Bank of America Beats Q4 Estimates But Stock Falls on Trump Rate Cap Proposal

January 14, 2026 · by Fintool Agent

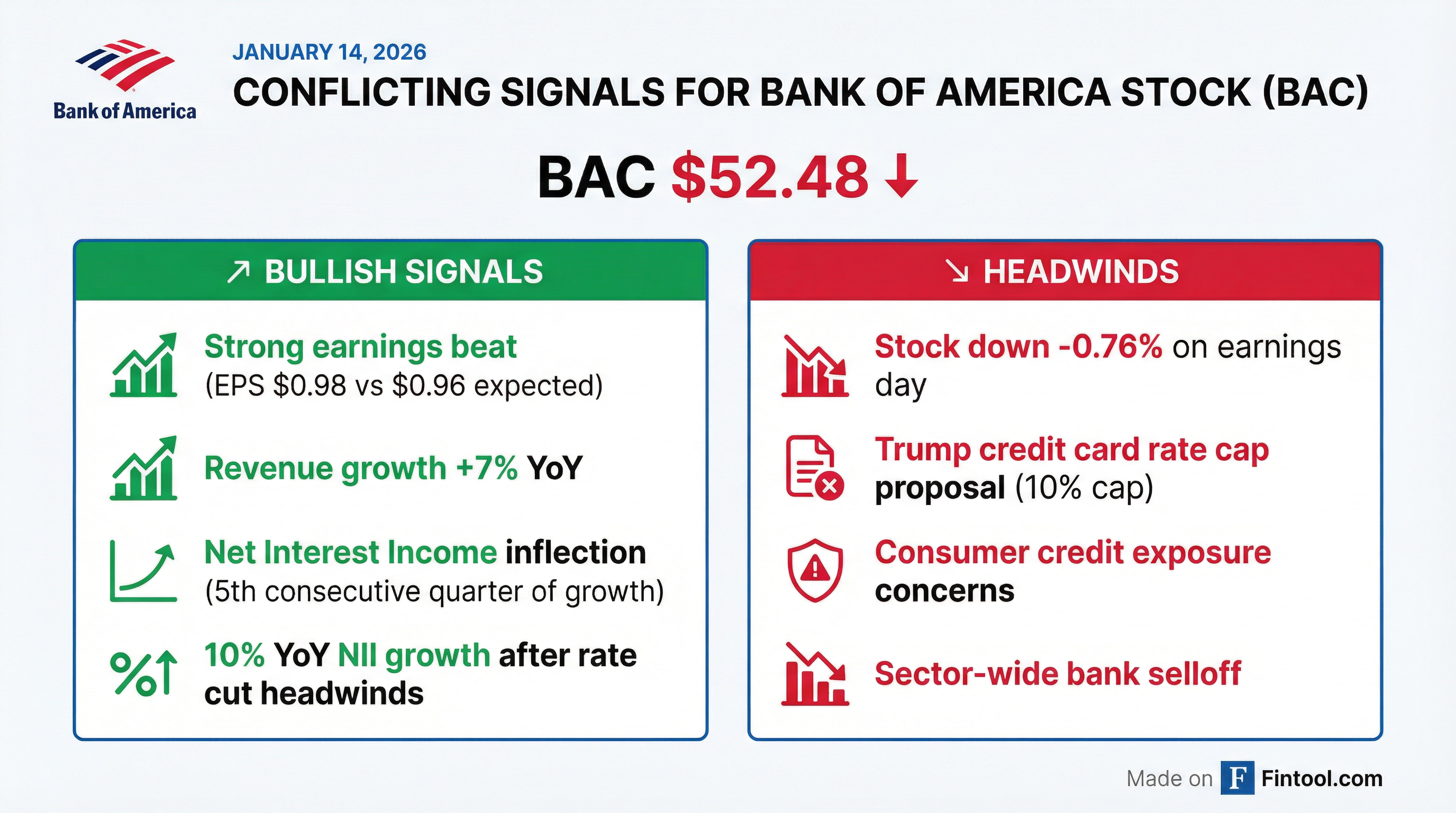

Bank of America reported Q4 2025 net income of $7.6 billion, up 12% year-over-year, with diluted earnings per share of $0.98—beating analyst expectations of $0.96 by two cents. Revenue reached $28.4 billion, a 7% increase from the prior year and above the $27.55 billion consensus estimate.

But the beat wasn't enough. BAC shares fell 0.8% to $52.48 on Tuesday as President Trump's proposal to cap credit card interest rates at 10% rattled the entire banking sector. The selloff hit Citigroup even harder—down 4.7%—given its heavier consumer credit card exposure.

The NII Inflection Is Real

The most significant development in the quarter wasn't the earnings beat—it was confirmation that net interest income has definitively turned. NII rose to $15.8 billion ($15.9 billion on a fully taxable-equivalent basis), up 10% from $14.4 billion in Q4 2024.

This matters because NII had been declining as the Fed cut rates, bottoming in Q3 2024. Q4 marks the fifth consecutive quarter of sequential improvement—a trend that management expects to continue into 2026.

CEO Brian Moynihan emphasized the bank's focus on "responsible growth" and organic customer additions: "We completed our 11th consecutive year of responsible growth...We added a record number of net new consumer checking accounts, grew wealth management assets and client balances, and recorded strong commercial and investment banking revenue."

Segment Performance: All Four Units Profitable

All four business segments contributed to the quarter:

| Segment | Net Income | YoY Change |

|---|---|---|

| Consumer Banking | $3.3B | +8% |

| Global Wealth & Investment Management | $1.4B | +14% |

| Global Banking | $2.3B | +5% |

| Global Markets | $1.6B | +15% |

Consumer Banking's $3.3 billion contribution reflects solid deposit growth and rising consumer spending. The wealth management unit benefited from higher asset valuations and fee income. Global Markets rode the broader trading tailwinds that lifted peers like Goldman Sachs, which hit all-time highs earlier this week.

The Rate Cap Overhang

President Trump's proposal to cap credit card interest rates at 10% cast a shadow over an otherwise strong report. Current average credit card APRs exceed 20%, meaning such a cap would effectively cut card lending profitability in half.

For Bank of America specifically, consumer credit cards represent a meaningful but not dominant portion of the loan book. The greater concern is what a rate cap signals about the regulatory direction—and whether it could extend to other consumer lending products.

The market's reaction was swift and indiscriminate. While Citigroup fell nearly 5% on its outsized card exposure, even JPMorgan and Wells Fargo—with more diversified loan books—saw pressure.

Credit Quality Remains Stable

Net charge-offs totaled $1.5 billion for the quarter, with the net charge-off ratio at 0.58%. The provision for credit losses was $1.5 billion, essentially matching actual losses and signaling management's confidence in portfolio quality.

This is notable given ongoing concerns about consumer credit health. Bank of America's numbers suggest that—at least in its portfolio—stress remains contained despite the higher rate environment of recent years.

Full Year: Record in Several Categories

For full-year 2025, Bank of America generated $114.3 billion in total revenue (net of interest expense). The bank returned $23 billion to shareholders through dividends and buybacks, including $9.9 billion in common stock repurchases.

| Metric | FY 2025 | FY 2024 | Change |

|---|---|---|---|

| Net Income | $29.6B | $26.5B | +12% |

| Total Revenue | $114.3B | $110.0B | +4% |

| Return on Equity | 12% | 11% | +100bps |

| Diluted EPS | $3.48 | $3.08 | +13% |

What to Watch

Near-term: The political trajectory of the credit card rate cap. Markets will parse Congressional reaction and assess passage probability. Any movement toward hearings or legislative text could pressure bank stocks further.

Medium-term: NII trajectory through 2026. If Bank of America can sustain 10%+ NII growth while keeping credit losses contained, the fundamental story remains intact regardless of one day's stock action.

Competition: Wells Fargo had its asset cap lifted in June 2025, making it a more formidable competitor again. Watch for market share shifts in consumer and commercial banking.

Related: