Insurance Brokers Crash as ChatGPT Enters the Business: WTW Suffers Worst Day Since 2008

February 10, 2026 · by Fintool Agent

Willis Towers Watson plunged 11.45% on Monday—its worst trading session since November 2008—as the launch of AI-powered insurance apps on ChatGPT sparked fears that artificial intelligence could disintermediate the $300 billion global insurance brokerage industry.

The S&P 500 Insurance Index fell 3.9%, its biggest single-day drop since October, as investors dumped shares of human-capital-intensive businesses seen as vulnerable to AI automation.

What Triggered the Crash

Two developments collided on February 9 to spook the market:

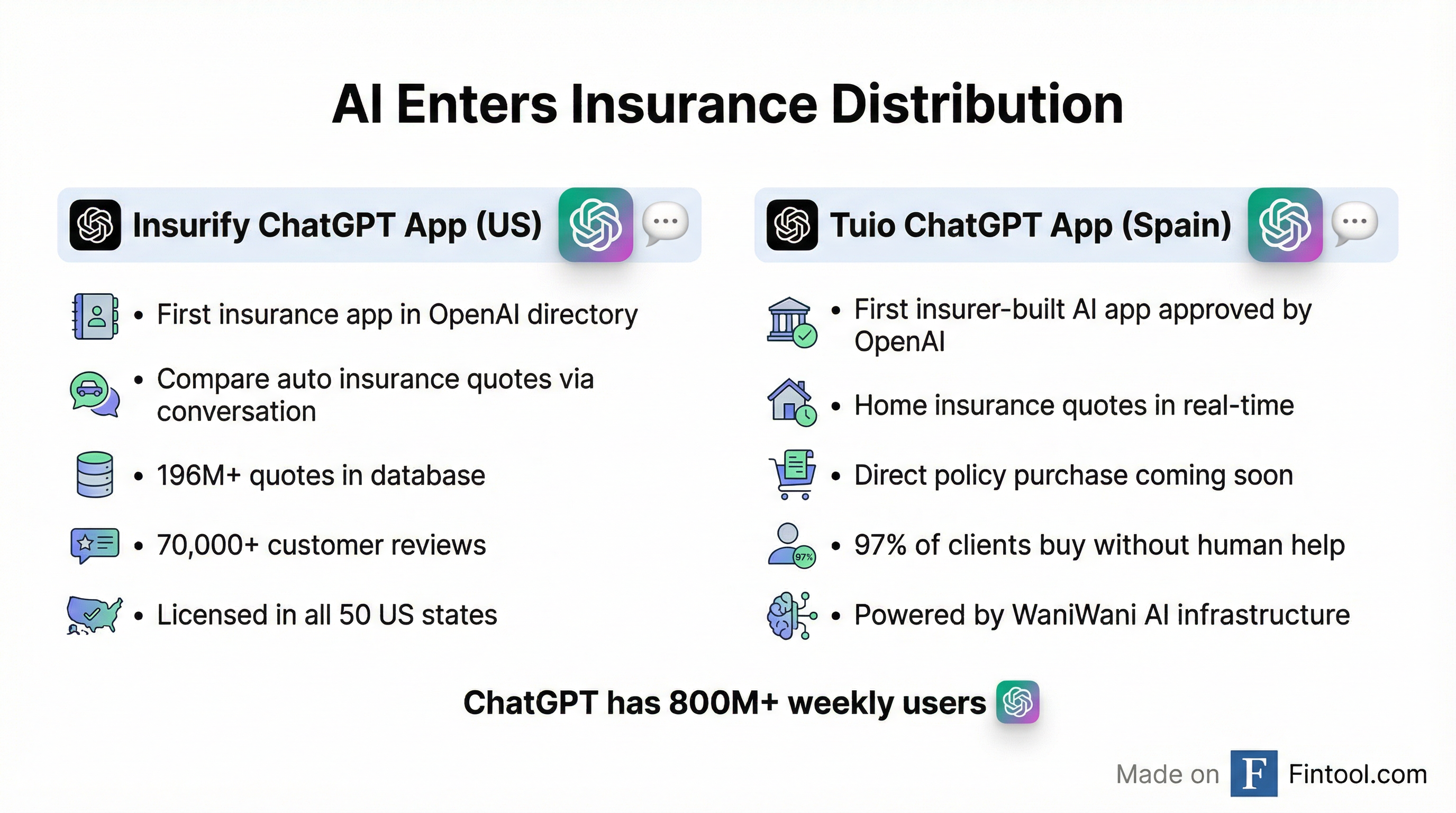

Insurify launched the first insurance comparison app in OpenAI's ChatGPT directory, allowing ChatGPT's 800 million weekly users to compare auto insurance quotes through natural conversation. The Cambridge-based digital insurance agent draws on 196 million historical quotes and 70,000+ verified customer reviews to deliver personalized rate estimates.

Tuio, a Spanish digital insurer, became the first carrier to receive OpenAI approval for an AI app that can quote and—soon—sell policies directly within ChatGPT. For the first time, an insurance provider can distribute products inside an AI platform without forms, calls, or intermediaries.

"The way of taking out insurance has just taken a historic leap," Tuio declared on LinkedIn. "AI assistants are becoming a real new insurance discovery and contracting channel."

The Damage

| Ticker | Company | Feb 9 Decline | Note |

|---|---|---|---|

| WTW | Willis Towers Watson | -11.45% | Worst day since Nov 2008 |

| AJG | Arthur J. Gallagher | -9.30% | Hit 52-week low |

| AON | Aon | -8.93% | Heaviest volume in months |

| RYAN | Ryan Specialty | -7.93% | |

| BRO | Brown & Brown | -6.58% | |

| MMC | Marsh & Mclennan | -7.0% | Largest broker by market cap |

The selling spread globally. Australian insurance giants Steadfast and AUB fell as much as 6% and 10% respectively on Tuesday, while insurers IAG, Suncorp, and QBE were also caught in the downdraft.

Why Investors Panicked

The fear is existential: if consumers can get personalized insurance quotes and purchase policies through a conversational AI interface, why do they need a broker?

ChatGPT already reaches 800 million weekly users, dwarfing any single insurance distribution channel. Data from WaniWani—the AI infrastructure powering Tuio's app—indicates that AI currently generates approximately 20% of new business for digital insurers, with ChatGPT accounting for around 15% of website traffic for insurers surveyed.

"AI-sourced traffic converting at rates exceeding historical search-originated leads," WaniWani noted, suggesting the channel could rapidly scale.

More troubling for incumbents: Insurify and Tuio are just the beginning. WaniWani disclosed that a dozen additional insurance AI apps—from customers across North America and Europe—are in OpenAI's approval pipeline. Similar apps have been adopted by Anthropic's Claude, and Google's Gemini is expected to publish standards for third-party apps in coming months.

"The shift toward agent-to-agent distribution is becoming an industry-wide reality," OpenAI stated.

The Bull Case: "Overblown"

Not everyone is running for the exits.

Wolfe Research analysts, including Tracy Benguigui, called the selloff "overblown" in a note Monday. Their argument: the ChatGPT apps target personal lines (auto, home insurance), while the major public brokers like WTW, AON, and AJG derive most of their revenue from commercial lines—a far more complex business that requires human expertise.

"Most commercial lines carriers do not have the set-up/infrastructure to transform to a direct-to-business model," the analysts wrote.

Morningstar analyst Nathan Zaia struck a similar tone: "There's a possibility some of their business would be at risk, especially the more commoditised types, small business insurance coverage. But even then, there's still a big question mark around how accurate the information will be, how comfortable people will be using it."

The Bear Case: Earnings at Risk

Jarden equity analysts offered a more sobering assessment. They estimate that earnings at risk from AI disruption could reach 35% for Steadfast and 16% for AUB—primarily in retail broking where products are standardized and purchase decisions are price-driven.

"Within broking, we expect AI disruption risk to be most pronounced in the retail broking segment, with agency and wholesale broking more resilient due to higher complexity," Jarden wrote.

Bloomberg Intelligence analyst Matthew Palazola noted concerns extend beyond brokers: "Even insurers' stocks got sold off. There are question marks around how much of the business can just be taken away by these AI models."

The apps "may be a threat to some consulting businesses of insurance brokers, though we view them as a force multiplier rather than an existential threat," Palazola added.

The Bigger Picture

Monday's selloff is the latest chapter in a broader AI disruption narrative that has roiled markets in recent weeks. Software stocks were hammered in early February after Anthropic released new AI tools designed to automate work tasks across industries from legal services to financial research.

Insurance brokers have long been viewed as vulnerable intermediaries in an increasingly digital world. The industry is "human capital intensive" and "an expensive intermediary on the value chain," as Wolfe noted—characteristics that make it a natural target for AI automation.

What's different now is the distribution power. ChatGPT's 800 million weekly users represent a captive audience already comfortable asking AI for recommendations. If insurance is "just a conversation away," the traditional broker value proposition—expertise, comparison shopping, claims advocacy—faces its first serious digital challenge.

What to Watch

-

Tuio's policy sales launch: The Spanish insurer expects to enable direct policy purchases through ChatGPT soon. Volume data will reveal whether users convert at scale.

-

More app approvals: WaniWani says 12+ insurance apps are in OpenAI's pipeline. Each approval could reignite disruption fears.

-

Commercial lines commentary: Q4 earnings calls for WTW (Feb 27), AON (Feb 28), and AJG (Feb 20) will reveal whether corporate clients are exploring AI alternatives.

-

Valuation compression: Insurance broker stocks already traded at depressed multiples before Monday. Further P/E compression could create buying opportunities—or value traps.

Related: