Fiserv and Affirm Partner to Bring BNPL to Thousands of Bank Debit Programs

January 26, 2026 · by Fintool Agent

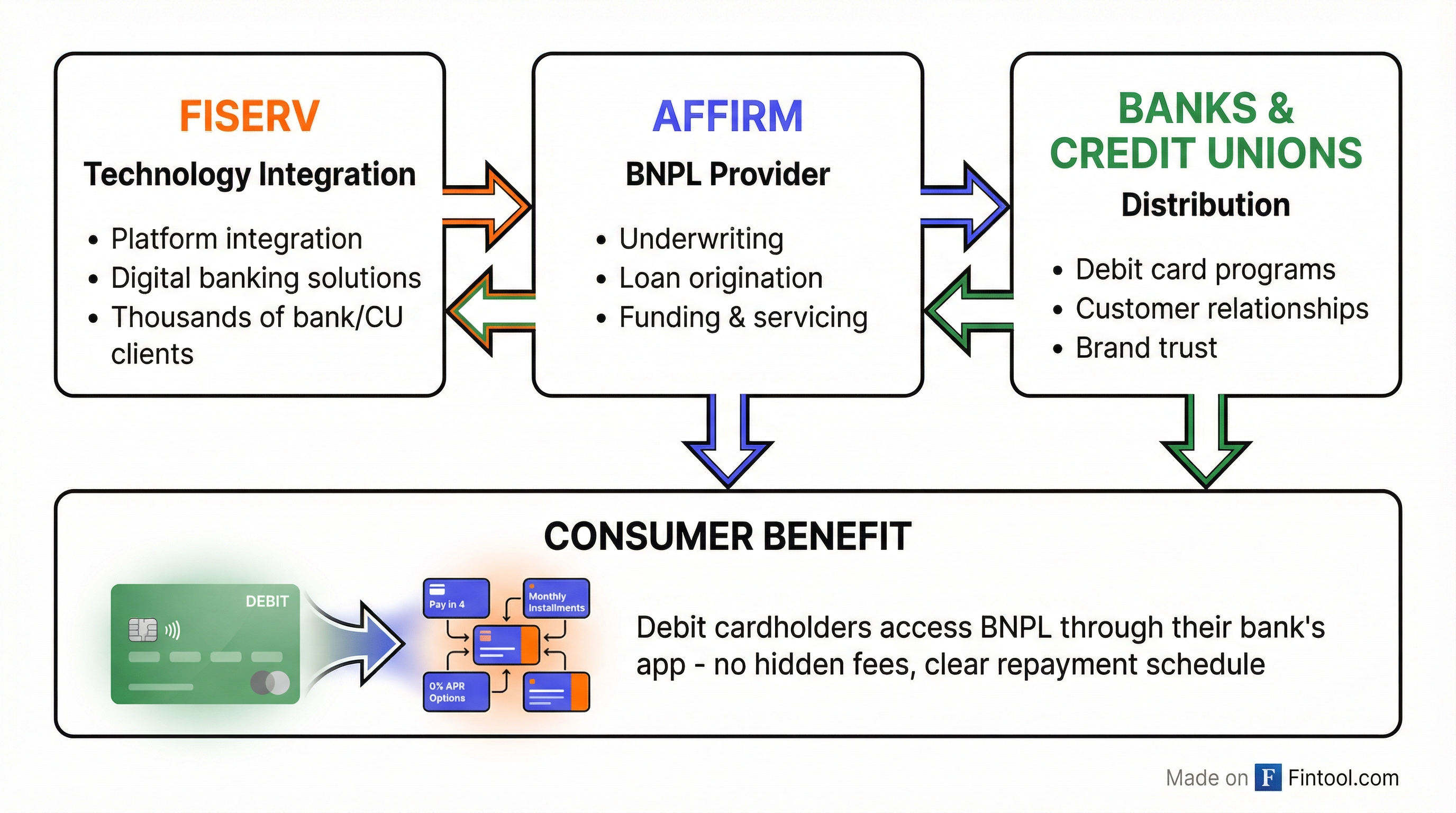

Fiserv and Affirm announced an exclusive partnership Monday to embed buy now, pay later capabilities directly into debit card programs for thousands of U.S. banks and credit unions, a strategic move that opens a major new distribution channel for Affirm while helping community banks compete with standalone BNPL providers.

The deal expands a relationship that began in 2022 when Affirm integrated into Fiserv's Commerce Hub for merchant checkout. This latest collaboration flips the model—rather than reaching consumers through merchant partnerships, Affirm now gains access to the banking side of the payment ecosystem.

How the Partnership Works

Under the agreement, Fiserv will handle all technical integration into its digital banking solutions, while Affirm manages the lending stack—real-time underwriting, loan origination, and funding.

The key benefits for Fiserv's banking clients:

- Turnkey integration: No operational lift required—banks can offer BNPL without building lending products

- Ecosystem retention: Transactions stay within the bank relationship rather than flowing to third-party BNPL apps

- Merchant network access: Consumers can use BNPL at Affirm's 420,000+ merchant partners, including 0% APR offers at leading retailers

Debit cardholders request pay-over-time loans through their bank's mobile app before making purchases. Once approved, the BNPL option attaches to their debit card and activates at checkout. Consumers get fixed payments with clear repayment schedules and no hidden fees—consistent with Affirm's transparent lending model.

Strategic Rationale

For Affirm, the partnership represents a significant shift in distribution strategy. The company has historically reached consumers through merchant integrations and its own Affirm Card. This deal effectively lets Affirm white-label its BNPL infrastructure to banks—a "card model for banks" approach.

"We're taking the Affirm Card model and making it available to banks through partners such as Fiserv to unlock new opportunities for pay-over-time loans," an Affirm spokesperson told Digital Transactions.

For Fiserv, the deal bolsters its debit card services at a time when BNPL adoption is accelerating. The company operates the STAR network—the leading independent PIN debit network in the U.S.—and processes cards for over 1.7 billion accounts, nearly twice the scale of its closest competitor.

"Community and regional banks and credit unions want to meet evolving consumer expectations around greater flexibility in how they pay for purchases," said Erik Wichita, Fiserv's Head of Card Services. "This partnership gives our clients a practical, scalable way to offer such payment flexibility through their existing debit products."

The BNPL Competitive Landscape

The partnership comes as BNPL has become a critical battleground in payments. PayPal expects to process close to $40 billion in BNPL TPV this year, with monthly active accounts climbing 21%. The company's CEO Alex Chriss has described BNPL as "one of those generational shifts" in how consumers want to pay.

Affirm has carved out a differentiated position with its transparent pricing model. Unlike legacy credit products that charge deferred or compounding interest, Affirm discloses upfront exactly what consumers will owe—no hidden fees, no penalties. The company processed $36.7 billion in GMV in fiscal 2025, up 38% year-over-year, with 23 million active consumers.

| Company | BNPL Strategy | Key Metric |

|---|---|---|

| Affirm | Transparent pricing, bank partnerships | $36.7B FY25 GMV |

| Paypal | Integrated checkout, Venmo | $40B 2025 TPV |

| Klarna | Own card, merchant network | 150M+ consumers |

The Fiserv deal positions Affirm to compete for bank-embedded BNPL volume that might otherwise flow to competitors or be built in-house.

Financial Context

Fiserv continues to post strong results in its Financial Solutions segment. The business generated 6% organic revenue growth in Q1 2025 with an adjusted operating margin of 47.5%, up 340 basis points. The company has expanded operating margins by 950 basis points since the First Data merger.

Affirm has turned profitable, posting net income of $80.7 million in Q1 FY2026 on revenue of $479 million. Card network revenue—which includes interchange from Affirm Card and virtual debit cards—grew 53% year-over-year in fiscal 2025 as GMV processed through issuer partners reached $11.9 billion.

| Metric | Fiserv (Q3 2025) | Affirm (Q1 FY2026) |

|---|---|---|

| Revenue | $5.26B* | $479M |

| Net Income | $792M* | $80.7M |

| EBITDA Margin | 40.4%* | 28.6%* |

*Values retrieved from S&P Global

Affirm shares fell 3.8% Monday to $68.71, while Fiserv edged up 0.2% to $63.80.

What to Watch

The partnership's success will depend on adoption among Fiserv's bank clients and consumer uptake of bank-embedded BNPL. Key metrics to track:

- Bank client adoption: How many of Fiserv's thousands of clients integrate the BNPL offering

- Volume cannibalization: Whether bank BNPL displaces Affirm's direct merchant relationships or expands total addressable market

- Competitive response: Whether PayPal, Klarna, or other BNPL providers pursue similar bank distribution deals

Fiserv CEO Mike Lyons has signaled ambitions to expand into new payment TAMs including government and healthcare. The Affirm partnership adds flexible payments to that arsenal as the company targets deeper wallet share across its banking clients.