Fannie Mae and Freddie Mac Crash 12% as IPO Dreams Unravel

January 16, 2026 · by Fintool Agent

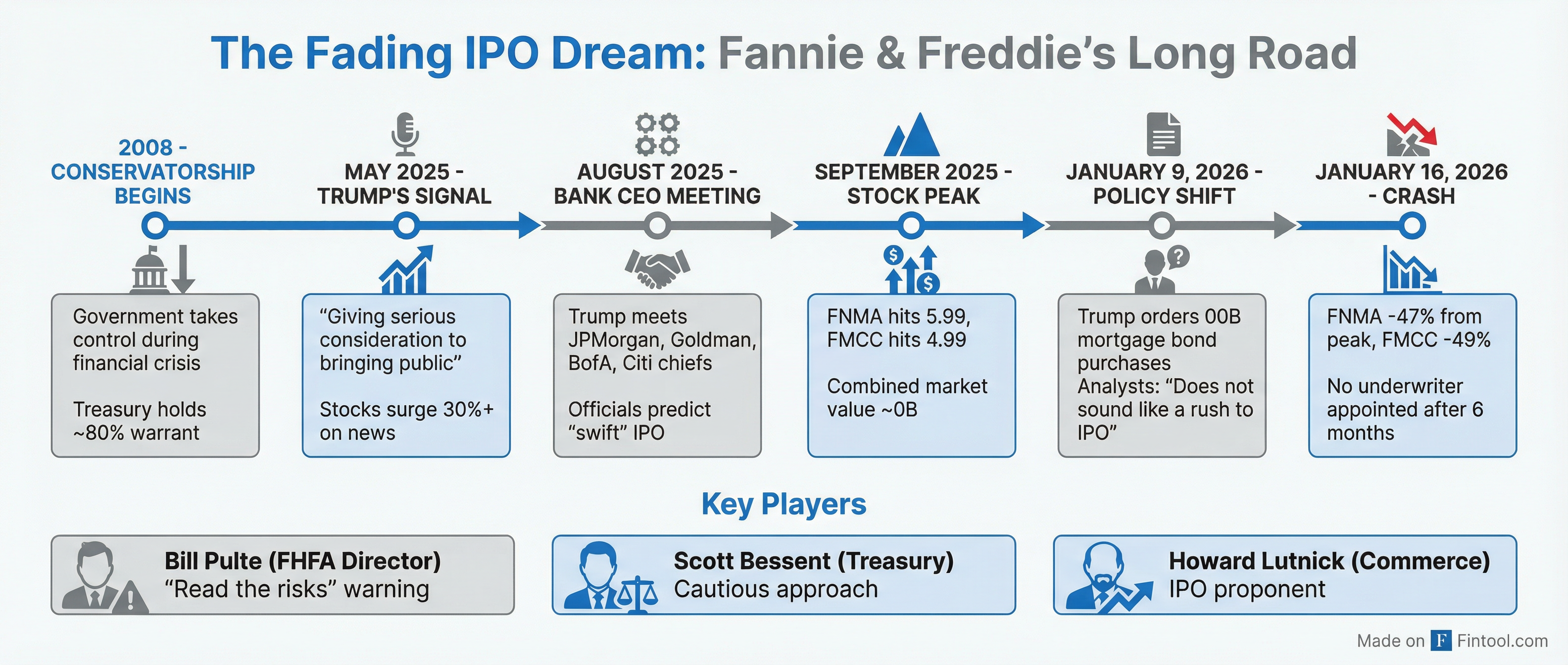

Fannie Mae+0.00% and Freddie Mac-0.54% shares collapsed Friday, each plunging approximately 12%, as the six-month anniversary of the administration's IPO push arrives with no Wall Street bank appointed to underwrite what was supposed to be one of the most consequential stock offerings in years.

The mortgage giants have now lost nearly half their value from September peaks—Fannie Mae is down 47% from $15.99 to $8.51, while Freddie Mac has fallen 49% from $14.99 to $7.68—as investors abandon hope that President Trump will prioritize privatization over using the companies as instruments of housing policy.

Six Months, No Underwriter

The contrast between August's optimism and January's reality is stark. Last summer, Trump summoned the CEOs of JPMorgan Chase+3.95%, Goldman Sachs+4.31%, Bank of America+2.89%, and Citigroup+5.98% to the White House to discuss taking the government-sponsored enterprises public. Officials predicted the offering would happen quickly.

Six months later, the government has retained Sullivan & Cromwell as legal adviser, but has not appointed a single major Wall Street bank to structure or sell the offering.

The delay reflects a fundamental tension within the administration. Commerce Secretary Howard Lutnick and FHFA Director Bill Pulte have championed fast-tracking the IPO. But Treasury Secretary Scott Bessent has taken a more cautious approach, wary of disrupting the mortgage market or increasing borrowing costs for homebuyers.

"Bessent may want to keep the status quo and not do a hasty stock offering," said Wesley Lin, a professor of public policy at UCLA and former policy adviser in the Obama and Biden administrations. "It's a 'let's not rock the boat' approach."

The $200 Billion Pivot

The death knell for near-term IPO hopes came January 9, when Trump ordered Fannie and Freddie to purchase $200 billion in mortgage bonds—framing the directive as an effort to lower mortgage rates and monthly payments ahead of the midterm elections.

"Trump praised his decision not to IPO the companies in his first term... This does not sound like a President who is in a rush to IPO the enterprises," TD Cowen analyst Jaret Seiberg wrote in a note.

JonesTrading analyst Mike O'Rourke was blunter: "If the GSEs can serve as a funding arm for Presidential policy, we shouldn't ever expect them to be re-privatized again."

The 80% Dilution Risk

Even if an IPO eventually materializes, existing shareholders face a structural problem the 10-K risk factors make clear: Treasury holds warrants to acquire approximately 80% of both companies' common stock for nominal consideration.

This means the government could effectively retain control even after conservatorship ends, and the ownership interest of existing common stockholders would be "substantially diluted" if Treasury exercises the warrant.

FHFA Director Bill Pulte recently took to social media to urge investors to "read the risks that Freddie Mac has in their 10-K" before investing—a warning that sent shares tumbling 10% and underscored the regulatory uncertainty hanging over the stocks.

Bloomberg Intelligence estimates there's roughly a one-in-three chance privatization won't be completed before Trump leaves office, and says that probability is rising. The analysis notes it will take "months if not years" to complete critical steps such as revising capital requirements for the two enterprises.

What's at Stake

The combined valuation of Fannie and Freddie is estimated at $500-700 billion—making even a 5% public float a potential $25-30 billion offering that would generate massive fees for Wall Street banks.

But the stakes extend far beyond investor returns. The two GSEs own or guarantee roughly half of America's $12 trillion mortgage market. Any misstep in transitioning them out of government control could send shockwaves through housing finance.

Senate Democrats have warned that privatization could weaken the implicit federal guarantee that keeps mortgage rates lower, potentially pushing borrowing costs up for millions of homebuyers.

What to Watch

The immediate catalyst is Trump's pending decision on the IPO path—FHFA's Pulte told CNBC on January 8 that Trump would decide "in the next month or two."

Key questions remain:

- Will Treasury appoint an underwriter? The lack of a lead bank after six months signals either internal disagreement or waning priority.

- Capital requirements: Current levels remain "significantly below" regulatory requirements, which would need revision before any stock sale.

- Board independence: Both stock exchanges require independent board majorities. Pulte appointed himself chair of both companies and named allies to board seats—a potential obstacle to re-listing.

- Midterm calculus: With housing affordability a key voter issue, the administration may prioritize using the GSEs for rate relief over pursuing privatization.

For investors who rode the 700%+ rally following Trump's re-election, Friday's selloff is a painful reminder of the risk embedded in shares that haven't traded on a major exchange since 2008. The dream of a historic IPO isn't dead—but it's looking increasingly distant.

Related Companies: Fannie Mae (fnma)+0.00% | Freddie Mac (fmcc)-0.54% | JPMorgan Chase (jpm)+3.95% | Goldman Sachs (gs)+4.31%