Earnings summaries and quarterly performance for Palo Alto Networks.

Executive leadership at Palo Alto Networks.

Board of directors at Palo Alto Networks.

Aparna Bawa

Director

Carl Eschenbach

Director

Helle Thorning-Schmidt

Director

James Goetz

Director

John Donovan

Lead Independent Director

John Key

Director

Lorraine Twohill

Director

Mary Pat McCarthy

Director

Ralph Hamers

Director

Research analysts who have asked questions during Palo Alto Networks earnings calls.

Saket Kalia

Barclays Capital

8 questions for PANW

Brian Essex

JPMorgan Chase & Co.

5 questions for PANW

Gabriela Borges

Goldman Sachs

5 questions for PANW

Gregg Moskowitz

Mizuho

5 questions for PANW

Rob Owens

Piper Sandler Companies

5 questions for PANW

Brad Zelnick

Credit Suisse

4 questions for PANW

Joshua Tilton

Wolfe Research

4 questions for PANW

Meta Marshall

Morgan Stanley

4 questions for PANW

Andrew Nowinski

Wells Fargo

3 questions for PANW

Fatima Boolani

Citi

3 questions for PANW

Joseph Gallo

Jefferies & Company Inc.

3 questions for PANW

Matthew Hedberg

RBC Capital Markets

3 questions for PANW

Shaul Eyal

TD Cowen

3 questions for PANW

Adam Borg

Stifel Financial Corp.

2 questions for PANW

Adam Tindle

Raymond James

2 questions for PANW

Brad Alan Zelnick

Deutsche Bank AG

2 questions for PANW

Hamza Fodderwala

Morgan Stanley

2 questions for PANW

Joe Gallo

Jefferies

2 questions for PANW

John DiFucci

Guggenheim Securities

2 questions for PANW

Jonathan Ho

William Blair & Company

2 questions for PANW

Matthew George Hedberg

RBC Capital Markets LLC

2 questions for PANW

Patrick Colville

Scotiabank

2 questions for PANW

Paul Liguori

Bank of America Merrill Lynch

2 questions for PANW

Gray Powell

BTIG

1 question for PANW

Joel Fishbein

Truist Securities

1 question for PANW

Keith Weiss

Morgan Stanley

1 question for PANW

Peter Weed

Bernstein

1 question for PANW

Robbie Owens

Piper Sandler

1 question for PANW

Roger Boyd

UBS

1 question for PANW

Tal Liani

Bank of America

1 question for PANW

Recent press releases and 8-K filings for PANW.

- At MWC Barcelona 2026, Palo Alto Networks introduced an expanded security ecosystem to protect high-performance AI Factories, securing both physical and digital infrastructure for sovereign AI deployments.

- The company announced four collaborations—with Nokia, U Mobile, Aeris, and Celerway—to integrate AI-powered security services directly into 5G, IoT and data center networks.

- In partnership with Nokia, Palo Alto Networks will combine data center security with AI platforms to support European “Gigafactories” and address data sovereignty requirements.

- Additional agreements include real-time SECaaS for U Mobile’s 4G/5G infrastructure, unified IoT fleet visibility with Aeris, and extended edge protection via Celerway-integrated VM-Series firewalls.

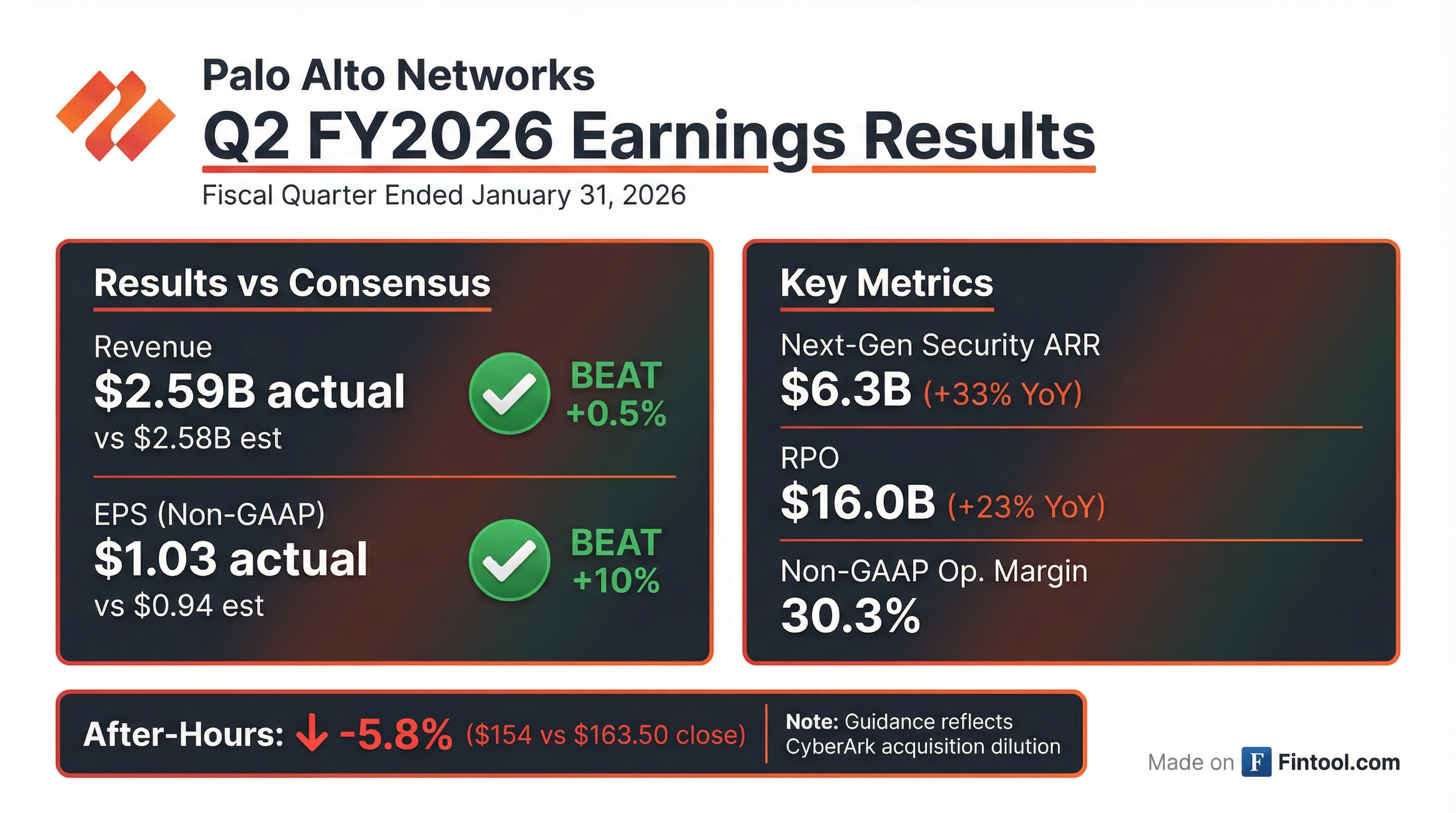

- Revenue of $2.59 B, up 15% year-over-year

- Next-Gen Security ARR of $6.33 B, up 33% year-over-year

- Remaining Performance Obligation (RPO) reached $16.0 B, up 23% year-over-year

- Non-GAAP operating margin of 30.3% (+190 bps y/y) and non-GAAP EPS of $1.03, up 27% y/y

- Strong subscription growth: Next-Generation Security ARR grew 33% to $6.33 B (28% organic) and total revenue rose 15% to $2.59 B in Q2 FY2026.

- Robust profitability and cash flow: Non-GAAP operating margin expanded 190 bps to 30.3%, non-GAAP EPS was $1.03, and Q2 free cash flow reached $502 M.

- Strategic M&A acceleration: Closed Chronosphere (adding ~$200 M ARR) and CyberArk, with combined cash outlays of $4.9 B, strengthening observability and identity security offerings.

- Product momentum: SASE ARR surpassed $1.5 B (+40% YoY) and Cortex XIM ARR exceeded $500 M, while Prisma AIRS scaled to 100+ customers.

- Upbeat guidance: Q3 NGS ARR is guided to $7.94–7.96 B (+56%) with revenue of $2.941–2.945 B, and full-year FY2026 NGS ARR is forecast at $8.52–8.62 B (+53–54%).

- Palo Alto delivered NGSRR growth of 28%, 15% revenue increase (ex-Chronosphere), 30.3% operating margin, EPS of $1.03, and Q2 free cash flow of $502 million.

- SASE ARR surpassed $1.5 billion (≈40% YoY growth) and Prisma Browser reached over 1,500 customers; Cortex XIM ARR topped $500 million with 600+ customers.

- Closed Chronosphere (≈$200 million ARR) and CyberArk acquisitions, expanding into observability and identity security, with integration plans already in motion.

- Q3 guidance: NGS ARR of $7.94 billion–$7.96 billion (+56%), revenue of $2.941 billion–$2.945 billion (+28–29%); FY 2026 revenue of $11.28 billion–$11.31 billion (+22–23%).

- Palo Alto Networks delivered 15% revenue growth to $2.59 billion and Next-Generation Security ARR up 33% to $6.33 billion (28% organic) in Q2 FY26.

- Operating margin expanded to 30.3%, marking a third consecutive quarter above 30%, with diluted non-GAAP EPS of $1.03 and Q2 adjusted free cash flow of $502 million.

- Platformization momentum continued with 110 net new platformizations in Q2 (total ~1,550, +35%), Prisma AIRS exceeding 100 customers, and 200 customers deploying Cortex AgentiX for autonomous response.

- Completed acquisitions of Chronosphere (adds ~$200 million ARR) and CyberArk, and announced intent to acquire Koi to bolster observability, identity security, and AI-driven endpoint protection.

- Total revenue for fiscal Q2 2026 was $2.6 billion, up 15% year-over-year.

- Next-Generation Security ARR grew 33% to $6.3 billion; Remaining performance obligation rose 23% to $16.0 billion.

- GAAP net income was $432 million (EPS $0.61); Non-GAAP net income was $732 million (EPS $1.03).

- Q3 2026 guidance: Total revenue of $2.941 billion–$2.945 billion (up 28–29%), Next-Gen Security ARR of $7.94 billion–$7.96 billion (up 56%), and Non-GAAP EPS of $0.78–$0.80.

- Revenue grew 15% year-over-year to $2.6 billion in fiscal Q2 2026, up from $2.3 billion in Q2 2025.

- GAAP net income was $432 million (EPS $0.61) and non-GAAP net income was $732 million (EPS $1.03) in Q2 2026.

- Next-Generation Security ARR increased 33% to $6.3 billion, and remaining performance obligation rose 23% to $16.0 billion.

- Fiscal Q3 2026 guidance includes Next-Gen Security ARR of $7.94 billion–$7.96 billion, total revenue of $2.941 billion–$2.945 billion, and non-GAAP EPS of $0.78–$0.80.

- MSIAM 2.0 integrates AI-driven Cortex XSIAM with 24/7 expert monitoring to enhance cyber resilience outcomes

- Offers a 250-hour Breach Response Guarantee, providing elite incident response to limit recovery costs

- Delivers immediate SOC maturity and supports third-party EDR for seamless integration and future consolidation on Cortex XDR

- Available now through Palo Alto Networks and its ecosystem of partners

- Palo Alto Networks announced completion of its acquisition of CyberArk, positioning Identity Security as a core pillar of its platformization strategy to secure every identity—human, machine, and agentic—across enterprises.

- Under the terms of the transaction, CyberArk shareholders receive $45.00 in cash plus 2.2005 shares of Palo Alto Networks common stock per ordinary share.

- CyberArk’s Identity Security solutions will remain available as a standalone platform while integration into Palo Alto Networks’ security ecosystem is underway with no disruption for existing customers.

- Palo Alto Networks intends to pursue a secondary listing on the Tel Aviv Stock Exchange under the ticker “CYBR” to honor CyberArk’s heritage and reinforce its global strategy.

- Palo Alto Networks has completed its acquisition of CyberArk, integrating the CyberArk Identity Security Platform to secure human, machine, and agentic identities as a core pillar of its platform strategy.

- Under the transaction terms, CyberArk shareholders will receive $45.00 in cash plus 2.2005 shares of Palo Alto Networks common stock per CyberArk share.

- Palo Alto Networks plans to dual-list on the Tel Aviv Stock Exchange under the "CYBR" ticker, positioning it as the largest company by market capitalization on TASE.

- CyberArk's solutions will remain available standalone while integration into PANW's ecosystem begins, with no expected customer disruption.

Fintool News

In-depth analysis and coverage of Palo Alto Networks.

Quarterly earnings call transcripts for Palo Alto Networks.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more