to advance an "AI for Everyone" framework.

- The launch occurs as SK Telecom reports strong gross margins (~90.08%) and sizable trailing-12-month revenue (~$12.22 billion), but a recent year-over-year earnings growth decline of roughly 56.4%.

Dec 27, 2025, 11:05 PM

SK Telecom Co., Ltd. Reports Q3 2025 Financial Results

SKM

Earnings

Debt Issuance

Demand Weakening

- SK Telecom Co., Ltd.'s consolidated revenue for the nine months ended September 30, 2025, decreased to W 12,770,541 million from W 13,429,088 million in the prior year, with operating profit falling to W 954,082 million from W 1,569,260 million.

- For the three-month period ended September 30, 2025, the company reported a consolidated net loss attributable to owners of the parent company of W 158,198 million, resulting in a basic loss per share of W 766.

- As of September 30, 2025, total consolidated assets stood at W 28,895,347 million, with total liabilities of W 17,086,403 million and total equity of W 11,808,944 million.

- During the nine months ended September 30, 2025, the company engaged in significant financing activities, including issuing W 300,000 million in new long-term borrowings and W 1,120,490 million in new debentures, while repaying W 200,000 million in long-term borrowings and W 1,304,420 million in debentures.

Dec 12, 2025, 11:03 AM

AIEEV Showcases Distributed GPU Cloud Innovation at SK AI SUMMIT 2025

SKM

Product Launch

New Projects/Investments

- AIEEV participated in the SK AI SUMMIT 2025 held on November 3-4 in Seoul, where it showcased its flagship Air Cloud platform, a distributed GPU cloud infrastructure.

- The company demonstrated its Auto-Scaling GPU capability and highlighted Air Cloud's ability to connect idle GPUs globally to power low-cost, high-efficiency distributed AI inference.

- Air Cloud's architecture is designed to enable up to an 80% reduction in inference costs by creating a data-center-less network for scalable and stable AI operations.

- AIEEV's technology and growth potential have been recognized through its participation in programs such as the SK Telecom AI Startup Acceleration Program, Daegu City’s ABB Industry Initiative, Samsung Electronics’ C-Lab Outside, and the K-Startup TIPS Program.

Nov 12, 2025, 2:00 PM

KRAFTON Reports Strong Q3 2025 Financial Results

SKM

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- KRAFTON reported Q3 2025 revenue of 870.6 billion KRW, a 21% increase year-over-year, and operating profit of 348.6 billion KRW, up 7.5% year-over-year.

- For the first three quarters of 2025, the company achieved record cumulative revenue of 2,406.9 billion KRW and operating profit of 1,051.9 billion KRW.

- The PC segment revenue grew 29% annually to 353.9 billion KRW, while the mobile segment contributed 488.5 billion KRW in Q3 2025.

- KRAFTON is accelerating its "AI First" strategy with a 100 billion KRW GPU cluster investment and plans to launch its first AI-controlled playable character, PUBG Ally, in H1 2026.

- The company is also strengthening its presence in India with 300 billion KRW invested in growth initiatives and plans to unveil Palworld Mobile at G-Star 2025.

Nov 5, 2025, 3:48 AM

Quarterly earnings call transcripts for SK TELECOM CO.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more