China's Anta Sports Buys 29% Puma Stake for $1.8 Billion, Becoming Largest Shareholder

January 27, 2026 · by Fintool Agent

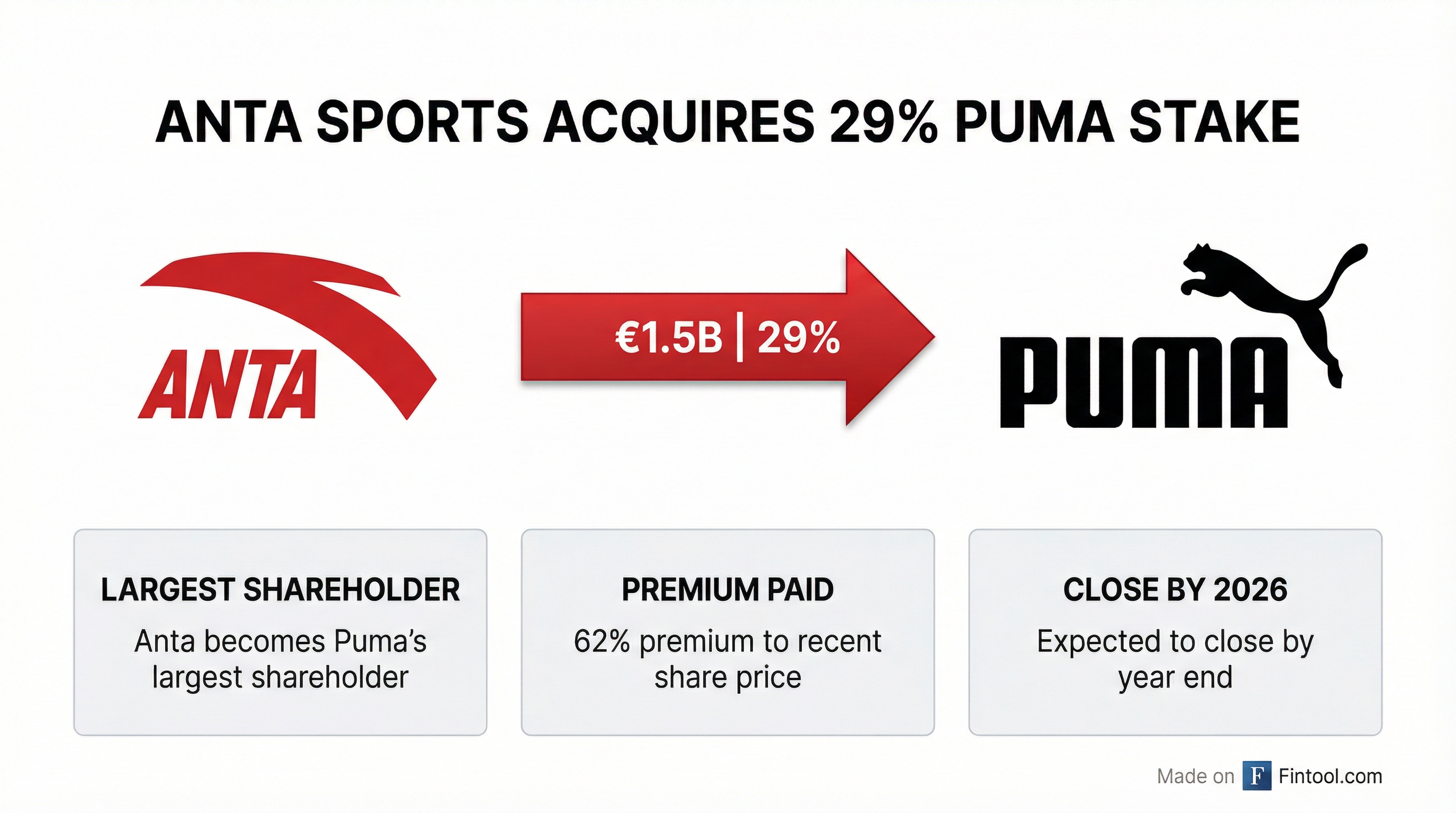

Chinese sportswear giant Anta Sports Products Ltd. has agreed to buy a 29.06% stake in Puma SE from the Pinault family's Artemis investment vehicle for €1.5 billion ($1.8 billion), making the Fila owner and Salomon backer the largest shareholder in the struggling German sportswear maker.

The cash offer of €35 per share represents a roughly 62% premium to Puma's recent share price, and sent Puma shares surging as much as 17% in early trading before settling up about 9% by mid-afternoon.

"This acquisition makes Anta Sports the largest shareholder of Puma and marks a major step forward in our 'single-focus, multi-brand, globalization' strategy," said Ding Shizhong, Board Chairman of Anta Sports. "We believe Puma's share price over the past few months does not fully reflect the long-term potential of the brand."

The Deal Structure

Anta will purchase approximately 43 million shares from Groupe Artémis, the investment company controlled by the Pinault family, which also owns luxury conglomerate Kering. The transaction will be entirely financed using Anta's internal cash resources.

Key terms of the deal:

| Metric | Value |

|---|---|

| Stake acquired | 29.06% |

| Purchase price | €1.5 billion ($1.8 billion) |

| Price per share | €35 |

| Premium to recent price | 62% |

| Expected close | By end of 2026 |

| Financing | Internal cash |

Anta said it intends to seek "adequate representation" on Puma's Supervisory Board but currently has no plans to make a full takeover offer for the company.

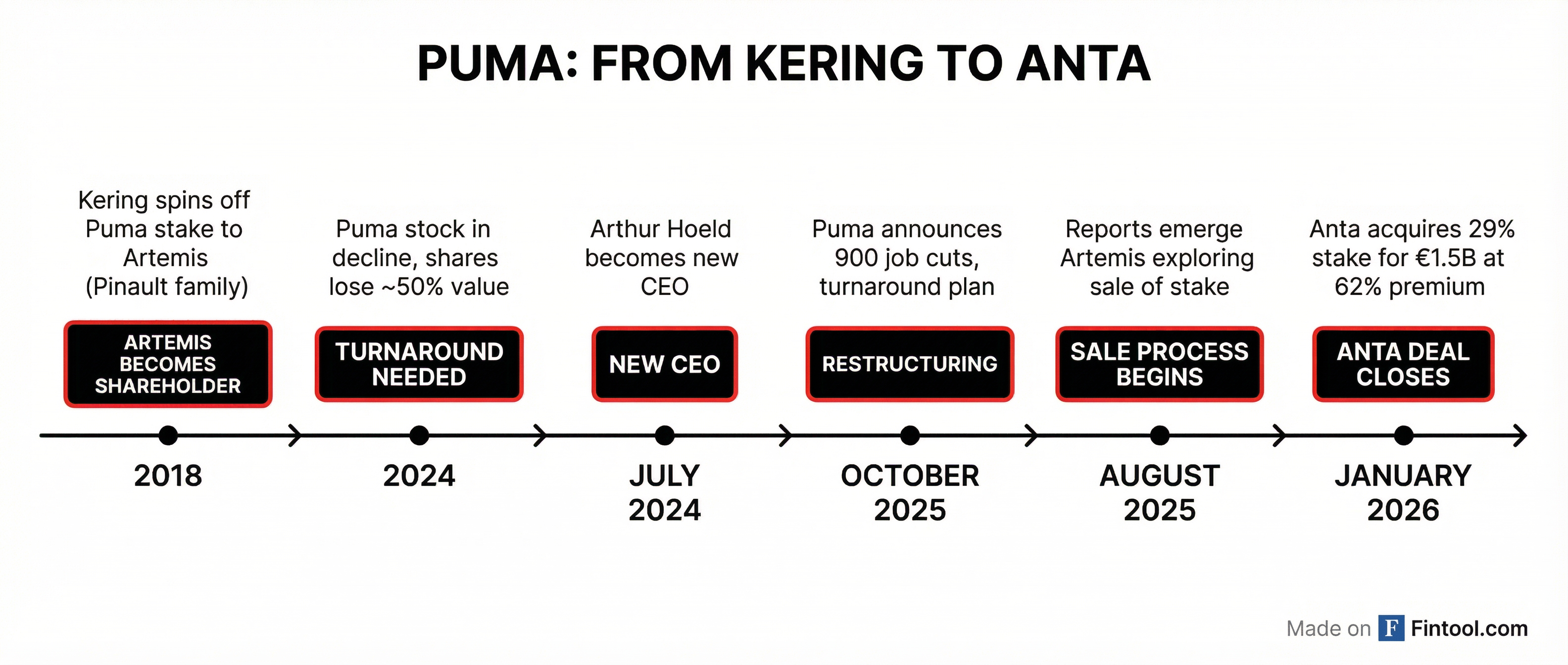

Why Artemis Is Selling

The Pinault family acquired the Puma stake in 2018 when luxury conglomerate Kering repositioned itself as a "pure luxury player" focused on brands like Gucci and Saint Laurent. Since then, Puma's stock has lost more than half its value, declining approximately 62% over the past two years.

The sale helps Artemis reduce its debt load at a time when its core Kering investment is also facing challenges from the luxury slowdown. Kering's flagship brand Gucci has struggled with declining sales, putting pressure on the broader portfolio.

Anta's Global Sportswear Empire

Anta brings a proven track record in building and revitalizing international sportswear brands. The company already operates an extensive portfolio spanning mass market to premium segments:

Most notably, Anta holds a controlling stake in Amer Sports, the NYSE-listed parent company of Salomon, Arc'teryx, Wilson, and Peak Performance. Under Anta's stewardship, Amer Sports has delivered strong financial results:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $1.64* | $1.47* | $1.24* | $1.76* |

| Gross Margin | 56.1%* | 57.8%* | 58.5%* | 56.8%* |

| EBITDA Margin | 14.2%* | 17.4%* | 7.1%* | 17.2%* |

*Values retrieved from S&P Global

Christian Reindl, portfolio manager at Union Investment, a Puma shareholder, noted: "Anta has already shown with other brands that it can successfully support them, e.g. Amer Sports. Operationally, however, Puma remains a restructuring case for the time being."

Puma's Turnaround Challenge

Puma has been under significant pressure as sportswear competition has intensified. Recent sneaker launches, including the much-hyped Speedcat, failed to generate the momentum executives had hoped for.

New CEO Arthur Hoeld, who took over in July 2024, announced a turnaround plan in October 2025 that included:

- 900 job cuts on top of 500 layoffs earlier in the year

- Reduced discounting to protect brand value

- Improved marketing effectiveness

- Streamlined product range

The company is set to report fourth-quarter results on February 26, giving investors a first look at how the restructuring is progressing.

Anta Chairman Ding expressed confidence in the turnaround: "We have confidence in its management team and strategic transformation. Moving forward, we hope to build strong trust, work together at arm's length, and leverage our complementary strengths without compromising independence."

Strategic Rationale: Unlocking China

Anta's core value proposition is its unrivaled access to the Chinese market—the world's second-largest sportswear market and a notoriously difficult one for Western brands to penetrate independently.

Anta's portfolio brands and Puma offer "highly complementary strengths across product portfolio, category specialization and regional footprint," according to the company's announcement. While Puma has strength in football, running, basketball, and motorsport across Europe, Latin America, Africa, and India, Anta dominates in China and Southeast Asia.

The deal structure preserves Puma's operational independence while giving Anta influence over strategic direction:

"Anta Sports fully appreciates Puma's management culture and independent governance as a German-listed company. These representatives will work closely with the other Supervisory Board members... while preserving Puma's strong brand identity and heritage."

Geopolitical Considerations

The deal has already drawn scrutiny from U.S. lawmakers. Senator Mike Lee raised competition concerns about the transaction, questioning whether it could harm competition even if a full takeover were never completed.

The transaction requires regulatory approvals and is expected to close by the end of 2026. Given Anta's Hong Kong listing and Puma's German headquarters, the deal will need to navigate both Chinese and European regulatory frameworks.

What to Watch

- February 26, 2026: Puma Q4 2025 earnings—first look at turnaround progress

- Throughout 2026: Regulatory approval process

- By year-end 2026: Expected deal close

- Post-close: Anta board representation and strategic influence

For investors in the broader sportswear space, this deal signals continued consolidation in an industry increasingly dominated by a handful of global players. Nike, with a market cap of $96 billion, remains the industry leader, but Anta's aggressive M&A strategy is rapidly building a challenger portfolio.