Frontier Airlines CEO Barry Biffle Ousted After 11 Years Amid $190M Losses, Spirit Merger Talks

January 8, 2026 · by Fintool Agent

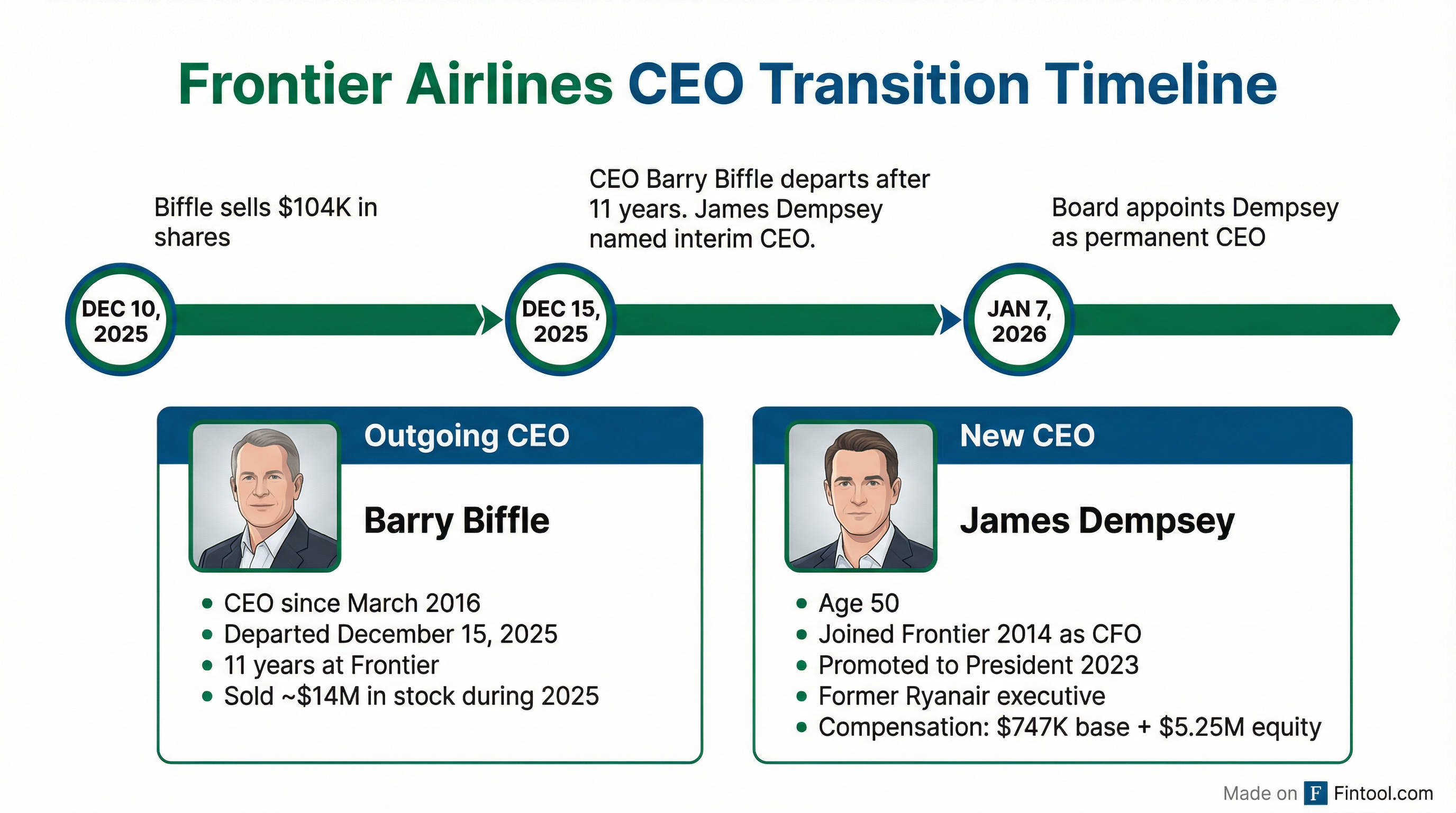

Frontier Group Holdings has made James Dempsey's role as CEO permanent, ending a rapid leadership transition that began just three weeks ago when longtime chief Barry Biffle abruptly departed the Denver-based ultra-low-cost carrier. The move comes as Frontier grapples with mounting losses, a broken guidance promise, and renewed merger talks with bankrupt Spirit Airlines—discussions that Biffle himself had reportedly resisted.

Shares fell 11% in the days following Biffle's December 15 departure before stabilizing. The stock closed at $4.83 on January 8, down 33% over the past year.

The Departure: No Reason Given, Plenty of Context

Frontier's December 15 announcement was terse: Biffle was out, effective immediately, and would stay on as an advisor through year-end. The 8-K filing stated his departure was "not the result of any disagreement with the Company on any matter relating to the Company's operations, policies or practices."

That boilerplate language masks a more complex reality. Biffle led Frontier for nearly a decade, serving as CEO since March 2016 after joining as president in 2014. His tenure saw the airline go public in 2021 and build what management claimed was a 48% cost advantage over competitors.

But 2025 unraveled those gains. The airline that confidently projected "at least $1 per share" in adjusted EPS for 2025 during its February earnings call instead posted cumulative losses of $190 million through the first three quarters—$43 million in Q1, $70 million in Q2, and $77 million in Q3.

Financial Trajectory: From Profitability Promise to Red Ink

The numbers tell a stark story of deteriorating performance:

| Metric | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|

| Revenue ($M) | $845 | $950 | $910 | $978 | $884 | $898 | $854 |

| Net Income ($M) | -$26 | $31 | $26 | $54 | -$43 | -$70 | -$77 |

| EBITDA Margin | -9.9%* | -3.5%* | -7.7%* | -1.2%* | -9.0%* | -9.5%* | -13.5%* |

*Values retrieved from S&P Global

By May, Biffle acknowledged the situation had deteriorated, blaming "macro uncertainty" and "aggressive pricing and promotions across the industry" for an "outsized impact" on Frontier's domestic leisure-focused business.

The Insider Selling Pattern

Biffle's stock transactions in the weeks preceding his departure raise questions. SEC Form 4 filings show he sold approximately $1.64 million in shares between December 4-11, 2025—just days before the departure announcement:

| Date | Transaction | Shares | Price | Value |

|---|---|---|---|---|

| Dec 4, 2025 | Sale | 55,187 | $5.04 | $278K |

| Dec 5, 2025 | Sale | 44,813 | $5.05 | $226K |

| Dec 8, 2025 | Sale | 100,000 | $5.54 | $554K |

| Dec 10, 2025 | Sale | 17,373 | $6.01 | $104K |

| Dec 11, 2025 | Sale | 82,627 | $5.78 | $478K |

For the full year, Biffle sold approximately 1.96 million shares worth $14.2 million, leaving him with roughly 632,000 shares at departure.

The Spirit Merger Connection

The timing of Biffle's departure appears connected to revived merger discussions with Spirit Airlines. Just one day after Frontier announced Biffle's exit, Bloomberg reported the two carriers were in advanced talks about combining—negotiations that could be announced "as soon as this month."

This isn't new territory. Frontier and Spirit have circled each other since 2022, when Spirit rejected Frontier's merger proposal in favor of a JetBlue offer that ultimately collapsed. During Spirit's first bankruptcy earlier in 2025, Frontier made at least two merger proposals, including a $2.16 billion bid, which Spirit rejected as insufficient.

Industry sources told Reuters that Biffle "had been cautious about a full acquisition, on concerns that absorbing Spirit could strain its balance sheet." His removal may signal the board's willingness to pursue a deal more aggressively.

The New CEO: A Ryanair Veteran Steps Up

James Dempsey, 50, brings a decade of Frontier experience and a European low-cost carrier pedigree to the permanent role. He joined Frontier as CFO in 2014, became president in October 2023, and held senior positions at Ryanair and PricewaterhouseCoopers before that.

His compensation package signals the board's confidence:

- Base salary: $747,000

- Target bonus: 125% of base salary

- Annual equity awards: $3.5 million grant date value

- Promotion PSUs: $1.75 million (cliff vesting over 4 years, performance-based)

The PSU structure ties Dempsey's upside to share price appreciation—the award pays out based on a multiplier determined by Frontier's stock price at the end of the performance period versus the beginning, with a maximum cap at $30 per share.

"Jimmy has demonstrated over his more than a decade at Frontier that he's the right leader to drive our airline forward," said Board Chair Bill Franke. "His expertise will help us capitalize on the opportunities we see ahead, preserve our industry-leading cost advantage and guide Frontier into the future."

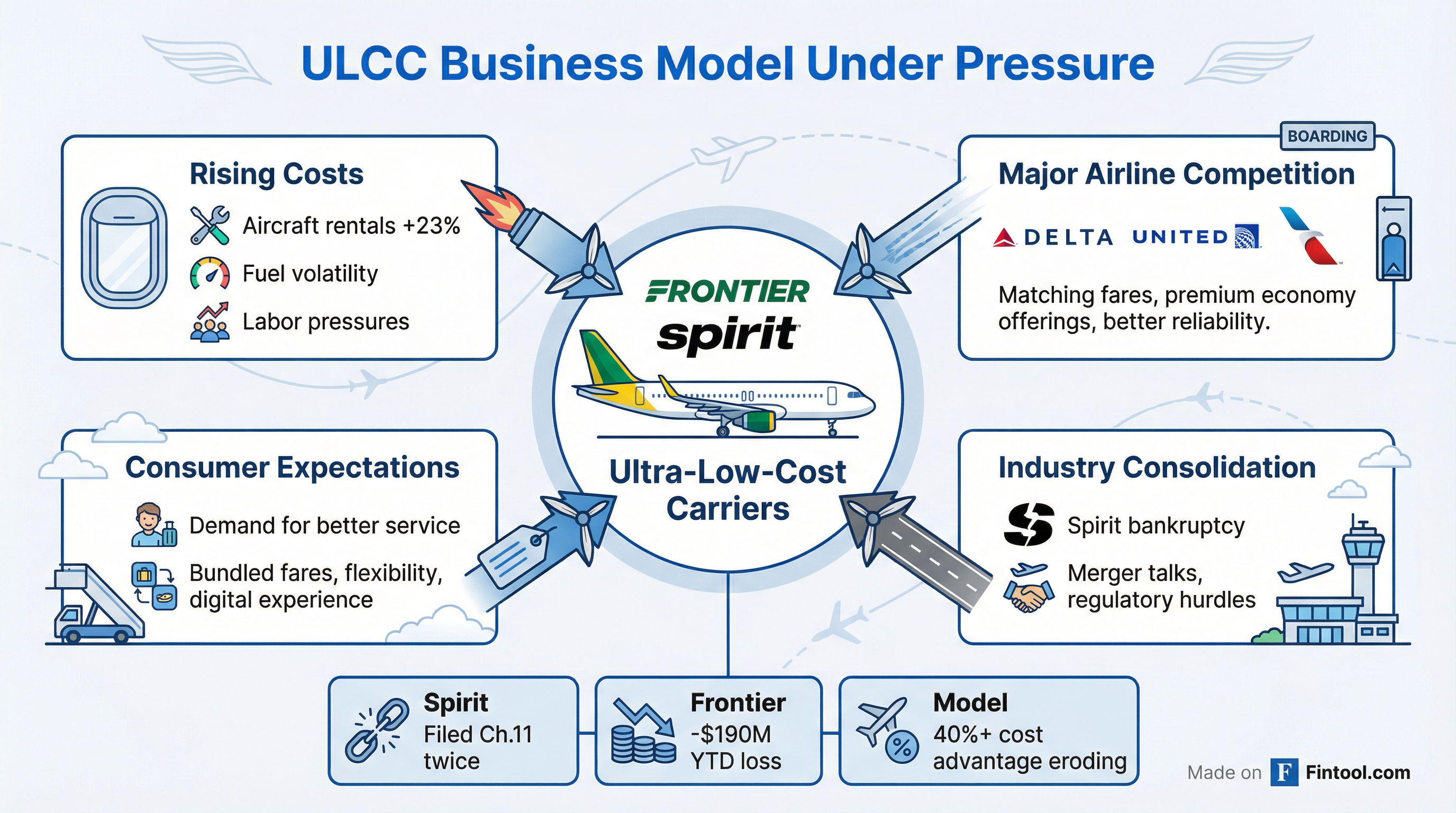

ULCC Model Under Siege

Frontier's struggles aren't isolated. The entire ultra-low-cost carrier business model faces an existential test. Spirit Airlines has filed for bankruptcy protection twice in less than 12 months. The major carriers—Delta, United, and American—have learned to match discount fares selectively while leveraging loyalty programs and premium cabins to defend market share.

"The mainline carriers have effectively figured out how to compete—with higher costs and better service," Dan Akins, an economist with Flightpath Economics, told the New York Times.

Frontier's cost advantage, once the foundation of its investment thesis, faces new headwinds. BofA Securities downgraded the stock to Underperform this week, projecting aircraft rental costs to surge 23% per available seat mile in 2026 and 44% in Q1 alone. The firm cut its 2026 EPS estimate from $0.10 profit to an $0.11 loss.

What to Watch

Q4 2025 Results: Frontier updated guidance this week, saying adjusted EPS will come in "at the higher end" of its previous $0.04-$0.20 range, citing "strong revenue performance" that overcame government shutdown disruptions. This would mark a modest return to profitability after three consecutive losing quarters.

Spirit Merger Talks: A deal could materialize within weeks—or collapse entirely. Success would create a combined ULCC with significant scale but also integration risk and regulatory scrutiny. Failure would leave both carriers vulnerable as standalone entities in a hostile competitive environment.

Dempsey's First Earnings Call: The new CEO's strategic vision—particularly on pricing, capacity, and M&A—will be scrutinized when Frontier reports Q4 results in early February.

Related Companies: Frontier Group Holdings (ulcc) · Spirit Aviation Holdings (flyyq) · Delta Air Lines (dal) · United Airlines (ual) · American Airlines (aal) · Ryanair (ryaay)