JPMorgan's Troy Rohrbaugh Sees 'Possibly Best M&A Year in a Decade' at UBS Conference

February 10, 2026 · by Fintool Agent

JPMorgan Chase's investment banking chief delivered one of the most bullish outlooks on Wall Street at the UBS Financial Services Conference in Key Biscayne, Florida on Tuesday, declaring that 2026 could produce the strongest M&A year in a decade while confirming that Q1 has "started well across the franchise."

Troy Rohrbaugh, Co-CEO of the Commercial & Investment Bank, told investors that M&A pipelines "look excellent" heading into 2026 and could deliver "top decile or possibly the best year we've seen in a decade." The remarks reinforced what has emerged as a consensus view among major bank executives at this week's conference that a capital markets renaissance is underway.

Shares of JPMorgan rose 1.1% to $325.53 on the day, trading within 4% of their 52-week high of $337.25.

The 2026 Outlook: "We're Quite Positive"

Rohrbaugh opened with an unequivocal assessment: "We're quite positive on the outlook for 2026."

The bullish stance builds on a strong 2025, where JPMorgan's CIB delivered net income of $7.3 billion in Q4 alone, up 10% year-over-year. Markets revenue surged 17%, with Equity Markets up an exceptional 40%, while the firm maintained its #1 ranking in Global Investment Banking fees with 8.4% wallet share for the year.

When pressed on whether mid-teens growth in the banking wallet was achievable, Rohrbaugh remained cautiously optimistic: "It's certainly possible that we see that... I'm hopeful that that's the right number. But I think you're gonna need a lot of things to go right to get to that level."

On capital markets, Rohrbaugh acknowledged the 2021 peak—driven by the SPAC boom—may be difficult to match, but pointed to "the possibility of a very robust IPO pipeline" and "the possibility of some true mega deals happening."

Three Sectors Driving the Banking Wallet

Rohrbaugh identified the same three themes that powered 2025 as the primary drivers for 2026:

| Sector | Outlook | JPMorgan Position |

|---|---|---|

| Technology | Strong momentum continuing | Coming off strong 2025; AI driving activity |

| Healthcare | Including biotech this year | Added senior bankers; "pretty excited" about positioning |

| Diversified Industries | SRI Initiative tailwind | Targeting market share gains in all 28 subsectors |

"If you don't get those three right, you're not generally gonna have a good year in investment banking," Rohrbaugh emphasized.

Security & Resiliency Initiative: $10 Billion and Growing

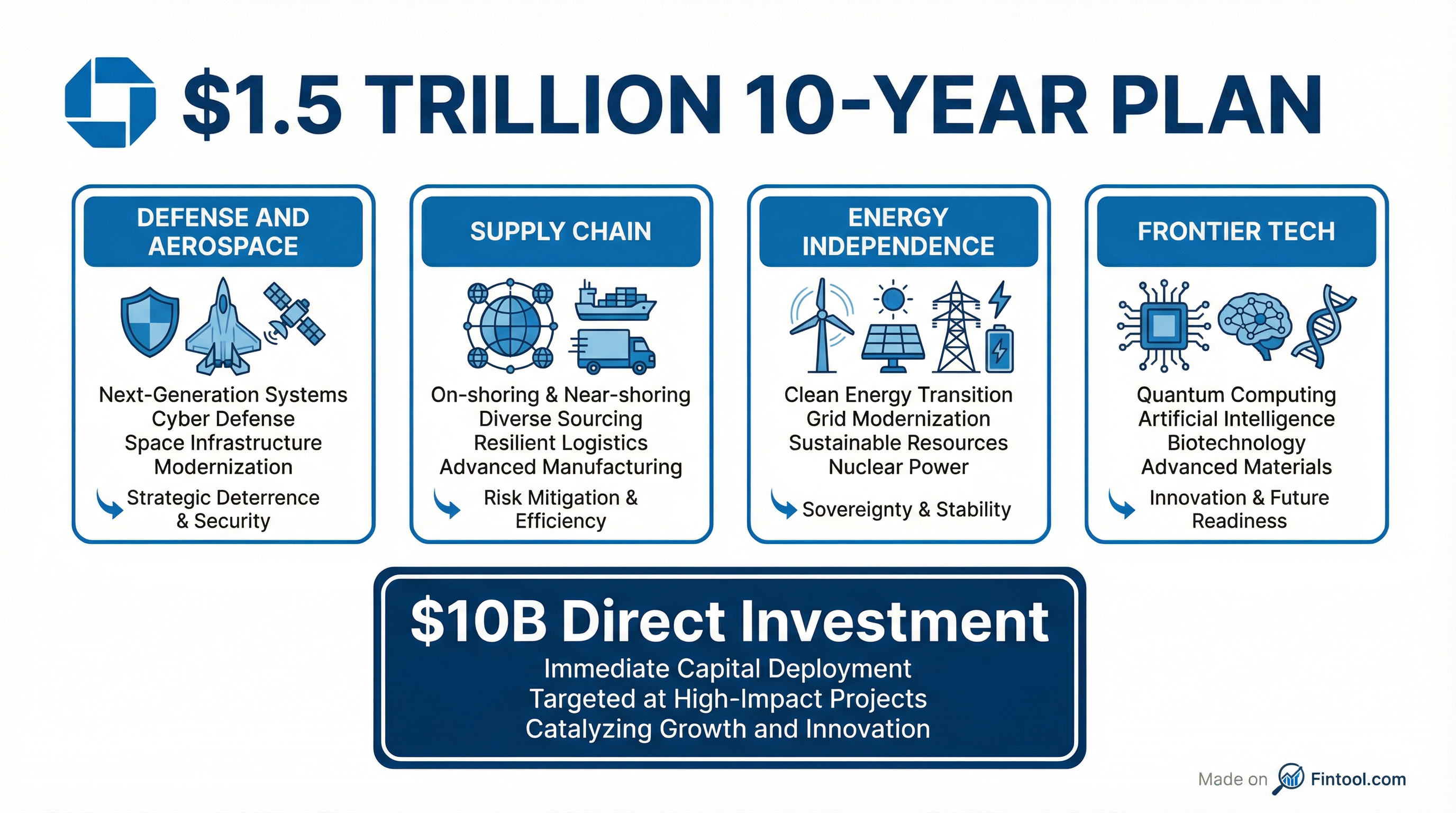

A key differentiator for JPMorgan's 2026 strategy is the Security and Resiliency Initiative (SRI), announced in October 2025. The $1.5 trillion, 10-year plan includes up to $10 billion of JPMorgan's own capital for direct equity investments.

Rohrbaugh provided new color on the initiative's scope: "We identified originally 27 subareas. We now are at 28."

The math is compelling. Over the past decade, JPMorgan deployed approximately $100 million annually in financing across these sectors—just under $1 trillion over 10 years. With SRI, the firm expects to increase that by at least 50% to $1.5 trillion.

"I actually think it'll be bigger than that," Rohrbaugh added. "When you think about the tailwinds of reshoring, the investments from a strategic nature that we here in the United States, North America, and our allies need to make, I think there's a lot of reasons that that number could be bigger."

The initiative's advisory council—announced in December—includes Jeff Bezos, Michael Dell, and Ford CEO Jim Farley, with Todd Combs (formerly of Berkshire Hathaway) heading the Strategic Investment Group.

Direct Lending: $50 Billion Firepower

JPMorgan's push into private credit continues to accelerate. Rohrbaugh confirmed the firm now has "a little bit over 12, roughly $14 billion" on its own balance sheet in direct lending, with capacity announced up to $50 billion and approximately $25 billion in partner capital.

The strategy is explicitly not about competing with private credit funds, but rather positioning JPMorgan as a solution-agnostic partner: "Our number one goal is to be agnostic to the borrower's need, to be able to go in and provide a whole set of solutions."

This represents a significant expansion from February 2025, when JPMorgan formally announced its $50 billion direct lending commitment at its Global Leveraged Finance Conference.

| Direct Lending Metric | Amount |

|---|---|

| On Balance Sheet | $14B |

| Announced Capacity | Up to $50B |

| Partner Capital | $25B |

| Total Deployable | $75B+ |

Markets: The "New Normal" Is Durable

On the markets business, Rohrbaugh made the case that post-COVID trading levels are sustainable—not an anomaly to be normalized away.

"We saw a little bit of normalization, and then it really quickly went back to that 2020 year. And then you saw the last two years, like, a significant expansion," he explained.

Three structural shifts underpin his confidence:

- Base volatility is "significantly higher" than the pre-COVID, post-GFC years

- Corporate wallet has grown substantially, creating new opportunities

- Financing demand has expanded dramatically as alternatives and sponsors have grown

"Our boss likes to call markets revenue the weather," Rohrbaugh quipped. "It's, like, very hard to predict, and we're gonna try and do as well as possible."

AI: 400 Projects and Counting

JPMorgan is deploying AI aggressively across the CIB, with Rohrbaugh revealing "roughly 400 AI projects" currently active.

The cost side is already delivering results. KYC and AML operations have seen "roughly a 40% reduction" in unit costs. But Rohrbaugh is most excited about revenue opportunities:

"We're seeing real revenue growth with our AI projects in our prime finance business. We're seeing it in our FX business. We're seeing it with our bankers in terms of helping them be more efficient, knowing the clients to call, knowing the deals to pursue."

On whether the benefits can be retained versus competed away, Rohrbaugh was pragmatic: "If you're gonna say, 'We're gonna provide you with this extra service because of our capability in AI, and we want you to pay for it on top of what you already pay us as a client,' that's gonna be difficult."

But efficiency gains in trading and service delivery should be more defensible: "That we should be able to retain a reasonable part of. But as other people deploy it, I think it's one of these things where the benefits will be shared between us and the customer."

Hiring 1,000 Bankers

The firm's commitment to growth is reflected in aggressive hiring. JPMorgan added "roughly 1,000 people last year in the front office. About a third of those are senior bankers," Rohrbaugh disclosed.

The hiring spans three key areas:

- Commercial Bank (CB): Continued expansion across U.S. locations, particularly in the innovation economy

- Global Corporate Bank (GCB): Growth on a global basis, partnering with payments offerings

- Global Investment Bank (GIB): SRI-related hires and targeting market share gains in subsectors where JPMorgan is not #1

"We're not gonna, in the GIB space or really anywhere in global banking, focus on quantity over quality," Rohrbaugh emphasized.

Q1 2026: "Started Well"

When asked for an update on current quarter trends, Rohrbaugh offered a restrained but positive assessment: "The way I would say is it started well across the franchise."

He deferred detailed guidance to the Company Update scheduled for February 23, when JPMorgan's executive team will provide a comprehensive review of firm performance and 2026 outlook.

What This Means for Investors

JPMorgan enters 2026 with multiple tailwinds: a strengthening M&A pipeline, a differentiated $1.5 trillion security initiative, expanding private credit capabilities, and AI-driven efficiency gains.

The key question is whether mid-teens wallet growth materializes. Rohrbaugh's admission that "you're gonna need a lot of things to go right" suggests upside remains contingent on avoiding exogenous shocks—an outcome he acknowledged is never guaranteed in the current geopolitical environment.

For now, the early Q1 read is encouraging. JPMorgan's scale, capital position, and strategic initiatives position it to capture an outsized share of whatever wallet emerges.

| Key JPMorgan Metrics | Q4 2025 | Full Year 2025 |

|---|---|---|

| CIB Net Income | $7.3B | — |

| CIB Revenue | $19.4B (+10% YoY) | — |

| Markets Revenue | $8.2B (+17% YoY) | — |

| IB Fees | $2.3B (-5% YoY) | #1 Global Ranking, 8.4% wallet share |

| Firm-wide Net Income | $13.0B | $57.5B (excl. items) |

| ROTCE | 18% | 20% |

Sources: Q4 2025 Earnings Materials

Related Companies: JPMorgan Chase | Goldman Sachs | Morgan Stanley | Citigroup | Bank of America | Wells Fargo