Devon and Coterra Explore Merger to Create $43 Billion U.S. Shale Giant

January 16, 2026 · by Fintool Agent

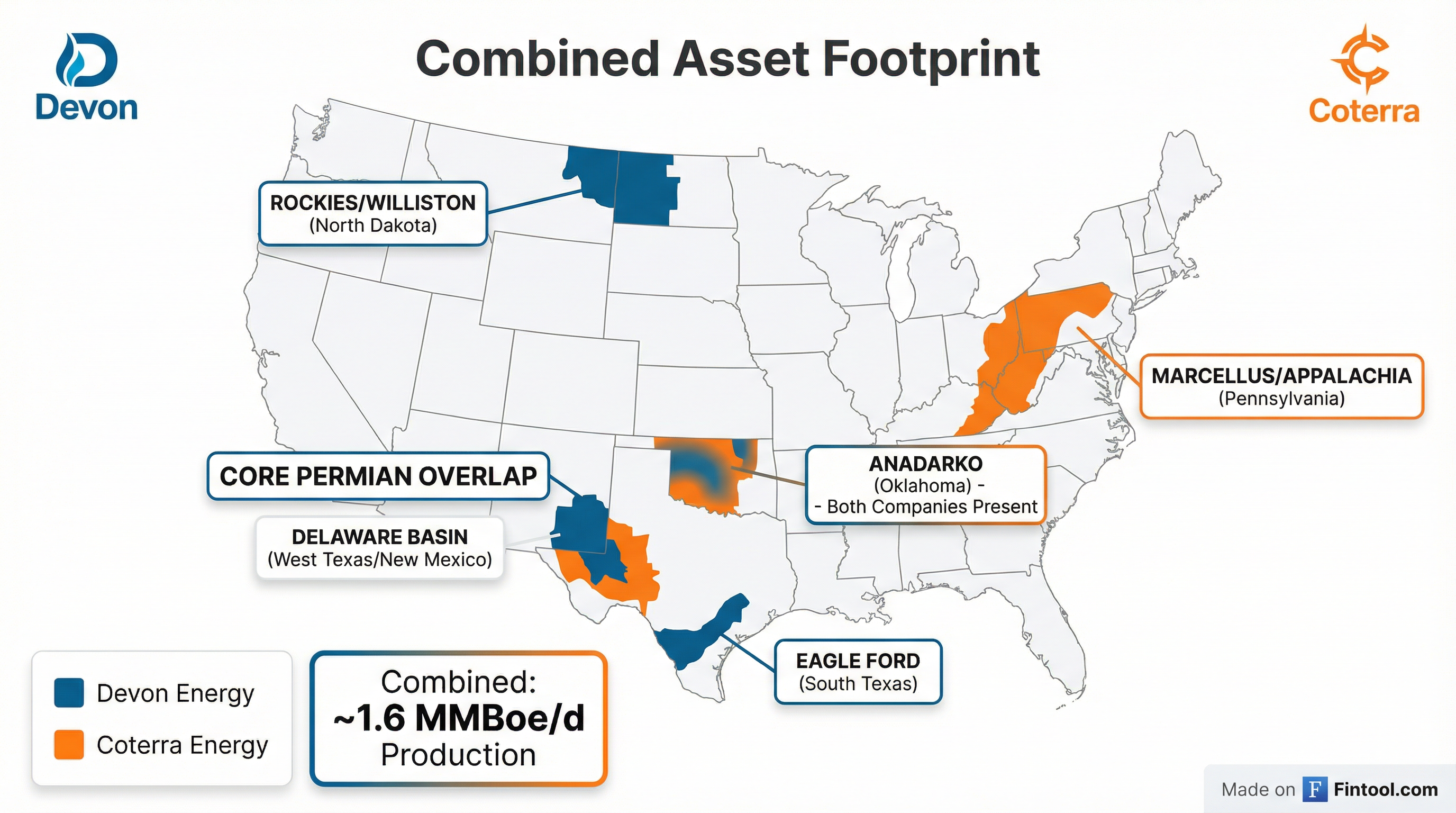

Devon Energy and Coterra Energy are in early-stage merger discussions that could create one of America's largest independent shale producers, combining roughly $43 billion in market capitalization and over 1.6 million barrels of oil equivalent per day in production.

The potential all-stock transaction would unite two companies with overlapping positions in the prized Delaware Basin—the most prolific section of the Permian—while Kimmeridge Energy Management, an activist investor with stakes in both companies, looms as a catalyst pushing for strategic consolidation.

Stock Reactions Tell the Story

Markets rendered a swift verdict on who benefits most from potential combination:

| Metric | Devon (DVN) | Coterra (CTRA) |

|---|---|---|

| Jan 15 Close | $36.32 | $25.73 |

| Change | -4.2% | +1.5% |

| Volume | 22.4M (4x avg) | 40.1M (3x avg) |

| Market Cap | $22.9B | $19.6B |

Devon's decline suggests investors anticipate it as the acquired party in an all-stock deal, facing potential dilution. Coterra's gain reflects expected benefits from absorbing Devon's Delaware Basin scale while streamlining its own multi-basin complexity.

The Strategic Logic: Permian Consolidation

Both companies control significant acreage in the economic core of the Delaware Basin—the highest-return oil play in North America—where longer lateral wells and operational scale drive superior margins.

Devon Energy's Asset Base:

- Delaware Basin: 496 MBoe/d (58% of production)

- Rockies/Williston: 205 MBoe/d (24%) - acquired via $5B Grayson Mill deal in Q3 2024

- Eagle Ford: 63 MBoe/d (8%)

- Anadarko Basin: 85 MBoe/d (10%)

Coterra Energy's Asset Base:

- Permian Basin: ~67% of 2025 capital allocation

- Marcellus Shale: ~14% of capital (natural gas focus)

- Anadarko Basin: ~10% of capital

A merger would create contiguous Delaware Basin acreage enabling longer horizontal wells and better capital efficiency—critical as the best Permian locations become increasingly drilled.

Financial Firepower

The combined entity would rank among the most profitable independents:

| Metric (TTM Q3 2025) | Devon | Coterra | Combined |

|---|---|---|---|

| Production (MBoe/d) | 853 | 785 | 1,638 |

| Revenue | $16.6B | $6.6B | $23.2B |

| EBITDA | $7.6B | $4.4B | $12.0B |

| EBITDA Margin | 46% | 66% | 52% |

| Total Debt | $8.6B | $4.1B | $12.7B |

| Net Debt/EBITDA | 1.0x | 0.9x | 1.1x |

Values retrieved from S&P Global

Coterra's higher EBITDA margin reflects its lower-cost Marcellus natural gas production, while Devon brings greater oil-weighted exposure and scale in the Rockies.

The Kimmeridge Catalyst

Activist investor Kimmeridge Energy Management holds approximately 5.7 million Devon shares and an undisclosed stake in Coterra, making it a common shareholder with leverage to push both boards toward a deal.

In November 2025, Kimmeridge released a scathing open letter calling Coterra's 2021 merger of Cabot Oil & Gas and Cimarex Energy a "failure" that created "complexity, inefficiency, and valuation compression."

Kimmeridge's Key Demands:

- Appoint an independent, non-executive chair

- Divest Marcellus and Anadarko assets

- Refocus entirely on Delaware Basin operations

- Create a "Permian pure-play" to unlock valuation

Kimmeridge Managing Partner Mark Viviano argued both companies "share similarities in that their premium Permian positions are undervalued within multi-basin companies."

Coterra CEO Tom Jordan pushed back, defending the company's diversified portfolio as providing stability across commodity cycles. But the merger talks suggest the board may be more receptive to strategic alternatives than its public statements indicate.

Industry Context: Scale or Die

The potential Devon-Coterra combination reflects the new reality in U.S. shale: with the best drilling locations increasingly depleted, independents need scale to compete with integrated majors like Exxon and Chevron who have consolidated Permian positions through mega-deals.

Recent Major Shale Deals:

- Exxon/Pioneer: $60B (2023)

- Chevron/Hess: $53B (2023)

- ConocoPhillips/Marathon: $23B (2024)

- Diamondback/Endeavor: $26B (2024)

A Devon-Coterra merger would position the combined company as the largest pure-play independent, with the scale to negotiate better service contracts, optimize midstream infrastructure, and sustain the drilling efficiencies that drive Permian economics.

What to Watch

Near-term catalysts:

- Board response: Whether Coterra formally engages or seeks competing bids

- Kimmeridge escalation: Potential proxy fight if talks stall

- Analyst revisions: Street estimates for synergies and accretion/dilution

- Regulatory timeline: Hart-Scott-Rodino review would be required

Deal risks:

- Talks remain preliminary with no assurance of agreement

- Coterra has reportedly held merger discussions with at least one other party

- Oil price volatility could shift strategic calculations

- Integration complexity across multiple basins

Devon's headquarters in downtown Oklahoma City and Coterra's Houston base would also require decisions on corporate domicile and leadership—politically sensitive in both states' energy-dependent economies.

Related: