Halozyme Raises 2026 Guidance to $1.8B, Hits $1B Royalty Milestone a Year Early

January 28, 2026 · by Fintool Agent

Halozyme Therapeutics delivered a major guidance raise at its January 28 Investor Conference Call, projecting royalty revenue will exceed $1 billion in 2026—one full year ahead of the timeline CEO Dr. Helen Torley set in 2018. The company also revealed it quietly closed the acquisition of Surf Bio in late December, adding a second hyperconcentration technology to its expanding drug delivery arsenal.

Shares rose 2.5% to $71.96 in morning trading, building on a 52-week gain that has taken the stock from $47.50 to within striking distance of its $79.50 high.

The Numbers: Across-the-Board Beats and Raises

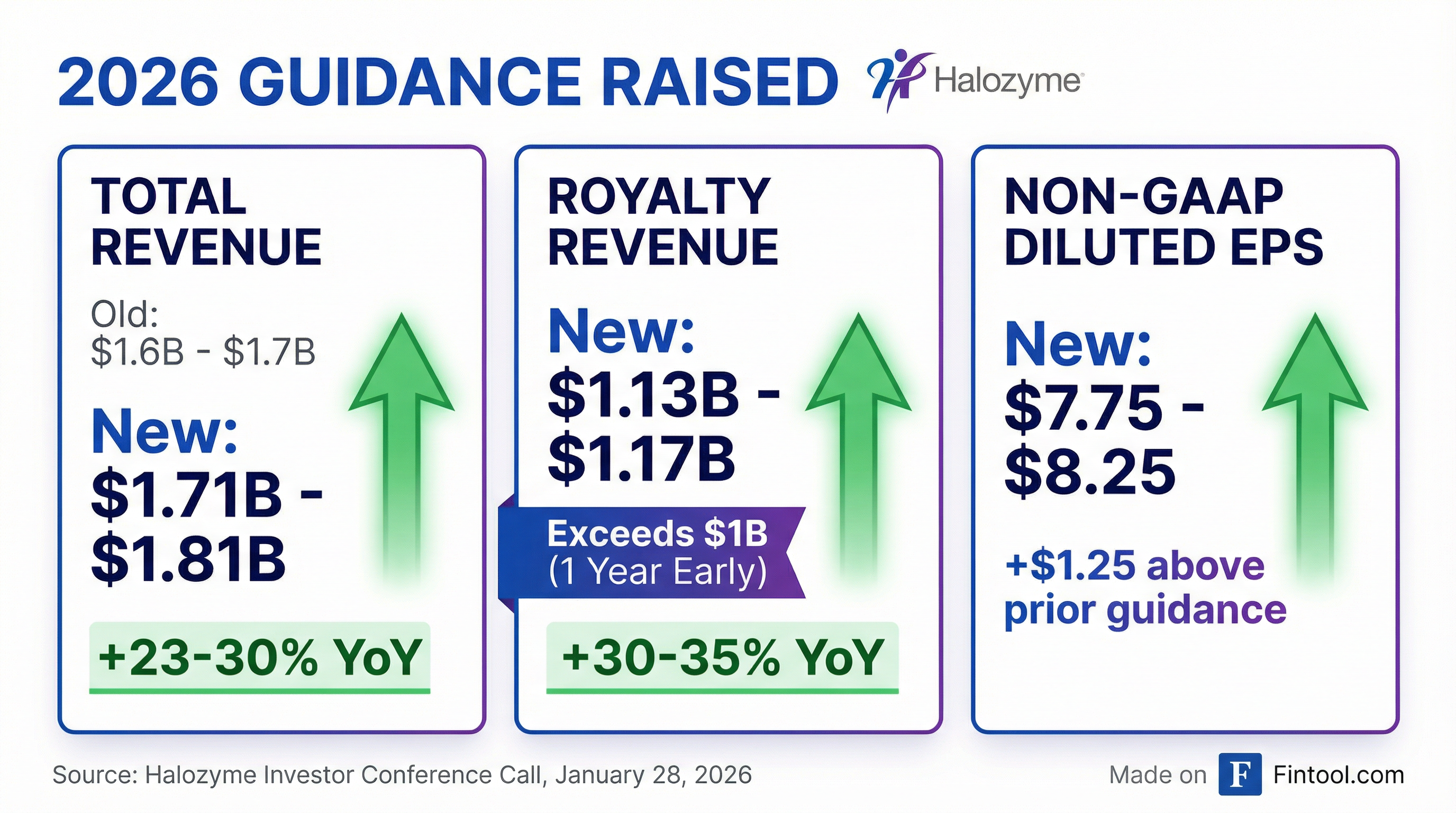

Halozyme raised guidance on virtually every metric for 2026 :

| Metric | 2025 Preliminary | 2026 Guidance | YoY Growth |

|---|---|---|---|

| Total Revenue | $1.385-1.40B | $1.71-1.81B | 23-30% |

| Royalty Revenue | $865-870M | $1.13-1.17B | 30-35% |

| Adjusted EBITDA | TBD* | $1.125-1.205B | — |

| Non-GAAP Diluted EPS | TBD* | $7.75-8.25 | — |

*EBITDA and EPS for 2025 pending accounting treatment of recent acquisitions

The 2025 preliminary results themselves represent a blowout year: royalty revenue growth of 51-52% year-over-year, with total revenue up 36-38% versus 2024.

"The fourth quarter, and specifically the month of December, was a standout period for Halozyme. Never before have we executed on such a broad series of value-creating events in such a brief time," Dr. Torley said on the call.

Surf Bio: The Second Hyperconcentration Play

Just six weeks after closing the Elektrofi acquisition in November 2025, Halozyme revealed it acquired Surf Bio in late December for up to $400 million—$300 million upfront plus up to $100 million in milestone payments.

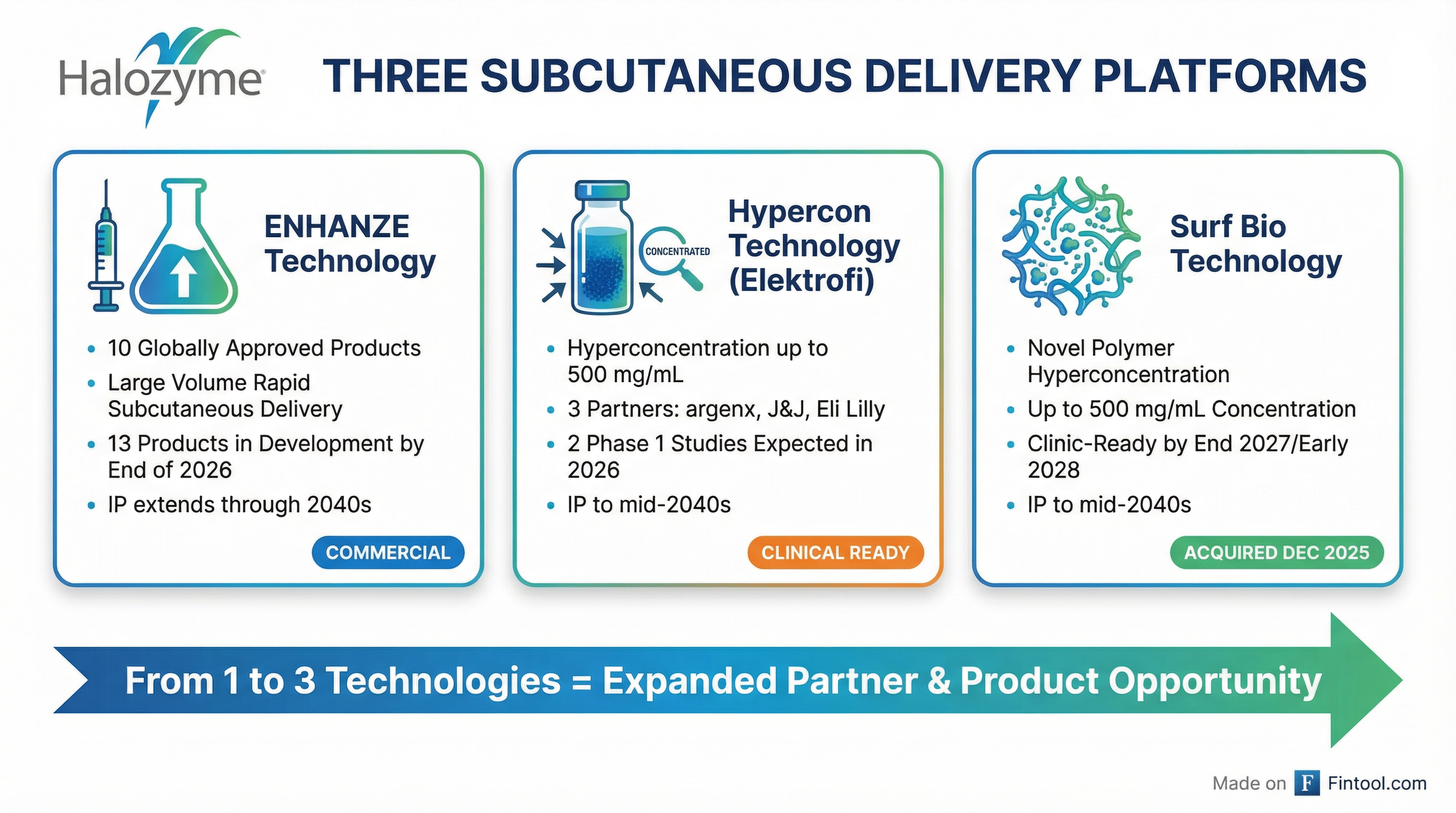

The deal gives Halozyme a third subcutaneous delivery platform:

| Technology | Mechanism | Status | Partners | IP Duration |

|---|---|---|---|---|

| ENHANZE | Hyaluronidase enzyme | 10 approved products | J&J, Argenx, Roche, Bristol-myers | Into 2040s |

| Hypercon (Elektrofi) | Dehydration process | 2 Phase 1 studies in 2026 | Argenx, J&J, Eli Lilly | Mid-2040s |

| Surf Bio | Novel polymer hyperconcentration | Preclinical | TBD | Mid-2040s |

Both hyperconcentration technologies achieve approximately 500 mg/mL concentrations—3-4x higher than typical formulations—enabling smaller injection volumes suitable for at-home autoinjector delivery.

"Strategically, two technologies that work differently to hyperconcentrate therapeutics expand our opportunity," Dr. Torley explained. "This allows us to work with more companies on leading and emerging top targets."

The Surf Bio technology uses a novel proprietary excipient that enables stable, dense, low-friction particles through spray drying. Dr. Torley described the viscosity as "incredibly low—like injecting water."

The $1 Billion Milestone—Achieved Early

The most striking data point: Halozyme will cross $1 billion in royalty revenue in 2026, one year ahead of Dr. Torley's original January 2018 projection.

"Many were skeptical at that time, wondering if we would navigate the then outsized concerns regarding patent cliffs in 2024 and 2027. You can see we came through this period very successfully," Dr. Torley said.

The growth is powered by three primary drivers:

-

DARZALEX FASPRO (J&J): The multiple myeloma blockbuster generated $14.3 billion in 2025 sales with >20% growth, commanding 90%+ share of total DARZALEX volume

-

VYVGART Hytrulo (Argenx): Hit $4.15 billion in 2025 sales—90% year-over-year growth—with the prefilled syringe launch in mid-2025 as a key driver

-

Six recently launched products: Including Ocrevus, Opdivo, and Tecentriq Hybreza, all contributing incremental royalty growth

2028 and Beyond: The Roadmap to $2 Billion

Halozyme provided multi-year guidance extending through 2028 :

| Metric | 2028 Projection | CAGR (2024-2028) |

|---|---|---|

| Total Revenue | >$2.0B | 18-20% |

| Royalty Revenue | $1.46-1.51B | 26-28% |

| Non-GAAP Diluted EPS | $10.50-11.10 | >2x from 2024 |

| Operating Margin | >60% | — |

| Free Cash Flow | >70% of EBITDA | — |

The guidance notably excludes potential upside from a U.S. manufacturing IP extension that could maintain mid-single-digit royalties on DARZALEX FASPRO and RYBREVANT FASPRO from September 2027 to March 2029.

For Hypercon specifically, Dr. Torley outlined a path to approximately $1 billion in royalty revenues by the mid-2030s, driven by 2-5 product launches after the first approvals in 2030-2031.

Partnership Momentum: 3 New ENHANZE Deals in Q4

December capped an aggressive partnership expansion, with three new ENHANZE collaboration agreements signed in late 2025 spanning :

- Large pharma and smaller biotechs

- New therapeutic areas: Obesity and inflammatory bowel disease added to oncology focus

- Both IV-to-subcutaneous conversion and subcutaneous extended dosing profiles

Clinical planning has "already kicked off" for all three new collaborations' Phase 1 studies.

The company expects 1-3 additional ENHANZE deals in 2026, plus 1-2 new Hypercon partnerships, targeting a total of 15 products in development by year-end (13 ENHANZE, 2 Hypercon).

Dr. Torley highlighted two emerging growth vectors generating "multiple incoming calls":

- Nucleic acids: Interest in ENHANZE for subcutaneous delivery of lipid nanoparticle formulations while mitigating immune responses

- Antibody-drug conjugates (ADCs): Potential for improved risk-benefit profiles through altered PK (lower Cmax, equivalent AUC)

The Biosimilar Question

Asked about biosimilar risk post-2029, Dr. Torley expressed confidence in Halozyme's defensive position :

"We have co-formulation patents for the majority, or expect co-formulation patents to be issued for the majority of our products... A biosimilar company can't follow the exact same path we have, which brings our expectation that they would need to do a pretty full clinical development program."

The DARZALEX royalty term extends through 2032 for both U.S. and EU. Dr. Torley signaled ongoing discussions with J&J to extend the relationship: "It's going to be very important that they do not have any discontinuity or risk... I think they'll be in our mutual interest to come forward with another type of agreement."

Financial Strength: The Asset-Light Model

Halozyme's royalty-driven business model delivers exceptional margins :

| Metric | FY 2024 | 2026-2028 Projected |

|---|---|---|

| Gross Margin | 76.5% | >80% |

| EBITDA Margin | 61.8% | 60%+ |

| Free Cash Flow / EBITDA | — | >70% |

| Operating Margin | — | >60% |

The company ended 2024 with $479 million in operating cash flow and nearly $400 million in free cash flow.

Notably, the 2026 guidance includes approximately $60 million in new operating expenses for advancing the Hypercon and Surf Bio platforms—investments not contemplated in prior guidance.

Accounting Watch: Surf Bio Treatment

One caveat on Q4 results: The accounting treatment for the Surf Bio acquisition remains under review. CFO Nicole LaBrosse noted that if classified as an asset acquisition (rather than business combination) of in-process R&D, a one-time P&L charge would appear in Q4 2025 results.

"That could be the impact of the Surf Bio technology being in the preclinical development stage," LaBrosse said. Full Q4 results with EBITDA and non-GAAP EPS will be reported in February.

What to Watch

Near-term catalysts:

- Q4 2025 earnings (February) with accounting clarification

- Hypercon Phase 1 study initiations (target: 2 by end of 2026)

- New partnership announcements (guidance: 3+ total deals in 2026)

Long-term milestones:

- Surf Bio clinic readiness (end 2027/early 2028)

- First Hypercon approvals (projected 2030-2031)

- Hypercon scaling to ~$1B royalty contribution (mid-2030s)

Dr. Torley, in her 12th year as CEO, left investors with a confident close: "I have a team that's delivered and will deliver again, and finally, that I have never been as confident or more excited in Halozyme's future."

Related: Halozyme Therapeutics · Johnson & Johnson · Argenx · Eli Lilly