Goldman Sachs CEO David Solomon Sees 'Top Decile' M&A Year at UBS Conference, Signals More AWM Deals

February 10, 2026 · by Fintool Agent

Goldman Sachs CEO David Solomon delivered a bullish message to investors at the UBS Financial Services Conference in Key Biscayne, Florida, declaring 2026 could be a "top quartile, potentially top decile" year for M&A activity while signaling openness to more acquisitions in the firm's asset and wealth management business.

The stock rose 1.6% to $943.62 on the day of Solomon's remarks, extending a rally that has seen Goldman shares climb from around $550 at the start of 2025 to become one of the biggest contributors to the Dow Jones Industrial Average's historic breach of 50,000 points last week.

The M&A Window is Open

Solomon's most emphatic message centered on the dealmaking environment. After years of regulatory headwinds where "whatever the question was, the answer was no," he said the pendulum has swung decisively: "Now, whatever the question is, the answer is maybe."

For strategic acquirers, the implications are clear. "There isn't a CEO in the world that hasn't woken up and said, 'Now is a moment for some period of years where I can do things strategically to strengthen my competitive position,'" Solomon said.

Goldman's advisory backlog—a closely watched forward indicator—reflects this optimism. The firm has been the #1 M&A advisor globally for 23 consecutive years, and Solomon described the pipeline as supportive of "meaningfully higher" activity than the five-year average.

Private equity sponsors, who have kept portfolio companies on the shelf while waiting for higher valuations, are also finally capitulating. Solomon cited Blackstone President Jon Gray's recent earnings call statement that "they are going to sell a lot of things this year."

"I think we're reaching a point where the valuation's becoming less important," Solomon explained. "They've got to return capital. The pressure from the LP community and the cycle life of fundraising has reached a point in time for most of these firms that they can't get into the valuation debate as much."

Capital Markets Poised for Recovery

Beyond advisory, Solomon expects both equity and debt capital markets to accelerate—though not to 2021's frothy levels.

On the IPO front, several large private companies have "decided for a variety of reasons they want to get to the public markets," creating a more constructive environment. Solomon predicted "better pull-through than what's been expected" on equity issuance.

Debt capital markets should benefit from the same forces driving M&A. "There's significant activity. That activity has to be financed," Solomon said, pointing to massive AI infrastructure financing needs—including Google's recent large-scale debt offerings—as a structural tailwind.

Asset & Wealth Management: Raising the Bar Again

The longer-term story at Goldman continues to center on transforming the firm's mix toward more durable, fee-based revenue streams in Asset & Wealth Management.

Solomon highlighted that AWM is now a "top five, sixth, or seventh" active asset manager globally with over $3.5 trillion in assets under supervision. The business is growing "better than 10%"—exceeding the original high-single-digit target—and Goldman has raised its margin target from 25% to 30%.

Goldman Sachs Financial Snapshot

| Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Revenue ($B) | $12.2 | $11.5 | $11.3 | $9.7 |

| Net Income ($B) | $4.7 | $3.7 | $4.1 | $4.6 |

| Diluted EPS | $14.12 | $10.91 | $12.25 | $14.01 |

| ROE (%) | 15.3% | 12.0% | 13.2% | 14.8%* |

*Values retrieved from S&P Global.

The path to higher margins runs through alternatives. Goldman is targeting $750 billion in fee-based alternatives AUS by 2030, fundraising $75-100 billion annually. As more capital comes on fee, the margin mix improves structurally.

"The profitability contribution from alternatives as opposed to the more traditional asset management business is higher margin," Solomon explained. "That mix has been improving as we scale our alternatives business."

The Acquisition Playbook

Goldman's recent dealmaking in AWM tells the story of a firm willing to deploy capital to accelerate this transformation.

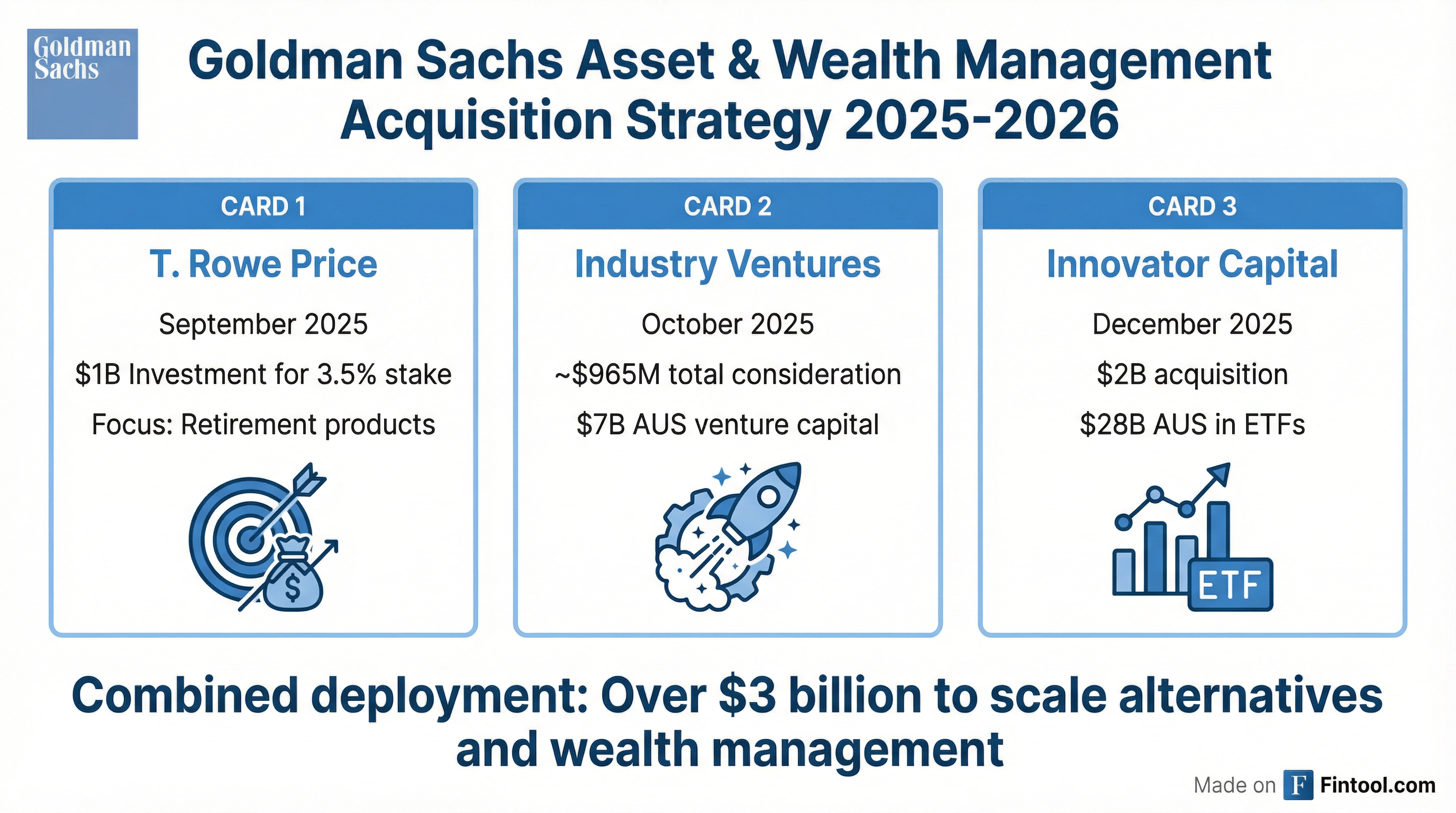

Since September 2025, Goldman has deployed over $3 billion on strategic moves:

T. Rowe Price Partnership (September 2025): Goldman invested up to $1 billion in T. Rowe Price common stock for a stake of up to 3.5%, forming a strategic collaboration focused on retirement and wealth products incorporating private markets access.

Industry Ventures (October 2025): Goldman acquired the $7 billion venture capital platform for $665 million upfront plus up to $300 million in contingent consideration. The deal closed in January 2026, bringing deep VC relationships and secondary investing capabilities into Goldman's External Investing Group.

Innovator Capital Management (December 2025): The $2 billion acquisition of the defined-outcome ETF pioneer adds $28 billion in AUS across 159 ETFs, making Goldman a top-10 active ETF provider. The deal is expected to close in Q2 2026.

Solomon revealed how the Industry Ventures deal came together organically. Hans Swildens, the founder, approached Goldman when another buyer emerged: "Mike [Brandmeyer] said, 'No, I can't help you think about that. But I'll help you think about selling it to Goldman Sachs.'"

The message for investors: Goldman is actively hunting. "We would love to find interesting inorganic things that can accelerate the scale and the growth of our asset and wealth management platform," Solomon said. "However, to do significant things, the bar is going to be very high. And we're incredibly focused on the culture of the firm."

Trading Business: Durable, Not Cyclical

Solomon pushed back on the perception of Goldman's trading businesses as purely cyclical. The markets division has benefited from structural advantages: scale, breadth, and the shift toward more financing-intensive models.

"When we look at these businesses, we try to look at 10-year averages," Solomon said. "There's a base durability, especially given all the financing that's going on in these businesses."

Goldman is the #1 or #2 counterparty to 123 of its top 150 accounts—and the firm continually analyzes where it can improve positioning. "We're constantly looking at where we have gaps and trying to say, 'How can we improve those gaps?'"

The Macro Setup: Tailwinds with Speed Bumps

Solomon outlined a constructive macro backdrop for risk assets:

- Fiscal stimulus remains in place with little political appetite to retreat

- Deregulation is freeing capacity previously devoted to compliance

- Technology supercycle driving massive infrastructure investment

- Midterm election dynamics likely to produce populist, stimulative policies

But he was characteristically cautious. "I would expect that we'll have something... that'll create somewhere in the year a speed bump or recalibration or slowdown," Solomon warned, citing trade policy, inflation, and geopolitical risks as potential triggers—similar to April 2025's tariff-induced selloff.

On AI, Solomon noted Goldman's software exposure is "insignificant in the scale of our overall platform" but acknowledged the narrative around AI disruption has been "too broad." There will be winners and losers, and "plenty of companies pivot and do just fine."

Stock Performance

Goldman's stock has been a standout performer, helping drive the Dow from 25,000 to 50,000—a journey highlighted in the Wall Street Journal the morning of Solomon's remarks.

Analysts remain constructive. The consensus price target stands at $950.50, implying modest upside from current levels.* Forward EPS estimates for 2026 point to continued strength, with Q1 2026 consensus at $15.69 per share.*

*Values retrieved from S&P Global.

The Bottom Line

Solomon's message at the UBS conference was one of measured optimism. The dealmaking environment is the best in years, the regulatory pendulum has swung favorably, and Goldman is positioned to capture share across investment banking, trading, and asset management.

But the firm isn't resting. With $3 billion deployed on AWM acquisitions in the past five months and an appetite for more, Goldman is aggressively building the durable, fee-based revenue streams that could command a higher multiple.

"These businesses are diverse, durable, and have an ability in a growing economy to grow more than historically they've been credited with," Solomon concluded. "The historic multiples are too low based on the earnings durability of these businesses now."