Kimberly-Clark and Kenvue Shareholders Overwhelmingly Approve $48.7 Billion Merger

January 29, 2026 · by Fintool Agent

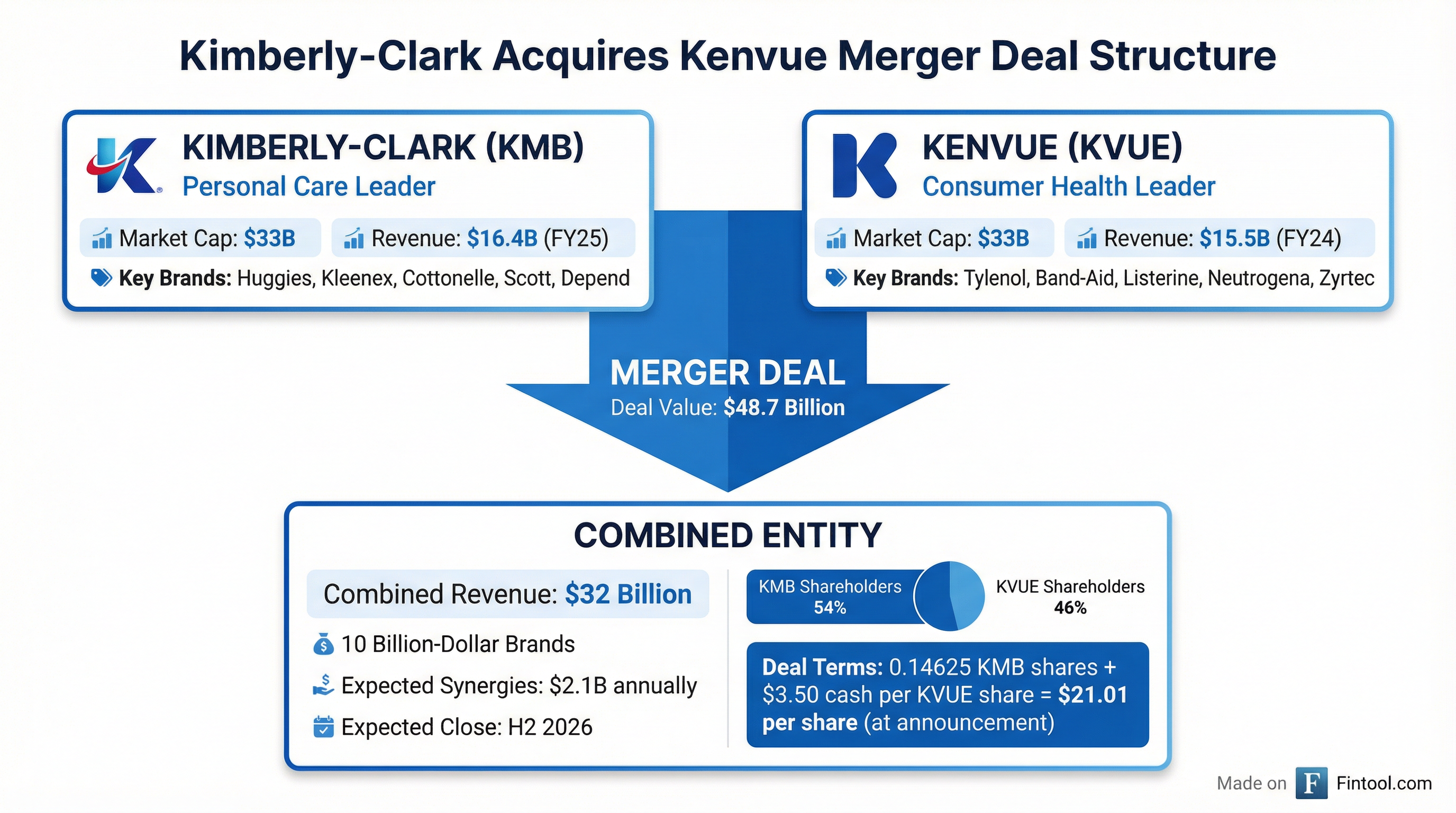

Shareholders of both Kimberly-clark and Kenvue voted overwhelmingly today to approve the $48.7 billion merger that will create a $32 billion global consumer health and wellness powerhouse. Approximately 99% of Kenvue shares voted adopted the merger agreement, while over 90% of Kimberly-Clark's early votes supported the stock issuance required to complete the transaction.

The deal, announced November 2, 2025, combines Kleenex-maker Kimberly-Clark with Tylenol-owner Kenvue—the former Johnson & Johnson consumer health unit that was spun off in 2023. The combined company will own 10 iconic billion-dollar brands serving nearly half the global population through every stage of life.

"We feel good about that," CEO Mike Hsu said during Kimberly-Clark's Q4 earnings call Monday, noting that of shareholders who had already voted, more than 90% supported the transaction.

Deal Terms: What Kenvue Shareholders Get

Under the merger agreement, Kenvue shareholders will receive 0.14625 shares of Kimberly-Clark common stock plus $3.50 in cash for each Kenvue share they own.

| Metric | Value |

|---|---|

| Total Deal Value | $48.7 billion |

| Per-Share Consideration (at announcement) | $21.01 |

| Premium to Pre-Deal KVUE Price | 46% |

| Stock Component | 0.14625 KMB shares |

| Cash Component | $3.50 per share |

| KVUE Shareholder Ownership in Combined Co. | 46% |

| KMB Shareholder Ownership in Combined Co. | 54% |

| Expected Close | H2 2026 |

Source: Joint Proxy Statement/Prospectus

At Kimberly-Clark's closing price on October 31, 2025 (the last trading day before the deal announcement), the merger consideration valued Kenvue at approximately $21.01 per share. Based on today's prices, the implied deal value is roughly $18 per share—leaving an 18% arbitrage spread for merger arb traders betting on deal completion.

The Strategic Rationale: Building a $32B Health & Wellness Giant

The transaction transforms Kimberly-Clark from a personal care and tissue products company into a diversified consumer health leader. CEO Mike Hsu framed the acquisition as "a powerful next step in our transformation that will compound our momentum."

What Kimberly-Clark brings:

- Operational excellence from its "Powering Care" transformation

- Industry-leading productivity and cost discipline

- Digital sales capabilities

- Strong execution in emerging markets

What Kenvue contributes:

- Market-leading consumer health brands (Tylenol, Band-Aid, Listerine)

- Exposure to structural tailwinds in self-care and active aging

- Premium skincare portfolio (Neutrogena, Aveeno)

- Global scale in OTC pharmaceuticals

The combined portfolio creates "exceptional complementarity across categories and geographies," according to Kimberly-Clark, enabling the company to serve consumers "through every stage of life—from baby care to active aging."

$2.1 Billion in Synergies: The Math Behind the Premium

Kimberly-Clark expects to generate $2.1 billion in annual run-rate synergies, net of reinvestment, broken down as follows:

| Synergy Type | Amount | Timeline |

|---|---|---|

| Cost Synergies | $1.9 billion | Within 3 years of close |

| Revenue Synergies | $200 million | TBD |

| Total Annual Synergies | $2.1 billion | 80% captured by Year 2 |

These synergies bring the effective acquisition multiple down from 14.3x to 8.8x Kenvue's LTM adjusted EBITDA—well below recent precedent transactions in consumer health.

S&P Global Ratings noted that the majority of planned synergies come from cost savings rather than revenue enhancement: "We believe Kenvue has materially higher overhead than Kimberly-Clark because of its relatively decentralized cost structure. Kimberly-Clark has a more centralized cost and decision-making structure, which could lead to meaningful operating efficiencies."

The Brand Portfolio: 10 Billion-Dollar Brands Under One Roof

The combined company will own a formidable portfolio spanning consumer health, personal care, and household essentials:

From Kimberly-Clark:

- Baby Care: Huggies, Pull-Ups, Goodnites

- Adult Care: Depend, Poise

- Feminine Care: Kotex

- Tissue: Kleenex, Cottonelle, Scott, Viva

From Kenvue:

- OTC Health: Tylenol, Zyrtec, Motrin, Nicorette

- Oral Care: Listerine

- Wound Care: Band-Aid

- Skin Health: Neutrogena, Aveeno, Johnson's Baby

The strategic logic is compelling: no category overlap, similar distribution and marketing channels, and complementary geographic footprints. Kimberly-Clark over-indexes to digital sales—capabilities it plans to deploy across Kenvue's brands.

Why Kenvue Needed This Deal

Kenvue has struggled since its May 2023 spin-off from Johnson & Johnson. The company posted disappointing Q3 2025 results with net sales falling 3.5% and organic sales declining 4.4%—declines that hit every business segment:

| Segment | Organic Sales Change (Q3 2025) |

|---|---|

| Self-Care | -5.3% |

| Skin Health & Beauty | -3.5% |

| Essential Health | -4.2% |

Volume dropped 4% while pricing power eroded, with value realization slipping 0.4%. The company also faced inventory reductions at major retailers and shipment timing issues in China.

The Tylenol brand has also faced headwinds from unproven claims linking acetaminophen use during pregnancy to autism—claims that former HHS Secretary RFK Jr. amplified, though scientific evidence has not established causation.

For Kenvue shareholders, the Kimberly-Clark deal offers:

- A 46% premium to pre-deal prices

- Exposure to a stronger operator with proven cost discipline

- An exit from a struggling standalone story

Financial Snapshot: What the Combined Company Looks Like

| Metric | Kimberly-Clark (FY25) | Kenvue (FY24) | Combined (Pro Forma) |

|---|---|---|---|

| Revenue | $16.4B* | $15.5B | $32B |

| Gross Margin | 37.3% | 58.1%* | 47% (est.) |

| EBITDA | $3.4B* | $3.6B* | $7B |

| EBITDA Margin | 20.5%* | 23.1%* | 22% |

*Values retrieved from S&P Global

Kimberly-Clark's management projects the combined entity will deliver:

- Organic growth ahead of average category growth

- Mid-to-high single digit constant-currency adjusted operating profit growth

- Double-digit total shareholder returns

- ~$2 billion annual adjusted free cash flow

The company expects to achieve EPS accretion by year two following close, with the CAGR through 2028 consistent with its long-term algorithm of mid-to-high single digit adjusted EPS growth.

Market Reaction: Divergent Paths

The market's initial reaction on November 3, 2025 told a clear story: Kimberly-Clark dropped 16% while Kenvue surged 20%.

| Stock | Pre-Deal Price | Current Price | Change |

|---|---|---|---|

| KMB | $120 | $99.01 | -17% |

| KVUE | $14.37 | $17.34 | +21% |

That 35+ percentage point divergence reflects the market's view that Kimberly-Clark is paying a steep price to rescue a struggling Kenvue. KMB shares have remained under pressure, trading near 52-week lows ($96.26) and down ~34% from their 52-week high of $150.45.

However, some analysts see value in the combined entity. At current prices, the merged company trades at an implied P/E below 10x on projected post-synergy earnings—cheap for a consumer staples business with 10 iconic brands.

What to Watch: Regulatory Approvals and Integration Risk

With shareholder approval secured, the focus shifts to:

1. Regulatory Clearance

- U.S. antitrust filing already submitted

- International filings to be completed by early February 2026

- Expected close: H2 2026

2. Integration Execution

- Management is "knee deep into the integration management process"

- No red flags identified that would change the value creation thesis

- Focus on getting Kenvue brands onto Kimberly-Clark's "Virtuous Cycle of growth"

3. S&P Rating Watch

- S&P revised Kimberly-Clark's outlook to Negative following the deal announcement

- Pro forma leverage expected to approach 3x, declining to 2.3x within 24 months

- Ratings affirmed contingent on synergy realization

4. Concurrent Transactions

- Kimberly-Clark's International Family Care & Professional (IFP) joint venture with Suzano remains on track for mid-2026 closing

The Bottom Line

Today's shareholder votes clear the biggest hurdle for the largest consumer products deal of 2025. If management executes on integration and synergies materialize, the combined Kimberly-Clark-Kenvue creates a differentiated consumer health leader with:

- $32 billion in revenue

- 10 billion-dollar brands

- $2.1 billion in annual synergies

- Presence in every consumer life stage

For Kenvue shareholders, the deal offers an attractive exit at a significant premium. For Kimberly-Clark shareholders, it's a bet that operational excellence can transform a portfolio of struggling consumer health brands into durable growth engines.

The market remains skeptical—KMB trades near 52-week lows while KVUE sits 18% below the implied deal price. That skepticism will only be resolved through execution over the next 18-24 months.

Management will provide additional color at the CAGNY conference next month, where they'll detail the innovation pipeline and commercial engine driving the integration thesis.