Earnings summaries and quarterly performance for U-Haul Holding Co /NV/.

Executive leadership at U-Haul Holding Co /NV/.

Douglas Bell

President, Repwest Insurance Company

Jason Berg

Chief Financial Officer

Joe Shoen

Chairman and President

JT Taylor

President, U-Haul

Kristine Campbell

General Counsel

Maria Bell

Chief Accounting Officer

Samuel Shoen

U-Box Project Manager

Matthew Braccia

President, Amerco Real Estate Company

Robert Simmons

President, Oxford Life Insurance Company

Board of directors at U-Haul Holding Co /NV/.

Research analysts who have asked questions during U-Haul Holding Co /NV/ earnings calls.

Steven Ralston

Zacks Small-Cap Research

6 questions for UHAL

James Wilen

Wilen Management

5 questions for UHAL

Steven Ramsey

Thompson Research Group

5 questions for UHAL

Andy Liu

Wolfe Research, LLC

2 questions for UHAL

Jeffrey Kauffman

Vertical Research Partners

2 questions for UHAL

Keegan Carl

Wolfe Research, LLC

1 question for UHAL

Stephen Farrell

Oppenheimer & Co. Inc.

1 question for UHAL

Recent press releases and 8-K filings for UHAL.

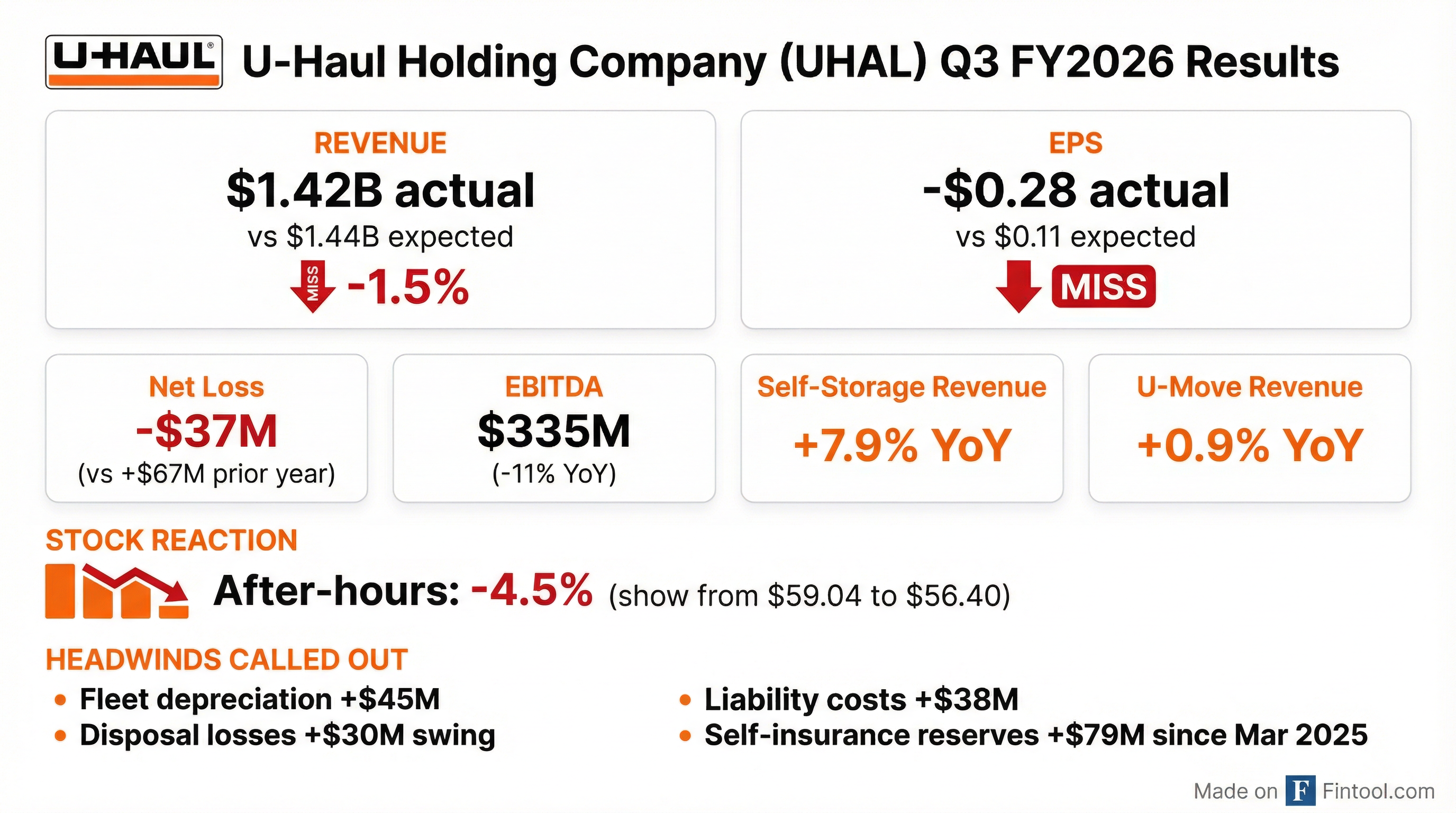

- U-Haul Holding Company (UHAL) reported a net loss of $37 million, or $0.18 per non-voting share, for Q3 2026, a significant decline from earnings of $67 million ($0.35 per non-voting share) in the prior year's quarter.

- Adjusted EBITDA for the moving and storage segment decreased 11%, or nearly $42 million, primarily due to a $75 million cost increase from fleet depreciation and a $26 million loss on disposal of retired rental equipment, particularly cargo vans.

- Moving and storage operating expenses rose by $66 million, driven by increases in personnel costs ($16 million), fleet maintenance ($13 million), and a $38 million increase in self-insurance liability costs due to reserve strengthening.

- Despite the losses, equipment rental revenues increased $8 million (under 1%), and storage revenues grew $18 million (8%) for the quarter.

- Looking ahead, the company plans to reduce new truck purchases by over $500 million in the next fiscal year and has already decreased real estate acquisition and development spending by $444 million in the first nine months of fiscal 2026 compared to the prior year.

- U-Haul Holding Company reported a Q3 2026 loss of $37 million, or $0.18 per non-voting share, a significant decline from $67 million in earnings in the prior year, primarily due to a $75 million increase in costs from fleet depreciation and losses on disposal of rental equipment.

- The company is facing an over-fleeted situation and excessive acquisition costs for 2023 and 2024 model year vans and pickups, leading to increased depreciation and losses on sale; however, 2026 cargo van purchases are expected to be 12% to 20% cheaper than previous years.

- Storage revenues increased 8% or $18 million for the quarter, with average revenue per foot improving by nearly 7%, though same-store occupancy decreased 490 basis points to just over 87%.

- Management is implementing strategies to address these challenges, including opening more U-Haul dealership locations to utilize excess fleet, increasing sales of older trucks, and investing in U-Box expansion in underserved markets.

- U-Haul Holding Company (UHAL) reported total revenues of $1,319.9 million for Q3 FY 2026, with U-Move revenue increasing by 0.9% and Self-storage revenue increasing by 7.9% compared to the third quarter of fiscal year 2025.

- For Q3 FY 2026, the company recorded an operating profit of $7.1 million and a pretax loss of ($78.1 million), with Adjusted EBITDA at $335.0 million.

- Operational expansion included the addition of 16 new self-storage locations and 1.5 million additional net rentable square feet in Q3 FY 2026, contributing to an increase of +400 total locations and nearly 10,000 truck units since December 2024.

- As of December 31, 2025, total debt was $8.06 billion, with net debt at $7.05 billion, and a net debt to Adjusted EBITDA (TTM) ratio of 4.3x. The UHAL.B share class maintains dividend priority with a $0.05 per share quarterly policy.

- U-Haul Holding Company reported a net loss of $37 million, or $0.18 per non-voting share, for Q3 2026, a significant decrease from earnings of $67 million ($0.35 per non-voting share) in the same quarter last year.

- This decline was primarily driven by a $75 million increase in costs from fleet depreciation and a $26 million loss on disposal of retired rental equipment, largely due to excessive acquisition costs of vans and pickups in model years 2023 and 2024.

- Adjusted EBITDA for the moving and storage segment decreased 11%, or nearly $42 million, while operating expenses rose $66 million, notably due to a $38 million increase in self-insurance liability costs from reserve strengthening.

- Despite these challenges, storage revenues increased 8% or $18 million, with average revenue per foot improving by nearly 7%, although same-store occupancy decreased 490 basis points to just over 87%.

- Looking ahead, the company anticipates a decrease of over $500 million in new truck purchases for the next fiscal year and has already reduced real estate acquisition and development spending by $444 million in the first nine months of fiscal 2026 compared to the prior year.

- U-Haul Holding Company reported a net loss of ($37.0) million for the third quarter of fiscal 2026, a decrease from net earnings of $67.2 million in the prior year, with earnings per share for Non-Voting Shares (UHAL.B) of ($0.18) compared to $0.35. For the nine-month period ended December 31, 2025, net earnings available to shareholders were $210.9 million, down from $449.4 million in the prior year, and Non-Voting Shares (UHAL.B) EPS was $1.09 versus $2.31.

- Consolidated revenue for the third quarter of fiscal 2026 increased to $1,415,608 thousand from $1,388,558 thousand in the same period last year.

- Moving and Storage earnings from operations decreased by $120.2 million to $7.1 million in Q3 FY26, primarily due to $74.6 million in increased losses from disposal of retired rental equipment and fleet depreciation, and $37.9 million in higher liability costs.

- Self-storage revenues increased by 7.9%, or $17.9 million, in Q3 FY26 compared to Q3 FY25, although same-store occupancy decreased by 4.9% to 87.2%.

- The company declared a cash dividend of $0.05 per share on its Non-Voting Common Stock on December 3, 2025, which was paid on December 30, 2025.

- U-Haul Holding Company reported a net loss available to common shareholders of ($37.0) million for the third quarter ended December 31, 2025, a significant decline from net earnings of $67.2 million in the prior year's third quarter. Earnings (losses) per share for Non-Voting Shares (UHAL.B) were ($0.18) for the quarter, compared to $0.35 in the same period of fiscal 2025.

- Consolidated revenue for the third quarter of fiscal 2026 increased to $1,415.6 million from $1,388.6 million in the third quarter of fiscal 2025. This growth was primarily driven by self-storage revenues increasing 7.9% and self-moving equipment rental revenues increasing 0.9%.

- For the nine-month period ended December 31, 2025, net earnings available to shareholders were $210.9 million, a decrease from $449.4 million for the same period last year.

- The company declared a cash dividend of $0.05 per share on its Non-Voting Common Stock on December 3, 2025.

- U-Haul Holding Company reported Q2 2026 earnings of $106 million and $0.54 per non-voting share, a decrease from $187 million and $0.96 per share in the prior year quarter.

- The earnings decline was primarily driven by a $107 million cost increase from fleet depreciation and a $38 million loss on disposal of retired rental equipment, compared to an $18 million gain in the same period last year.

- The self-storage segment demonstrated strong performance with revenues up nearly $22 million (10%) and average revenue per foot improving by just under 5%. Same-store occupancy decreased by 350 basis points to 90.5%, partly due to the removal of delinquent tenants.

- Capital expenditures for new rental equipment totaled $1,325 million for the first six months of fiscal 2026, an increase of $169 million year-over-year. Management anticipates normalized annual depreciation for the fleet to be around $700-$750 million in the future, reflecting a larger fleet and higher truck costs.

- The company is actively expanding its dealer network, adding nearly 1,000 new locations in the last 12 months to surpass 25,000 locations, aiming to enhance customer convenience and grow moving transactions.

- U-Haul Holding Company reported net earnings available to common shareholders of $105.6 million for the second quarter ended September 30, 2025, a decrease from $186.8 million in the prior year, with Earnings per share for Non-Voting Shares (UHAL.B) at $0.54.

- Despite the profit decline, consolidated revenue for Q2 FY26 increased to $1,719.9 million from $1,658.1 million in Q2 FY25.

- The decrease in profits was primarily due to an $83.3 million reduction in Moving and Storage earnings from operations, largely driven by $56.1 million in increased losses from equipment disposal and a $50.6 million rise in fleet depreciation expense.

- The company declared a cash dividend of $0.05 per share on its Non-Voting Common Stock, paid on September 26, 2025.

- U-Haul Holding Company reported net earnings available to common shareholders of $105.6 million and earnings per share for Non-Voting Shares (UHAL.B) of $0.54 for the second quarter ended September 30, 2025, a decrease from $186.8 million and $0.96, respectively, in the same period last year.

- Consolidated revenue for the second quarter of fiscal 2026 increased to $1.72 billion from $1.66 billion in the prior year period.

- Moving and Storage earnings from operations decreased by $83.3 million to $197.4 million, primarily due to a $50.6 million increase in fleet depreciation expense and $56.1 million in increased losses from the disposal of retired rental equipment compared to the second quarter of fiscal 2025.

- The company declared a cash dividend of $0.05 per share on its Non-Voting Common Stock on August 21, 2025, which was paid on September 26, 2025.

- U-Haul Holding Co. reported Q1 2026 earnings of $142 million and EPS of $0.73 per non-voting share, compared to $195 million and $1.00 respectively for the same quarter last year.

- Adjusted EBITDA for the Moving and Storage segment increased 6% or nearly $31 million, driven by strong revenue growth across product lines. Equipment rental revenue increased $44 million (over 4%), storage revenues were up $19 million (9%), and U-Box revenue increased about 16%.

- The decline in earnings was primarily attributed to a $22 million loss on the disposal of retired rental equipment (compared to an $8 million gain last year) and increased depreciation, which accounted for $0.21 of the EPS decline. Moving and Storage operating expenses also increased $44 million, with personnel costs up $20 million and liability costs up $17 million.

- Capital expenditures for new rental equipment were $585 million, a $46 million increase compared to the same period last year. The company invested $294 million in real estate acquisitions and self-storage/U-Box warehouse development.

- U-Box one-way transactions are leading growth, exceeding truck rental transactions as a percentage, and the company believes there is significant potential for U-Box to continue growing.

Quarterly earnings call transcripts for U-Haul Holding Co /NV/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more