Earnings summaries and quarterly performance for WHITE MOUNTAINS INSURANCE GROUP.

Executive leadership at WHITE MOUNTAINS INSURANCE GROUP.

Board of directors at WHITE MOUNTAINS INSURANCE GROUP.

DT

David Tanner

Detailed

Deputy Chairman of the Board

MD

Margaret Dillon

Detailed

Director

MC

Mary Choksi

Detailed

Director

PC

Peter Carlson

Detailed

Director

PG

Philip Gelston

Detailed

Director

RC

Reid Campbell

Detailed

Director

SY

Steven Yi

Detailed

Director

SS

Suzanne Shank

Detailed

Director

WH

Weston Hicks

Detailed

Chairman of the Board

Research analysts covering WHITE MOUNTAINS INSURANCE GROUP.

Recent press releases and 8-K filings for WTM.

White Mountains makes strategic investment in Bishop Street Underwriters

WTM

M&A

New Projects/Investments

- White Mountains Insurance Group, Ltd. (WTM) completed a $125 million strategic structured capital investment in Bishop Street Underwriters on February 26, 2026.

- Bishop Street Underwriters, a RedBird Capital Partners portfolio company, is a diversified platform of Managing General Agents (MGAs) and niche underwriting teams focused on the property and casualty insurance sector.

- The investment is intended to support and accelerate Bishop Street's growth, building on its 2025 performance which included surpassing $650 million in gross written premium.

1 day ago

White Mountains Insurance Group Makes Strategic Investment in Bishop Street Underwriters

WTM

New Projects/Investments

M&A

- White Mountains Insurance Group (WTM) has completed a $125 million strategic structured capital investment in Bishop Street Underwriters.

- Bishop Street Underwriters, a RedBird Capital Partners portfolio company, reported over $650 million in gross written premium and maintained a sub-50 percent portfolio loss ratio in 2025.

- This investment is intended to accelerate Bishop Street's strategy and expand its global footprint in 2026.

1 day ago

White Mountains Reports Strong Q4 and Full-Year 2025 Results Driven by Bamboo Sale

WTM

Earnings

M&A

Share Buyback

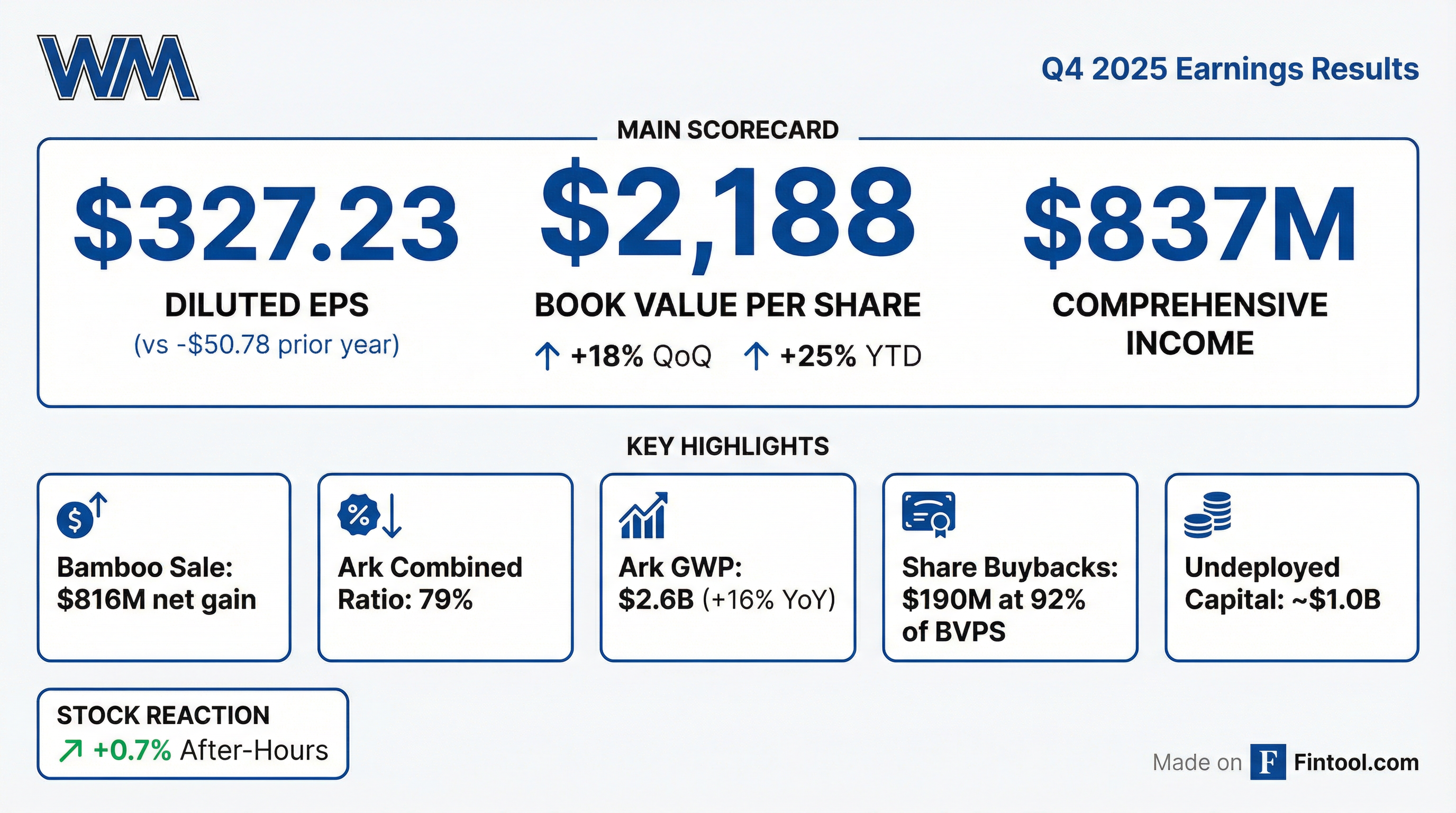

- White Mountains Insurance Group, Ltd. reported book value per share of $2,188 as of December 31, 2025, marking an increase of 18% for the fourth quarter of 2025 and 25% for the year ended December 31, 2025, including dividends. The net gain from the sale of Bamboo was the largest contributor, adding approximately $320 to BVPS in 2025.

- The company's comprehensive income attributable to common shareholders was $837 million for the fourth quarter of 2025 and $1,109 million for the year ended December 31, 2025. Basic earnings per share reached $327.23 for Q4 2025 and $430.14 for the full year 2025.

- During the fourth quarter of 2025, White Mountains repurchased approximately $190 million of shares. Excluding MediaAlpha, the investment portfolio delivered a return of 2.0% in the quarter and 8.9% for the year.

- A net deferred tax expense of $73 million was recognized in the fourth quarter of 2025 due to the reversal of a deferred tax asset, following the enactment of Pillar II legislation by Luxembourg in December 2025.

Feb 6, 2026, 1:21 PM

White Mountains Reports Strong Fourth Quarter and Full-Year 2025 Results

WTM

Earnings

M&A

Share Buyback

- White Mountains Insurance Group reported book value per share of $2,188 as of December 31, 2025, representing an 18% increase for the fourth quarter and a 25% increase for the full year, including dividends.

- The company's comprehensive income attributable to common shareholders was $837 million for the fourth quarter of 2025 and $1,109 million for the full year ended December 31, 2025.

- These results were significantly driven by the sale of Bamboo on December 5, 2025, which contributed a net gain of $816 million for the year and $848 million in net cash proceeds.

- White Mountains repurchased 95,484 common shares for $193 million in the fourth quarter of 2025 and concluded the year with approximately $1.0 billion in undeployed capital.

Feb 6, 2026, 1:00 PM

White Mountains Announces Preliminary Tender Offer Results

WTM

Share Buyback

- White Mountains Insurance Group, Ltd. (WTM) announced the preliminary results of its "modified Dutch auction" tender offer, which expired on December 19, 2025.

- The company expects to purchase 67,186 shares at or below $2,050 per share, totaling approximately $137.7 million.

- This purchase represents approximately 2.6% of White Mountains's shares outstanding as of November 19, 2025, with an expected 2,476,555 common shares outstanding immediately following payment.

Dec 22, 2025, 1:00 PM

White Mountains Completes Sale of Bamboo

WTM

M&A

- White Mountains Insurance Group, Ltd. (WTM) completed the sale of a controlling interest in Bamboo to affiliates of funds advised by CVC Capital Partners on December 5, 2025.

- The company sold approximately 77.3% of its equity interest in the Bamboo Group for net cash proceeds of $848 million at closing.

- White Mountains retained an indirect equity interest in Bamboo valued at $250 million, representing an approximately 15% fully-diluted equity stake.

- The transaction is expected to result in a pro forma increase in White Mountains's book value of $844.6 million as of September 30, 2025.

- Pro forma net income attributable to common shareholders for the nine months ended September 30, 2025, increased to $284.3 million, with basic and diluted earnings per share rising to $110.55.

Dec 8, 2025, 1:10 PM

White Mountains Reports Third Quarter 2025 Results

WTM

Earnings

M&A

New Projects/Investments

- White Mountains Insurance Group, Ltd. reported book value per share of $1,851 as of September 30, 2025, representing an increase of 3% for the third quarter and 6% for the first nine months of 2025, including dividends.

- The company entered into an agreement to sell approximately 77% of its equity interest in Bamboo, which is expected to increase book value per share by $325 to $2,176 and raise undeployed capital from $0.3 billion to $1.1 billion as of September 30, 2025.

- White Mountains acquired a controlling interest in Distinguished Programs on September 2, 2025, for $224 million in cash consideration.

- Comprehensive income attributable to common shareholders was $114 million for the third quarter of 2025 and $272 million for the first nine months of 2025.

Nov 6, 2025, 1:18 PM

White Mountains Reports Third Quarter 2025 Results

WTM

Earnings

M&A

New Projects/Investments

- White Mountains Insurance Group reported a book value per share of $1,851 as of September 30, 2025, representing an increase of 3% for the third quarter of 2025 and 6% for the first nine months of 2025, including dividends.

- The company's comprehensive income attributable to common shareholders was $114 million for the third quarter of 2025 and $272 million for the first nine months of 2025.

- White Mountains entered an agreement to sell approximately 77% of its equity interest in Bamboo, which is expected to increase book value per share by $325 to $2,176 as of September 30, 2025, and boost undeployed capital from roughly $0.3 billion to $1.1 billion.

- The Ark/WM Outrigger segment reported gross written premiums of $366 million in Q3 2025 and $2,289 million for the first nine months of 2025, with Ark's combined ratio at 76% for Q3 2025.

- Kudu achieved a 9% return on equity on a trailing 12-month basis as of September 30, 2025, and HG Global grew its book value by 3% in the third quarter of 2025.

Nov 6, 2025, 1:00 PM

White Mountains to Sell Controlling Interest in Bamboo to CVC

WTM

M&A

- White Mountains Insurance Group, Ltd. (WTM) has signed a definitive agreement to sell a controlling interest in Bamboo, a data-enabled insurance distribution platform, to funds advised by CVC Capital Partners.

- The transaction values Bamboo at $1.75 billion.

- White Mountains expects the transaction to result in a gain of approximately $310 to its book value per share and net cash proceeds of approximately $840 million.

- White Mountains will retain an approximately 15% fully-diluted equity stake in Bamboo post-closing, valued at $250 million based on the transaction.

- The transaction is expected to close by the end of the fourth quarter of 2025.

Oct 3, 2025, 8:20 PM

White Mountains to Sell Controlling Interest in Bamboo

WTM

M&A

New Projects/Investments

- White Mountains Insurance Group, Ltd. (WTM) has signed a definitive agreement to sell a controlling interest in Bamboo, a data-enabled insurance distribution platform, to funds advised by CVC Capital Partners.

- The transaction values Bamboo at $1.75 billion.

- White Mountains expects the sale to result in a gain of approximately $310 to its book value per share and net cash proceeds of approximately $840 million.

- White Mountains will retain an approximately 15% fully-diluted equity stake in Bamboo, valued at $250 million.

- The transaction is expected to close by the end of the fourth quarter of 2025.

Oct 3, 2025, 12:00 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more