Eli Lilly Pays Up to $2.4 Billion for Orna Therapeutics, Joining In Vivo CAR-T Race

February 9, 2026 · by Fintool Agent

Eli Lilly is acquiring Orna Therapeutics for up to $2.4 billion, gaining access to a cutting-edge circular RNA platform that could revolutionize how cell therapies are delivered to patients with autoimmune diseases .

The deal makes Lilly the fourth major pharmaceutical company to enter the rapidly emerging in vivo CAR-T space through acquisition in the past year—and at the highest potential valuation yet for the technology.

The Deal

Under the terms announced Monday, Orna shareholders could receive up to $2.4 billion in cash, comprising an upfront payment and subsequent milestone payments tied to clinical development progress .

The acquisition includes:

- ORN-252: Orna's lead program, a CD19-targeting in vivo CAR-T therapy designed for B cell-driven autoimmune diseases, described as "clinical trial-ready"

- oRNA® Platform: Orna's proprietary circular RNA technology that enables more durable protein expression than traditional mRNA

- LNP Delivery System: Lipid nanoparticle technology that allows therapeutic payloads to reach immune cells in vivo

"Early autologous CAR-T studies have shown the promise of cell therapy for patients with autoimmune diseases, but the complexity, cost, and logistics of ex vivo approaches make it challenging to deliver these breakthroughs to the broader population of patients who need them," said Francisco Ramírez-Valle, Senior Vice President and Head of Immunology Research at Lilly .

Why In Vivo CAR-T Matters

Traditional CAR-T cell therapy—already approved for certain blood cancers—requires extracting a patient's T cells, engineering them in a lab over several weeks, and infusing them back after lymphodepleting chemotherapy. The process costs upwards of $400,000 per treatment and requires specialized manufacturing infrastructure.

In vivo CAR-T eliminates the extraction step entirely. Instead, RNA encoding a chimeric antigen receptor is delivered directly into the patient via lipid nanoparticles, programming the body's own immune cells to target disease without ever leaving the body.

Orna's circular RNA approach offers an additional advantage: oRNA molecules are more stable than linear mRNA and may deliver longer-lasting protein expression, potentially unlocking treatments that weren't feasible with earlier RNA platforms .

The Competitive Landscape

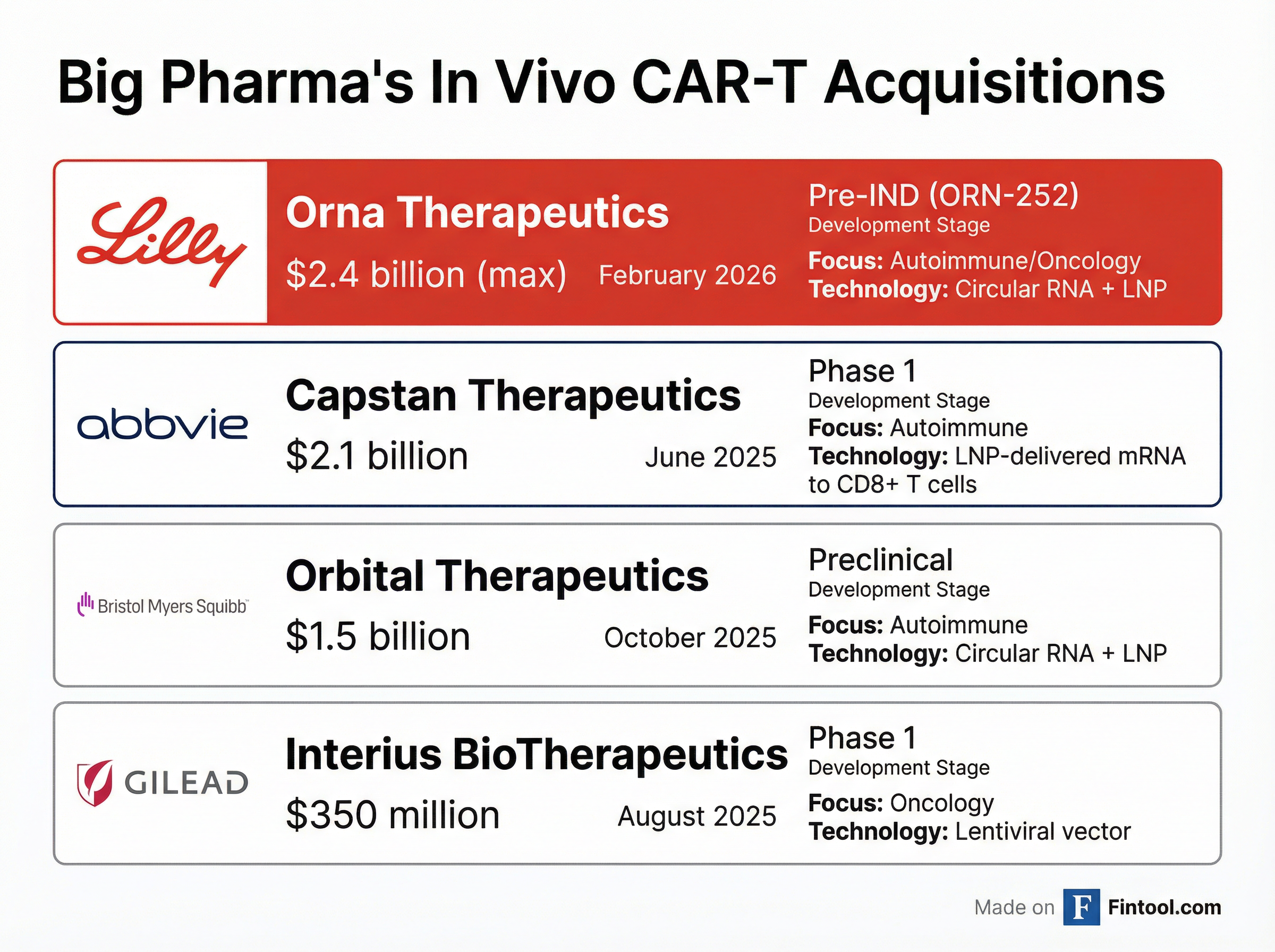

Lilly's acquisition enters a crowded field. Big Pharma has poured billions into in vivo CAR-T technology over the past year:

| Acquirer | Target | Deal Value | Date | Stage | Technology |

|---|---|---|---|---|---|

| AbbVie | Capstan | $2.1B | Jun 2025 | Phase 1 | LNP + mRNA |

| Eli Lilly | Orna | Up to $2.4B | Feb 2026 | Pre-IND | Circular RNA + LNP |

| Bristol Myers | Orbital | $1.5B | Oct 2025 | Preclinical | Circular RNA + LNP |

| Gilead | Interius | $350M | Aug 2025 | Phase 1 | Lentiviral vector |

Notably, both Lilly and Bristol Myers have bet on circular RNA technology, while AbbVie went with traditional mRNA. The choice could prove consequential—circular RNA's enhanced stability may translate to better real-world efficacy, but the technology is less mature.

Lilly's M&A Spree

The Orna acquisition extends a remarkable deal-making streak for Lilly. In the past twelve months, the company has deployed billions in acquisitions to diversify its pipeline beyond its GLP-1 obesity franchise:

| Deal | Target | Value | Area | Date |

|---|---|---|---|---|

| Scorpion Therapeutics | STX-478 (PI3Kα inhibitor) | $1.4B | Oncology | Mar 2025 |

| Verve Therapeutics | Gene editing for CVD | $550M + $300M CVR | Cardiovascular | Jul 2025 |

| SiteOne Therapeutics | STC-004 (Nav1.8 inhibitor) | Up to $1.0B | Pain | Jul 2025 |

| Innovent Biologics | Immunology/oncology collaboration | $350M + $8.5B milestones | Immunology | Feb 2026 |

| Orna Therapeutics | Circular RNA/in vivo CAR-T | Up to $2.4B | Autoimmune | Feb 2026 |

The spending reflects both Lilly's financial firepower—Q4 2025 revenue hit $19.3 billion, up 43% year-over-year —and management's urgency to build platforms that can deliver growth as GLP-1 competition intensifies.

Lilly's Immunology Push

The Orna deal represents Lilly's most significant bet on autoimmune disease since acquiring Morphic Holding for its oral integrin assets in 2024 .

Lilly's immunology franchise already includes:

- Ebglyss (lebrikizumab): Approved for atopic dermatitis, now in Phase 3 for allergic rhinitis

- Omvoh (mirikizumab): Approved for ulcerative colitis and Crohn's disease

- Taltz (ixekizumab): Established in psoriasis and psoriatic arthritis

The company is also exploring combinations of its GLP-1 drugs with immunology treatments. "Patients who have both immune diseases and obesity tend to have a higher disease burden," noted Adrienne Brown, President of Lilly Immunology. "We're really excited about the opportunity to find new ways to combat the underlying inflammation in these diseases" .

Studies are underway combining Zepbound with Taltz for psoriasis and with Omvoh for IBD.

Financial Capacity

Lilly has ample resources to fund the acquisition. The company reported cash of $9.8 billion as of Q3 2025 , with robust cash flow generation:

| Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Revenue | $12.7B | $15.6B | $17.6B | $19.3B |

| Net Income | $2.8B | $5.7B | $5.6B | $6.6B |

The company has also expanded its debt capacity, issuing $6.8 billion in notes in August 2025 and maintaining $10 billion in unused credit facilities .

What to Watch

The Orna acquisition positions Lilly in a high-risk, high-reward race. In vivo CAR-T technology remains unproven in large clinical trials—no product has yet advanced beyond early-stage development. Key milestones to watch:

- IND Filing for ORN-252: Lilly will need to advance Orna's lead program into clinical trials, likely in 2026-2027

- Competition Readouts: AbbVie's Capstan program and Bristol Myers' Orbital asset are further along; their clinical results could validate or challenge the approach

- Manufacturing Scale-Up: The economics of in vivo CAR-T depend on achieving scalable, cost-effective production

- Regulatory Path: The FDA has yet to establish clear guidance for in vivo cell therapy products

For investors, the deal signals Lilly's conviction that obesity drugs alone won't sustain its growth trajectory. With nearly $1 trillion in market capitalization, the company is betting that autoimmune diseases—affecting over a billion people globally—represent the next frontier .

Related Companies: