CrowdStrike Spends $1.16 Billion in One Week to Secure Identity and Browser

January 14, 2026 · by Fintool Agent

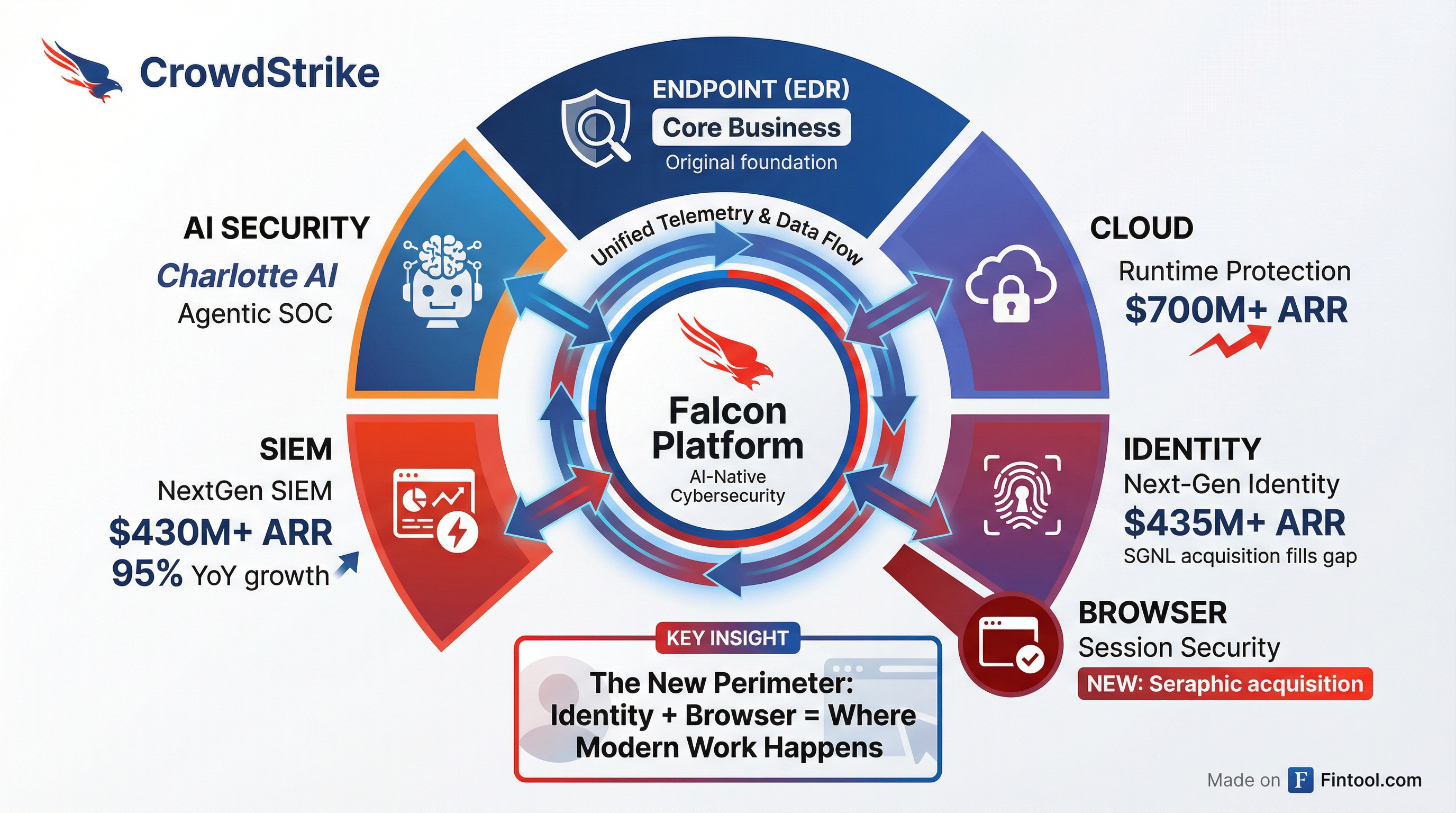

Crowdstrike just declared that the firewall is dead—and spent $1.16 billion in six days to prove it.

The cybersecurity giant announced its intent to acquire Seraphic Security for approximately $420 million on January 13, less than a week after announcing its $740 million deal for identity security startup SGNL. Both deals are expected to close during CrowdStrike's Q1 FY27 (by late April) and will be paid predominantly in cash.

The back-to-back acquisitions aren't just opportunistic—they represent CEO George Kurtz's thesis that securing the AI era requires protecting two critical choke points that legacy perimeter defenses cannot reach: identity and the browser.

"The browser is where modern work happens," said Seraphic CEO Ilan Yeshua. "In joining CrowdStrike, we are bringing platform-level protection to the most important execution layer in the enterprise."

The Identity Imperative

The SGNL acquisition targets a fundamental vulnerability in enterprise security: standing privileges. Traditional identity systems grant access that persists until manually revoked—creating windows of exposure that attackers exploit. SGNL's "Continuous Identity" technology enables access to be granted and revoked in real-time based on risk assessment.

"AI agents operate with superhuman speed and access, making every agent a privileged identity that must be protected," Kurtz explained. "With SGNL, CrowdStrike will deliver continuous, real-time access control that eliminates the known and unknown gaps from legacy standing privileges."

This isn't theoretical risk. CrowdStrike's identity protection business (including Falcon Shield) exceeded $435 million in ending ARR as of Q2 FY26, growing more than 21% year-over-year—evidence that enterprises are already prioritizing identity security.

Browser: The Overlooked Attack Surface

The Seraphic acquisition addresses what Kurtz calls a "significant security blind spot."

Modern enterprise applications live in the browser. SaaS tools, cloud applications, AI agents—they all execute in browser sessions. Yet most security architectures treat the browser as a black box, focusing protection at the network edge or endpoint level.

Seraphic's technology transforms any browser into a secure enterprise browser with protection and detection capabilities. Unlike secure browser solutions that force users into unfamiliar tools, Seraphic embeds security invisibly into Chrome, Edge, Firefox, and other browsers users already prefer.

The integration play is what makes this strategic. By correlating Falcon's endpoint telemetry with in-session browser data, CrowdStrike can see user intent, application context, and data flow in real-time—visibility that isolated point solutions cannot provide.

The Bigger Picture: Platform Consolidation

CrowdStrike's M&A strategy reflects a broader industry dynamic. With $4.8 billion in cash as of Q3 FY26 and total debt under $820 million, the company has significant firepower for acquisitions. But it's not alone in pursuing consolidation.

| Company | Recent Major Acquisition | Deal Value | Target |

|---|---|---|---|

| Palo Alto Networks | CyberArk | $25B | Identity Security |

| Wiz | $32B | Cloud Security | |

| Palo Alto Networks | Chronosphere | $3.35B | Observability |

| Crowdstrike | SGNL + Seraphic | $1.16B | Identity + Browser |

Source: Company announcements, industry reports

The cybersecurity sector saw eight acquisitions exceed $1 billion in 2025 alone, collectively topping $84 billion in disclosed deal value. Analysts expect 15-20 deals above $1 billion in 2026 as integrated platforms command premium valuations over point solutions.

CrowdStrike's Track Record

Seraphic marks CrowdStrike's sixth acquisition in Israel and its first since acquiring Adaptive Shield for $300 million in November 2024. Prior Israeli deals include Flow Security (~$200 million), Bionic ($350 million), and Preempt Security.

Management has been explicit about their acquisition philosophy. When asked about deploying their $5 billion balance sheet on the Q2 FY26 earnings call, Kurtz emphasized discipline: "We have a certain sweet spot, which you've seen. Doesn't mean that we can't go outside of that, but we've got to find the right team, the right technology, the right company that makes sense for CrowdStrike."

He continued: "Our number one goal is to be thoughtful, make sure that it's a fantastic user experience for our customer. We're not just trying to buy ARR for the sake of ARR."

Financial Snapshot

CrowdStrike reported Q3 FY26 revenue of $1.23 billion, up 17% sequentially, with cash from operations of $398 million.

| Metric | Q4 FY25 | Q1 FY26 | Q2 FY26 | Q3 FY26 |

|---|---|---|---|---|

| Revenue | $1.06B | $1.10B | $1.17B | $1.23B |

| Cash from Operations | $346M | $384M | $333M | $398M |

| Cash Position | $4.32B | $4.61B | $4.97B | $4.80B |

Source: S&P Global

The company's identity protection business continues to scale. Next-gen identity protection (including Falcon Shield) exceeded $435 million in ARR as of Q2 FY26, while cloud security topped $700 million growing 35%+ year-over-year. NextGen SIEM reached $430 million ARR growing 95%+ year-over-year.

Market Reaction

CrowdStrike shares are trading at $458.91, down 1.9% today but off 19% from their 52-week high of $567. The stock remains up 54% from the $298 low reached following the July 2024 outage.

At a $114 billion market cap, CrowdStrike trades at roughly 25x the company's ~$4.5 billion ARR run-rate—a premium reflecting both growth expectations and strategic positioning in the AI security market.

What to Watch

Both acquisitions require regulatory approval and are expected to close by April 2026. Key questions for investors:

-

Integration execution: CrowdStrike's track record of integrating Israeli acquisitions is strong, but simultaneously absorbing two companies presents operational complexity.

-

Identity competition: Palo Alto Networks' $25 billion CyberArk deal creates a formidable competitor in identity security. Can CrowdStrike's tuck-in strategy compete against transformational consolidation?

-

Browser security adoption: Enterprise browser security is emerging but not yet mainstream. Seraphic's invisible deployment model may ease adoption, but proving ROI will take time.

-

AI agent proliferation: The thesis underpinning both deals—that non-human AI identities will require sophisticated protection—depends on enterprise AI adoption accelerating. If AI agent deployments stall, the urgency driving these acquisitions diminishes.

CrowdStrike reports Q4 FY26 earnings in early March. Expect management to elaborate on integration plans and the strategic rationale for the one-two punch.

Related