Earnings summaries and quarterly performance for Stellantis.

Research analysts who have asked questions during Stellantis earnings calls.

José Asumendi

JPMorgan Chase & Co.

7 questions for STLA

Philippe Houchois

Jefferies

7 questions for STLA

Thomas Besson

Kepler Cheuvreux

7 questions for STLA

Horst Schneider

Bank of America

6 questions for STLA

Michael Foundoukidis

ODDO BHF

3 questions for STLA

Patrick Hummel

UBS Group AG

3 questions for STLA

Emmanuel Rosner

Wolfe Research

2 questions for STLA

Henning Kosman

Barclays

2 questions for STLA

Itay Michaeli

TD Cowen

1 question for STLA

Michael Tyndall

HSBC

1 question for STLA

Stephen Reitman

Bernstein

1 question for STLA

Stuart Pearson

Exane BNP Paribas

1 question for STLA

Recent press releases and 8-K filings for STLA.

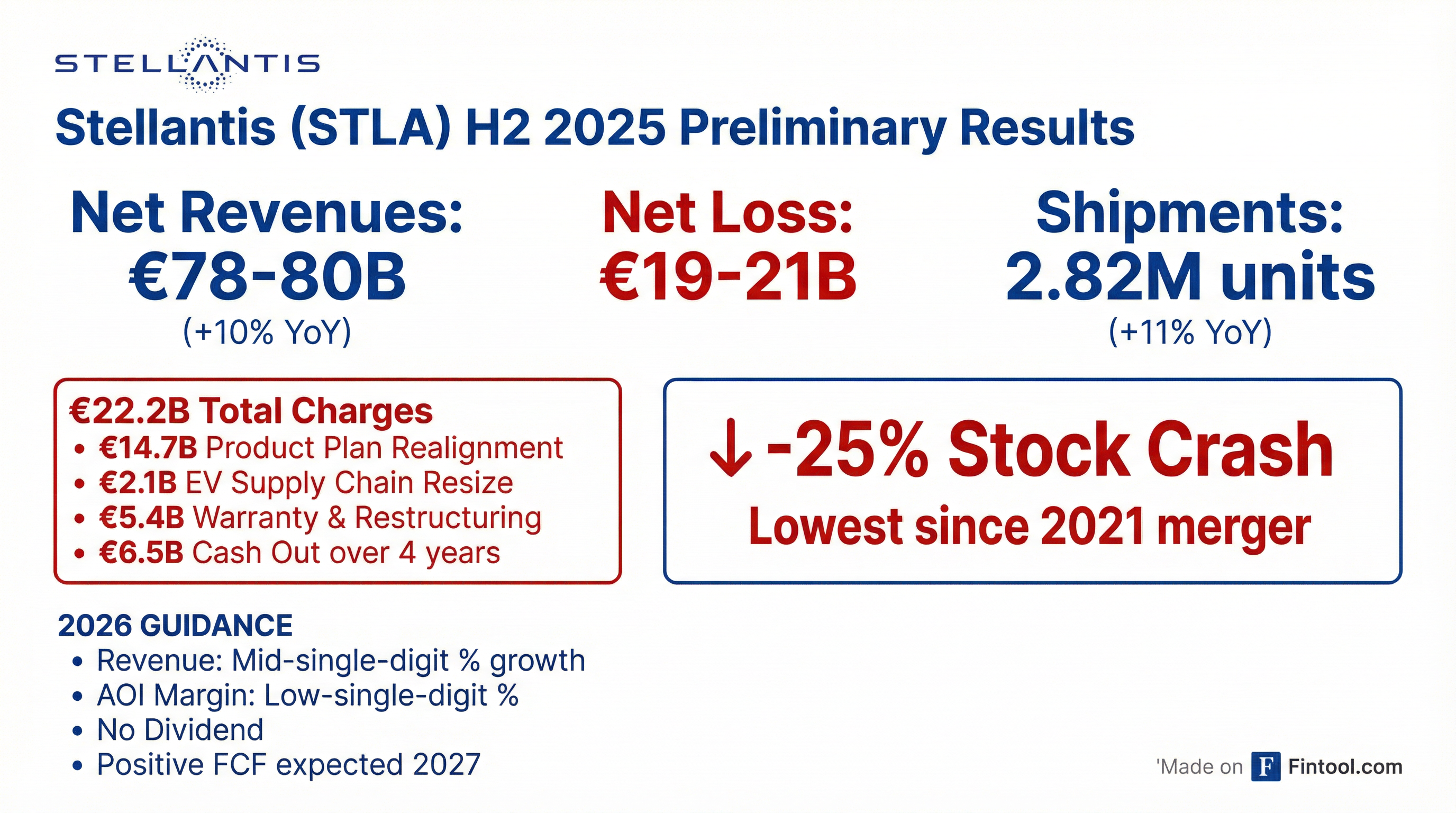

- Stellantis announced a €22.2 billion strategic reset of its electric-vehicle programs, including €14.7–17.4 billion in non-cash write-downs and €6.5–7.7 billion in cash payments over four years, due to overestimating the pace of the energy transition.

- As part of this shift, the company will unwind EV programs, sell its 49% stake in a Canadian battery joint venture, and pivot towards more hybrids and combustion-engine models, stating future EV expansion must be "governed by demand rather than command".

- The company expects a significant €19–21 billion net loss in 2025, will suspend its 2026 dividend, and authorized up to €5 billion in bond issuance, leading to a 25–29% stock plunge in a single session.

- Analysts note Stellantis's €22 billion charge exceeds similar EV-related restructurings by other major U.S. automakers, linking the retreat from aggressive EV investment to recent U.S. policy shifts impacting demand.

- Stellantis announced a business reset resulting in approximately €22.2 billion in charges for the second half of 2025, primarily due to re-aligning product plans and reduced expectations for Battery Electric Vehicle (BEV) products. This led to a preliminary H2 2025 Net loss of (€19) - (€21) billion, Adjusted Operating Income of (€1.2) - (€1.5) billion, and Industrial Free Cash Flows of (€1.4) - (€1.6) billion.

- Due to the 2025 Net loss, the company will not pay a dividend in 2026 and authorized the issuance of up to €5 billion in non-convertible subordinated perpetual hybrid bonds, while maintaining approximately €46 billion in Industrial available liquidity at year-end 2025.

- The company initiated 2026 guidance, projecting improvement in Net revenues, Adjusted Operating Income margin, and Industrial Free Cash Flows.

- Consolidated shipments for H2 2025 increased by 11% year-over-year to 2.8 million units, with Q4 2025 shipments up 9% year-over-year to 1.5 million units, significantly driven by North America. Additionally, Stellantis will sell its 49% equity stake in NextStar Energy to LG Energy Solution.

- In H2 2025, Stellantis reported a 10% year-over-year revenue increase but a negative Adjusted Operating Income (AOI) of EUR 1.2 billion-EUR 1.5 billion and negative Industrial free cash flow of EUR 1.4 billion-EUR 1.6 billion. The company also recorded EUR 22 billion in charges, primarily related to product plans and EV supply chain adjustments.

- For 2026, Stellantis expects net revenues to rise by a mid-single-digit percentage and anticipates a low single-digit margin, with improvement expected in the second half. The company projects to be profitable at the group level throughout 2026 and expects a return to positive Industrial free cash flow in 2027.

- The company is undergoing a "decisive reset" to align with customer demand, including launching 10 all-new products in 2025 and reintroducing the HEMI V8 to the Ram 1500. This strategy has contributed to a more than 150% increase in the North American order book and a 13% increase in European order intake in H2 2025.

- Stellantis maintained strong liquidity, ending 2025 with approximately EUR 46 billion in industrial available liquidity , and authorized up to EUR 5 billion in hybrid bonds to preserve its balance sheet. Quality has shown significant improvement, with the one-month in-service KPI improving more than 50% in North America and more than 30% in Europe in 2025.

- Stellantis announced a €22.2 billion charge and a "decisive reset" of its strategy, reversing parts of its prior EV-heavy approach due to overestimating the pace of the energy transition.

- The charges are projected to result in a preliminary H2 2025 net loss of about €19–21 billion, drive negative adjusted operating income, and lead to the suspension of the 2026 dividend.

- The company's stock plunged 24–27%, wiping more than €5 billion off its market value, which now stands at roughly €18 billion.

- Stellantis plans to issue up to €5 billion of hybrid bonds to shore up its balance sheet and anticipates €6.5 billion of cash outflows over the next four years related to these charges.

- The company is retreating from prior ambitious EV targets, including selling only electric vehicles in Europe and reaching 50% EV sales in the U.S. by 2030, a shift attributed to strategic and execution missteps.

- Stellantis reported preliminary H2 2025 revenues rose 10% year-over-year on 11% higher consolidated shipments, but Adjusted Operating Income (AOI) was negative in the range of EUR 1.2 billion-EUR 1.5 billion, and industrial free cash flow was negative in the range of EUR 1.4 billion-EUR 1.6 billion.

- The company took EUR 22 billion in charges in 2025, primarily related to product plans (EUR 14.7 billion) due to substantially reduced volume and profitability expectations for BEV products, and resizing the EV supply chain.

- For 2026, Stellantis expects net revenues to rise by a mid-single-digit %, with a low single-digit % margin, and industrial free cash flow to improve year-over-year, including approximately EUR 2 billion in projected cash payments. The company expects to be profitable at group level throughout all 2026.

- Stellantis is undergoing a decisive reset, empowering regional teams, launching 10 all-new products in 2025, and improving quality, with North American order books up more than 150%. New products are expected to drive market share growth in 2026.

- Stellantis reported initial signs of recovery in H2 2025, with global shipments increasing by 11% and North American shipments by 39% compared to H2 2024. European order intake also rose by 13% in H2 2025 and 23% in Q4 2025 year-over-year.

- The company expects a return to positive Industrial Free Cash Flow in 2027 and will not pay a dividend this year due to a net loss. To preserve its strong balance sheet and liquidity, the Board authorized the issuance of up to EUR 5 billion in hybrid bonds. Stellantis finished 2025 with industrial available liquidity of approximately EUR 46 billion, representing 30% of net revenues.

- Stellantis is undergoing a profound strategic reset, including a new leadership team, a leaner organizational structure, and the recruitment of over 2,000 engineers in 2025. The company launched 10 new products in 2025 and reported quality improvements (one-month in-service KPI) of 50% in North America and 30% in Europe.

- Cash payments for realignments are projected to be EUR 6.5 billion over four years, with EUR 2 billion expected in 2026, including EUR 1 billion in Q1 2026.

- Stellantis reported estimated consolidated shipments of 1.5 million units for the three months ending December 31, 2025.

- This represents a 9% increase year-over-year.

- The growth was primarily driven by a 43% year-over-year increase in North America shipments, which grew by approximately 127 thousand units.

- Shipments also increased in South America (+7% y-o-y), Middle East & Africa (+2% y-o-y), and China, India & Asia Pacific (+20% y-o-y), though this was partially offset by a 4% decline in Enlarged Europe.

- DriveItAway Holdings, a partner of Stellantis' Free2move, launched operations in eight additional major U.S. markets in January 2026, expanding its national footprint to twenty-one active metropolitan regions.

- This rapid expansion, which includes new markets such as Dallas, Houston, and Seattle, follows a December rollout of nine new cities.

- The company is executing a structured growth strategy to build national mobility infrastructure and aims for a NASDAQ-tier platform in 2026.

- Stellantis is showcasing a diverse lineup of new and updated vehicles at the 2026 Detroit Auto Show, featuring both internal combustion engine (ICE) and electric models across its Jeep, Ram, Dodge, Chrysler, FIAT, and Alfa Romeo brands.

- Key product introductions include the 2026 Jeep Cherokee turbo hybrid, the all-electric Jeep Recon, the return of the 5.7-liter HEMI V-8 in the 2026 Ram 1500, the 777-horsepower 2027 Ram 1500 SRT TRX, and the multi-energy 2026 Dodge Charger lineup.

- The company announced a $13 billion investment over four years in the U.S. to launch five new vehicles, implement 19 additional product actions, produce a new four-cylinder engine, and create over 5,000 new jobs.

- Several Stellantis vehicles are finalists for prestigious awards, including the 2026 North America Car and Truck of the Year and the Alfa Romeo 33 Stradale for two EyesOn Design Awards.

- Stellantis' vehicle production in Italy declined approximately 20% in 2025 to 379,706 units, with passenger-car output plunging 24.5% to 213,706, marking the lowest levels in decades.

- This significant drop was primarily attributed to delays in launching new models, contributing to overall output roughly halving since 2023.

- Union leaders are advocating for an accelerated industrial plan, new investments, and model assignments to prevent further plant closures in Italy.

- Separately, Stellantis' sales in Canada fell about 12% to 114,720 units in 2025, although the Chrysler brand experienced strong gains, including a 79% jump in the fourth quarter.

- Stellantis shares recently closed at $11.09 and had lost 5.28% over the prior month, with analysts projecting $1.72 EPS and approximately $179.49 billion in revenue for the year.

Fintool News

In-depth analysis and coverage of Stellantis.

Quarterly earnings call transcripts for Stellantis.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more