Canada Slashes Chinese EV Tariffs to 6%, Breaking With U.S. in Historic Trade Reset

January 16, 2026 · by Fintool Agent

Canada will cut tariffs on Chinese electric vehicles from 100% to 6.1%, Prime Minister Mark Carney announced Friday in Beijing—a dramatic break with U.S. trade policy that brings Chinese automakers one step closer to the American market.

The landmark agreement, forged during the first Canadian prime ministerial visit to China since 2017, allows up to 49,000 Chinese EVs into Canada annually at preferential rates—roughly 3% of the 1.8 million vehicles sold there each year. In exchange, Beijing will slash tariffs on Canadian canola from 84% to about 15%, unlocking what Carney called "nearly $3 billion in export orders" for Canadian farmers.

Tesla+3.50% shares were flat at $439.04, while General Motors+1.13% rose 0.8% to $81.54 and Ford+0.58% fell 0.8% to $13.70 as investors weighed the implications of Chinese competition moving closer to North America.

The Deal Structure

The agreement reverses tariffs that Canada imposed in September 2024 under former PM Justin Trudeau, who followed the U.S. in slapping 100% duties on Chinese EVs to protect domestic automakers from subsidized competition.

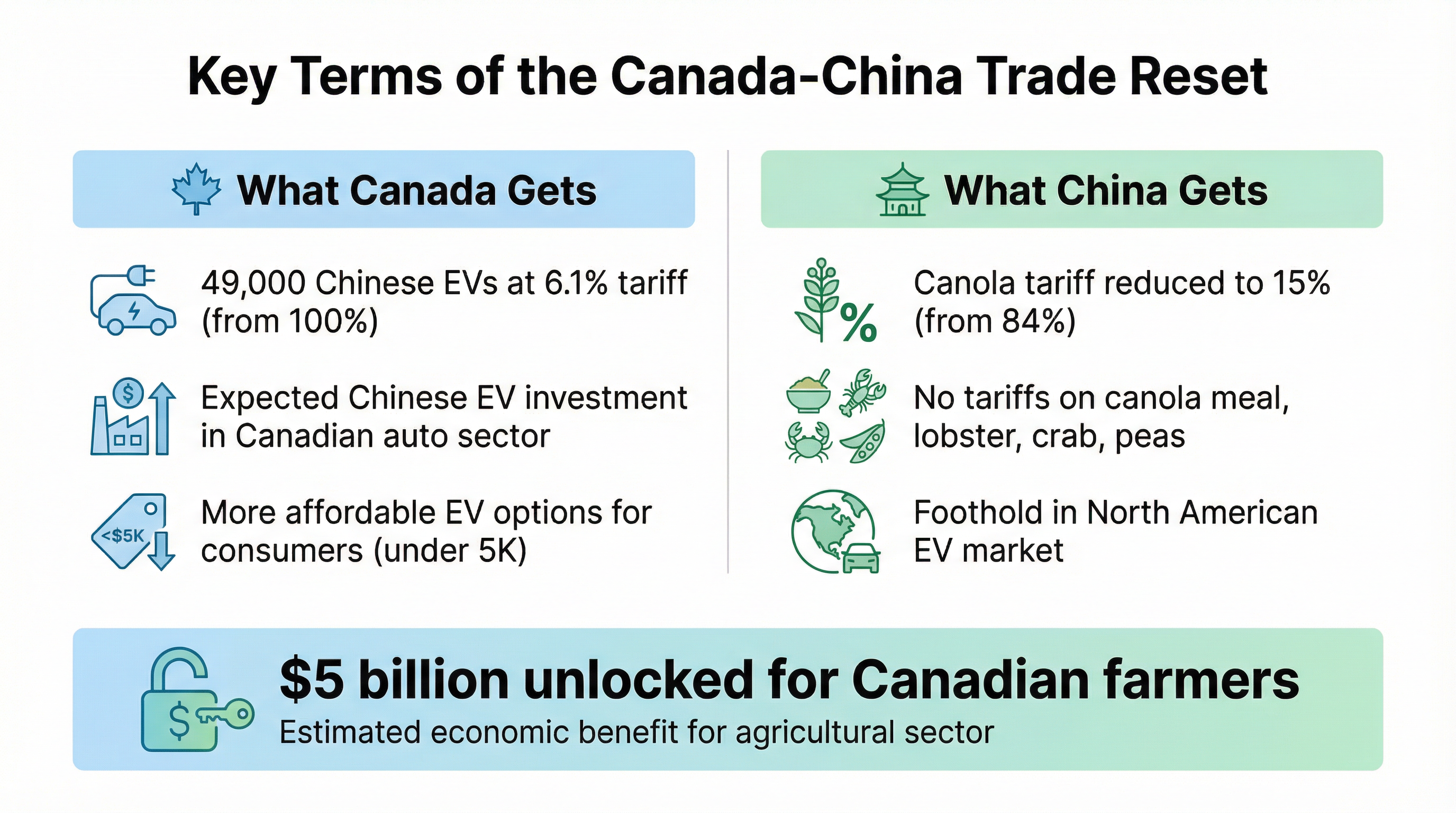

What Canada Gets:

- Chinese EV imports at 6.1% tariff (down from 100%)

- Initial cap of 49,000 vehicles, growing to ~70,000 over five years

- Expected Chinese investment in Canadian auto manufacturing "within three years"

- Lower-cost EV options for consumers (imports priced under $35,000)

What China Gets:

- Canola tariffs reduced to ~15% from 84% by March 1

- Removal of tariffs on canola meal, lobsters, crabs, and peas through year-end

- A strategic foothold in a G7 nation amid broader U.S.-led decoupling efforts

The deal came after two days of meetings between Carney and Chinese leaders, including President Xi Jinping, who hailed a "turnaround" in relations.

Why It Matters for U.S. Automakers

The timing is significant. Chinese automaker BYD sold 4.6 million vehicles globally in 2025, overtaking Tesla as the world's largest battery-electric vehicle manufacturer. With EVs priced at a fraction of Western competitors—and Chinese brands expected to control about 30% of the global vehicle market by 2030—the concern for Detroit is existential.

| Company | Stock Price | Change | Market Cap | Year-to-Date |

|---|---|---|---|---|

| Tesla+3.50% | $439.04 | +0.1% | $1.41T | +4.8% |

| General Motors+1.13% | $81.54 | +0.8% | $76B | +6.1% |

| Ford+0.58% | $13.70 | -0.8% | $54B | +2.6% |

| Stellantis-23.65% | $9.74 | -2.8% | $28B | -10.3% |

GM has already disclosed that tariff impacts could hit EBIT by $3.5–$4.5 billion in 2025, though recent modifications have provided some relief. Ford warned in its latest 10-K that tariffs, "should they be implemented and sustained for an extended period of time, would have a significant adverse effect" on the industry.

The concern isn't just direct competition from imports—it's the potential for Chinese manufacturers to establish factories in Canada and ship vehicles south.

A Diplomatic Rebuke

Carney's framing of the deal was pointed. Asked about the contrast with Washington, the former Bank of England governor said China has become a "more predictable" partner to deal with than the United States.

The comment landed amid heightened U.S.-Canada tensions. President Trump has imposed tariffs on Canadian goods and suggested Canada could become America's 51st state. U.S. Trade Representative Jamieson Greer called Canada's decision "problematic" and suggested it would complicate North American trade negotiations.

Ontario Premier Doug Ford, whose province is Canada's auto manufacturing heartland, was blunt in his criticism: "The federal government is inviting a flood of cheap made-in-China electric vehicles without any real guarantee of equal or immediate investments in Canada's economy, auto sector or supply chain."

The Bigger Picture

The deal reflects a broader recalibration of global trade relationships in response to U.S. protectionism under Trump. Beijing is eager to cooperate with a G7 nation in what analysts call a traditional sphere of U.S. influence.

"Given current complexities in Canada's trade relationship with the U.S., it's no surprise that Carney's government is keen to improve the bilateral trade and investment relationship with Beijing," said Even Rogers Pay of Trivium China. "Meanwhile, it's difficult for Washington to criticize Carney for striking a beneficial trade deal when Trump himself just did so in October."

For U.S. automakers, the calculus is more complicated. While 100% tariffs keep Chinese EVs out of America for now, the northern border is becoming more porous. Chinese-brand vehicles are already common sights near the Mexico border—the same could become true near Canada.

And then there's this: Trump himself said this week in Detroit that he would welcome Chinese automakers building factories in the U.S. "If they want to come in and build the plant and hire you and hire your friends and your neighbors, that's great," he said.

What to Watch

Near-term catalysts:

- March 1, 2026: China expected to implement canola tariff reductions

- Q2 2026: First Chinese EVs under new quotas expected to arrive

- Ongoing: U.S. response and potential impact on USMCA negotiations

Key questions:

- Will Chinese manufacturers announce Canadian manufacturing investments?

- How will U.S. automakers adjust pricing and strategy?

- Does this set a precedent for other U.S. allies to pursue similar deals?