Citigroup to Cut 1,000 Jobs This Week as Fraser's Restructuring Enters Final Year

January 12, 2026 · by Fintool Agent

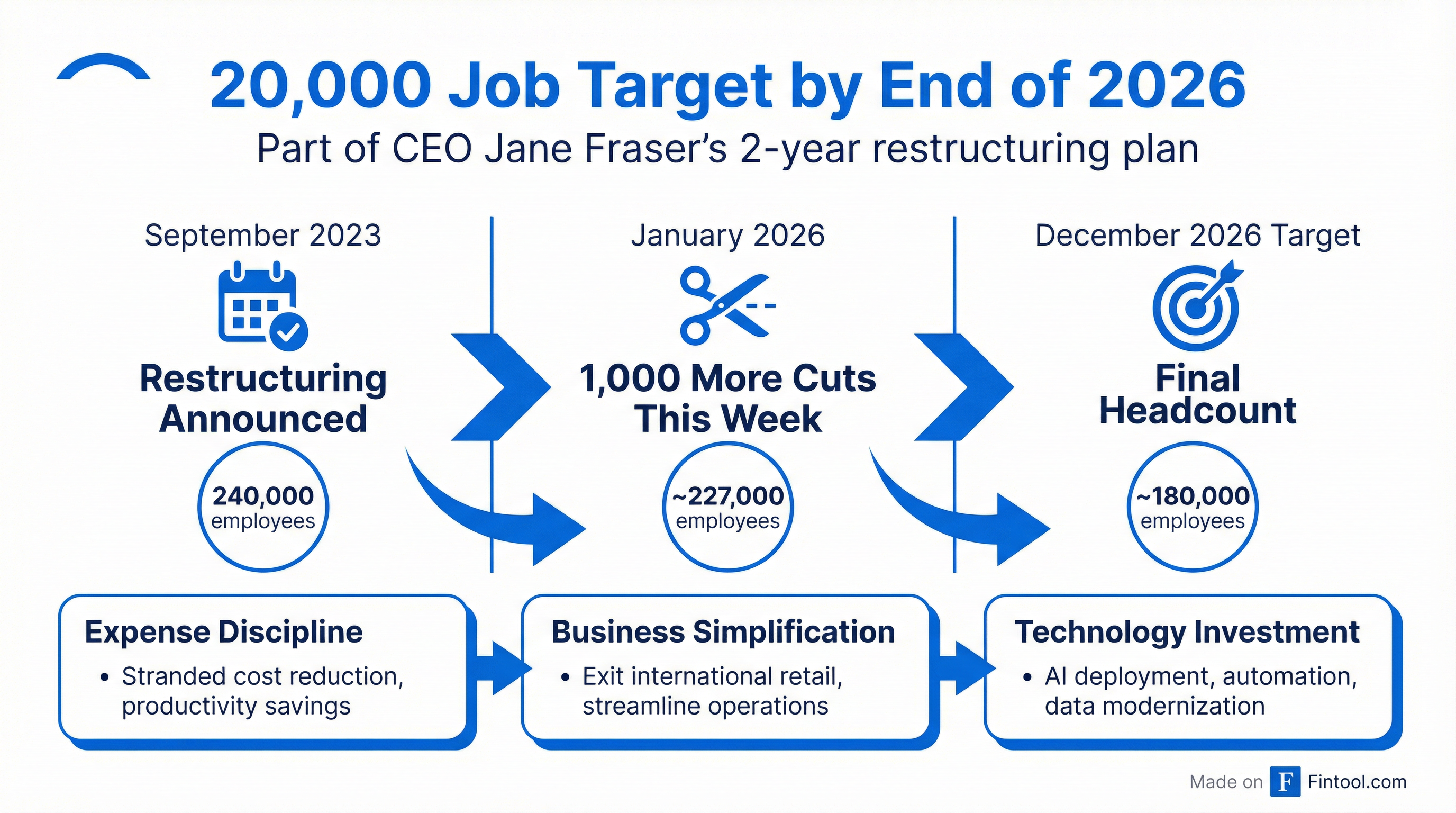

Citigroup will eliminate approximately 1,000 jobs this week as CEO Jane Fraser pushes to complete a sweeping restructuring that has already transformed Wall Street's most globally dispersed bank.

The cuts bring the bank closer to its target of reducing headcount by 20,000 positions by the end of 2026—a goal set when Fraser announced the reorganization in September 2023. With about 227,000 employees at the end of September, Citigroup still needs to eliminate several thousand more workers this year to reach the approximately 180,000 target.

"We will continue to reduce our headcount in 2026," the bank said in a statement. "These changes reflect adjustments we're making to ensure our staffing levels, locations and expertise align with current business needs; efficiencies we have gained through technology; and progress against our transformation work."

The Stock's Wild Day

The timing couldn't be more fraught. Citigroup shares dropped 3% on Monday to $117.70—the steepest decline among major banks—after President Trump demanded a cap on credit card interest rates at 10%. As one of America's largest credit card issuers, Citigroup would face significant margin pressure if such a cap were implemented.

Yet the single-day selloff belies a remarkable turnaround story. Over the past 12 months, Citigroup shares have soared 68%—more than any other major bank and nearly double the gains at JPMorgan Chase (+35%), Wells Fargo (+35%), or Bank of America (+25%).

Fraser's Transformation: The Numbers

When Fraser took the helm in March 2021—becoming the first woman to run a major U.S. bank—she inherited a sprawling institution that had chronically underperformed rivals. Her September 2023 reorganization eliminated management layers, collapsed regional hierarchies, and set an aggressive timeline to slash costs while investing in core franchises.

The financial trajectory tells the story of a turnaround gaining traction:

| Metric | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|

| Net Income ($B) | $3.24 | $2.86 | $4.06 | $4.02 | $3.75 |

| Diluted EPS | $1.51 | $1.34 | $1.96 | $1.96 | $1.86 |

| Return on Equity | 6.3% | 5.5% | 7.8% | 7.5% | 7.1% |

| Total Assets ($T) | $2.43 | $2.35 | $2.57 | $2.62 | $2.64 |

Management has consistently pointed to three pillars driving expense reduction: stranded cost elimination from divested businesses, productivity gains from organizational simplification, and severance as targeted headcount reductions take hold.

"We are very focused on bringing down our expense base. At the same time, the transformation remains our number one priority and we will continue to make the investments needed specifically as it relates to data and regulatory reporting," CFO Mark Mason said on the Q1 2025 earnings call.

The Banamex Variable

A key piece of the headcount puzzle remains the planned IPO of Citibanamex, the bank's Mexican retail operation. That listing alone will remove roughly 40,000 employees from Citigroup's roster, representing a significant portion of the 60,000 total reduction CFO Mason originally outlined.

The Banamex separation—slated for completion next year—caps Citigroup's exit from international consumer banking, a strategic retreat that has also included sales of operations across Asia and Europe. Poland remains the final outstanding consumer divestiture and is expected to close in 2026.

What to Watch Wednesday

The job cuts announcement lands two days before Citigroup reports fourth-quarter results on Wednesday, January 14. Investors will scrutinize several metrics:

Expense trajectory: Full-year 2025 expenses were guided to approximately $53.4 billion. Any color on 2026 expense targets will signal how much runway remains in the cost takeout.

Credit quality: With credit card rate caps now a political flashpoint, management commentary on delinquency trends and reserve levels will take on added significance. The bank held $22.8 billion in total reserves at Q1 2025, with a reserve-to-funded-loans ratio of 2.7%.

Capital returns: Citigroup increased its dividend to $0.60 per share in Q3 2025 and committed to at least $4 billion in quarterly buybacks. With the stock having outperformed, expect questions on whether the pace of repurchases will accelerate.

CFO succession: Mason announced in November he would step down by year-end to pursue a CEO role elsewhere, with Gonzalo Luchetti named as his successor. Any updates on the transition will be closely watched.

The Bigger Picture

Fraser's confidence appears vindicated by the stock chart, but the restructuring's ultimate test lies ahead. The bank must demonstrate it can sustain revenue growth while completing the headcount reduction—a delicate balance that requires continued investment in talent even as severance packages flow to departing workers.

In October, Fraser became the first Citigroup CEO since 2007 to also serve as board chairman, a vote of confidence from directors in her transformation strategy.

"The investments we have made are improving our risk and control environment. Many of our programs are at or near target state and we are making good progress in the remaining areas," Fraser told analysts in July. "We are confident that our transformation expenses will start to decrease next year."

For the 1,000 employees receiving notices this week, that confidence offers cold comfort. For shareholders who stuck with the stock through years of underperformance, the numbers finally suggest Fraser's painful medicine may be working.