Intel Surges 10% After CEO's White House Meeting as US Stake Doubles

January 9, 2026 · by Fintool Agent

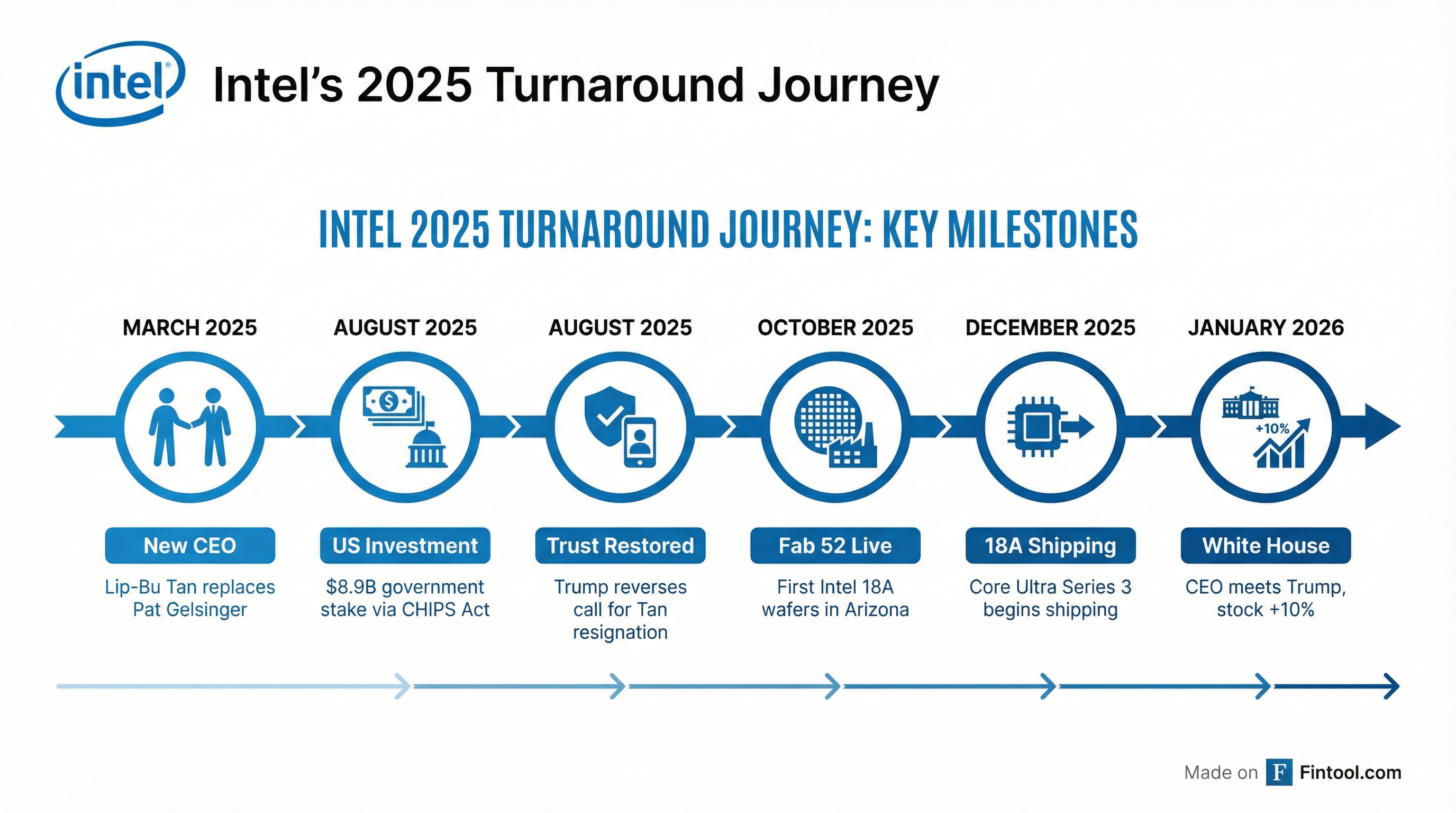

Intel+4.87% stock surged 10% on Friday after CEO Lip-Bu Tan met with President Donald Trump at the White House, capping a remarkable turnaround that has seen the US government's $8.9 billion CHIPS Act investment more than double in value to nearly $19 billion.

"The United States Government is proud to be a Shareholder of Intel," Trump wrote on Truth Social Thursday evening, praising Tan as "very successful" and declaring that America's "determination to bring leading edge Chip Manufacturing back to America" is "exactly what is happening."

The endorsement sent Intel shares to their highest level in nearly two years, closing at $45.55—up 122% from the $20.47 price the government paid when it took its stake in August.

From Pariah to Partner

The warm White House reception marks a dramatic reversal from just months earlier. In mid-2025, Trump publicly demanded Tan's resignation over concerns about the CEO's historic ties to Chinese companies. Senator Tom Cotton had flagged Tan's connections as a potential national security risk for a company receiving billions in taxpayer funds.

But that friction evaporated after Tan met with Trump in August and the administration brokered its landmark investment. Intel committed to "always operate within the highest legal and ethical standards," and the government took a 10% stake through a creative restructuring of CHIPS Act grants.

Tan responded to Trump's post on X, writing that he was "honored and delighted to have the full support and encouragement" of the President and Commerce Secretary Howard Lutnick as Intel "brings leading edge chip manufacturing back to America."

18A Milestone Validates Strategy

The timing of the White House meeting was deliberate. Intel announced this week at CES 2026 that its Core Ultra Series 3 processors—the first products built on its breakthrough Intel 18A process—are now shipping to customers.

Intel 18A represents the most advanced semiconductor manufacturing node developed and produced in the United States. The technology delivers up to 15% better performance per watt and 30% improved chip density compared to previous generations, achieved through innovations including RibbonFET transistor architecture and PowerVia backside power delivery.

"We are entering an exciting new era of computing, made possible by great leaps forward in semiconductor technology that will shape the future for decades to come," Tan said in October when unveiling the 18A architecture.

The chips are being manufactured at Fab 52, Intel's newest high-volume facility at its Ocotillo campus in Arizona—part of the more than $100 billion the company is investing to expand domestic operations.

The Numbers: A Taxpayer Windfall

The government's investment has been extraordinarily profitable:

| Metric | August 2025 | January 2026 | Change |

|---|---|---|---|

| Share Price | $20.47 | $45.55 | +122% |

| Govt Stake Value | $8.9B | $19B | +$10B |

| Govt Ownership | 10% | 10% | — |

Intel's Q3 2025 results showed the turnaround gaining momentum, with revenue of $13.7 billion (up 3% year-over-year), gross margins expanding to 38%, and the company returning to profitability with $4.1 billion in net income.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $14.3B | $12.7B | $12.9B | $13.7B |

| Net Income | -$0.1B | -$0.8B | -$2.9B | $4.1B |

| Gross Margin | 17.3% | 37.8% | 33.7% | 38.2% |

Values retrieved from S&P Global

Chip Sector Catches Rally

Intel's surge lifted the broader semiconductor complex. Broadcom+7.22% rose 1.7%, Micron+3.08% gained 1.4%, and European equipment maker Asml+4.66% jumped 5.4%.

The rally reflects renewed confidence in domestic chip manufacturing at a moment when the industry is increasingly viewed as strategically critical. Beyond the government stake, Intel has attracted $5 billion from Nvidia+7.87% and $2 billion from SoftBank—investments that signal confidence from key industry players and AI leaders.

What to Watch

Q4 Earnings (January 22): Intel guided for $12.8-13.8 billion in revenue with 36.5% non-GAAP gross margin. The results will show whether the 18A ramp is translating to sustained profitability.

Xeon 6+ Launch (H1 2026): Intel's next-generation server processor built on 18A targets hyperscale data centers with up to 288 E-cores and significant efficiency gains. Success here would validate Intel's foundry ambitions.

Foundry Customer Wins: With NVIDIA, Amazon AWS, and others already expressing support, additional foundry commitments would demonstrate that Intel can compete for third-party manufacturing business against TSMC.

For now, the message from the White House is unambiguous: America's chip champion has the administration's full backing—and the stock price to prove it.

Related: