Alphabet Launches $15 Billion Bond Sale to Fund AI Buildout, Including Ultra-Rare 100-Year Debt

February 9, 2026 · by Fintool Agent

Alphabet is tapping the bond market for approximately $15 billion in what will be one of the largest corporate debt offerings of 2026, as the Google parent joins a wave of hyperscalers raising unprecedented amounts of capital to finance the AI infrastructure arms race.

The seven-part offering includes bonds maturing as far out as 2066, with initial price discussions for the 40-year tranche at roughly 120 basis points over Treasuries. More unusually, Alphabet is also considering issuing bonds in Swiss francs and British pounds—including a rare 100-year "century bond"—underscoring the company's confidence in its multi-generational staying power.

Alphabet shares rose 0.9% to $325.68 on Monday, pushing market capitalization to $3.94 trillion.

The $180 Billion Question

The bond sale comes just five days after Alphabet stunned investors with its 2026 capital expenditure guidance: $175 billion to $185 billion, nearly double the $91.4 billion spent in 2025.

"Our successful execution, coupled with strong performance, reinforces our conviction to make the investments required to further capitalize on the AI opportunity," CFO Anat Ashkenazi said on the Q4 earnings call.

The capex explosion reflects surging demand across Alphabet's AI portfolio:

| Metric | Q4 2025 | FY 2025 |

|---|---|---|

| Revenue | $113.8B | $402.8B |

| Net Income | $34.5B | $132.2B |

| Google Cloud Revenue | $17.7B (Q4) | $70B+ run rate |

| Cloud Backlog | $240B (+55% QoQ) | — |

| CapEx | $27.9B | $91.4B |

CEO Sundar Pichai framed the investment as essential to meeting extraordinary demand: "The investment we have been making in AI are already translating into strong performance across the business... To meet customer demand and capitalize on the growing opportunities ahead of us, our 2026 CapEx investments are anticipated to be in the range of $175 billion-$185 billion."

From Cash-Rich to Debt-Financed

For decades, Alphabet operated with minimal debt, sitting on mountains of cash while generating prodigious free cash flow. That era is ending.

| Metric | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|---|

| Total Debt | $30.0B | $29.8B | $30.4B | $67.0B |

| Cash & Equivalents | $21.9B | $24.0B | $23.5B | $30.7B |

| Total Assets | $365.3B | $402.4B | $450.3B | $595.3B |

| Total Equity | $256.1B | $283.4B | $325.1B | $415.3B |

As recently as early 2025, Alphabet carried less than $11 billion in total long-term debt. The bond issuance spree has fundamentally changed its capital structure—though with $132 billion in annual net income and a debt-to-EBITDA ratio of just 0.45x, Alphabet can comfortably service far more debt.

S&P affirmed Alphabet's AA+ rating with a stable outlook, noting the company has "additional capacity to increase net debt over $200 billion before it would reach our 1x S&P Global Ratings-adjusted net leverage downgrade threshold." Moody's assigned an equivalent Aa2 rating, citing "dominant positions in search, YouTube, Android, and digital advertising."

For context, Alphabet's AA+ credit rating equals Apple's and exceeds the United States government's (the US was downgraded to AA+ by S&P in 2011). Only two S&P 500 companies—Johnson & Johnson and Microsoft—carry the top AAA rating.

The Hyperscaler Bond Bonanza

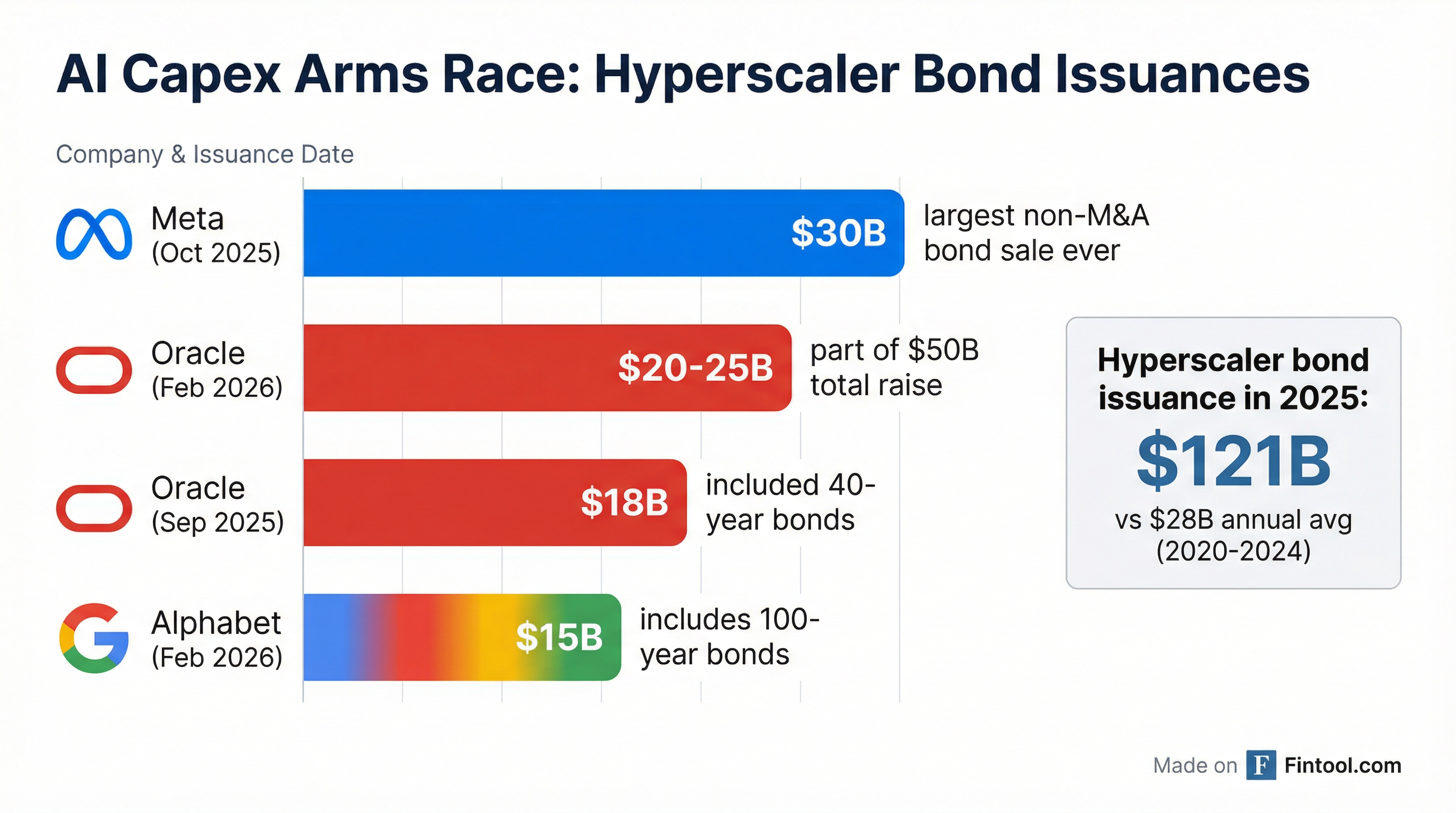

Alphabet is the latest hyperscaler to tap debt markets at historic scale. The five major AI infrastructure providers—Amazon, Alphabet, Meta, Microsoft, and Oracle—issued a combined $121 billion in US corporate bonds in 2025, compared with an average $28 billion annually between 2020 and 2024.

The competitive landscape for AI infrastructure capital is fierce:

- Meta raised $30 billion in October 2025—the largest individual non-M&A high-grade bond sale in history, with a $125 billion order book

- Oracle sold $18 billion in September 2025 (including 40-year bonds) and is currently raising an additional $20-25 billion, part of a $45-50 billion total funding plan for 2026

- Microsoft and Amazon have also increased debt issuance to fund AI buildouts

Bank of America estimates hyperscalers will issue roughly $190 billion in bonds this year. The AI capex boom shows no signs of slowing: collectively, hyperscalers are expected to spend more than $630 billion on AI infrastructure in 2026.

What Alphabet Is Building

The capital flood is financing an unprecedented infrastructure buildout. On the Q4 call, management detailed where the money is going:

AI Compute Capacity

- GPUs from partner NVIDIA, including the forthcoming Vera Rubin platform announced at CES

- Proprietary TPUs (Tensor Processing Units) developed over a decade

- Support for frontier model development by Google DeepMind

Data Center Expansion

- Approximately 60% of capex going to servers, 40% to data centers and networking

- Announced intent to acquire Intersect, a data center and energy infrastructure solutions provider

- Strategic investments including significant stakes in Other Bets like Waymo

Efficiency Improvements

- Reduced Gemini serving unit costs by 78% in 2025 through model optimizations

- First-party models now process over 10 billion tokens per minute via API, up from 7 billion last quarter

CFO Ashkenazi warned that the infrastructure buildout will pressure near-term margins: "The significant increase in our investments in technical infrastructure will continue to put pressure on the P&L in the form of higher depreciation expense and related data centers operations costs, such as energy. In 2025, depreciation increased by nearly $6 billion, or 38%... we expect the growth rate in 2026 depreciation to accelerate."

The Risk: Is This a Bubble?

The elephant in the room: are hyperscalers overinvesting in AI infrastructure? Oracle's stock has fallen 50% from its September 2024 peak as investors fret about capital intensity and uncertain returns. Credit default swaps on Oracle debt hit their highest levels since 2008 in December.

Alphabet appears better positioned than peers. Its diversified revenue base—Search and YouTube still generate the majority of profit—provides cushion if AI monetization disappoints. Free cash flow, while declining due to capex, remains substantial at $38 billion for FY 2025. And its sterling credit rating gives it access to capital at rates other companies can only envy.

When asked what "keeps him up at night," Pichai was direct: "Compute capacity—all the constraints, be it power, land, supply chain constraints. How do you ramp up to meet this extraordinary demand for this moment, get our investments right for the long term, and do it all in a way that we are driving efficiencies and doing it in a world-class way?"

What to Watch

Near-term:

- Pricing and demand for the bond offering (strong order books would signal confidence in AI spending)

- Q1 2026 results and any updates to capex guidance

- Depreciation expense trajectory (management warned of "meaningful" increases)

Longer-term:

- Google Cloud revenue acceleration—Cloud backlog grew 55% QoQ to $240 billion

- AI monetization across Search, YouTube, and Enterprise products

- Free cash flow stabilization as capex peaks

The century bond, if issued, would be a fascinating signal of Alphabet's confidence in its long-term franchise. Only a handful of companies—Disney, Coca-Cola, Norfolk Southern—have issued 100-year bonds. If investors are willing to lend Google money until 2126, it speaks volumes about perceived durability in an AI-transformed world.