Earnings summaries and quarterly performance for TETRA TECH.

Executive leadership at TETRA TECH.

Dan L. Batrack

Chief Executive Officer

Leslie L. Shoemaker

Executive Vice President, Chief Innovation and Sustainability Officer

Preston Hopson

Senior Vice President, General Counsel and Secretary

Roger R. Argus

President

Steven M. Burdick

Executive Vice President, Chief Financial Officer

Board of directors at TETRA TECH.

Research analysts who have asked questions during TETRA TECH earnings calls.

Sabahat Khan

RBC Capital Markets

6 questions for TTEK

Sangita Jain

KeyBanc Capital Markets

6 questions for TTEK

Michael Dudas

Vertical Research Partners

5 questions for TTEK

Timothy Mulrooney

William Blair & Company

4 questions for TTEK

Andrew J. Wittmann

Robert W. Baird & Co.

2 questions for TTEK

Andy Wittmann

Baird

2 questions for TTEK

Ryan Connors

Northcoast Research Partners

2 questions for TTEK

Tate Sullivan

Maxim Group

2 questions for TTEK

Tim Mulrooney

William Blair

2 questions for TTEK

Justin Hauke

Robert W. Baird & Co.

1 question for TTEK

Recent press releases and 8-K filings for TTEK.

- Greenland Resources Inc. has been granted an exclusive special exploration license, MEL-S 2026-07, covering 1,147.76 km2 in the Semersooq region of Greenland.

- This new license surrounds the company's existing exploitation license for molybdenum and magnesium, significantly expanding its mineral license position on the east coast of Greenland.

- The license permits exploration for all minerals except hydrocarbons and radioactive elements, with previous reports indicating highly anomalous molybdenum values in rock samples within the new area.

- The potential for additional molybdenum could enhance the company's Malmbjerg project, which holds Proven and Probable Reserves of 571 million pounds of contained molybdenum metal and is recognized as a priority EU project.

- Tetra Tech was awarded a $100 million multiple-award contract by the Air Force Civil Engineer Center (AFCEC).

- The 5-year contract involves providing planning and assessment services to support AFCEC projects, including assessing environmental impacts, conducting mitigation planning, and developing environmental impact statements.

- Tetra Tech's Chairman and CEO, Dan Batrack, stated the company looks forward to continuing to use its Leading with Science® approach for Air Force and Space Force projects.

- Tetra Tech reported a strong Q1 2026, with net revenue up 8% to $987 million and GAAP earnings per share up 17% to $0.40. Operating income increased by 12% to $131 million, and EBITDA on net revenue expanded by 140 basis points to 14.2%.

- The company's board approved a 12% year-over-year increase in the quarterly cash dividend, and Tetra Tech repurchased an additional $50 million in stock during Q1 2026.

- Tetra Tech's net debt amounted to $565 million, with a net debt to EBITDA leverage of 0.86 times, providing significant capacity for future growth investments, including an additional $2 billion in debt capacity for larger acquisitions.

- The company increased its FY 2026 guidance for net revenue and EPS, reflecting the strong Q1 performance and recent acquisitions like Halvik, while the CEO transitions to focus on strategic M&A opportunities.

- Tetra Tech reported adjusted net revenue of $987 million and adjusted EPS of $0.34 for Q1 2026, excluding USAID and DOS. This compares to adjusted net revenue of $959 million and adjusted EPS of $0.29 in Q1 2025, excluding USAID and DOS.

- The company provided FY 2026 guidance for net revenue between $4.15 billion and $4.30 billion and adjusted EPS between $1.46 and $1.56.

- Tetra Tech's Q1 2026 backlog (excluding USAID & DOS) reached $3.95 billion , and the company returned $67 million to shareholders through dividends and buybacks in Q1 2026, increasing its quarterly dividend by 12% year-over-year. The net debt leverage improved to 0.86 in Q1 2026.

- Tetra Tech reported strong first quarter fiscal year 2026 results, with net revenue up 8% to $987 million and GAAP earnings per share of $0.40. Operating income increased by 12% to $131 million, and EBITDA on net revenue expanded by 140 basis points to 14.2%.

- The company updated and increased its fiscal year 2026 guidance, projecting net revenue between $4.15 billion and $4.3 billion and adjusted earnings per share between $1.46 and $1.56. This guidance implies a 9% increase in net revenue and an 80 basis point expansion of EBITDA margins for the full year.

- Capital allocation highlights include a 12% increase in the quarterly cash dividend and $50 million in stock buybacks during Q1 2026. The company maintains a strong balance sheet with net debt on EBITDA at 0.86 times, down from over 2x in Q2 2023, and has significant capacity for additional debt for larger acquisitions.

- Tetra Tech completed the sale of its non-core Norway operation and acquired Halvik and Providence. CEO Dan Batrack will transition day-to-day operations to Roger Argus, President and CEO Designate, by the February 19th shareholders meeting, to focus on strategic acquisitions and vision.

- Tetra Tech reported a strong first quarter for fiscal year 2026, with net revenue up 8% to $987 million and adjusted earnings per share up 17% to $0.34.

- The company increased its full-year fiscal 2026 guidance, with updated net revenue expected to be between $4.15 billion and $4.3 billion, and adjusted earnings per share between $1.46 and $1.56.

- Tetra Tech maintained a strong financial position, with net debt on EBITDA at 0.86x (20% lower year-over-year), and the board approved a 12% increase in the quarterly cash dividend. The company also bought back an additional $50 million in stock during Q1 2026.

- CEO Dan Batrack announced a transition in his role to focus more on large-scale M&A and strategic partnerships, noting the company has significant capacity, including $2 billion in debt capacity for acquisitions.

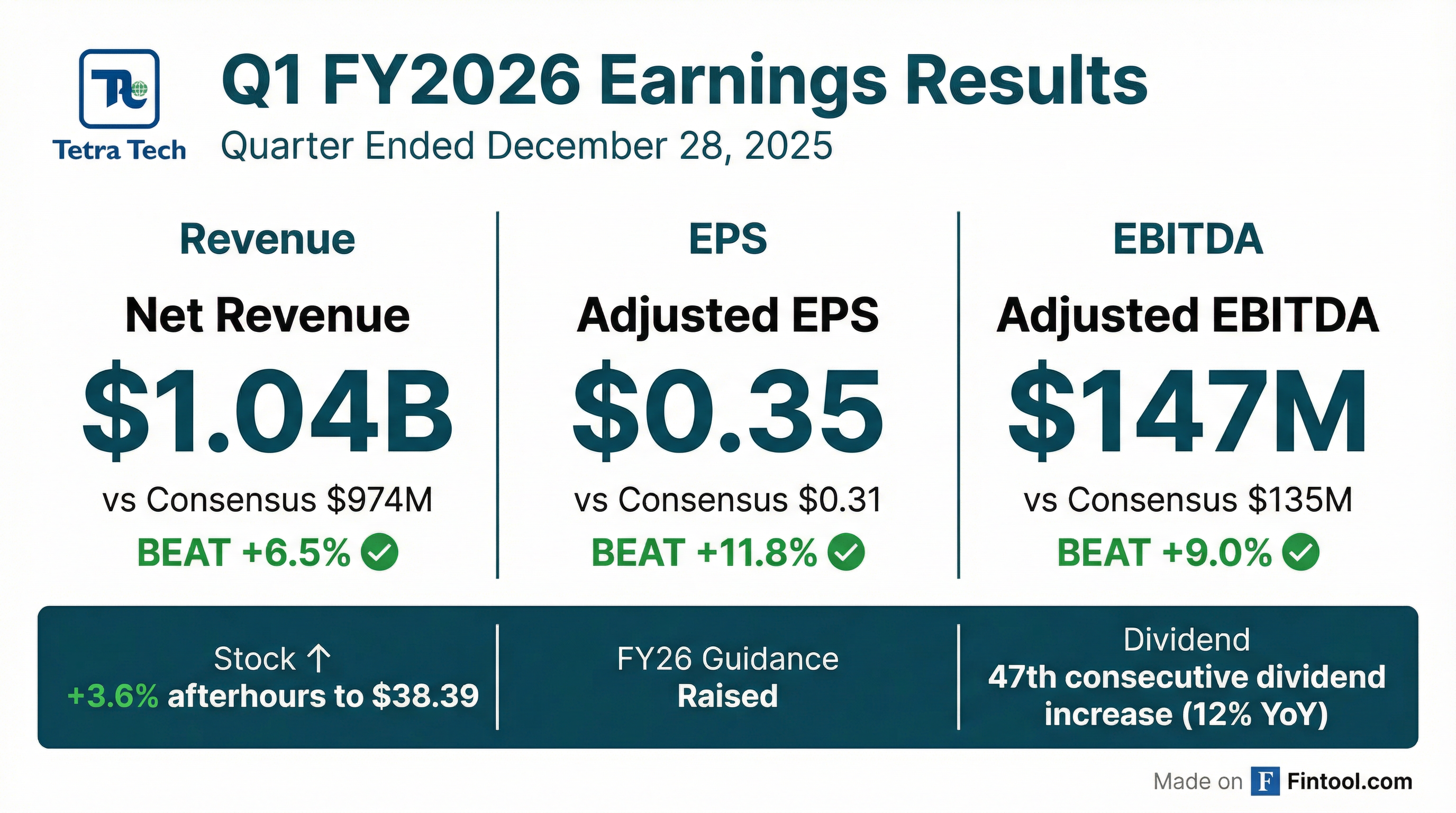

- Tetra Tech reported strong first quarter 2026 results for the period ended December 28, 2025, with revenue of $1.21 billion, net revenue of $1.04 billion, EPS of $0.40, and adjusted EPS of $0.35. The company subsequently raised its fiscal year 2026 guidance for net revenue to range from $4.15 billion to $4.30 billion and adjusted EPS to range from $1.46 to $1.56.

- The Board of Directors approved a $0.065 per share quarterly dividend on January 26, 2026, representing a 12% increase year-over-year, payable on February 27, 2026.

- In the first quarter, Tetra Tech repurchased $50 million of common stock, with $548 million remaining under its share repurchase programs as of December 28, 2025. The company's backlog stood at $3.95 billion at the end of the first quarter.

- Tetra Tech reported strong first quarter fiscal year 2026 results, with net revenue of $1.04 billion and EPS of $0.40, alongside an 80 basis point improvement in adjusted EBITDA margin year-over-year.

- The company raised its fiscal year 2026 guidance, now projecting net revenue between $4.15 billion and $4.30 billion and adjusted EPS between $1.46 and $1.56.

- Tetra Tech's Board of Directors approved its 47th consecutive quarterly dividend of $0.065 per share, a 12% increase year-over-year, and the company repurchased $50 million of common stock in the first quarter.

- The company's backlog stood at $3.95 billion at the end of the first quarter, including a $151 billion ten-year multiple award contract for the U.S. Missile Defense Agency SHIELD program.

- Tetra Tech Canada and Westinghouse Electric Company have signed a memorandum of understanding (MoU) to collaborate on AP1000® and AP300™ reactor projects in Ontario.

- Under the MoU, Tetra Tech will leverage its engineering expertise and clean energy capacity to support Westinghouse in the development and deployment of these nuclear technologies.

- The agreement aims to strengthen domestic project development capabilities and position Westinghouse’s technologies as leading solutions for Canada’s clean energy future.

- A four-unit AP1000 facility in Canada is projected to power at least three million homes and support $28.7 billion Canadian dollars in GDP during construction.

- Tetra Tech, Inc. (NASDAQ: TTEK) has acquired Halvik Corp, a high-end provider of advisory consulting services specializing in advanced data analytics, systems modernization, and cybersecurity for U.S. defense and civilian agencies.

- This acquisition expands Tetra Tech's high-end analytics and digital solutions across U.S. federal agencies, strengthening its relationships with the U.S. Army, Navy, Air Force, and Department of Transportation.

- Halvik Corp, with 600 employees, will join Tetra Tech's Government Services Group; the terms of the acquisition were not disclosed.

Quarterly earnings call transcripts for TETRA TECH.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more