Apple Posts Record $143.8B Quarter on 'Staggering' iPhone Demand and China Rebound

January 30, 2026 · by Fintool Agent

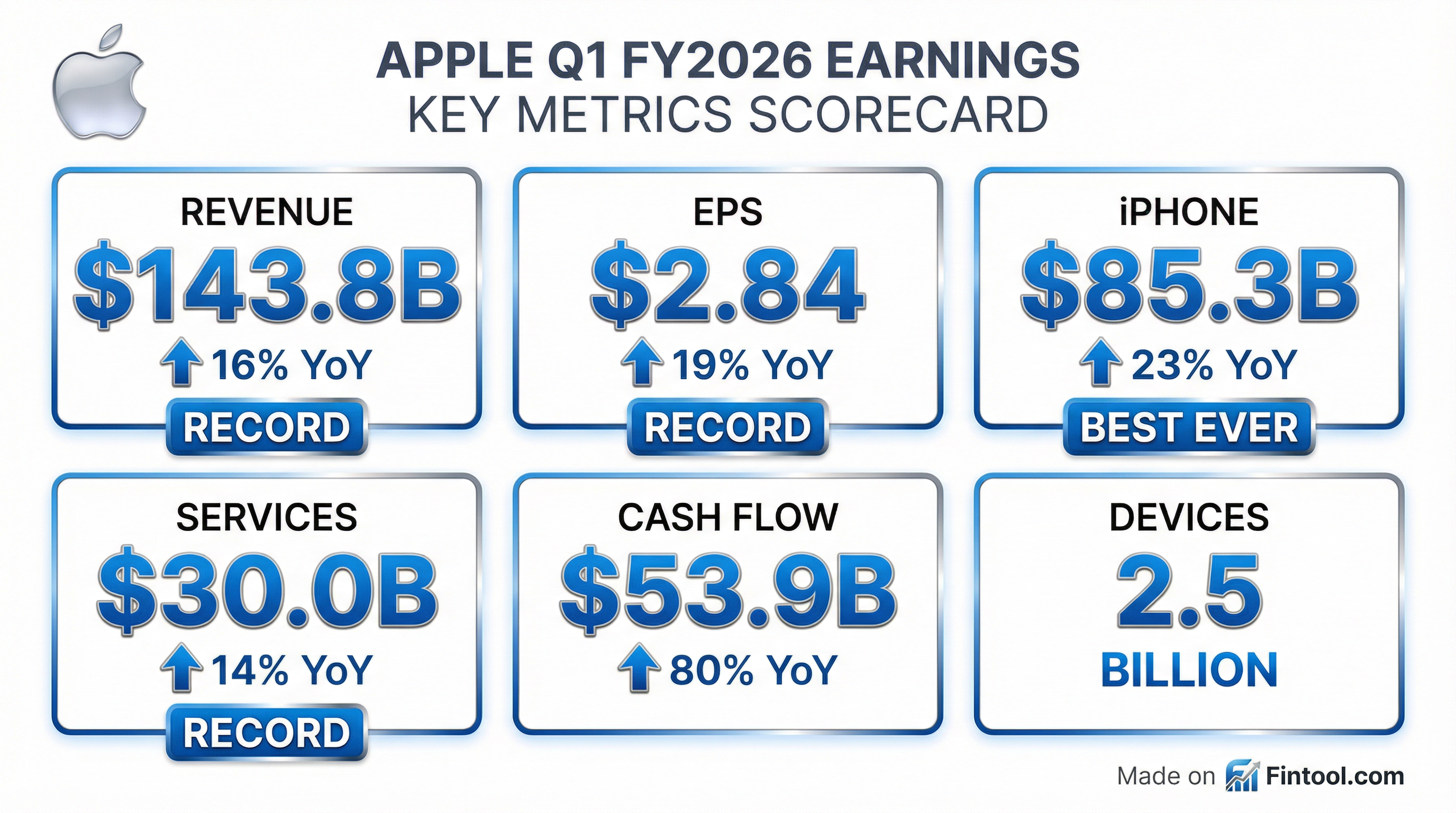

Apple delivered what CEO Tim Cook called "a quarter for the record books," posting all-time highs for revenue, EPS, iPhone sales, and operating cash flow as the iPhone 17 family drove unprecedented demand across every geographic region.

The headline numbers crushed Wall Street expectations: revenue of $143.8 billion (vs. $138.5B consensus), EPS of $2.84 (vs. $2.67 consensus), and iPhone revenue of $85.3 billion that beat estimates by more than $6.6 billion—an 8.4% surprise on the company's most important product line.

Perhaps most striking was Greater China, which had been a persistent overhang on Apple's stock. The region surged 38% year-over-year to $25.5 billion—flipping from headwind to tailwind and delivering Apple's best iPhone quarter ever in China.

The Numbers

| Metric | Q1 FY2026 | Q1 FY2025 | YoY Change | vs. Consensus |

|---|---|---|---|---|

| Revenue | $143.8B | $124.3B | +16% | Beat by $5.3B |

| EPS | $2.84 | $2.40 | +19% | Beat by $0.17 |

| Net Income | $42.1B | $36.3B | +16% | — |

| iPhone | $85.3B | $69.1B | +23% | Beat by $6.6B |

| Services | $30.0B | $26.3B | +14% | In-line |

| Mac | $8.4B | $9.0B | -7% | Missed by $0.5B |

| iPad | $8.6B | $8.1B | +6% | Beat |

| Wearables/Home | $11.5B | $11.7B | -2% | Missed |

| Gross Margin | 48.2% | 46.9% | +130 bps | Beat |

| Operating Cash Flow | $53.9B | $29.9B | +80% | ALL-TIME RECORD |

iPhone: "Simply Staggering" Demand

The iPhone 17 family powered Apple's best-ever quarter for the device, with revenue of $85.3 billion—up 23% year-over-year and representing nearly 60% of total company sales.

"The demand for iPhone was simply staggering," Cook told CNBC. "It exceeded our expectations, to say the least."

The company set all-time iPhone revenue records across every geographic segment, including:

- Americas: All-time record

- Europe: All-time record

- Japan: All-time record

- Greater China: Best iPhone quarter ever

- India: December quarter record

Customer satisfaction for the iPhone 17 family reached 99% in the U.S. according to 451 Research, while Worldpanel surveys showed iPhone was the top-selling smartphone model in the U.S., urban China, U.K., Australia, and Japan.

China: From Overhang to Tailwind

The China turnaround was the quarter's biggest surprise. After multiple quarters of stagnation and competitive pressure from domestic brands, Greater China revenue surged 38% to $25.5 billion—well above the $21.8 billion consensus.

"We saw a lift that, frankly, was much greater than we thought we would see," Cook said. "It was product-driven."

Key China highlights from the call:

- Store traffic grew "strong double digits" year-over-year

- Upgraders: Set an all-time record in mainland China

- Switchers: Double-digit growth from competing brands

- Installed base: Reached all-time highs in both Greater China and mainland China

- Market position: iPhone was the top three smartphones in urban China per Worldpanel

The region's 38% growth was more than double Apple's overall 16% revenue increase, and Cook emphasized that Mac, iPad, and Watch also saw the majority of buyers being new to those products in China.

Services: The $30 Billion Run-Rate Engine

Services hit an all-time record of $30.0 billion, up 14% year-over-year, extending Apple's remarkable track record in building recurring revenue streams.

The segment reached all-time records in:

- Advertising

- Cloud services

- Music

- Payment services

- Video (December quarter record)

Apple TV+ viewership grew 36% in December versus the prior year, with shows like Pluribus driving engagement. Cook highlighted upcoming content including Cape Fear from Steven Spielberg and Martin Scorsese, plus the return of Ted Lasso for a fourth season.

The installed base of active devices crossed 2.5 billion—up from 2.35 billion a year ago—providing an ever-growing foundation for services monetization.

Guidance: Strong Outlook, But Supply Constraints

Apple guided for Q2 revenue growth of 13%-16% year-over-year, implying $107.8-$110.7 billion versus consensus of $104.8 billion. Services is expected to grow at a similar 14% rate.

However, management warned of constrained iPhone supply during the current quarter:

"We exited the December quarter with very lean channel inventory due to that staggering level of demand. And based on that, we're in a supply chase mode to meet the very high levels of customer demand. We are currently constrained, and at this point, it's difficult to predict when supply and demand will balance."

The constraint is driven by availability of advanced nodes (specifically 3nm) where Apple's SoCs are produced, compounded by less supply chain flexibility than normal due to surging demand.

Memory pricing is also a headwind. While it had minimal impact in Q1, Apple expects it to have "more of an impact" on Q2 gross margins, which is reflected in the 48%-49% guidance range.

| Q2 FY2026 Guidance | Range |

|---|---|

| Revenue Growth | 13%-16% YoY |

| Revenue (Implied) | $107.8B - $110.7B |

| Gross Margin | 48% - 49% |

| OpEx | $18.4B - $18.7B |

| Tax Rate | 17.5% |

Google Collaboration for AI

Apple announced during the call that it is collaborating with Google to develop "the next generation of Apple Foundation Models," which will power future Apple Intelligence features including a more personalized Siri coming later this year.

"We basically determined that Google's AI technology would provide the most capable foundation," Cook said. Apple will continue running models on-device and in Private Cloud Compute to maintain its privacy-first approach.

Separately, Apple recently acquired Israeli AI startup Q.AI in a deal reportedly valued at nearly $2 billion to accelerate its audio and voice AI capabilities.

Capital Return

Apple generated $53.9 billion in operating cash flow—an all-time quarterly record—and returned nearly $32 billion to shareholders through $25 billion in buybacks (93 million shares) and $3.9 billion in dividends.

The board declared a quarterly dividend of $0.26 per share, payable February 12 to shareholders of record as of February 9.

What to Watch

Near-term:

- Q2 iPhone supply constraints and when supply/demand balance

- Memory pricing trajectory and margin impact

- China momentum sustainability through non-holiday quarters

Medium-term:

- Apple Intelligence adoption rates and premium pricing power

- Google collaboration timeline and scope

- Services growth as installed base scales past 2.5B devices

Risks:

- Advanced node capacity constraints (TSMC 3nm)

- Rising memory costs pressuring margins

- Tariff exposure (Apple estimated $1.4B impact in Q1)