AIG CEO Zaffino to Step Down After Transforming Insurance Giant

January 6, 2026 · by Fintool Agent

American International Group announced Tuesday that Chairman and CEO Peter Zaffino will retire by mid-2026 and transition to executive chairman, ending a transformational five-year tenure that rescued one of America's most storied insurers from a decade of underperformance. Aon veteran Eric Andersen will join as president and CEO-elect on February 16, taking the helm after June 1.

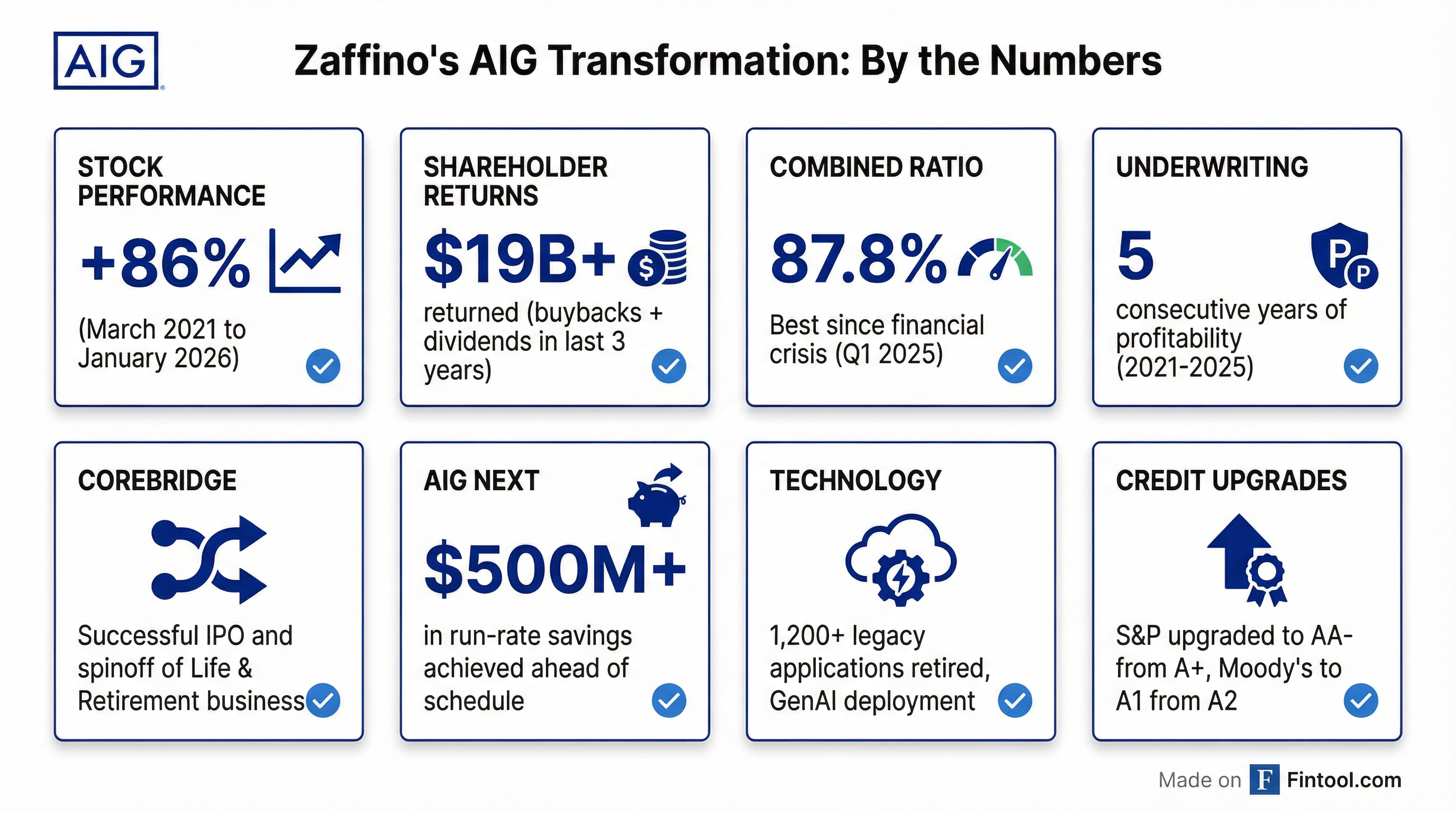

AIG shares fell nearly 7% on the news, closing at $79.02—though the stock remains up 86% from the $45.31 level when Zaffino took over in March 2021.

The Turnaround Architect Exits

Zaffino's departure marks the end of a remarkable corporate rehabilitation. When he succeeded Brian Duperreault as CEO in March 2021, AIG was still struggling to recover from the 2008 financial crisis and its $182 billion taxpayer bailout—an event that made the company synonymous with Wall Street excess.

Under Zaffino, AIG delivered five consecutive years of underwriting profitability from 2021 through 2025—a streak that had eluded the company for years.

"I am incredibly proud of our colleagues and the extraordinary progress we have delivered during my tenure to make AIG a top industry performer," Zaffino said in a statement. "We have returned AIG to vastly improved profitability, significantly strengthened our balance sheet, and built tremendous financial flexibility."

Show me AIG's combined ratio over the past 5 years compared to peers Pull AIG's stock performance since March 2021 versus the S&P 500 Insurance index What did Zaffino say at AIG's April 2025 Investor Day about the transformation?

Stock Performance Under Zaffino

The stock's 86% gain under Zaffino significantly outpaced the broader market, reflecting restored investor confidence. At its April 2025 peak of $87.72, AIG had nearly doubled from Zaffino's starting point.

| Period | AIG Stock Price | Change |

|---|---|---|

| March 2021 (Zaffino becomes CEO) | $45.31 | — |

| January 2022 (becomes Chairman) | $57 | +26% |

| September 2022 (Corebridge IPO) | $52 | +15% |

| April 2025 (52-week high) | $87.72 | +94% |

| January 5, 2026 (pre-announcement) | $84.38 | +86% |

| January 6, 2026 (announcement day) | $79.02 | +74% |

Stock data from market-data skill

The Record: What Zaffino Built

AIG's transformation under Zaffino touched every part of the business:

Underwriting Excellence: The company posted an 87.8% accident year combined ratio in Q1 2025—the best first quarter result since the financial crisis. This metric is the gold standard for property and casualty insurers, measuring profitability on the insurance they write.

Capital Returns: Over the past three years, AIG returned more than $19 billion to shareholders through stock repurchases and dividends. In 2025 alone, the company returned approximately $6 billion through the first nine months.

Corebridge Spinoff: Zaffino oversaw the separation of AIG's life and retirement business into Corebridge Financial through a 2022 IPO—a strategic move that focused the company on its core property and casualty operations. AIG has since reduced its stake to 15.5%.

Cost Discipline: The AIG Next initiative delivered over $500 million in run-rate expense savings ahead of schedule. The company retired more than 1,200 legacy applications while modernizing its technology infrastructure and deploying generative AI.

Credit Upgrades: Both S&P and Moody's upgraded AIG's financial strength ratings in 2025—S&P to AA- from A+, and Moody's to A1 from A2—validating the turnaround.

| Financial Metric | FY 2020 (Pre-Zaffino) | FY 2024 |

|---|---|---|

| Net Income | $(5.9)B | $(1.4)B* |

| Return on Equity | (8.7)% | 5.8%* |

| Total Debt | $38.5B | $9.8B* |

*FY 2024 reflects Corebridge deconsolidation impact. Values retrieved from S&P Global.

Compare AIG's combined ratio to Travelers, Chubb, and Hartford over the past 3 years How much has AIG spent on share buybacks since 2022? What is AIG's current analyst consensus rating and price target?

Andersen: The Aon Veteran Taking the Helm

Eric Andersen joins from Aon, where he spent nearly three decades rising to the role of president. During his tenure as president from 2020 through 2025, Andersen led initiatives that grew Aon's market value from $35 billion to $85 billion.

His background includes:

- CEO of Aon Benfield: Led the world's largest reinsurance intermediary

- CEO of Aon Risk Solutions Americas: Managed the company's Americas risk business

- Global account management: Deep relationships with major corporate clients and insurers

"Eric is an incredibly accomplished and widely respected insurance executive, and we have worked together closely during my tenure at AIG," Zaffino said. "Eric's deep understanding of our company and our industry ideally positions him to become AIG's next CEO."

Notably, Zaffino himself came from the brokerage side—he spent years at Marsh before joining AIG. The choice of another broker-side veteran suggests the board values distribution relationships and client-facing expertise as AIG enters its next chapter.

Market Reaction: Why the Stock Fell

Despite Zaffino's successful track record, AIG shares dropped nearly 7% on the announcement. Several factors likely contributed:

Leadership uncertainty: CEO transitions create execution risk, even with orderly succession plans. Zaffino has been synonymous with AIG's turnaround, and investors may need time to assess Andersen's priorities.

Valuation premium at risk: AIG had traded at an improved multiple under Zaffino. The stock's decline from its April 2025 high of $87.72 to $79.02 on announcement day suggests some of that premium could compress during the transition.

External hire vs. internal promotion: While Andersen is highly regarded, some investors may have preferred an internal candidate with deep AIG-specific experience.

John Rice, AIG's Lead Independent Director, moved to reassure stakeholders: "Peter's vision, tireless dedication and laser-focused execution have fundamentally reshaped AIG, restoring its reputation as a global leader. As we onboard Eric, we are grateful to benefit from Peter's continued leadership as CEO, and then as Executive Chair, where he will continue to drive AIG's future-focused digital and data initiatives and strategic relationships."

Show me AIG's insider buying or selling activity over the past 6 months What is the consensus price target for AIG? How does AIG's valuation compare to Chubb, Travelers, and Hartford?

What to Watch

Transition timeline: Andersen joins as president and CEO-elect on February 16, 2026. He is expected to become CEO and join the board after June 1, 2026, following what the company described as an "orderly transition period."

Strategic priorities: Will Andersen maintain Zaffino's focus on underwriting discipline and capital returns, or pivot toward growth? The company's Q4 2025 earnings call in early February will be closely watched for signals.

Investor Day targets: AIG set ambitious three-year financial targets at its April 2025 Investor Day, including 10%+ Core Operating ROE. Management reaffirmed these targets through Q3 2025. Whether Andersen commits to these benchmarks will matter.

Zaffino's ongoing role: As executive chairman, Zaffino will continue to drive "future-focused digital and data initiatives and strategic relationships." The extent of his involvement could influence both continuity and Andersen's autonomy.