CSX Misses Estimates as 'Subdued' Industrial Demand Weighs on Railroad

January 22, 2026 · by Fintool Agent

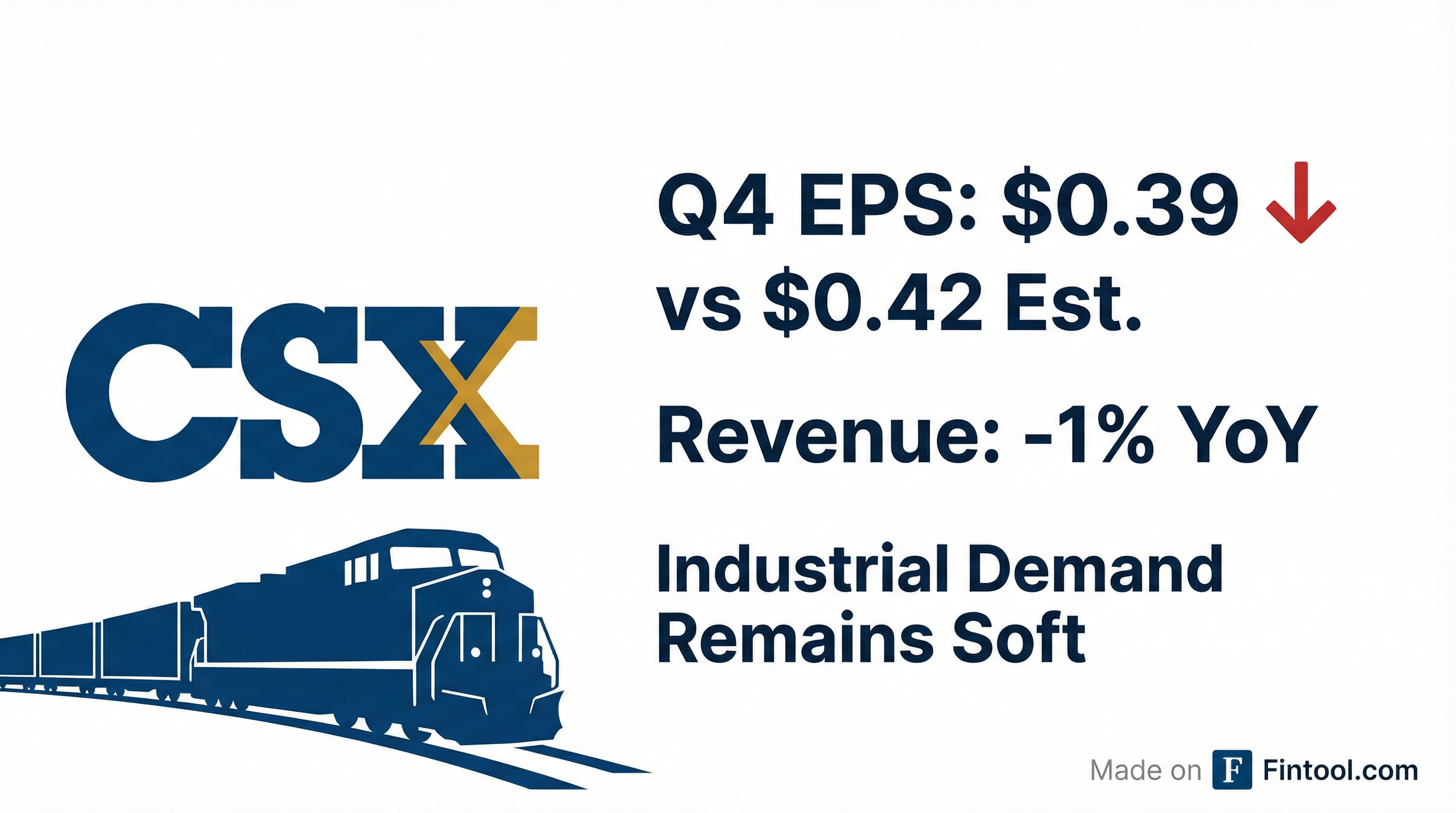

CSX Corporation delivered a sobering assessment of the industrial economy Wednesday, missing fourth-quarter earnings estimates and warning that "no short-term catalyst on the horizon" will lift freight demand in 2026.

The nation's third-largest railroad by revenue reported Q4 earnings of $0.39 per share, below analyst expectations of $0.41-$0.42, while revenue fell 1% year-over-year to $3.51 billion. The miss comes as the company navigates what CEO Steve Angel called "a challenging year for CSX and for our industry overall, with subdued demand and limited growth opportunities persisting across many of our key markets."

Shares fell 2% to $35.78 in regular trading before recovering in after-hours to $36.97.

The Numbers

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Revenue | $3.51B | $3.54B | -1% |

| Operating Income | $1.11B | $1.21B adj. | -8% |

| EPS | $0.39 | $0.42 adj. | -7% |

| EBIT Margin | 31.6% | 35.4% adj. | -380 bps |

For the full year, CSX reported revenue of $14.09 billion and EPS of $1.54 ($1.61 adjusted), with an operating margin of 32.1% (33.2% adjusted).

The quarter included $50 million in charges related to "severance and rationalization of specific technology investments" as management moves to align costs with the weak demand environment.

A Macro Warning Sign

Railroads are often viewed as economic bellwethers, and CSX's commentary painted a cautious picture for 2026. Chief Commercial Officer Maryclare Kenney was blunt: "Our visibility is limited, but from what we can see and hear from our customers today, there's no short-term catalyst on the horizon to lift the major industrial markets."

The weakness is broad-based:

- Chemicals volume down 6% — "The industrial chemicals market remains weak, and many of our customers are carefully controlling freight spend as they manage through inflation and tariff pressures"

- Forest products down 11% — Impacted by plant closures in pulp and containerboard

- Automotive down 5% — Supply constraints with chips and metals limited output

The bright spots were infrastructure-related: minerals volume remains strong on aggregates and cement demand for infrastructure projects, while intermodal revenue grew 7% on new business wins and faster transit times.

2026 Guidance: Self-Help Over Macro Hope

With industrial production expected to remain flat and GDP growth modest, CSX is betting on internal execution rather than economic recovery to drive results.

"We do not anticipate any meaningful improvement in macroeconomic conditions," Angel said, outlining guidance for low single-digit revenue growth and 200-300 basis points of operating margin expansion.

CFO Kevin Boone detailed over 100 cost savings initiatives spanning "vehicle spend to overtime, focus on rental equipment, travel" across the organization. The company expects inflation of 3-3.5% and is targeting productivity gains that "come in at a very, very high incremental margin" when volume returns.

Capital expenditures will fall below $2.4 billion—a "substantial reduction" from 2025—as the company completes major infrastructure projects like the Blue Ridge expansion and Howard Street Tunnel double-stack upgrade.

Notably, Angel withdrew CSX's 2025-2027 investor day targets, replacing them with single-year guidance only. "The macroeconomic environment and the industry dynamics were meaningfully different than compared to today," he explained.

The Merger Shadow

CSX's results come against the backdrop of the proposed Union Pacific-Norfolk Southern merger—potentially the largest railroad deal in history—which could reshape competitive dynamics across the industry.

Asked about positioning, Angel, a railroad industry veteran who previously led Vulcan Materials through a hostile bid, was pragmatic: "You have to make sure that you're running the business to the best of your ability every day. And that's kind of the key in this process."

He noted there could be opportunities to capture business during the lengthy regulatory review: "We see some today that we're taking advantage of."

The Bottom Line

CSX's miss isn't catastrophic—the stock trades near its 52-week high of $37.54—but the messaging matters. This is a company telling investors that America's industrial economy remains stuck in neutral, with no acceleration visible on the horizon.

For a sector that moves everything from cars to chemicals to coal, that's a data point worth watching.

What to Watch:

- Q1 2026 earnings — Angel expects "good year-over-year performance" versus last year's storm-impacted quarter

- Howard Street Tunnel — Double-stack capability coming in Q2 opens new intermodal lanes

- UNP-NSC merger developments — Regulatory timeline and competitive implications

- Industrial production data — ISM Manufacturing and factory orders for signs of inflection

Related

- CSX Corporation — Company profile and financials

- Union Pacific Corporation — Competitor profile

- Norfolk Southern Corporation — Competitor profile