Earnings summaries and quarterly performance for Corebridge Financial.

Executive leadership at Corebridge Financial.

Kevin Hogan

President and Chief Executive Officer

Marc Costantini

President and Chief Executive Officer (effective December 1, 2025)

Elias Habayeb

Executive Vice President and Chief Financial Officer

Jonathan Novak

Executive Vice President and President of Institutional Markets

Lisa Longino

Executive Vice President and Chief Investment Officer

Terri Fiedler

Executive Vice President and President of Retirement Services

Board of directors at Corebridge Financial.

Adam Burk

Director

Alan Colberg

Chair of the Board

Amy Schioldager

Director

Christina Banthin

Director

Christopher Lynch

Director

Colin J. Parris

Director

Deborah Leone

Director

Edward Bousa

Director

Gilles Dellaert

Director

Keith Gubbay

Director

Minoru Kimura

Director

Rose Marie Glazer

Director

Tomohiro Yao

Director

Research analysts who have asked questions during Corebridge Financial earnings calls.

Suneet Kamath

Jefferies

6 questions for CRBG

Joel Hurwitz

Dowling & Partners Securities, LLC

5 questions for CRBG

Alex Scott

Barclays PLC

4 questions for CRBG

Elyse Greenspan

Wells Fargo

4 questions for CRBG

John Barnidge

Piper Sandler

4 questions for CRBG

Thomas Gallagher

Evercore

4 questions for CRBG

Ryan Krueger

KBW

3 questions for CRBG

Wesley Carmichael

Autonomous Research

3 questions for CRBG

Cave Montazeri

Deutsche Bank

2 questions for CRBG

Daniel Bergman

TD Cowen

2 questions for CRBG

Jack Matten

BMO Capital Markets

2 questions for CRBG

Tom Gallagher

Evercore ISI

2 questions for CRBG

Tracy Benguigui

Wolfe Research

2 questions for CRBG

Wes Carmichael

Wells Fargo

2 questions for CRBG

Wilma Burdis

Raymond James Financial

2 questions for CRBG

Yaron Kinar

Oppenheimer & Co. Inc.

2 questions for CRBG

Francis Matten

BMO Capital Markets

1 question for CRBG

Jamminder Bhullar

JPMorgan Chase & Co.

1 question for CRBG

Joshua Shanker

Bank of America Merrill Lynch

1 question for CRBG

Michael Ward

Citi Research

1 question for CRBG

Taylor Scott

BofA Securities

1 question for CRBG

Wilma Jackson Burdis

Raymond James

1 question for CRBG

Recent press releases and 8-K filings for CRBG.

- Corebridge Financial, Inc. (the "Company") entered into a Share Repurchase Agreement with American International Group, Inc. (AIG) on February 12, 2026.

- The Company is expected to repurchase shares of its common stock for an aggregate purchase price of approximately $750 million.

- The per share purchase price for the repurchase is $30.42, which was the closing price of the Company's common stock on the New York Stock Exchange on February 12, 2026.

- The closing of the repurchase transaction is expected on February 17, 2026.

- This transaction was enabled by Nippon Life Insurance Company's waiver of a transfer restriction that previously prevented AIG from reducing its ownership below 9.9% of the Company's outstanding shares prior to December 9, 2026.

- Corebridge Financial reported a strong 2025, with earnings per share up 4%, return on average equity up 20 basis points, and capital return to shareholders up 13%. Sales reached a record $42 billion, an increase of 4% year-over-year, driven by 24% growth in Institutional Markets sales.

- The company executed the industry's largest variable annuity reinsurance transaction, contributing to a 110% payout ratio in 2025, and anticipates approximately $900 million in share repurchases in the first half of 2026 from these proceeds.

- Corebridge successfully launched its RILA product, MarketLock, quickly becoming a top 10 provider, and the board approved a 4% increase in the common stock dividend to $0.25 per share.

- For 2026, the company expects to meet its key financial targets for adjusted ROE, capital return, and run-rate EPS growth, but at the lower end of its 10%-15% targeted range. Operating expenses are projected to increase by 4%-5%, or $60 million, in the near term due to strategic investments.

- CFO Elias Habayeb announced his departure after this earnings call.

- Corebridge Financial reported strong 2025 performance, with earnings per share up 4% year-over-year, return on average equity up 20 basis points, and capital return to shareholders up 13%.

- The company announced significant capital returns, including a 110% payout ratio in 2025 (or 75% excluding VA reinsurance proceeds), a 4% increase in its common stock dividend to $0.25 per share, and plans for approximately $900 million in share repurchases in the first half of 2026.

- Corebridge has reduced its sensitivity to short-term interest rate movements by nearly 75% since mid-2024 and expects to grow total sources of income in 2026, with Individual Retirement base spread income estimated at $2.55 billion.

- Marc Costantini has taken over as President and CEO, and Elias Habayeb is departing as CFO.

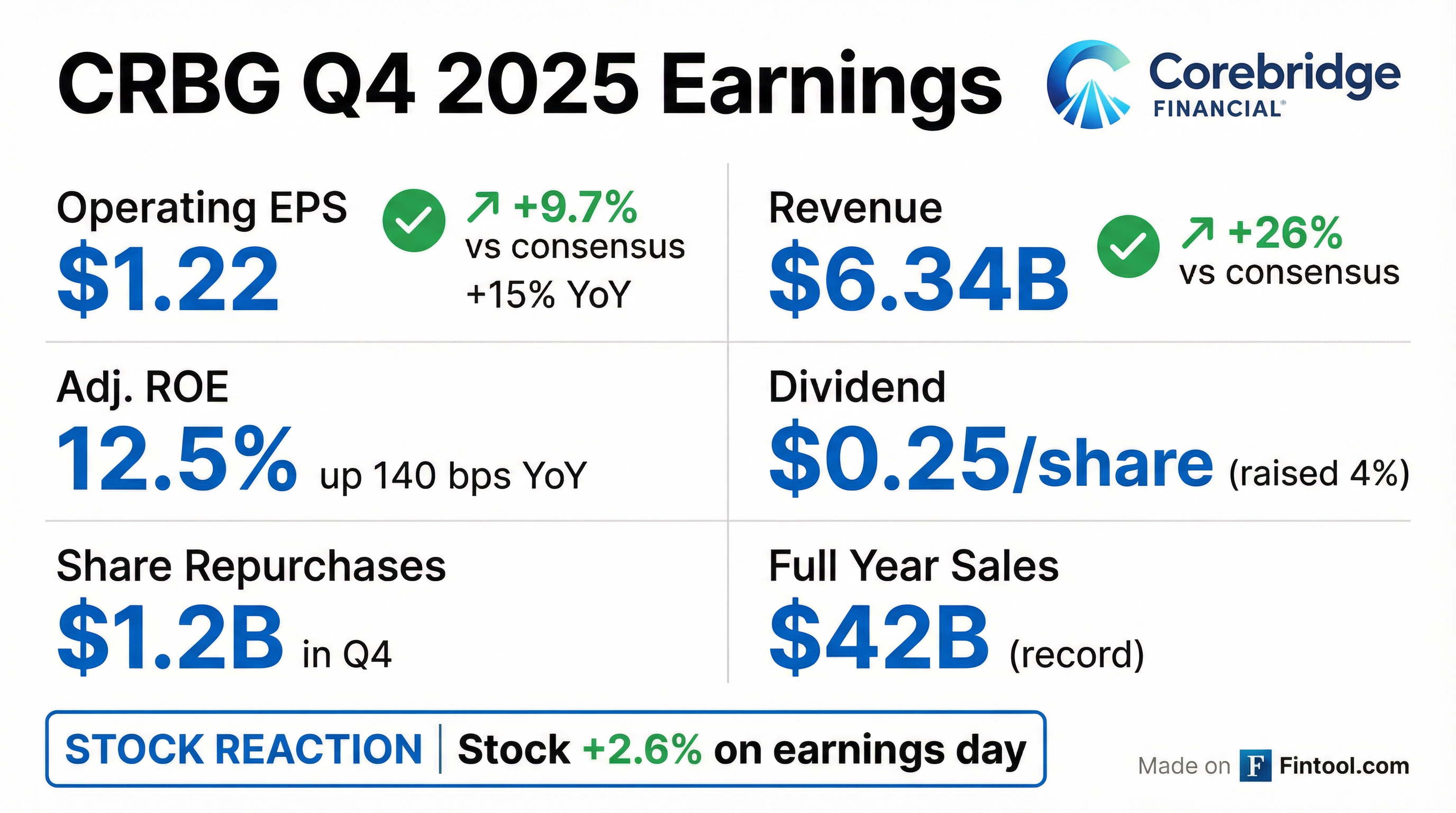

- Corebridge Financial reported a strong Q4 2025 operating EPS of $1.22, a 15% year-over-year increase, and full year 2025 sales grew 4% to a record $42 billion.

- The company returned $2.6 billion in capital to shareholders in 2025, including $1.2 billion in Q4, resulting in an annual payout ratio of 110%. The board also approved a 4% increase in the common stock dividend to $0.25 per share.

- Strategic initiatives in 2025 included the launch of the MarketLock RILA product, which quickly became a top 10 provider, and the execution of the industry's largest variable annuity reinsurance transaction to de-risk complex liabilities.

- For 2026, Corebridge expects to meet its key financial targets for adjusted ROE, capital return, and run-rate EPS growth, projecting the lower end of the 10%-15% targeted range, with operating expenses increasing 4%-5% ($60 million) due to strategic investments.

- Elias, the CFO, announced that this would be his final earnings call.

- For Q4 2025, Corebridge Financial reported a net income of $814 million ($1.59 per share) and adjusted after-tax operating income of $626 million ($1.22 operating EPS). For the full year 2025, the company had a net loss of $366 million ($0.68 per share) but achieved adjusted after-tax operating income of $2.4 billion ($4.42 operating EPS).

- Premiums and deposits for Q4 2025 were $10.1 billion, contributing to a full-year total of $41.7 billion, representing a 4% increase from the prior year.

- The company returned $1.2 billion to shareholders in Q4 2025, including $1.1 billion in share repurchases, and a total of $2.6 billion for the full year 2025, reflecting a 110% payout ratio. Additionally, the Board approved a 4% increase in the common stock dividend to $0.25 per share.

- Corebridge maintained robust capital and liquidity, with a Life Fleet RBC ratio of 430-440% and holding company liquidity of $2.3 billion as of December 31, 2025.

- Corebridge Financial reported a net income of $814 million and operating EPS of $1.22 for the fourth quarter of 2025, while the full year 2025 saw a net loss of $366 million and operating EPS of $4.42.

- Premiums and deposits reached $10.1 billion in Q4 2025 and $41.7 billion for the full year 2025.

- The company returned $1.2 billion to shareholders in Q4 2025, including $1.1 billion in share repurchases, and a total of $2.6 billion for the full year 2025, with $2.1 billion from share repurchases.

- The Board of Directors approved a 4% increase in the common stock dividend, declaring $0.25 per share payable on March 31, 2026.

- Corebridge Financial, Inc. (CRBG) has closed on the final portions of its previously announced agreement with Venerable Holdings, Inc..

- This final closing included the reinsurance of all Individual Retirement variable annuities issued by The United States Life Insurance Company in the City of New York (USL) and the sale of a related investment adviser and manager (SAAMCo).

- The sale of SAAMCo closed on January 1, 2026, and the reinsurance agreement with USL closed on January 2, 2026.

- The largest component of this transaction, involving the reinsurance of variable annuities issued by American General Life Insurance Company (AGL), was completed in August 2025.

- Corebridge Financial (CRBG) has successfully closed the final portions of its previously announced agreement with Venerable.

- This transaction included the reinsurance of Individual Retirement variable annuities issued by The United States Life Insurance Company in the City of New York (USL) and the sale of a related investment adviser and manager (SAAMCo).

- This final closing builds on the August 2025 completion of the largest component, which involved reinsuring variable annuities from American General Life Insurance Company (AGL).

- Corebridge Financial, Inc. completed a public offering of 500,000 shares of its 6.875% Fixed Rate Reset Non-Cumulative Preferred Stock, Series A on November 18, 2025.

- The offering generated $495,000,000 in proceeds to the company before expenses, based on a liquidation preference of $1,000 per share.

- Dividends on the Series A Preferred Stock will be paid semi-annually, commencing on June 1, 2026, at an initial fixed rate of 6.875% per annum until the First Reset Date on December 1, 2030.

- The Series A Preferred Stock is perpetual and may be redeemed by the company under specific conditions, including on or after the First Reset Date at $1,000 per share.

- Corebridge Financial, Inc. (CRBG) entered into an underwriting agreement on November 4, 2025, for the sale of its common stock.

- American International Group, Inc., as the selling stockholder, agreed to sell 32,600,000 shares of common stock at a price of $31.0300 per share.

- Corebridge Financial, Inc. also agreed to repurchase 16,113,438 shares of common stock from the underwriter at the same per share price, subject to the completion of the offering.

Quarterly earnings call transcripts for Corebridge Financial.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more