eBay Snaps Up Depop for $1.2B, Capturing Gen Z's Favorite Resale Marketplace

February 18, 2026 · by Fintool Agent

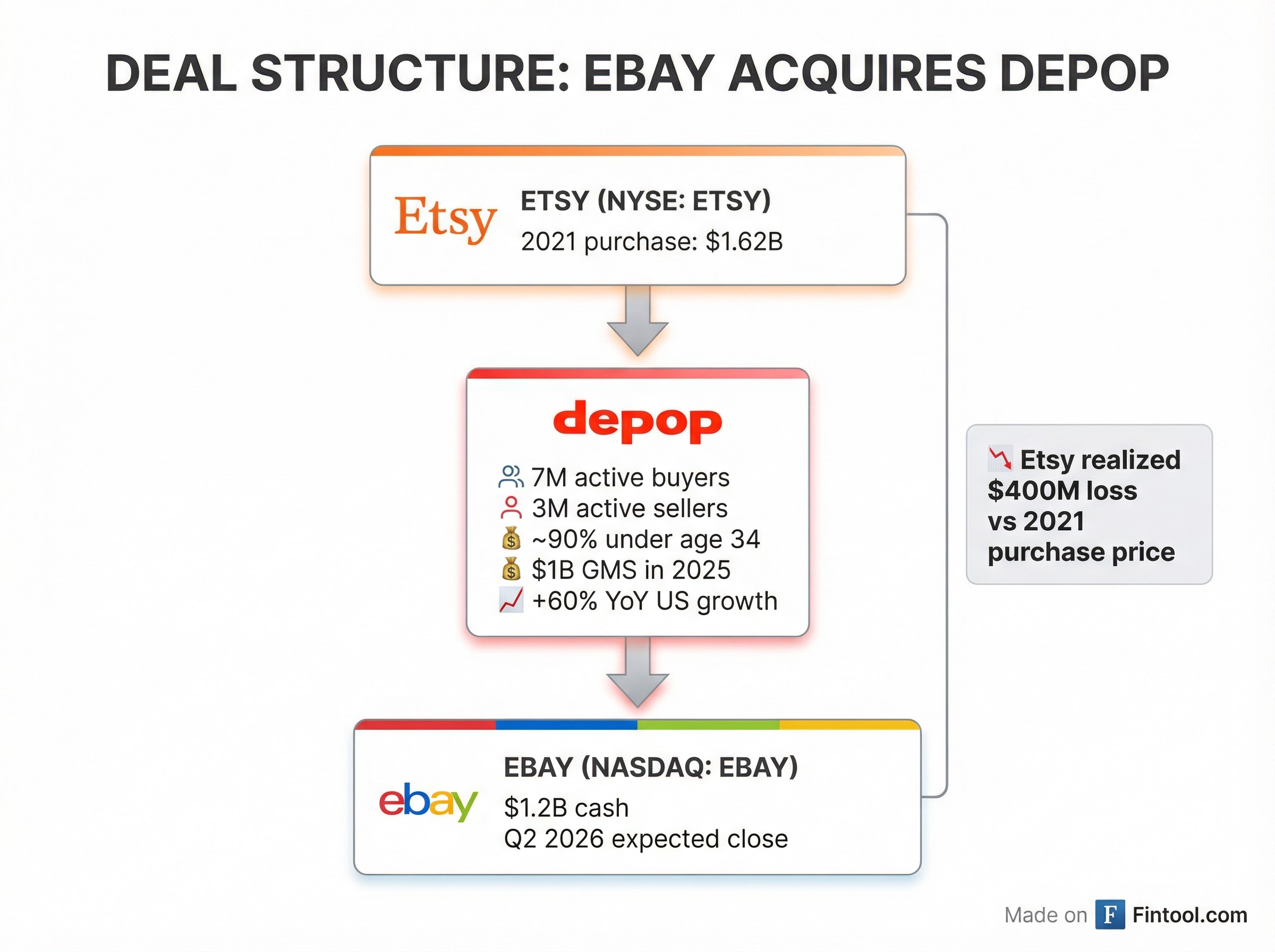

Ebay is acquiring Depop, the social-forward resale marketplace beloved by Gen Z shoppers, from Etsy for approximately $1.2 billion in cash. The deal, announced alongside eBay's Q4 earnings beat, marks a strategic pivot by the 30-year-old auction giant to capture younger consumers driving the booming secondhand fashion market.

Etsy, which bought Depop at the peak of pandemic-era valuations for $1.62 billion in 2021, is taking a roughly $400 million loss on the sale—but its stock surged 14% in after-hours trading as investors cheered the company's renewed focus on its core artisan marketplace.

The Deal at a Glance

Depop has carved out a unique position in the secondhand fashion market with its mobile-first, community-driven platform. Key metrics underscore why eBay sees value:

| Metric | Value |

|---|---|

| Active Buyers | 7 million |

| Active Sellers | 3 million |

| User Demographics | 90% under age 34 |

| 2025 GMS | $1 billion |

| US GMS Growth (2025 YoY) | 60% |

"Depop has built a trusted, social-forward marketplace with strong momentum in the pre-loved fashion category," said Jamie Iannone, eBay's CEO. "This acquisition presents an opportunity to advance one of our newest and fastest-growing Focus Categories with a marketplace that complements our existing presence, and enables us to reach a younger demographic across the expanding recommerce landscape."

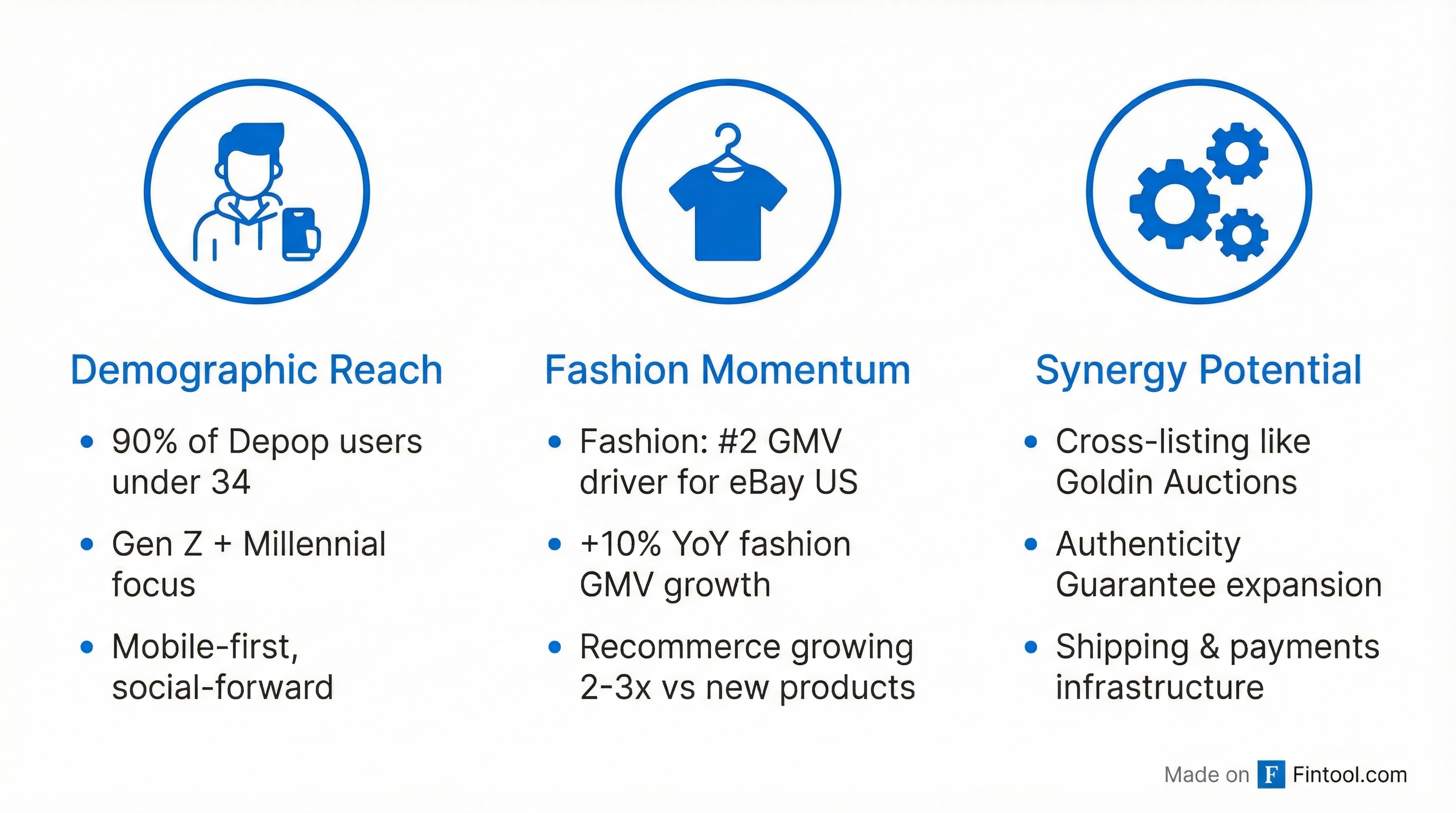

Strategic Rationale: Why Depop, Why Now

Fashion has emerged as one of eBay's most important growth vectors. CEO Iannone highlighted that fashion was "the second-largest contributor to our U.S. GMV growth in Q4, with particular strength in C2C." eBay's fashion category delivered 10% year-over-year GMV growth in the US in 2025, representing more than $10 billion in annual volume.

The recommerce market—driven by Gen Z and millennial consumers who prioritize sustainability, individuality, and value—is projected to grow 2-3x faster than the market for new products through 2027.

eBay plans to integrate Depop much like it did with Goldin Auctions in collectibles—keeping the brand and platform independent while layering on eBay's infrastructure:

- Authenticity Guarantee expansion to Depop listings

- Shipping and cross-border trade capabilities

- Payments and financial services integration

- Cross-listing inventory between platforms

"Similar to how we've demonstrated the power of cross-listing inventory with Goldin in collectibles, we see a clear opportunity to replicate that success with Depop, given its complementary range of brands and price points," Iannone noted.

eBay's Q4 Beat Sets the Stage

The acquisition announcement came alongside strong Q4 2025 results that exceeded analyst expectations:

| Metric | Q4 2025 | Consensus | Beat/Miss |

|---|---|---|---|

| Revenue | $2.97B | $2.88B | Beat |

| Adjusted EPS | $1.41 | $1.34 | Beat |

| GMV | $21.2B | $20.8B | Beat |

eBay guided Q1 2026 revenue of $3.0–3.05 billion, well above the $2.8 billion consensus, and EPS of $1.53–1.59 versus $1.48 expected.

Quarterly Revenue Trend

| Period | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Revenue | $2.59B | $2.73B | $2.82B | $2.97B |

| EBITDA Margin | 26.9% | 21.6% | 25.2% | 24.1% |

Etsy's Pivot: Shedding Assets to Focus on Core

For Etsy, the Depop sale completes a strategic retreat from its pandemic-era acquisition spree. The company sold Reverb, its music gear marketplace, in June 2025 for approximately $108 million—recognizing a $5.1 million loss on the transaction. The Reverb sale triggered a $101.7 million goodwill impairment charge earlier that year.

"We are excited that this transaction allows us to focus exclusively on the compelling opportunity we see in front of us: to grow the Etsy marketplace," said Kruti Patel Goyal, Etsy's recently appointed chief executive.

Etsy has struggled with decelerating GMS growth. The company's Q3 2025 filing showed consolidated GMS declining 6.5% year-over-year to $2.72 billion, with the core Etsy marketplace accounting for $2.43 billion and Depop contributing $292 million.

Market Reaction: A Tale of Two Stocks

The market's response underscored the divergent trajectories of these two e-commerce players:

| Stock | After-Hours Move | 1-Year Return |

|---|---|---|

| EBAY | +8% | +17.8% |

| ETSY | +14% | -23.1% |

Etsy's sharp rally reflects investor enthusiasm for a cleaner story focused on its core marketplace—though the stock remains down significantly from its pandemic highs. Etsy plans to use a portion of the proceeds for share repurchases.

What to Watch

The deal is expected to close in Q2 2026, subject to regulatory approvals and customary closing conditions. Key questions for investors going forward:

For eBay:

- Can Depop maintain its 60% US growth trajectory under new ownership?

- How quickly can eBay layer on its services (authentication, shipping, payments)?

- Will cross-listing drive incremental GMV, as it has with Goldin?

For Etsy:

- Does the simplified story attract new investors?

- Can the core Etsy marketplace return to growth without the Depop tailwind?

- How will management deploy the $1.2 billion in proceeds?

The Bottom Line

eBay's $1.2 billion bet on Depop is a calculated move to capture the next generation of online shoppers. With fashion as its fastest-growing focus category and recommerce outpacing traditional retail, the deal positions eBay squarely in one of e-commerce's most dynamic segments. For Etsy, the transaction—while crystallizing a loss—allows management to refocus on what it does best: connecting artisans with consumers seeking unique, handmade goods.