Earnings summaries and quarterly performance for FI.

Executive leadership at FI.

Mike Lyons

Chief Executive Officer

Adam Rosman

Chief Administrative Officer and Chief Legal Officer

Andrew Gelb

Head of Financial Institutions Group

Dhivya Suryadevara

Co-President

Guy Chiarello

Vice Chairman

Jennifer LaClair

Head of Merchant Solutions

Paul Todd

Chief Financial Officer

Takis Georgakopoulos

Co-President

Board of directors at FI.

Ajei Gopal

Director

Céline Dufétel

Director (effective January 1, 2026)

Charlotte Yarkoni

Director

Doyle R. Simons

Non-Executive Chairman of the Board

Gary Shedlin

Director (effective January 1, 2026)

Gordon Nixon

Non-Executive Chairman of the Board (effective January 1, 2026)

Harry DiSimone

Director

Henrique de Castro

Director

Kevin Warren

Director

Lance Fritz

Director

Stephanie Cohen

Director

Wafaa Mamilli

Director

Research analysts who have asked questions during FI earnings calls.

Darrin Peller

Wolfe Research, LLC

7 questions for FI

Tien-tsin Huang

JPMorgan Chase & Co.

7 questions for FI

David Koning

Robert W. Baird & Co.

6 questions for FI

Harshita Rawat

AllianceBernstein

6 questions for FI

Jason Kupferberg

Bank of America

5 questions for FI

Timothy Chiodo

UBS Group AG

5 questions for FI

Andrew Jeffrey

William Blair & Company

3 questions for FI

Dan Dolev

Mizuho Financial Group

3 questions for FI

James Faucette

Morgan Stanley

3 questions for FI

Ramsey El-Assal

Barclays

3 questions for FI

Will Nance

Goldman Sachs

2 questions for FI

Bryan Keane

Deutsche Bank

1 question for FI

James Friedman

Susquehanna Financial Group, LLLP

1 question for FI

William Nance

The Goldman Sachs Group, Inc.

1 question for FI

Recent press releases and 8-K filings for FI.

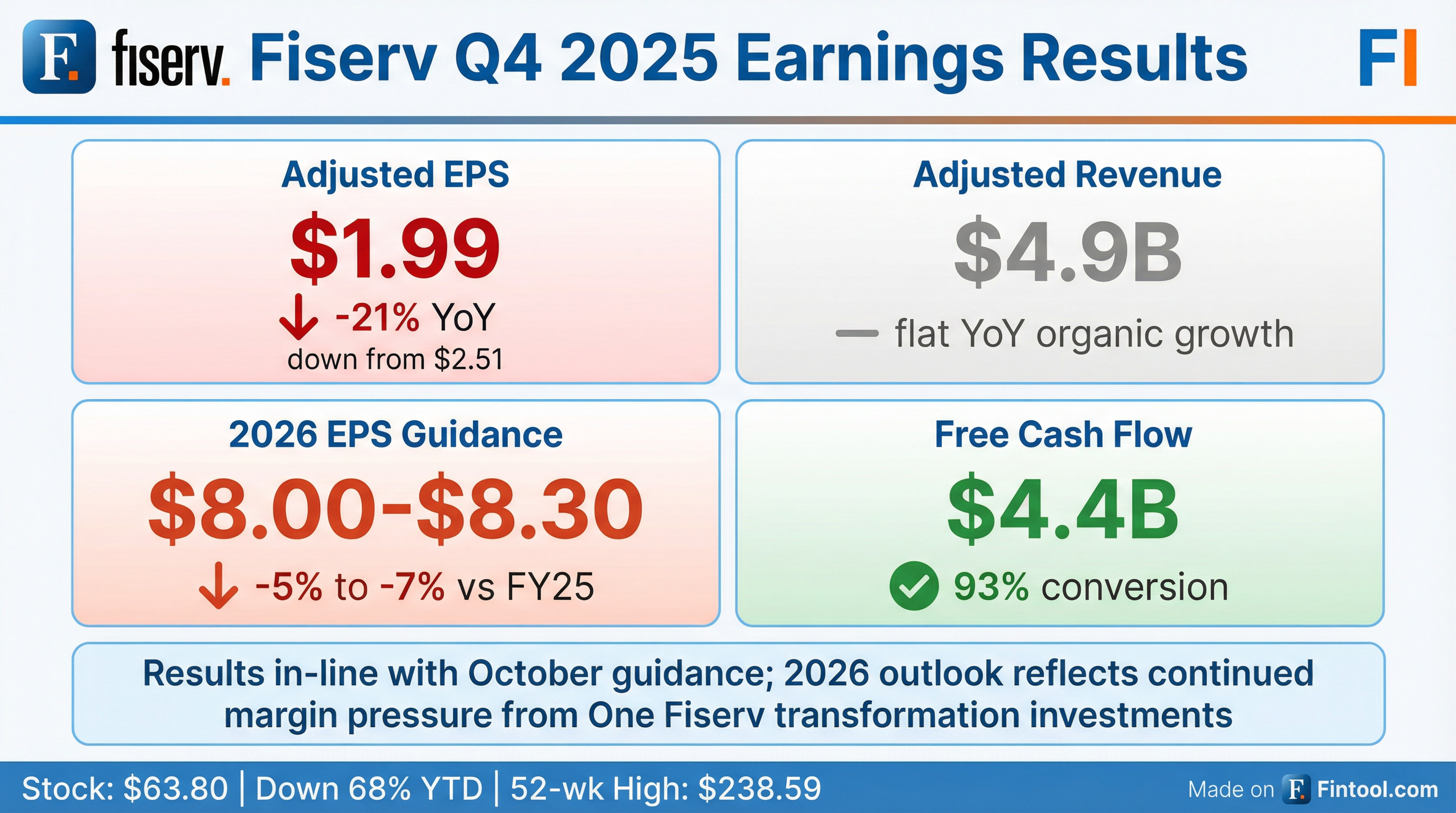

- Fiserv’s Q4 2025 adjusted revenue was $4.9 B, flat year-over-year, with adjusted EPS of $1.99 and an adjusted operating margin of 34.9%.

- For full-year 2025, organic revenue grew 3.8%, adjusted EPS reached $8.64, and free cash flow totaled $4.44 B with a 93% free cash flow conversion rate.

- Merchant Solutions organic revenue rose 6% and Financial Solutions grew 2% in 2025.

- Clover segment revenue jumped 23% to $3.3 B, with GPV up 10% excluding the gateway conversion.

- 2026 guidance calls for 1–3% organic revenue growth and adjusted EPS of $8.00–$8.30.

- Fiserv CEO Mike Lyons recapped a comprehensive strategic review begun in Q3 2025 that led to four key guidance adjustments: Argentina impacts, underperformance in core businesses, investments in client experience, and rebalancing short- vs. long-term initiatives.

- CFO Paul Todd said CapEx will step up to ~$1.8 billion (high-single-digit percentage of revenue) in 2025 for One Fiserv resiliency projects and is expected to remain at that level in 2026 with no further ramp.

- Fiserv will consolidate its core banking platforms from 16 to five modern cores, with no forced conversion timelines and continued support for legacy systems until clients choose to migrate.

- Merchant Solutions saw non-Clover SMB revenues decline in H1 2025, driven by Argentina; excluding Argentina, non-Clover SMB was flat to slightly positive, while future growth will focus on Clover for long-term value.

- Fiserv expects full-year 2025 margins to be down ~200 bps and forecasts 33–35% structural margins for 2026; free cash flow conversion remains stable and excess cash will support share buybacks after maintaining 2.5–3× leverage.

- Completed an in-depth strategic review identifying a culture of short-termism and underinvestment, leading to revised long-term structural growth in the mid-single digits and margin targets, with incremental investments realigned accordingly.

- Reversed prior short-term revenue actions by restoring market pricing on STAR/Accel debit networks, shifting from perpetual license sales to recurring revenue, and removing select Clover end-of-life fees to strengthen ISO partnerships.

- Ramping CapEx to approximately $1.8 B in 2025 under the One Fiserv initiative for resiliency and technology enhancements, then sustaining high-single-digit % of revenue in 2026 with no further step-up planned.

- Simplifying core banking offerings by consolidating 11 legacy cores into five modern platforms (two for credit unions, three for banks), supporting all legacy cores with no forced migrations, and focusing on execution and customer experience.

- Merchant Solutions will see non-Clover SMB ex-Argentina flat to slightly positive, with Clover targeting 10–15% volume growth and 15–20% revenue growth via hardware, value-added services, and vertical expertise—backed by ~600 quota-carrying sales hires to bolster distribution.

- Fiserv’s management announced the outcome of a comprehensive internal and external review leading to a recalibration of its long-term structural growth rates and margins and a renewed focus on balancing short- and long-term initiatives.

- The company reversed certain short-term revenue boosts by reducing Star and Excel debit network pricing and rolling back select Clover end-of-life fees to enhance long-term client acquisition and optimize recurring revenue.

- CFO guidance indicated CapEx will increase to ~$1.8 billion (~7–9% of revenue) in 2025 for resiliency and technology enhancements, and remain at a high single-digit percentage of revenue in 2026.

- Fiserv plans to consolidate its 11 credit union and bank cores into five modern platforms by early 2026, with no forced conversions, offering incentives for on-time migrations.

- In Merchant Solutions, non-Clover SMB revenues are expected to be flat to slightly positive ex-Argentina, while Clover is targeting 10–15% volume growth and 15–20% revenue growth through hardware, value-added services, vertical expertise, and Clover Capital.

- Senate Democrats have demanded information on ex-CEO Frank Bisignano’s role in forecasting after Fiserv admitted it would not meet its prior guidance.

- This probe follows a securities fraud class action filed after shares cratered 47% on Oct. 29, 2025 amid Q3 2025 results deemed “abysmal” and based on “objectively difficult to achieve” assumptions.

- On July 23, 2025, Fiserv revised its 2025 organic revenue guidance to 10% and raised the low end of its EPS forecast to $10.15, citing an anticipated growth ramp in H2.

- The class period runs July 23 – Oct. 29, 2025, with a lead plaintiff deadline of Jan. 5, 2026.

- Senate Democrats demand information on former CEO Frank Bisignano’s role in crafting forecasts after Fiserv admitted assumptions were “objectively difficult to achieve”.

- Q3 2025 results triggered a 47% share price plunge on October 29 following a sequential decline in adjusted revenue and sharply reduced guidance (organic growth cut to 3.5–4%, EPS to $8.50–$8.60).

- A securities fraud class action (Cypanga Sicav SIF v. Fiserv) was filed, covering investor losses between July 23 and October 29, 2025.

- Fiserv announced its CFO’s departure and a board reshuffle effective January 1, 2026, as new CEO Michael Lyons acknowledged the prior guidance was overly optimistic.

- Fiserv CEO Mike Lyons and newly appointed CFO Paul Todd detailed a Q3–Q4 strategic review that drove a guidance reset, attributing lowered organic growth primarily to cyclical declines in Argentina and necessary high-ROI CapEx/OpEx investments for long-term value creation.

- The leadership affirmed the core business is capable of mid-single-digit revenue growth and mid-30% margins, with no material product quality issues identified; priorities include enhancing customer service, accelerating digital product rollouts, and balancing short-term versus long-term initiatives.

- In the Merchant segment, the Clover growth outlook was adjusted to $3.3 billion based on pricing and operational reprioritization; growth drivers include vertical/horizontal platform expansion, accelerated international rollouts, and thoughtful backbook conversions targeting mid- to high-teens revenue growth potential.

- Within Financial Solutions, the card issuing business is expected to normalize to mid-single-digit growth after Q2 noise, while significant investments in Optis core modernization, the Vision Next issuing platform, and embedded finance capabilities (Finxact, Payfare) aim to bolster competitive positioning

- Fiserv conducted a thorough strategic review, reducing 2025 organic growth guidance to 3.5–4% from 10–12%, driven by lower Argentina contributions, business performance, and reinvesting in high-ROI initiatives.

- Argentina’s anticipation revenue, which added 10 ppt to growth last year, will contribute only 2 ppt in 2025 due to structural rate changes; the business remains healthy and core to Fiserv’s merchant offerings.

- Removing cyclical factors, Fiserv expects mid-single digit growth and mid-30% margins, aligning current performance with longer-term structural targets.

- Strategic investments focus on scaling the Clover platform—enhancing vertical expertise (hospitality, healthcare), horizontal SaaS integration, international expansion (Canada, Brazil, Europe, Japan), and backbook migration to Clover.

- Fiserv is modernizing bank and merchant infrastructure: consolidating 16 core banking platforms into two credit union cores and Core Advance, and building a unified, global Commerce Hub gateway for omni-channel merchants by early 2027.

- Fiserv reset its organic revenue growth guidance to 3.5–4% for the next year (down from 10–12%), driven by cyclical deceleration in Argentina, business performance below expectations, high-ROI technology and OpEx investments, and a renewed focus on balancing short- and long-term initiatives.

- Mike Lyons, appointed CEO in May, and newly hired CFO Paul Todd—joined by refreshed audit committee members—confirmed there are no accounting irregularities, stressing the leadership changes aim to bring fresh perspective and strengthen governance.

- In the merchant segment, Fiserv lowered its Clover revenue target to $3.3 billion and is doubling down on vertical and horizontal expansions; it sees a mid- to high-teens revenue growth opportunity internationally, with launches in Canada, Brazil, Europe and an upcoming Japan partnership.

- On the banking and issuing side, Fiserv is consolidating 16 core platforms into 5, launching a single unified digital platform (Experience Digital) and VisionNEXT, expects mid-single-digit growth in card issuing, and is advancing embedded finance solutions with Finxact and Payfare.

- The company plans to deploy up to $1.8 billion in 2025 CapEx and intends to monetize approximately $200 million of non-strategic revenue to optimize capital allocation toward its highest-return businesses.

- Hagens Berman filed a securities fraud class action after Fiserv’s shares plunged 47% on its Q3 2025 results and guidance cut, wiping out $32 billion in market value.

- On July 23, 2025, Fiserv revised its 2025 organic revenue growth guidance to 10% and raised the low end of its EPS outlook to $10.15, citing anticipated back-half growth from key initiatives.

- The complaint alleges these assumptions were “objectively difficult to achieve” and misleading, given Fiserv’s subsequent October 29 update slashing organic growth to 3.5%–4% and EPS guidance to $8.50–$8.60.

- Alongside the guidance cut and sequential revenue decline, Fiserv announced its CFO and audit committee chair will step down effective January 1, 2026.

Quarterly earnings call transcripts for FI.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more