Earnings summaries and quarterly performance for VIRTUS INVESTMENT PARTNERS.

Executive leadership at VIRTUS INVESTMENT PARTNERS.

George R. Aylward

Chief Executive Officer

Andra C. Purkalitis

Chief Legal Officer, General Counsel and Corporate Secretary

Barry M. Mandinach

Head of Distribution

Elizabeth A. Lieberman

Chief Human Resources Officer

Michael A. Angerthal

Chief Financial Officer and Treasurer

Richard W. Smirl

Chief Operating Officer

Board of directors at VIRTUS INVESTMENT PARTNERS.

Research analysts who have asked questions during VIRTUS INVESTMENT PARTNERS earnings calls.

Crispin Love

Piper Sandler

5 questions for VRTS

Michael Cyprys

Morgan Stanley

4 questions for VRTS

Ben Budish

Barclays PLC

3 questions for VRTS

Benjamin Budish

Barclays PLC

3 questions for VRTS

William Katz

TD Cowen

3 questions for VRTS

Bill Katz

TD Securities

2 questions for VRTS

Annalei Davis

Morgan Stanley

1 question for VRTS

Bradley Hach

TD Cowen

1 question for VRTS

Recent press releases and 8-K filings for VRTS.

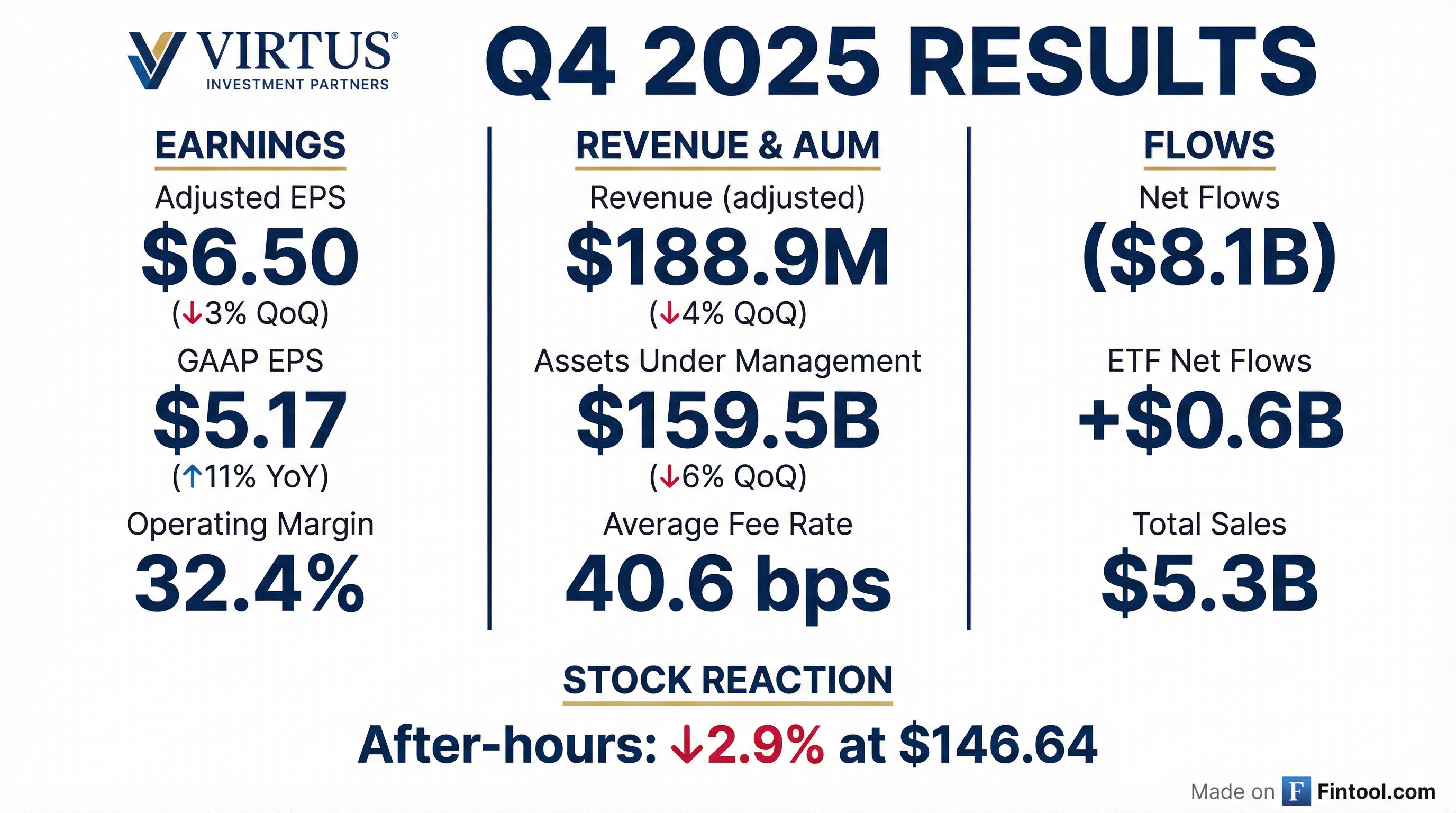

- Virtus Investment Partners reported Q4 2025 adjusted earnings per share of $6.50 and an operating margin of 32.4%, with assets under management (AUM) at $159 billion as of December 31, 2025, down from $169 billion.

- The company experienced total net outflows of $8.1 billion in Q4 2025, largely due to quality-oriented equity strategies, which represent half of its AUM.

- Strategic initiatives included launching three new actively managed ETFs and expanding into private markets with a pending 56% majority interest acquisition in Keystone National Group and a 35% minority investment in Crescent Cove.

- Virtus repurchased 60,000 shares for $10 million in Q4 2025 and ended the quarter with $386 million in cash and equivalents.

- For Q1 2026, the company anticipates an average fee rate of 41-42 basis points and employment expenses as a percentage of revenues in the 49%-51% range.

- Virtus Investment Partners reported Assets Under Management (AUM) of $159 billion at December 31, 2025, a decrease from $169 billion, driven by $8.1 billion in total net outflows, primarily from equity strategies, though ETFs generated $0.6 billion in positive net flows. Adjusted earnings per share (EPS) for Q4 2025 was $6.50, and the adjusted operating margin was 32.4%.

- The company expanded into private markets with the pending acquisition of a 56% majority interest in Keystone National Group, a private credit manager with approximately $2.5 billion in assets, and a 35% minority investment in Crescent Cove, a venture growth manager with over $1 billion in AUM.

- Virtus repurchased approximately 60,000 shares for $10 million in Q4 2025 and ended the quarter with $386 million in cash and equivalents. For Q1 2026, the company anticipates an average fee rate of 41-42 basis points and an effective tax rate of 25.3%, with net leverage expected to be 1.2x EBITDA by March 31, 2026, following the Keystone payment.

- Virtus Investment Partners reported adjusted earnings per share of $6.50 and an adjusted operating margin of 32.4% for Q4 2025.

- Assets Under Management (AUM) declined to $159.5 billion at December 31, 2025, primarily due to $8.1 billion in net outflows driven by quality-oriented equity strategies.

- The company expanded its offerings by acquiring a 56% majority interest in Keystone National Group and making a 35% minority investment in Crescent Cove, alongside launching three new actively managed ETFs in Q4 2025.

- Virtus returned capital to shareholders with $10 million in share buybacks during Q4 2025, bringing the full-year total to $60 million, and ended the year with $386 million in cash and equivalents.

- Virtus Investment Partners reported diluted earnings per share, as adjusted, of $6.50 for the fourth quarter of 2025.

- Assets Under Management (AUM) totaled $159.5 billion at December 31, 2025.

- The company experienced net outflows of ($8.1 billion) during the three months ended December 31, 2025.

- Revenues, as adjusted, were $188.9 million for the fourth quarter of 2025.

- During the quarter, the company repurchased 60,292 shares for $10.0 million.

- For Q4 2025, VIRTUS INVESTMENT PARTNERS reported assets under management (AUM) of $159.5 billion, with average AUM declining 3% to $165.2 billion. The company experienced net outflows of ($8.1) billion, primarily in quality-oriented equity strategies.

- Non-GAAP financial results for the quarter included an operating income, as adjusted, of $61.1 million and an operating margin, as adjusted, of 32.4%. Earnings per diluted share, as adjusted, were $6.50, representing a 3% decrease from the prior quarter.

- VIRTUS INVESTMENT PARTNERS acquired a 35% minority interest in Crescent Cove Advisors for $40 million and announced an agreement to acquire a majority interest in Keystone National Group. The company also repurchased $10 million of shares at an average price of $165.82 per share.

- Virtus Investment Partners reported diluted GAAP earnings per share of $5.17 and adjusted diluted earnings per share of $6.50 for the fourth quarter of 2025.

- Total GAAP revenues for Q4 2025 were $208.0 million, while adjusted revenues were $188.9 million.

- The company's assets under management (AUM) stood at $159.5 billion at December 31, 2025, with net outflows of ($8.1) billion for the quarter.

- During Q4 2025, Virtus Investment Partners repurchased 60,292 shares for $10.0 million and declared cash dividends of $2.40 per common share.

- Virtus Investment Partners reported preliminary assets under management (AUM) of $159.5 billion and other fee-earning assets of $1.8 billion, totaling $161.3 billion in client assets as of December 31, 2025.

- The change in AUM from September 30, 2025, was influenced by market performance and net outflows in U.S. retail funds, institutional accounts, and retail separate accounts, partially offset by positive net flows in exchange-traded funds.

- The preliminary average AUM for the quarter ended December 31, 2025, was $165.2 billion.

- Virtus Investment Partners, Inc. (VRTS) completed the acquisition of a 35% minority interest in Crescent Cove Advisors, LP on December 16, 2025.

- Crescent Cove Advisors, LP, founded in 2016, manages approximately $1.0 billion in assets as of November 30, 2025, and specializes in providing private capital solutions to middle market technology companies.

- This strategic investment broadens Virtus' offerings by adding a differentiated private markets capability focused on direct lending to high-growth technology companies.

- Virtus Investment Partners (VRTS) has completed the acquisition of a 35% minority interest in Crescent Cove Advisors, LP.

- Crescent Cove Advisors is a San Francisco-based firm that provides private capital solutions, specifically direct lending, to middle market technology companies.

- This transaction broadens Virtus' offerings by adding a differentiated private markets capability focused on lending to high-growth technology companies.

- Crescent Cove Advisors, founded in 2016, manages approximately $1.0 billion in assets as of November 30, 2025.

- Virtus Investment Partners reported preliminary assets under management (AUM) of $164.2 billion as of November 30, 2025.

- Total client assets, which include other fee earning assets of $1.8 billion, amounted to $166.0 billion.

- The change in AUM from October 31, 2025, reflects market performance and net outflows in retail separate accounts, U.S. retail funds, and institutional accounts, partially offset by positive net flows in exchange-traded funds.

Quarterly earnings call transcripts for VIRTUS INVESTMENT PARTNERS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more