Earnings summaries and quarterly performance for PRICE T ROWE GROUP.

Executive leadership at PRICE T ROWE GROUP.

Rob Sharps

Chair, Chief Executive Officer and President

Eric Veiel

Head of Global Investments and Chief Investment Officer

Glenn August

Chief Executive Officer, Oak Hill Advisors (OHA)

Jennifer Dardis

Chief Financial Officer and Treasurer

Josh Nelson

Head of Global Equity

Kimberly Johnson

Chief Operating Officer

Ramon Richards

Head of Technology, Data, and Operations

Board of directors at PRICE T ROWE GROUP.

Alan Wilson

Lead Independent Director

Allan Golston

Director

Cynthia Smith

Director

Dina Dublon

Director

Eileen Rominger

Director

Mark Bartlett

Director

Richard Verma

Director

Robert MacLellan

Director

Robert Stevens

Director

Sandra Wijnberg

Director

William Donnelly

Director

Research analysts who have asked questions during PRICE T ROWE GROUP earnings calls.

Alexander Blostein

Goldman Sachs

6 questions for TROW

Craig Siegenthaler

Bank of America

5 questions for TROW

Kenneth Worthington

JPMorgan Chase & Co.

5 questions for TROW

Michael Cyprys

Morgan Stanley

5 questions for TROW

Patrick Davitt

Autonomous Research

5 questions for TROW

Benjamin Budish

Barclays PLC

4 questions for TROW

Brennan Hawken

UBS Group AG

4 questions for TROW

Daniel Fannon

Jefferies Financial Group Inc.

4 questions for TROW

Glenn Schorr

Evercore ISI

3 questions for TROW

Ben Budish

Barclays PLC

2 questions for TROW

Dan Fannon

Jefferies & Company Inc.

2 questions for TROW

Michael Brown

Wells Fargo Securities

2 questions for TROW

Bill Katz

TD Securities

1 question for TROW

Brian Bedell

Deutsche Bank

1 question for TROW

Ivory Gao

Bank of America Securities

1 question for TROW

Ken Worthington

JPMorgan

1 question for TROW

William Katz

TD Cowen

1 question for TROW

Recent press releases and 8-K filings for TROW.

- Assets under management as of January 31, 2026: $1.80 trillion.

- Net outflows in January 2026 totaled $5.2 billion.

- AUM by asset class: $879 B equity; $213 B fixed income; $646 B multi-asset; $59 B alternatives.

- Target date retirement portfolios AUM stood at $580 B.

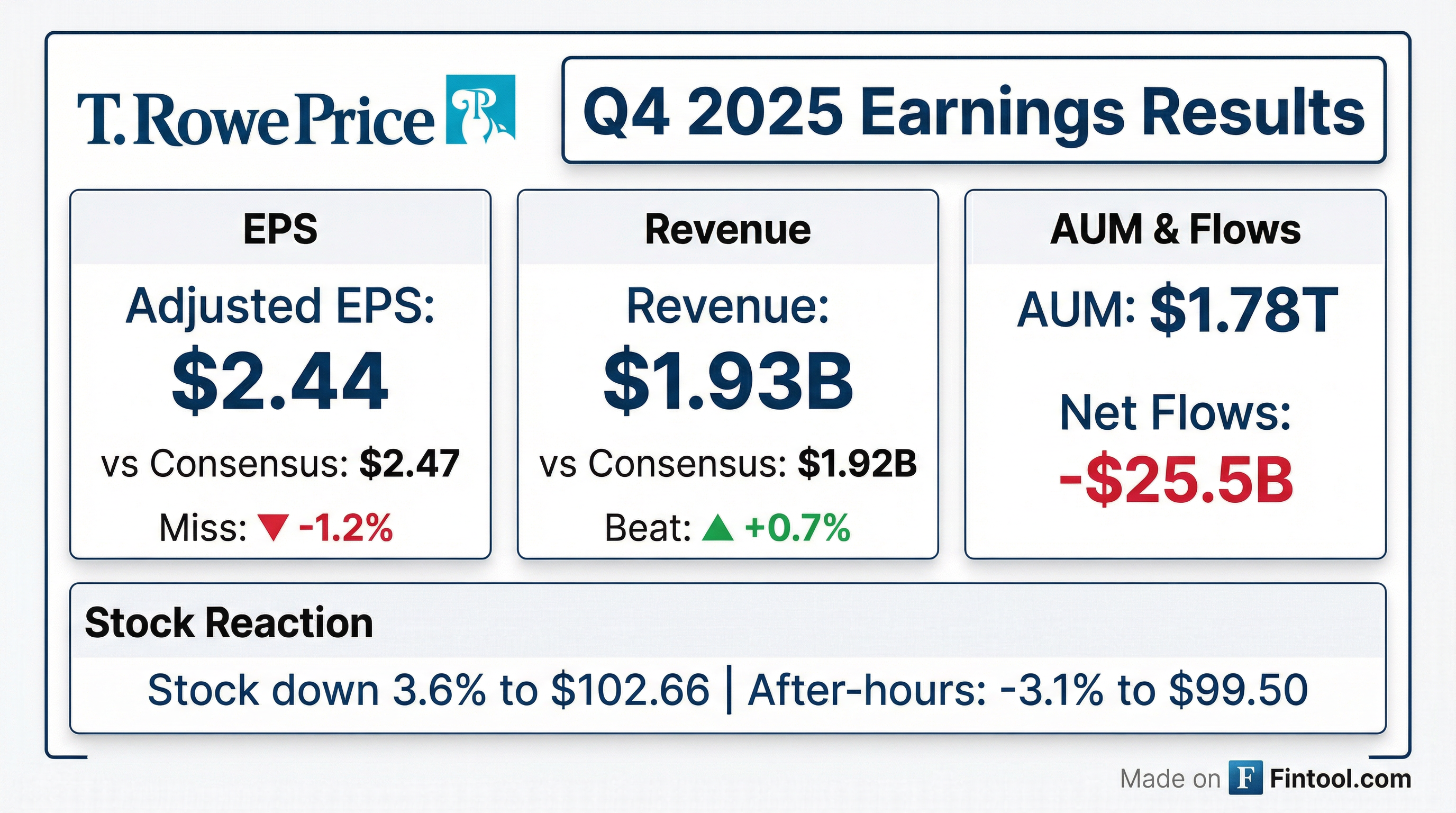

- Adjusted EPS of $2.44 in Q4 and $9.72 for FY 2025 (up 4.2% YOY); net outflows of $25.5 billion in Q4 and $56.9 billion for the year.

- AUM reached $1.78 trillion, up over 10% YTD despite net outflows, with positive Q4 flows in fixed income, alternatives, ETFs, and $5.2 billion net inflows in target date funds.

- For 2026, adjusted operating expenses are guided to rise 3–6%, while Q4 share repurchases totaled $141 million (FY $624.6 million) and the firm marked its 39th consecutive annual dividend increase.

- Advanced strategic initiatives with a Goldman Sachs co-branded retirement offering, 13 new ETFs in 2025 (AUM > $21 billion), a First Abu Dhabi Bank partnership, and the first close of a T. Rowe Price–managed private equity fund.

- Assets under management reached $1.78 T, despite net outflows of $25.5 B in Q4 2025.

- Net revenues rose to $1.934 B in Q4 2025 from $1.825 B in Q4 2024.

- Diluted EPS was $1.99 GAAP and $2.44 adjusted, versus $1.92 GAAP and $2.12 adjusted in Q4 2024.

- Effective fee rate (ex performance fees) declined to 38.8 bps from 40.5 bps in Q4 2024.

- Closed FY 2025 with $1.78 trillion AUM, up over 10% from the start of the year despite $56.9 billion in net outflows.

- Q4 adjusted diluted EPS of $2.44 and full-year adjusted diluted EPS of $9.72, a 4.2% increase from 2024, driven by higher average AUM and advisory revenue.

- Net outflows of $25.5 billion in Q4; fixed income and alternatives delivered positive flows, and ETFs saw $1.8 billion of Q4 net inflows (2025 total: $10.5 billion).

- About half of funds outperformed Morningstar peers over 1-, 3-, 5-, and 10-year periods (49%, 56%, 46%, 61%), with asset-weighted outperformance of 72% over three years and 79% over ten years.

- Launched 13 new ETFs in 2025, established partnerships with Goldman Sachs and First Abu Dhabi Bank, and OHA raised a record $16 billion in capital.

- Ended 2025 with $1.78 trillion in assets under management, up over 10% from the start of the year despite $56.9 billion of net outflows; Q4 outflows totaled $25.5 billion, largely from equity and mutual fund products, with market appreciation adding nearly $50 billion of equity AUM.

- Q4 adjusted diluted EPS of $2.44 and full-year EPS of $9.72, up 4.2% year-over-year; Q4 adjusted net revenue was $1.9 billion (FY $7.4 billion, +2.8%), and Q4 investment advisory revenue was $1.7 billion, up 4.2% versus Q4 2024, with an effective fee rate of 38.8 bps.

- Q4 adjusted operating expenses of $1.2 billion (FY $4.6 billion, +3.4%); 2026 expense guidance calls for a 3–6% increase; returned $624.6 million to shareholders in share buybacks (Q4 $141 million), closed the year with $3.8 billion of cash and discretionary investments, and marked the 39th consecutive annual dividend increase.

- Advanced strategic initiatives with 13 ETF launches in 2025 (AUM > $21 billion), co-branded model portfolios with Goldman Sachs, a new strategic partnership with First Abu Dhabi Bank, and the first close of a T. Rowe Price–managed private equity fund in January 2026.

- Achieved $1.8 trillion AUM at December 31, 2025, with net client outflows of $25.5 billion in Q4 and $56.9 billion for the full year 2025.

- Generated net revenues of $1.934 billion in Q4 2025 (up 6.0% YoY) and $7.315 billion for full-year 2025 (up 3.1%).

- Reported diluted EPS of $1.99 in Q4 (up 3.6% YoY) and $9.24 for FY 2025 (up 1.0%); adjusted diluted EPS was $2.44 in Q4 (up 15.1%) and $9.72 for the year (up 4.2%).

- Returned $426 million in Q4 and $1.8 billion in 2025 to shareholders via dividends and stock repurchases.

- Oak Hill Advisors, T. Rowe Price’s private markets platform, served as Administrative Agent and Lead Left Arranger for a private unitranche financing supporting Majesco’s acquisition of Vitech and a concurrent refinancing.

- OHA is the largest holder of the new debt facility, deepening its relationship with Thoma Bravo.

- The combined business unites Majesco’s cloud-native, AI-native insurance software with Vitech’s pension and benefits administration platform.

- As of September 30, 2025, Oak Hill Advisors manages approximately $108 billion in capital across credit strategies.

- Oak Hill Advisors (OHA), the private markets platform of T. Rowe Price Group, announced the final close of its first dedicated senior private lending strategy, OLEND, with $17.7 billion of total available capital, including $8.0 billion of equity commitments.

- OLEND will focus on direct lending to larger companies (EBITDA > $75 million), primarily in North America, targeting first lien and unitranche loans across recession-resistant industries.

- This fundraise marks OHA’s largest flagship fundraise in its history, supported by a diverse global investor base and meaningful contributions from T. Rowe Price’s partnership.

- T. Rowe Price reported preliminary month-end assets under management of $1.79 trillion and net outflows of $8.0 billion for November 2025.

- As of November 30, 2025, AUM by asset class were $891 billion in Equity, $211 billion in Fixed Income (including money market), $628 billion in Multi-asset, and $57 billion in Alternatives.

- Target date retirement portfolios reached $562 billion, up from $476 billion at year-end December 31, 2024.

- Beginning in July 2025, managed account-model delivery assets have been included in the firm’s AUM.

- T. Rowe Price’s 43rd annual outlook predicts favorable market conditions in 2026 driven by the AI boom, U.S. monetary and fiscal stimulus, and an expansionary phase in Europe despite sticky inflation and high valuations.

- The U.S. economy is bifurcated, with AI-related sectors booming while interest rate–sensitive areas like housing and manufacturing remain weak; significant Fed rate cuts will be needed to spur a sharp housing rebound.

- The “One Big Beautiful Bill” passed in July 2025 is expected to inject $200–300 billion in fiscal stimulus in 2026, front-loading support for corporate earnings alongside anticipated Fed rate cuts; Europe enters an expansion phase and Japan offers attractive valuations.

- In fixed income, the firm prefers low duration, overweight public credit versus government bonds, underweight U.S. exposure, seek inflation-linked bonds, and overweight emerging markets with a quality bias, emphasizing disciplined credit selection.

Quarterly earnings call transcripts for PRICE T ROWE GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more