ASML Joins $500 Billion Club as Third European Company Ever

January 15, 2026 · by Fintool Agent

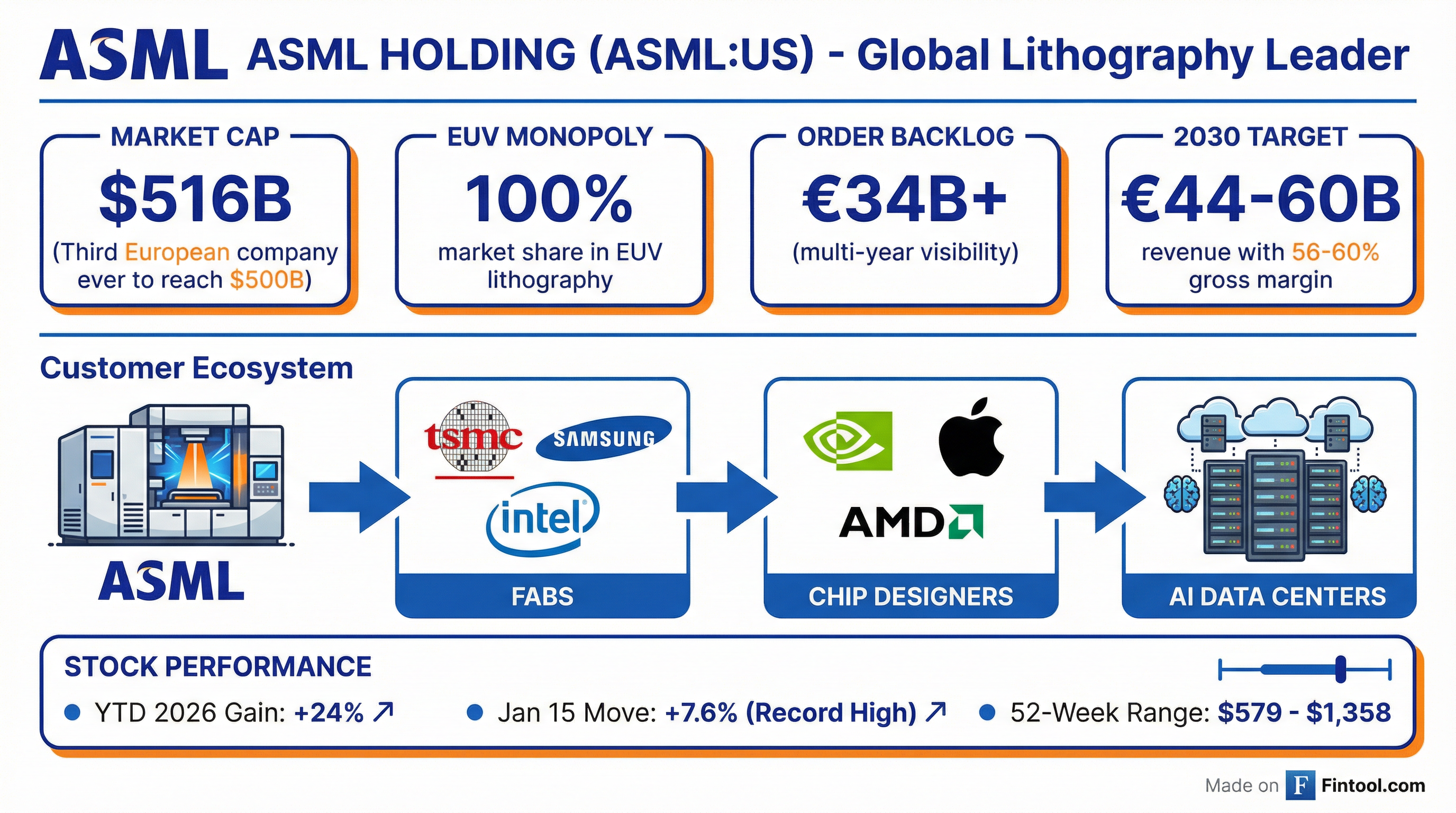

Asml Holding became only the third European company ever to surpass $500 billion in market value on Thursday, joining an elite club previously occupied only by luxury conglomerate LVMH and Danish pharma giant Novo Nordisk. The Dutch semiconductor equipment maker's shares surged 7.6% to a record high of $1,358, pushing its market capitalization to approximately $527 billion (€453 billion).

The catalyst: Taiwan Semiconductor Manufacturing Co. delivered a blockbuster Q4 earnings report and guided 2026 capital expenditure to $52-56 billion—roughly 21% above the $46 billion consensus—signaling that AI infrastructure spending shows no signs of cooling.

"The milestone means a lot for the market sentimentally," said Barclays strategist Emmanuel Cau. "Europe is a small market, so if ASML as a major stock goes up, the broader market will automatically benefit. The rally in ASML also gives European investors a gateway to play the mainstream AI trade."

The TSMC-ASML Feedback Loop

TSMC's results provided fresh optimism for sustained global AI spending in 2026. The world's largest contract chipmaker reported record Q4 net profit of approximately NT$506 billion ($16 billion), up 35% year-over-year, with revenue of NT$1.046 trillion (~$33.7 billion).

More importantly for ASML, TSMC raised its 2026 capex guidance dramatically:

| Metric | 2026 Guidance | 2025 Actual | Consensus |

|---|---|---|---|

| Capital Expenditure | $52-56B | $38-42B | $46B |

| YoY Change | +30% | N/A | +10% |

"We continue to observe robust AI-related demand from our customers," said TSMC Chairman C.C. Wei in the company's most recent earnings commentary. "The demand is almost insane and much, much higher than we can prepare. We are trying very hard to narrow the gap between demand and supply."

Europe's Most Valuable Tech Company

ASML's ascent to the $500 billion mark underscores a fundamental shift in European corporate leadership. Unlike past decades when energy companies and banks dominated the region's largest market caps, today's leaders increasingly come from technology, healthcare, and luxury goods.

| European Market Cap Leaders | Market Cap | Sector |

|---|---|---|

| Asml | $516B | Semiconductor Equipment |

| LVMH | $376B | Luxury Goods |

| SAP | $290B | Enterprise Software |

| Novo Nordisk | $266B | Pharmaceuticals |

| Hermès | $271B | Luxury Goods |

Data as of January 15, 2026

At $516 billion, ASML remains a fraction of Wall Street's technology giants—Nvidia and Alphabet both exceed $4 trillion. But the company's irreplaceable position in the semiconductor supply chain has made it one of the most strategically important companies on Earth.

The EUV Monopoly

ASML is the sole producer of extreme ultraviolet (EUV) lithography machines—the only equipment capable of printing the smallest features on advanced microchips. Chip designs from giants like Nvidia, Apple, and Amd cannot be manufactured without EUV.

"This company has that market completely cornered," said Daniel Newman of The Futurum Group.

The company's technological moat took more than two decades and €6 billion in R&D to build:

Current EUV Systems (NXE Series)

- Price: $180-220 million per machine

- Resolution: 13nm features

- Use: 7nm, 5nm, and 3nm chip nodes

- Sold: 44 systems in 2024

Next-Gen High-NA EUV (EXE Series)

- Price: $380-400 million per machine

- Resolution: 8nm features

- Use: Sub-2nm chip nodes (essential for AI processors)

- Status: First shipments to Intel, Samsung ramping

"High NA means two things," explained Jos Benschop, ASML's executive VP of technology. "First and foremost, shrink. So there's more devices on a single wafer. Secondly, by avoiding multiple patterning, you can make them faster and with higher yield."

Financial Performance

ASML's recent financial trajectory reflects the semiconductor industry's structural growth:

| Metric | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 |

|---|---|---|---|---|

| Revenue | €7.5B | €7.7B | €7.7B | €9.3B |

| Gross Margin | 51.6% | 53.7% | 54.0% | 51.7% |

| Net Income | €2.1B | €2.3B | €2.4B | €2.7B |

| Net Bookings | €5.4B | €5.5B | €3.9B | €7.1B |

The company expects full-year 2025 revenue growth of approximately 15% with gross margins around 52%—and has guided that 2026 revenue will not fall below 2025 levels.

Looking further ahead, ASML's November 2024 Investor Day outlined a path to €44-60 billion in annual revenue by 2030 with gross margins of 56-60%.

The China Question

One headwind: China accounted for a disproportionate share of ASML's recent sales as Chinese chipmakers stockpiled equipment ahead of tightening export controls. CEO Christophe Fouquet has warned that China business "should be back to the historical normal of between 20% and 25% in 2025"—down from 49% at its peak.

"We expect China customer demand, and therefore our China total net sales in 2026 to decline significantly compared to our very strong business there in 2024 and 2025," Fouquet said in the company's Q3 earnings statement.

However, this "normalization" is expected to be offset by surging demand from AI-focused Western and Taiwanese chipmakers.

What to Watch

Near-term catalyst: ASML reports Q4 2025 results on January 28, 2026. Key metrics to watch include:

- Net bookings trajectory (€5.4B in Q3)

- 2026 guidance specifics (currently "not below 2025")

- High-NA EUV production ramp progress

- Updated order backlog (currently €34B+)

Longer-term: The "TSMC-ASML feedback loop" has become the most powerful engine in the global economy, driving innovation at a scale never seen in the technology sector. Every dollar TSMC spends on capacity expansion flows directly through ASML's monopoly on cutting-edge lithography.

As one analyst put it: "The road to the future of AI runs through a single town in the Netherlands: Veldhoven."