Earnings summaries and quarterly performance for Seagate Technology Holdings.

Executive leadership at Seagate Technology Holdings.

William Mosley

Chief Executive Officer

Ban Seng Teh

Executive Vice President and Chief Commercial Officer

Gianluca Romano

Executive Vice President and Chief Financial Officer

James Lee

Senior Vice President, Chief Legal Officer, and Corporate Secretary

John Morris

Senior Vice President and Chief Technology Officer

Board of directors at Seagate Technology Holdings.

Dylan Haggart

Director

Jay Geldmacher

Director

Mark Adams

Director

Michael Cannon

Lead Independent Director

Prat Bhatt

Director

Richard Clemmer

Director

Shankar Arumugavelu

Director

Stephanie Tilenius

Director

Thomas Szlosek

Director

Yolanda Conyers

Director

Research analysts who have asked questions during Seagate Technology Holdings earnings calls.

Amit Daryanani

Evercore

8 questions for STX

Ananda Baruah

Loop Capital Markets LLC

8 questions for STX

Asiya Merchant

Citigroup Global Markets Inc.

8 questions for STX

Erik Woodring

Morgan Stanley

8 questions for STX

Timothy Arcuri

UBS

8 questions for STX

Vijay Rakesh

Mizuho

8 questions for STX

Wamsi Mohan

Bank of America Merrill Lynch

8 questions for STX

Aaron Rakers

Wells Fargo

7 questions for STX

Steven Fox

Fox Research

7 questions for STX

Karl Ackerman

BNP Paribas

6 questions for STX

Thomas O’Malley

Barclays Capital

6 questions for STX

CJ Muse

Cantor Fitzgerald

5 questions for STX

Mark Miller

The Benchmark Company LLC

5 questions for STX

Jim Schneider

Goldman Sachs

4 questions for STX

Krish Sankar

TD Cowen

4 questions for STX

Mark Newman

Bernstein

4 questions for STX

Tristan Gerra

Robert W. Baird & Co.

4 questions for STX

Christopher Muse

Cantor Fitzgerald

3 questions for STX

Mehdi Hosseini

Susquehanna Financial Group

2 questions for STX

Sreekrishnan Sankarnarayanan

Wolfe Research, LLC

2 questions for STX

Eddy Orabi

TD Cowen

1 question for STX

Hadi Orabi

TD Cowen

1 question for STX

Jacob Wilhelm

Wells Fargo

1 question for STX

James Schneider

Goldman Sachs

1 question for STX

Toshiya Hari

Goldman Sachs Group, Inc.

1 question for STX

Recent press releases and 8-K filings for STX.

- Seagate sees mid-20s% exabyte CAGR in nearline HDD demand over the next 3–5 years, maintaining a flat to slightly up average price per terabyte for CY 2026 under its consistent pricing strategy.

- Factories are fully utilized, and Seagate has no plans to add unit capacity, instead leveraging higher-capacity product mix to meet all production sold to date.

- HAMR drive adoption exceeded 20% of nearline exabyte shipments, with yields improving (yet still below PMR), and a Mozaic 4+ ramp slated for 2H 2026 to drive further cost-per-TB declines.

- Gross margins have improved for 11 consecutive quarters; Seagate targets returning >75% of FCF to shareholders, has reduced debt below $4 billion, and plans continued dividends and buybacks.

- AI and video workloads are driving data retention growth in the cloud, with minimal nearline/NAND overlap; SMR usage continues to rise among hyperscale customers.

- Nearline exabyte demand expected to grow at a mid-20% CAGR over the next 3–5 years, aligning with competitor forecasts.

- Maintains a flat to slight year-on-year increase in average price per terabyte, driven by consistent contract renegotiations and product mix effects.

- HAMR technology ramp (Mozaic 3+ in production and Mozaic 4+ qualifying) will deliver high-teens areal density gains and lower cost per terabyte, underpinning future cost declines.

- Plans for continued gross margin expansion through pricing, mix shifts to higher-capacity drives, and HAMR cost improvements, with another strong quarterly margin guide forthcoming.

- Commits to returning >75% of free cash flow to shareholders (historically 100%), while reducing debt below $4 billion after recent convertible transactions.

- Average price per terabyte expected flat to slightly up in 2026, with consistent modest increases on legacy products offset by mix shifts toward higher-capacity drives.

- Targets mid-20% nearline exabyte CAGR over the next 3–5 years, driven by mix changes toward higher-capacity drives amid demand exceeding supply.

- Second-gen HAMR (Mozaic 4+) qualification underway, with volume ramp slated for the second half of 2026; yield gains and areal-density improvements should lower cost per TB below current PMR levels.

- 11 consecutive quarters of pricing, cost and gross-margin improvement, maintaining a >75% free-cash-flow return policy while reducing debt below $4 billion and potentially returning full FCF to shareholders.

- Seagate completed exchanges of $600 million principal amount of its 3.50% Exchangeable Senior Notes due 2028, issuing approximately $599.2 million in cash and 5.95 million ordinary shares to noteholders.

- The exchanged notes have been retired, leaving approximately $400 million in aggregate principal amount of notes outstanding on unchanged terms.

- Shares were issued in private placements under the Securities Act’s Section 4(a)(2) exemption.

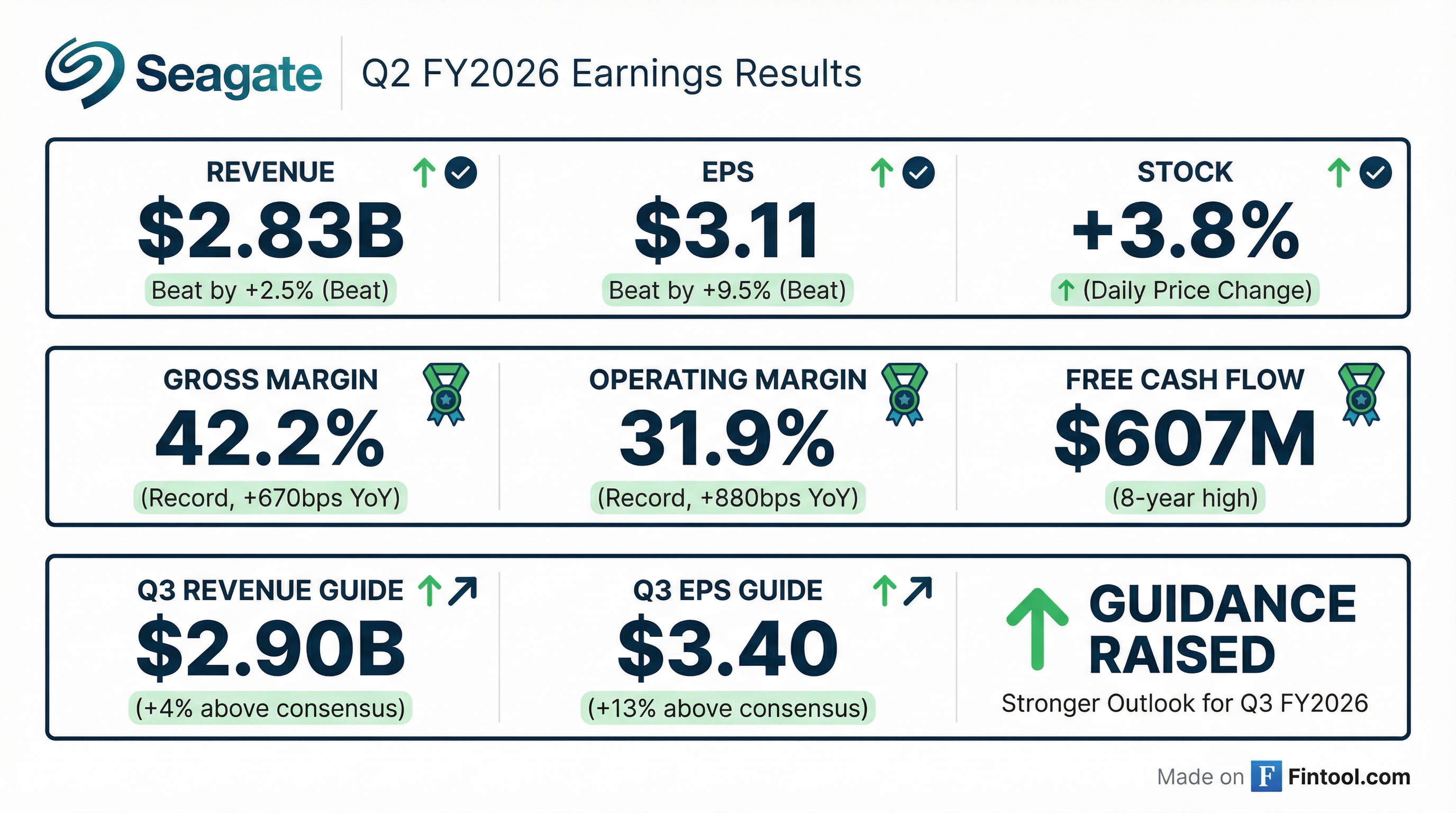

- Strong Q2 2026 financial performance: Revenue of $2.83 billion (+7% sequentially, +22% year-over-year); non-GAAP gross margin of 42.2%; non-GAAP operating margin of 31.9%; and non-GAAP EPS of $3.11.

- Record exabyte shipments: 190 EB shipped (+26% year-over-year), with 165 EB to data center customers (+31% year-over-year) and average cloud nearline drive capacity of ~26 TB.

- Robust cash flow and balance sheet actions: $607 million free cash flow generated (+42% quarter-over-quarter), $500 million of gross debt retired, net leverage at 1.1×, and $2.3 billion of total liquidity at quarter end.

- March quarter guidance: Revenue of $2.9 billion ± $100 million (midpoint +34% year-over-year), non-GAAP EPS of $3.40 ± $0.20, and expected non-GAAP operating margin in the mid-30s%.

- Seagate reported Q2 revenue of $2.83 billion, up 7% sequentially and 22% year-over-year; non-GAAP gross margin was 42.2%, operating margin 31.9%, and EPS $3.11.

- The company shipped 190 exabytes in the quarter (+26% YoY), with 165 exabytes to the data center market (87% of volume, +31% YoY).

- Q2 free cash flow was $607 million, the company returned $154 million to shareholders and retired approximately $500 million of exchangeable notes, reducing gross debt to $4.5 billion and net leverage to 1.1×.

- March-quarter guidance calls for revenue of $2.9 billion ± $100 million (mid-34% YoY growth) and non-GAAP EPS of $3.40 ± $0.20.

- Revenue of $2.83 B (+7% QoQ, +22% YoY), non-GAAP gross margin of 42.2% (+210 bps QoQ) and EPS of $3.11 in the December quarter

- 190 EB shipped (+26% YoY) with 87% volume in data center and average cloud nearline capacity of ~26 TB per drive

- HAMR shipments exceeded 1.5 M units in Q4, including 3 TB/disk Mozaic products to first CSP, with Mozaic 4 TB/disk qualifications on track

- $607 M free cash flow, $500 M debt retired, and net leverage improved to 1.1×, with $1 B cash and $2.3 B total liquidity

- Q3 revenue guidance of $2.9 B ± $100 M (midpoint +34% YoY) and EPS of $3.40 ± $0.20

- Revenue grew 22% YoY to $2.83 billion, surpassing the high end of guidance

- Non-GAAP gross margin expanded to 42.2%, up ~670 bps YoY, and operating margin reached 31.9%

- Data Center revenue rose 28% YoY to $2.2 billion on strong cloud demand

- Generated record free cash flow of $607 million, up 42% sequentially

- Q3 FY26 guidance: revenue of $2.90 billion ± $0.10 billion and non-GAAP EPS of $3.40 ± $0.20

- Revenue of $2.83 billion; GAAP gross margin 41.6% (non-GAAP 42.2%); GAAP EPS $2.60 (non-GAAP $3.11)

- Cash flow from operations of $723 million and free cash flow $607 million; retired $500 million of Exchangeable Senior Notes and declared a quarterly dividend of $0.74 per share

- Fiscal Q3 2026 guidance: revenue of $2.90 billion ± $100 million and non-GAAP EPS of $3.40 ± $0.20

- Seagate posted $2.83 billion in revenue, 41.6% GAAP gross margin (42.2% non-GAAP), and GAAP diluted EPS of $2.60 (non-GAAP $3.11) for Q2 2026.

- Generated $723 million in operating cash flow and $607 million in free cash flow; retired $500 million of 2028 Exchangeable Senior Notes and held $1.0 billion in cash and equivalents at quarter end.

- Declared a $0.74 per share quarterly cash dividend payable April 8, 2026.

- Provided Q3 2026 guidance of $2.90 billion revenue (± $100 million) and non-GAAP diluted EPS of $3.40 (± $0.20).

Quarterly earnings call transcripts for Seagate Technology Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more