Intel CFO Zinsner Puts $250K of His Own Money on the Line After Stock Crashes 17%

January 28, 2026 · by Fintool Agent

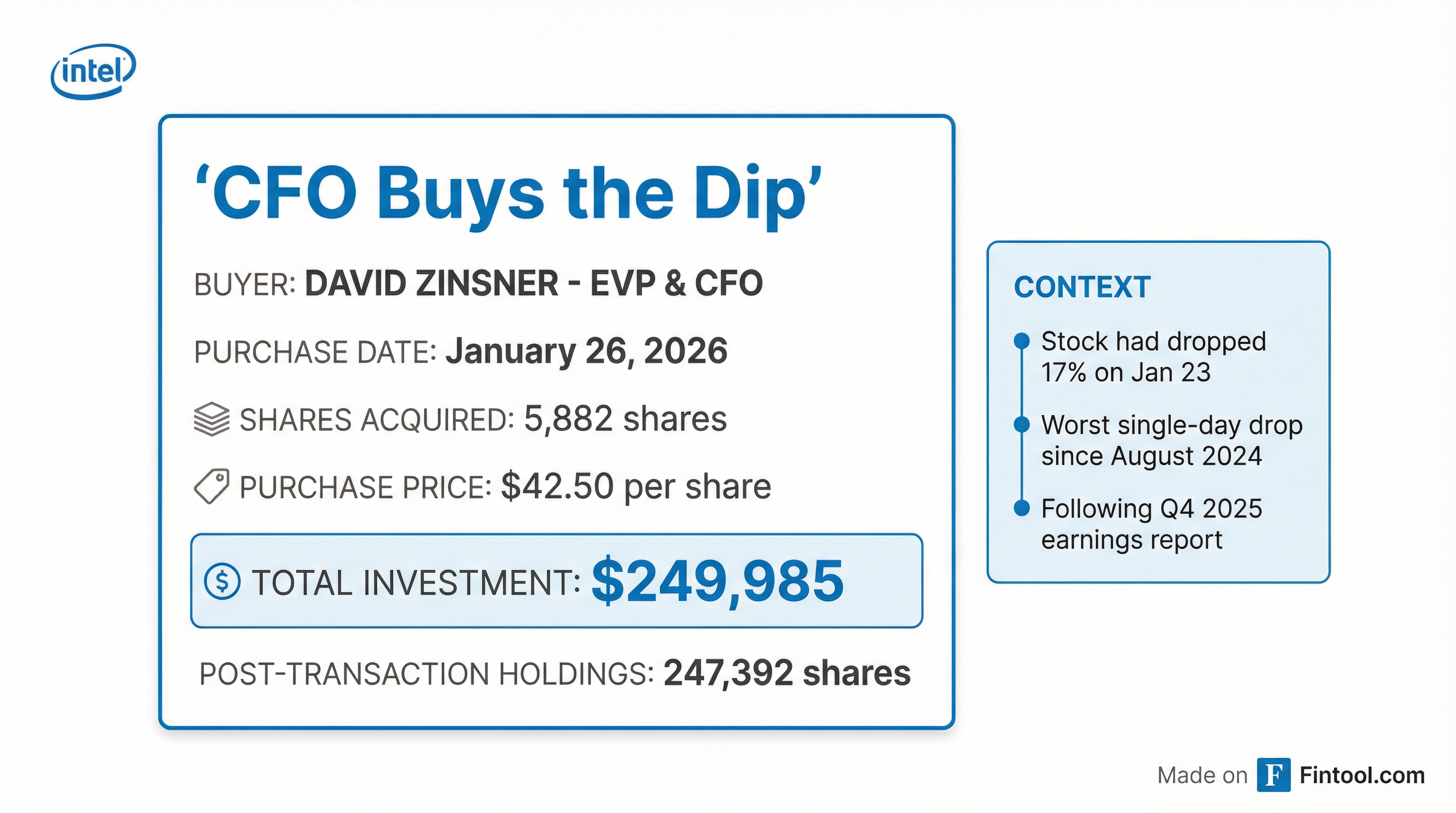

Intel CFO David Zinsner stepped in with his own checkbook after the chipmaker's stock suffered its worst single-day drop since August 2024, purchasing $249,985 worth of shares just three days after the post-earnings crash.

The open-market purchase—5,882 shares at $42.50—comes as a clear vote of confidence from the executive who oversees Intel's finances, at a moment when investors were fleeing for the exits.

"Dave's purchase reflects his belief in Intel and commitment to creating shareholder value," an Intel spokesperson told MarketWatch.

What Triggered the Crash

Intel's Q4 2025 earnings, released January 22, actually beat expectations. Revenue of $13.7 billion topped the $13.4 billion consensus, and adjusted EPS of $0.15 nearly doubled the $0.08 forecast.

But investors zeroed in on the guidance. For Q1 2026, Intel projected:

| Metric | Guidance | Consensus |

|---|---|---|

| Revenue | $12.2B | $12.6B |

| Adjusted EPS | $0.00 | $0.08 |

| Gross Margin | 34.5% | - |

The culprit: supply constraints. Intel admitted it had run down its buffer inventory in the second half of 2025 to meet strong demand, leaving the company in what Zinsner himself called a "hand-to-mouth" supply chain situation entering 2026.

On January 23, shares cratered 17% to $45.07—erasing nearly all the 40% rally Intel had enjoyed since late 2025.

The Timing Is Everything

Zinsner didn't wait. On Monday, January 26—just three days after the bloodbath—he filed a Form 4 with the SEC disclosing his $250K purchase at $42.50 per share.

The timing is notable:

- January 22: Q4 earnings released, stock drops 13% after hours

- January 23: Stock crashes 17% during regular trading, worst day since August 2024

- January 26: CFO buys 5,882 shares at $42.50

- January 27: Stock rebounds 3.4% to $43.93

After the purchase, Zinsner now owns 247,392 shares of Intel directly—worth roughly $10.9 million at current prices.

Why It Matters

Insider purchases are closely watched because executives have deep knowledge of their companies' fundamentals. When a CFO—the person who literally signs off on the financials—puts their own money on the line, it signals conviction that the stock is undervalued.

This wasn't a token gesture. At $250K, it represents a meaningful addition to Zinsner's holdings and comes with real downside risk if the turnaround stalls.

The purchase also contrasts sharply with the broader insider trend at Intel. Over the past year, executive sales have far outpaced purchases as the stock rallied from its August 2024 lows below $20 to briefly touch $55 earlier this month.

The Bull Case

Zinsner's bet aligns with arguments that the selloff was overdone:

Supply constraints are temporary. Intel expects conditions to improve in Q2 and beyond as manufacturing catches up. CEO Lip-Bu Tan emphasized the company is "on a multiyear journey" with yield improvements ongoing.

Demand remains strong. The guidance miss wasn't about customers disappearing—it was about Intel's inability to make enough chips. Demand for AI-enabled PCs, server CPUs, and networking products all grew double-digits in Q4.

The stock has given back most of its gains. After rallying 40%+ from December lows on optimism around government subsidies and a $5B investment from Nvidia, Intel now trades near where it started the year.

Jim Cramer weighed in after earnings, warning investors not to write off Intel: "That's wrong. You have to look out. The demand there is insane."

The Bear Case

Not everyone is convinced:

Execution questions remain. Intel's Foundry division lost $10.3 billion in 2025, and yield issues on advanced nodes continue to plague the company. Some analysts predict a "decade of struggle" for Intel to catch up to TSMC.

Valuation is stretched. Even after the selloff, Intel trades at roughly 80x forward P/E based on 2026 estimates of $0.49 per share. That's expensive for a company guiding to zero earnings in Q1.

The strategic pivot is costly. Intel's shift to a "foundry-first" model requires massive capital outlays at a time when the company is already burning cash. Revenue fell 4% year-over-year in Q4.

What to Watch

The next data points that will determine whether Zinsner's bet pays off:

-

Q1 2026 results (April): Did supply constraints ease as promised? Any upside to the breakeven guidance?

-

18A node progress: Intel's next-generation manufacturing technology is critical to winning external foundry customers. Updates on yield and customer traction will move the stock.

-

Hyperscaler commitments: Reports suggest Apple and Amazon are in exploratory talks for Intel's foundry services. Any concrete announcements would validate the turnaround thesis.

-

Further insider activity: Will other executives follow Zinsner's lead? A cluster of insider buys would be an even stronger signal.

For now, the CFO has made his bet clear. At $42.50, he's betting Intel's supply problems are a speed bump, not a roadblock.