Earnings summaries and quarterly performance for TAKEDA PHARMACEUTICAL CO.

Research analysts who have asked questions during TAKEDA PHARMACEUTICAL CO earnings calls.

Hidemaru Yamaguchi

Citigroup Inc.

8 questions for TAK

Michael Nedelcovych

TD Cowen

8 questions for TAK

Seiji Wakao

JPMorgan Chase & Co.

8 questions for TAK

Shinichiro Muraoka

Morgan Stanley

7 questions for TAK

Tony Ren

Macquarie Group

7 questions for TAK

Stephen Barker

Jefferies

6 questions for TAK

Matsubara

Nomura Securities

5 questions for TAK

Hiroyuki Matsubara

Nomura

3 questions for TAK

Miki Sogi

AllianceBernstein

3 questions for TAK

Steve Barker

Jefferies

3 questions for TAK

Kasumi Haruta

UBS

2 questions for TAK

Fumiyoshi Sakai

UBS

1 question for TAK

Hiroshi Wada

SMBC Nikko Securities

1 question for TAK

Kazuaki Hashiguchi

Daiwa Securities

1 question for TAK

Shinichiro Ueda

Goldman Sachs

1 question for TAK

Recent press releases and 8-K filings for TAK.

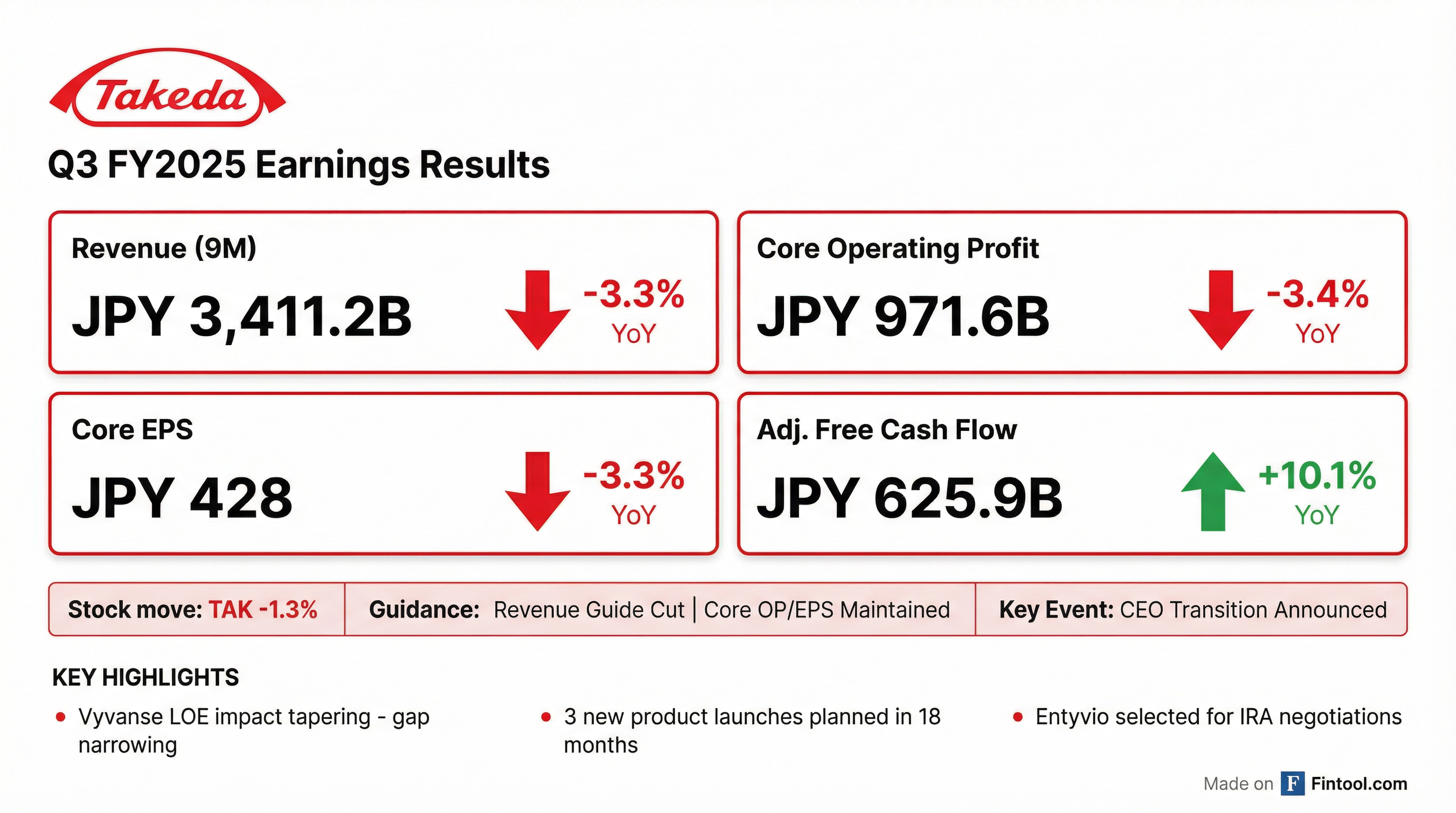

- Takeda reported Q3 FY25 year-to-date revenue of JPY 3.4 trillion, a 3.3% decrease (or -2.8% at constant exchange rate), and Core Operating Profit of JPY 971.6 billion, a 3.4% decrease. The company is managing the significant impact of Vyvanse generic erosion.

- The company is preparing for significant new product launches, including Oveporexin, rusfertide, and zasocitinib, which are key late-stage pipeline assets expected to launch over the next 18 months. New Drug Applications (NDAs) have been filed with the FDA for Oveporexin and rusfertide.

- Christophe Weber will transition from his role as CEO, with Julie Kim, the CEO-elect, taking the lead for the fiscal year 2026 guidance and formal handover in June.

- R&D expenses are likely to increase in the next fiscal year due to full-scale development of new assets, including those from the Innovent partnership, though the company will continue to tighten costs where possible.

- Takeda reported Q3 FY2025 year-to-date revenue of just over JPY 3.4 trillion, a 3.3% decrease, and Core Operating Profit of JPY 971.6 billion, a 3.4% decrease.

- The company updated its full-year FY2025 revenue guidance to a low single-digit decline at CER due to stronger than anticipated Vyvanse generic erosion, but maintained Core Operating Profit and Core EPS guidance.

- Takeda is preparing for significant new product launches, including oveporexton and rusfertide (expected this calendar year) and zasocitinib (expected first half of calendar year 2027), which are key assets in its late-stage pipeline.

- Christophe Weber will step down as CEO, with Julie Kim (CEO-elect) taking the lead for FY2026 guidance and formal handover in June, marking a planned leadership transition.

- Takeda reported Q3 2026 year-to-date revenue of JPY 3.4 trillion, a 3.3% decrease (or -2.8% at constant exchange rate), with Core Operating Profit at JPY 971.6 billion, a 3.4% decrease.

- The company maintained its full-year Core Operating Profit and Core EPS guidance but revised its revenue guidance to a low single-digit decline at constant exchange rate, primarily due to stronger than anticipated Vyvanse generic erosion.

- Takeda is preparing for the launch of three key late-stage pipeline assets: Oveporexin and Rusfertide in calendar year 2026, and Zasocitinib in the first half of calendar year 2027, which are expected to more than offset the anticipated impact of Entyvio biosimilar entry from the early 2030s.

- Entyvio sales grew 7.4% at constant exchange rate in Q3 2026, but the drug has been selected for IRA price negotiations, which is anticipated to lead to a substantial Medicare price cut from early 2028.

- Julie Kim, CEO-elect, will take the lead on earnings calls and set guidance for fiscal year 2026, with a formal handover in June.

- Takeda reported a net profit of ¥103.6 billion for the three months ended December, more than quadrupling year-over-year.

- For the nine-month period, profit rose to ¥216.081 billion while revenue fell 3.3% to ¥3.411 trillion.

- The company raised its FY2025 revenue guidance to ¥4.53 trillion from ¥4.50 trillion and projects higher net profit, with an operating profit target of ¥410.0 billion and an EPS forecast of ¥98.

- GuruFocus highlighted balance-sheet concerns, noting an Altman Z-Score around 1.21 and interest coverage near 1.95.

- Takeda reported a year-to-date revenue decline of 3.3% at Actual Exchange Rates (AER) to 3,411.2 Billion yen for the nine months ended December 31, 2025. Core Operating Profit decreased by 3.4% at AER to 971.6 Billion yen, while Reported Operating Profit increased by 1.2% at AER to 422.4 Billion yen.

- The company updated its full-year management guidance for Core Revenue to a "Low-single-digit % decline" (previously "Broadly flat"), primarily due to the impact of VYVANSE® generics.

- Takeda raised its full-year forecasts for FY2025, with Revenue now projected at 4,530.0 Billion yen, Core Operating Profit at 1,150.0 Billion yen, and Core EPS at 486 Yen, attributing the increase to cost discipline and FX tailwind.

- The company is progressing towards three transformative product launches (oveporexton, rusfertide, and zasocitinib) within the next 18 months, having already submitted New Drug Applications (NDAs) for oveporexton and rusfertide.

- Takeda has announced the U.S. availability of GAMMAGARD LIQUID ERC, a ready-to-use liquid immunoglobulin therapy with low immunoglobulin A (IgA) content (less than or equal to 2 µg/mL in a 10% solution).

- This new therapy is approved for replacement therapy in individuals aged two and older with primary immunodeficiency (PI) and can be administered intravenously or subcutaneously without reconstitution.

- Takeda is currently the only manufacturer of immunoglobulin therapy with this specific low IgA content.

- The company also stated that GAMMAGARD S/D, a lyophilized immunoglobulin therapy, will be discontinued at the end of December 2027.

- Takeda announced a CEO transition, with Christophe Weber retiring in June 2026 and Julie Kim succeeding him.

- The company is preparing for the launch of three significant products in the next 18 months: Oveporexton (narcolepsy type 1), Rusfertide (polycythemia vera), and Zasocitinib (psoriasis, psoriatic arthritis).

- These three new products are projected to generate a combined peak revenue potential of $6-$10 billion, which is critical to offset the anticipated decline of the $6 billion Entyvio product from 2030 due to biosimilar competition.

- Takeda, a $30 billion revenue company with over 50% from the U.S., is strategically focused on innovation, digital transformation, and investing approximately $5 billion annually in R&D across key therapy areas including gastroenterology, neuroscience, and oncology.

- Takeda's CEO, Christophe Weber, will retire in June 2026 and will be succeeded by Julie Kim.

- The company plans to launch three new products in the second half of 2026: oveporexton (for narcolepsy type 1), rusfertide (for polycythemia vera), and zasocitinib (for psoriasis and psoriatic arthritis), all with positive Phase III data.

- These three products have a combined peak revenue potential of $6 billion to $10 billion and are crucial to offset the anticipated decline of ENTYVIO, a $6 billion product representing 20% of current total revenue, which will face biosimilar competition starting in 2030.

- Takeda invests approximately $5 billion per year in R&D and has eight late-stage assets expected to launch before the end of the decade, including new oncology assets from a strategic partnership with Innovent.

- Takeda (TAK), a $30 billion revenue company with over 50% from the U.S., is strategically focused on innovation, investing $5 billion annually in R&D across gastroenterology, neuroscience, and oncology.

- The company is entering a phase of significant new product launches to counter past generic exposure, with eight late-stage assets expected to launch before the end of the decade.

- Three key products (Oveporexton, Rusfertide, and Zasocitinib) are slated for launch in the next 18 months, specifically in the second semester of 2026, with a combined peak revenue potential of $6-$10 billion.

- These launches are crucial to offset the projected decline of Entyvio, a $6 billion product representing 20% of total revenue, which will face biosimilar competition starting in 2030.

- CEO Christophe Weber will retire in June 2026, with Julie Kim set to succeed him, making successful product launches a top priority for the leadership transition.

- Takeda and Protagonist Therapeutics announced positive 52-week results from the pivotal Phase 3 VERIFY study evaluating rusfertide in patients with polycythemia vera (PV) at the ASH 2025 meeting on December 6, 2025.

- The study demonstrated sustained efficacy, with 61.9% of patients continuously treated with rusfertide maintaining absence of phlebotomy eligibility from baseline to Week 52, and mean hematocrit remaining below 43%.

- Long-term data from the THRIVE study showed a 13-fold reduction in the annual rate of phlebotomies from baseline, with a mean annualized rate of 0.7 phlebotomies/year during THRIVE compared to 9.2 phlebotomies/year prior to study entry.

- Rusfertide was generally well-tolerated through 52 weeks, with common treatment-emergent adverse events being injection site reactions (47.4%), anemia (25.6%), and fatigue (19.6%).

- Rusfertide has received Breakthrough Therapy, Orphan Drug, and Fast Track Designations from the U.S. FDA, and an NDA submission is expected by the end of 2025. The financial impact on Takeda for the fiscal year ending March 31, 2026 (FY2025) is immaterial.

Quarterly earnings call transcripts for TAKEDA PHARMACEUTICAL CO.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more