Iran's Economic Collapse Sparks Biggest Protests Since 2022 as Trump Warns of Intervention

January 4, 2026 · by Fintool Agent

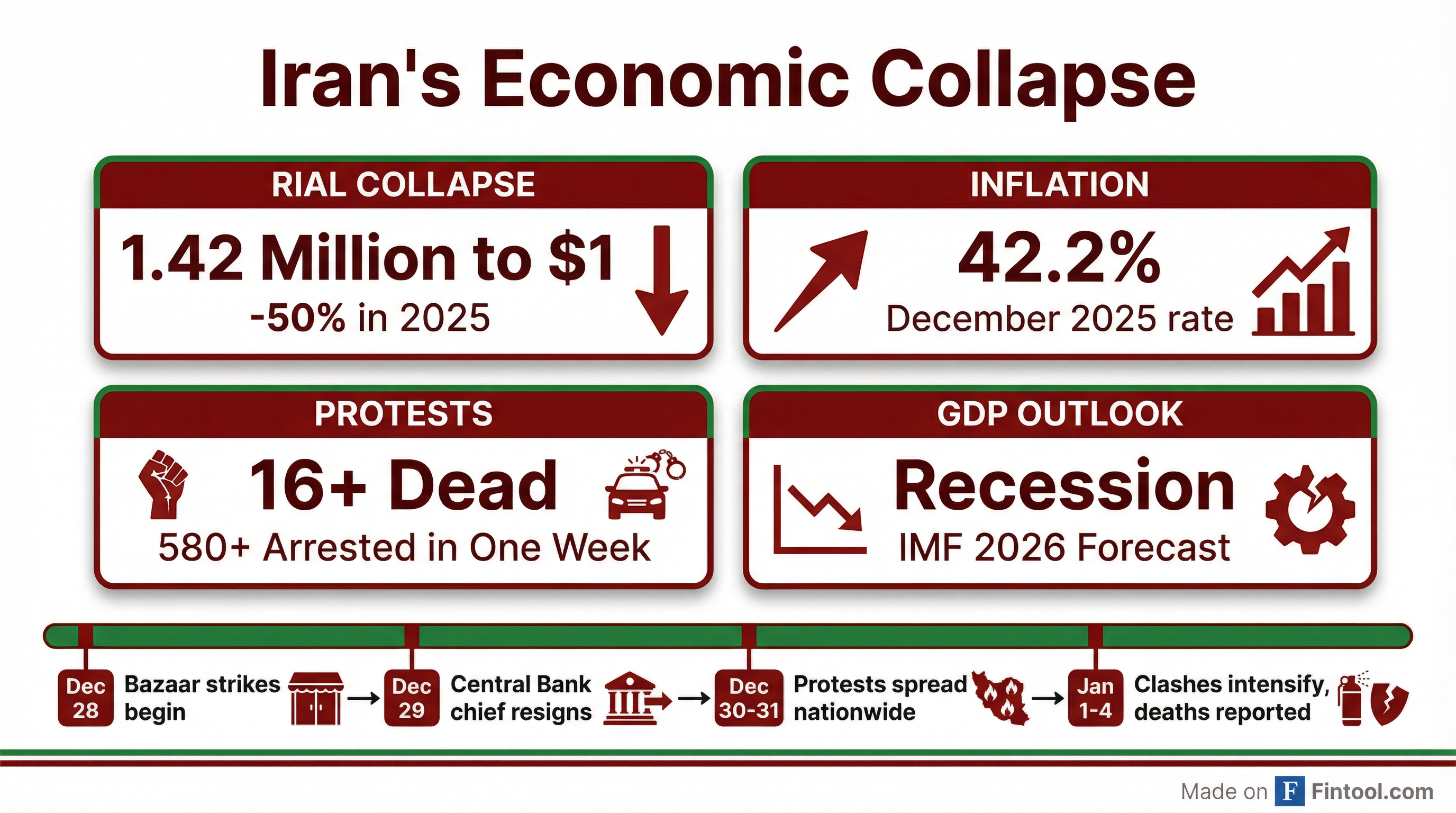

The Iranian rial's collapse to a record 1.42 million against the U.S. dollar has ignited the Islamic Republic's largest protests in three years, killing at least 16 people and forcing the central bank governor's resignation—all while President Trump warns of military intervention "if Iran violently suppresses peaceful protests."

For investors, the unrest in a nation holding the world's fourth-largest oil reserves represents a potential supply shock at a moment when crude markets are already navigating the fallout from Venezuela's regime change. Brent crude closed at $63.10 per barrel on December 29, the last trading day before the new year, with WTI at $57.89.

The Numbers Behind the Crisis

Iran's economy has reached a breaking point. The rial lost roughly half its value against the dollar in 2025 alone, accelerating a decade-long decline that has erased 97% of the currency's purchasing power since the 2015 nuclear accord.

| Indicator | Current Level | Context |

|---|---|---|

| Rial/USD Exchange Rate | 1.42 million | Record low, down 50% in 2025 |

| Annual Inflation | 42.2% | December 2025, up from 36% at start of year |

| Food Price Inflation | 72% | Year-over-year |

| Medical Price Inflation | 50% | Year-over-year |

| GDP Outlook | Recession | IMF 2026 forecast |

The International Monetary Fund projects Iran will enter recession in 2026, compounding the pain from Western sanctions that have severed the country from international capital markets and frozen foreign assets.

What Makes These Protests Different

The demonstrations erupted on December 28 when bazaar merchants—traditionally a conservative pillar of support for the Islamic Republic—shuttered their shops in Tehran's Grand Bazaar to protest the currency collapse. The bazaaris played a crucial role in the 1979 revolution that brought the current regime to power; their participation signals the economic pain has reached across all segments of Iranian society.

Within days, what began as economic protests morphed into political demonstrations, with crowds chanting "death to the dictator" and calling for an end to clerical rule.

The death toll and arrests as of January 4:

| Metric | Count | Source |

|---|---|---|

| Deaths | At least 16-17 | Rights groups Hengaw, HRANA |

| Arrests | 582+ | HRANA network |

| Security Force Deaths | 1 Basij member | Iranian state media |

The violence has been concentrated in rural and less populated areas, particularly in western provinces with Kurdish populations, reflecting security forces' reduced capacity to maintain control outside major cities.

The Geopolitical Pressure Cooker

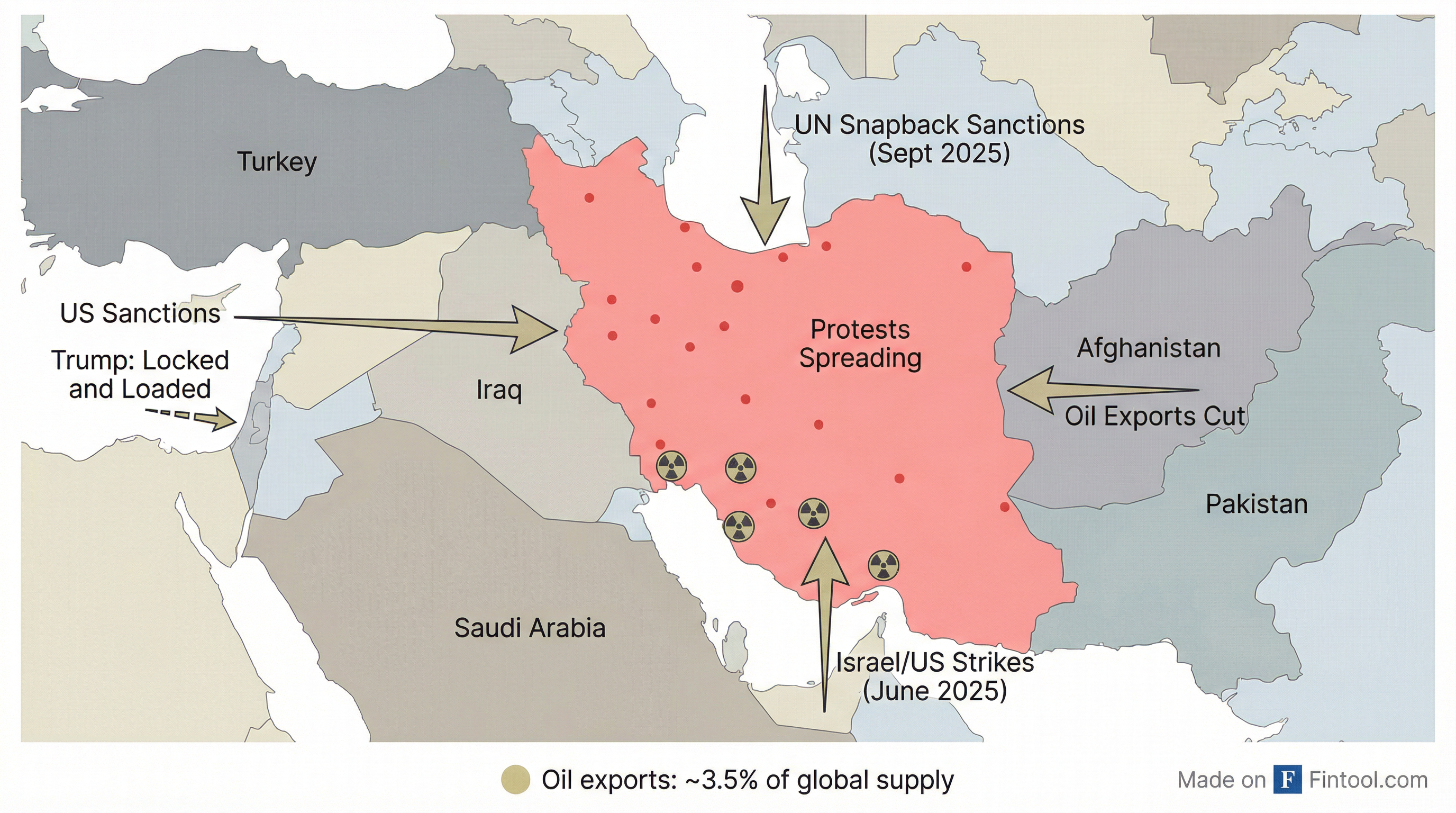

Iran's economic crisis did not emerge in isolation. The country is facing simultaneous pressure from multiple directions:

June 2025: Israel and the United States conducted a 12-day air campaign targeting Iran's nuclear facilities and military leadership, dealing a significant blow to the regime's defensive capabilities.

September 2025: The United Nations reimposed nuclear-related sanctions through the "snapback" mechanism, freezing Iranian assets abroad and halting arms transactions.

December 2025: The central bank governor resigned as the rial collapsed, and the government quietly raised gasoline prices—some of the world's cheapest—by introducing a new pricing tier.

January 2026: President Trump escalated rhetoric, warning on January 2 that the U.S. is "locked and loaded and ready to go" if Iran violently suppresses protesters. Supreme Leader Khamenei responded that Iran "will not yield to the enemy."

Oil Market Implications

Iran holds the world's fourth-largest proven oil reserves and currently supplies an estimated 3-4% of global crude production—roughly 3 million barrels per day, down from over 4 million before the reimposition of sanctions.

The market implications depend on how the crisis evolves:

Scenario 1: Protests contained, status quo maintained

Oil markets likely see modest risk premium (already partially priced in). Current sanctions continue limiting Iranian exports to roughly 1.5 million bpd, primarily to China.

Scenario 2: Regime crackdown triggers broader U.S. intervention

Additional sanctions or military action could further restrict Iranian exports, potentially removing 1-1.5 million bpd from global supply. This comes as Venezuela's crisis has already created uncertainty around 700,000+ bpd of supply.

Scenario 3: Regime change

A new government could eventually lead to sanctions relief and increased Iranian output—bearish for oil in the medium term but potentially volatile in the transition.

What the Regime Is Saying

President Masoud Pezeshkian, a reformist who took office amid hopes for economic opening, has struck a conciliatory tone while promising action. "The livelihood of the people is my daily concern," he said, announcing plans to "reform the monetary and banking system."

The government has moved to replace the central bank governor with Abdolnaser Hemmati, a former economy minister, and is reportedly considering subsidy reforms to redirect funds directly to consumers rather than producers.

But Supreme Leader Khamenei sent a harder message: "We talk to protesters. The officials must talk to them. But there is no benefit to talking to rioters. Rioters must be put in their place."

Investment Considerations

Energy exposure: Major integrated oil companies Exxonmobil+2.01%, Chevron+0.84%, Conocophillips+2.51%, and Occidental Petroleum+2.71% have limited direct Iran exposure due to sanctions, but benefit from any supply-driven price increases. Oil services names Schlumberger+2.40% and Halliburton+3.37% could see increased demand if non-Iranian producers accelerate to fill any supply gaps.

EM debt caution: The crisis underscores fragility in sanctioned and quasi-sanctioned emerging markets. Iran's situation—cut off from IMF support and international capital markets—represents an extreme case but highlights tail risks in similar economies.

Regional spillovers: Oil-exporting neighbors like Iraq, Kuwait, and Saudi Arabia may see modest currency appreciation if prices rise, while importers face higher costs.

What to Watch

-

OPEC+ response: Will major producers signal willingness to increase output if Iranian supply is further constrained? OPEC+ is reportedly keeping output steady despite member turmoil.

-

Trump administration actions: Any military or sanctions escalation would be the primary catalyst for oil price moves. The administration's response to both Iran and Venezuela will test whether a "maximum pressure" approach can coexist with concerns about energy inflation.

-

Protest evolution: If demonstrations spread to oil-producing Khuzestan province or target energy infrastructure, the impact on global supply becomes more direct.

-

China's response: Beijing remains Iran's primary oil customer and sanctions evasion partner. Any shift in Chinese buying patterns would significantly impact Iranian finances.

Related: