Amazon's $50 Billion OpenAI Gambit: Why the Anthropic Backer Is Hedging Both Sides of the AI Race

February 02, 2026 · by Fintool Agent

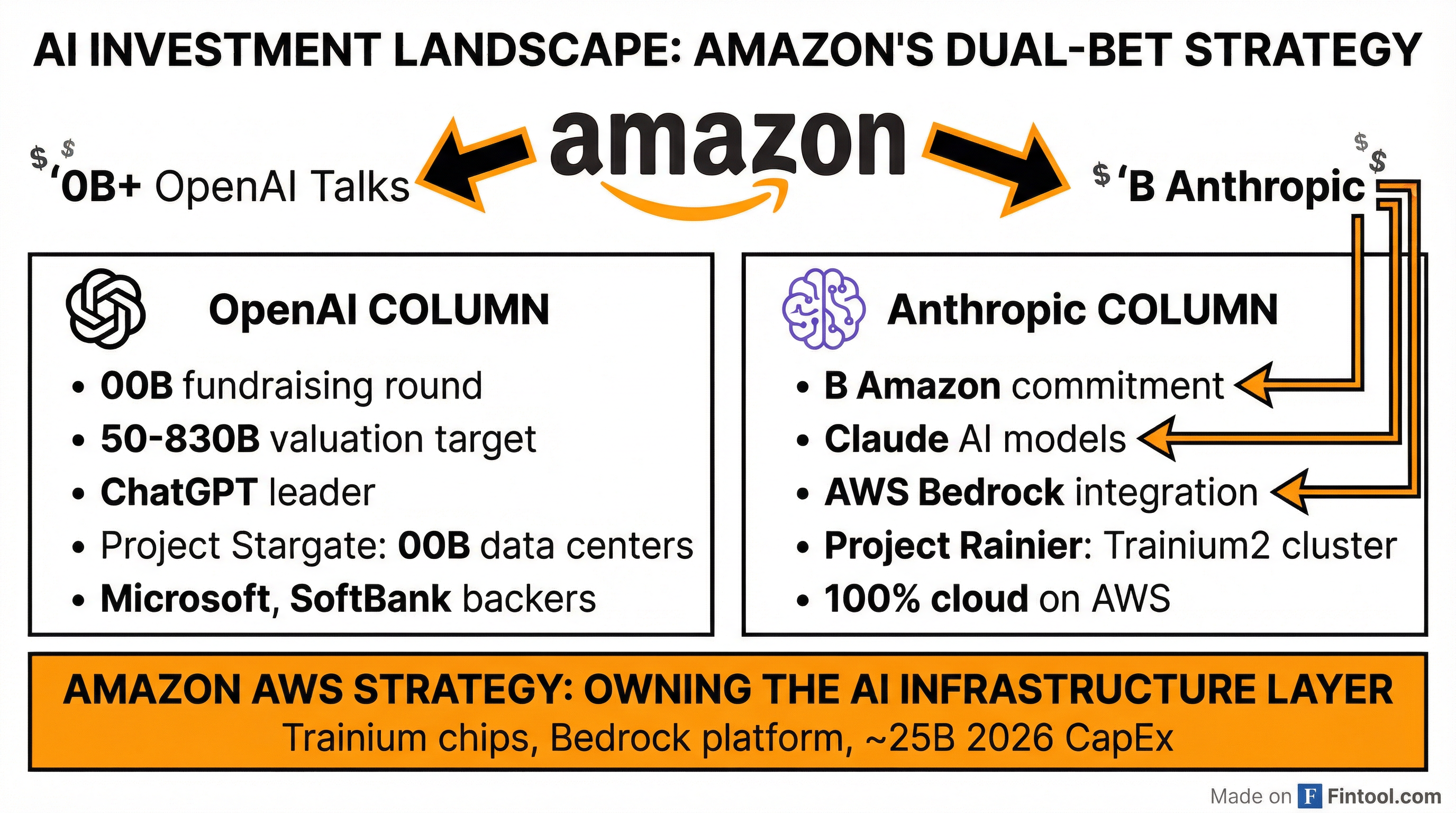

Amazon+1.53% is in talks to invest up to $50 billion in OpenAI, a move that would make the e-commerce giant one of the largest backers of the ChatGPT developer—despite already having committed $8 billion to OpenAI's fiercest rival, Anthropic.

The discussions, led directly by Amazon+1.53% CEO Andy Jassy and OpenAI CEO Sam Altman, represent the most aggressive AI hedging strategy yet by a major cloud provider. If completed, it would mark the largest single investment in an AI company in history.

The $100 Billion Funding Frenzy

OpenAI is seeking to raise as much as $100 billion in a funding round that could value the company between $750 billion and $830 billion—more than the GDP of Argentina.

The investor lineup reads like a who's who of Big Tech and sovereign capital:

- Amazon: Up to $50 billion under discussion

- Microsoft-1.61%: Existing backer, considering additional investment

- Nvidia-2.89%: Scaled back from initial $100 billion commitment to tens of billions

- SoftBank: Potentially $30 billion on top of its $40 billion prior commitment

- Middle East sovereign funds: Up to $50 billion from Abu Dhabi's MGX and others

Nvidia-2.89%'s pullback from its September 2025 commitment of up to $100 billion has created an opening. CEO Jensen Huang acknowledged last week that the memorandum of understanding was "non-binding" and cited concerns about OpenAI's "lack of discipline" and competitive threats from Google+1.68%'s Gemini and Anthropic's Claude.

Amazon's Dual-Bet Strategy

The paradox at the heart of this deal: Amazon+1.53% already has $8 billion invested in Anthropic, OpenAI's most capable competitor, with AWS serving as Anthropic's "primary cloud and training partner."

The Anthropic relationship runs deep. Amazon is collaborating with Anthropic on Project Rainier, "a cluster of Trainium2 ultra servers containing hundreds of thousands of Trainium2 chips" that will be "five times the number of exaFLOPS as the cluster Anthropic used to train their current leading set of Claude models."

CEO Andy Jassy has emphasized the strategic importance of this partnership: "It's also why you're seeing Anthropic build their future frontier models on Trainium2."

So why would Amazon consider backing both horses?

The infrastructure play. Regardless of whether OpenAI or Anthropic wins the AI race, Amazon wins if both run on AWS infrastructure. By investing in OpenAI, Amazon could potentially secure a cloud relationship similar to its Anthropic arrangement—steering compute spend toward AWS and its custom Trainium chips.

The competitive threat from Microsoft. Microsoft-1.61% has been OpenAI's principal investor and primary cloud partner since 2019. An Amazon investment could dilute that exclusivity and create optionality for OpenAI's infrastructure decisions.

The capex is already flowing. Amazon is spending aggressively on AI infrastructure regardless. Capital expenditures hit $35 billion in Q3 2025 alone, up from $25 billion in Q1 2025. As Jassy noted, the company believes AI "could be even larger" than AWS's already massive opportunity.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $187.8 | $155.7 | $167.7 | $180.2 |

| CapEx ($B) | $27.8 | $25.0 | $32.2 | $35.1 |

| Cash from Ops ($B) | $45.6 | $17.0 | $32.5 | $35.5 |

OpenAI's Burn Rate Problem

OpenAI desperately needs the capital. The company reached $13 billion in revenue last year but plans to spend $115 billion between 2025 and 2029 on computing infrastructure. Projected losses for 2026 alone: $14 billion.

The company's long-term committed spending is staggering: $1.4 trillion in data center and computing obligations.

Project Stargate, the $500 billion AI infrastructure initiative announced at the White House in January 2025, has secured only $52 billion in committed equity—$19 billion each from SoftBank and OpenAI, $7 billion each from Oracle and MGX. The remaining $448 billion must come from debt financing not yet secured.

Market Implications

The talks come at a pivotal moment:

- Amazon earnings February 5: Q4 2025 results could provide color on AI investment plans and AWS growth

- Microsoft-1.61% valuation concerns: MSFT stock dropped 12% last week after disclosing that 45% of its $625 billion cloud backlog is tied to OpenAI

- OpenAI IPO timeline: The company is considering going public as soon as later this year

- Nvidia exposure: Any large investment would likely flow back to Nvidia for GPU purchases

The deal structure matters. Amazon would presumably seek terms similar to its Anthropic investment—a minority stake without a board seat, but with strategic commitments around cloud infrastructure. OpenAI's CFO Sarah Friar has acknowledged that much of the fundraising "will go back to Nvidia" in chip purchases, creating a circular flow of capital that investors are increasingly scrutinizing.

What to Watch

Near-term catalysts:

- Amazon Q4 2025 earnings (February 5) for AI investment commentary

- OpenAI funding round close, expected in coming weeks

- Any announcements on OpenAI cloud infrastructure partnerships

Key questions:

- Does Amazon secure exclusive or preferred cloud terms with OpenAI?

- How does this affect Microsoft's OpenAI relationship?

- Will Nvidia ultimately participate, and at what level?

The AI infrastructure arms race is accelerating. Amazon's potential $50 billion bet on OpenAI—while already backing Anthropic—suggests the company believes the safest strategy is owning as much of the infrastructure layer as possible, regardless of which AI models ultimately win.

Related:

- Amazon+1.53% company profile

- Microsoft-1.61% company profile

- Nvidia-2.89% company profile

- Alphabet+1.68% company profile