Japan Launches World's First Deep-Sea Rare Earth Extraction as G7 Convenes Emergency Summit

January 11, 2026 · by Fintool Agent

Japan's deep-sea drilling vessel Chikyu departed Shizuoka on Sunday for what researchers call the world's first attempt to continuously extract rare earth elements from 6,000 meters below the ocean surface—deeper than Mount Fuji is tall—as G7 finance ministers converge on Washington for an emergency summit on critical minerals supply chains.

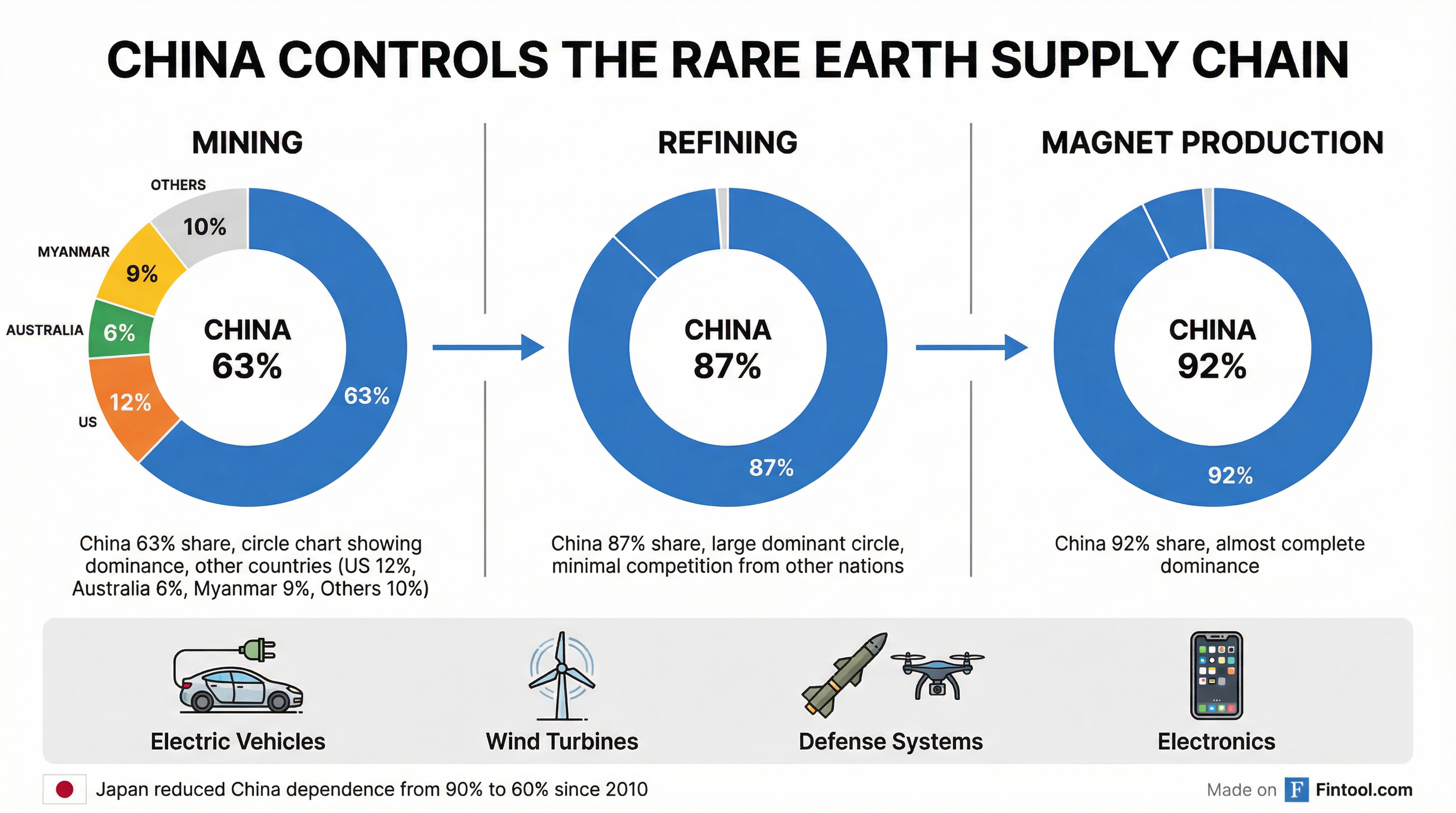

The parallel events underscore the growing urgency among Western nations to break China's stranglehold on materials essential for electric vehicles, wind turbines, smartphones, and defense systems. Beijing controls 63% of rare earth mining, 87% of refining, and 92% of permanent magnet production—and has been tightening the screws.

"Urgency is the theme of the day," a senior U.S. official said ahead of Monday's G7 meeting, which Treasury Secretary Scott Bessent has been pushing for since last summer. "We really just need to move faster."

The Chikyu Mission: Mining at Extreme Depths

The month-long mission to Minamitori Island, roughly 1,900 kilometers southeast of Tokyo, will test whether Japan can economically extract rare earth-rich mud from depths that have never been commercially mined. The area contains an estimated 16 million tons of rare earths—including approximately 730 years' worth of global dysprosium supply and 780 years of yttrium, according to Japanese government estimates.

"One of our missions is to build a supply chain for domestically produced rare earths to ensure a stable supply of minerals essential to industry," said Shoichi Ishii, the program director at Japan's Strategic Innovation Promotion Program.

The project has consumed 40 billion yen ($256 million) since 2018, and Japanese officials are eyeing joint development with the United States. If the test succeeds, a full-scale mining trial targeting 350 tonnes of sediment per day will launch in February 2027.

China is watching closely. When the Chikyu conducted surveys near the island in June 2025, a Chinese naval fleet sailed nearby—a move Japanese officials described as "intimidating."

G7 Meets Amid Chinese Export Curbs

The timing is no coincidence. Just days ago, reports emerged that China had begun restricting rare earth exports to Japanese companies and banning dual-use items to Japan's military, escalating a diplomatic dispute that began when Prime Minister Sanae Takaichi suggested Tokyo might respond militarily to an attack on Taiwan.

Monday's G7 meeting—which also includes Australia, India, South Korea, Mexico, and the EU—will discuss coordinated price floors to make Western mining investments economically viable against heavily subsidized Chinese production. Together, the attendees represent 60% of global critical minerals demand.

"It's not solved," the U.S. official said of diversification efforts. "There's a lot of different angles, a lot of different countries involved."

The U.S. was the first G7 nation to establish a minimum price floor for domestic rare earth supplies in 2024. An October deal with Australia created an $8.5 billion project pipeline and leverages a proposed strategic reserve.

"Cold War 2.0": MP Materials CEO on the New Battlefield

The strategic stakes were laid bare by MP Materials CEO Jim Litinsky on the company's Q3 2025 earnings call, framing the competition in stark geopolitical terms:

"We are now locked in a new kind of Cold War, a race of mutually assured economic destruction, fought not with weapons but with supply chains. Self-sufficiency, allied resilience, and national industrial champions are no longer optional. They are the front lines of security."

MP Materials operates the only scaled rare earth mine in North America at Mountain Pass, California. The company ceased shipments to China in April 2025 in response to Beijing's retaliatory tariffs and export controls, pivoting to customers in Japan, South Korea, and broader Asia.

The stock trades at $62, up from a 52-week low of $18.64, giving the company an $11 billion market cap. MP has partnerships with General Motors, Apple, and the Department of Defense—each representing a bet on domestic rare earth supply.

Litinsky was blunt about the competitive landscape:

"The vast majority of projects being promoted today simply will not work at virtually any price. Even deposits labeled heavy-rich still contain a vast majority of light rare earths and yttrium. When grades sit in the hundreds of parts per million, the cost to concentrate, separate, and refine becomes uneconomic. MP's overburden and tailings are quite literally more valuable by many multiples than many of those so-called projects."

Investment Implications

The rare earth sector presents a complex investment thesis: strategic necessity meets economic reality.

The bull case: China's dominance creates a single point of failure for Western supply chains. Government support—from price floors to strategic reserves to direct procurement—is accelerating. MP Materials has the only integrated production capability in North America, from mine to magnet.

The bear case: Deep-sea mining and alternative projects remain economically unproven at scale. China can undercut Western investments by flooding the market or selectively restricting supplies. Japan reduced its China dependence from 90% to 60% after a 2010 supply shock—but that still leaves significant exposure.

Companies with rare earth exposure:

- MP Materials (NYSE: MP) - Only scaled North American producer

- USA Rare Earth (NASDAQ: USAR) - Developing Oklahoma magnet facility and Texas deposit

- Ramaco Resources (NASDAQ: METC) - Pursuing rare earth extraction from coal mining

- Lynas Rare Earths (ASX: LYC) - Australian producer with Japan partnership

The downstream implications extend further. Seagate Technology disclosed in its annual report that rare earth elements are "critical in the manufacture of our products" and that Chinese export restrictions "could materially and adversely impact our supply chain continuity and operating results."

What to Watch

Near-term:

- G7 statement expected Monday evening

- Japan's Chikyu mission results (February 2027 for full-scale trial)

- China's response to coordinated Western price floors

Medium-term:

- MP Materials magnet production ramp at Fort Worth facility (expected by end of 2025)

- USA Rare Earth's first production line commissioning (early 2026)

- Australia strategic reserve implementation

Long-term:

- Minamitori Island commercial viability determination

- Potential bifurcation of global rare earth markets into Western and Chinese spheres

The race to secure critical minerals is no longer a theoretical exercise. With Japan's Chikyu probing depths taller than Mount Fuji and G7 finance ministers gathering for an extraordinary summit, the supply chain cold war has entered a new phase. For investors, the question is no longer whether diversification is necessary—but whether Western production can scale fast enough to matter.

Related