Kioxia's 540% Rally Makes It 2025's Best-Performing Stock Globally

December 31, 2025 · by Fintool Agent

A Japanese memory chipmaker that listed just 13 months ago has emerged as the world's best-performing stock of 2025, outpacing every company in the MSCI World Index—including Nvidia, Alphabet, and the rest of Silicon Valley's AI darlings.

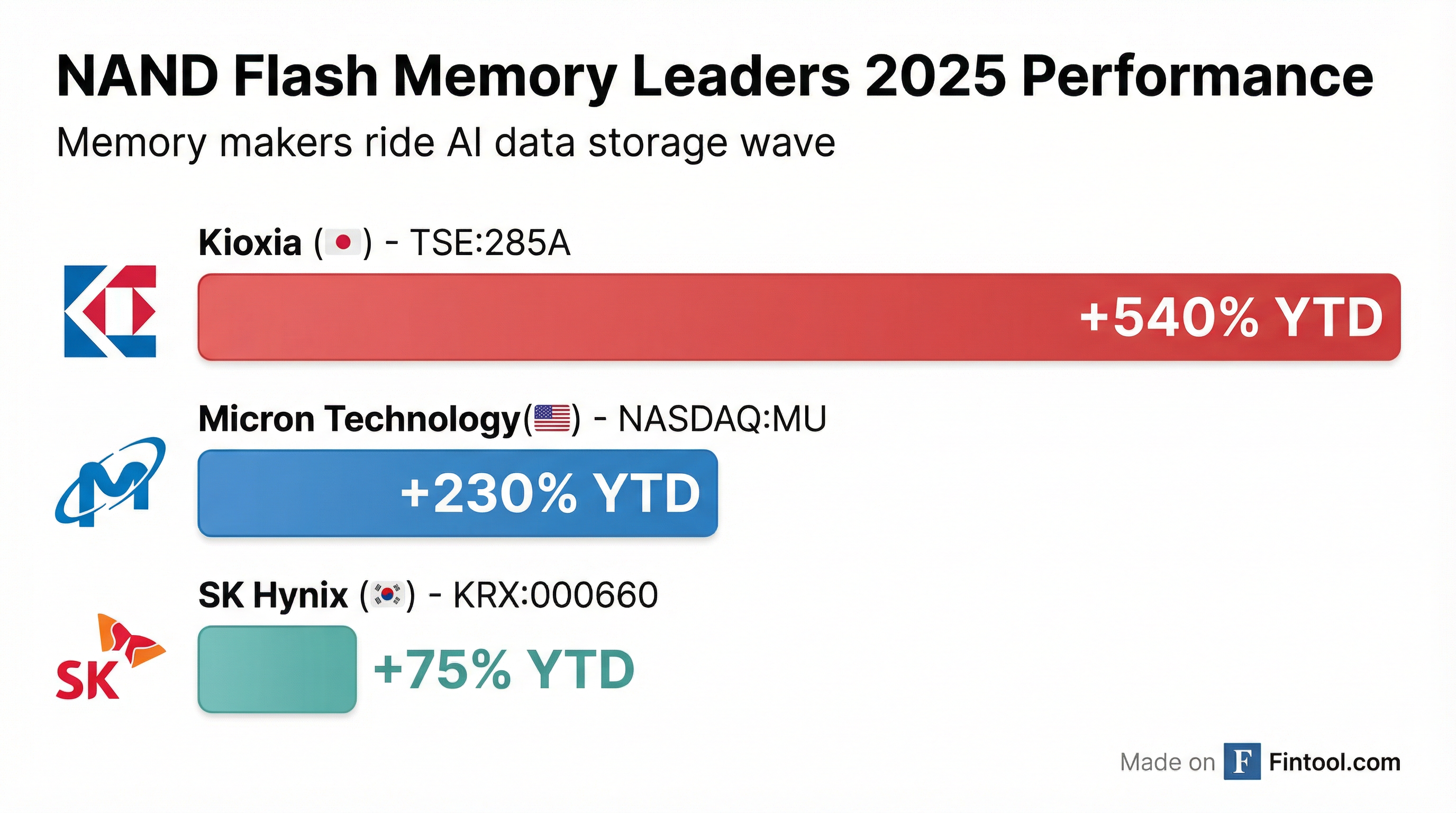

Kioxia Holdings (TSE:285A) surged 540% in 2025, propelling the Tokyo-based company to a market capitalization of approximately ¥5.7 trillion ($36 billion). The rally reflects an often-overlooked truth about the AI boom: artificial intelligence runs on memory as much as compute.

The AI Memory Bottleneck

While graphics processing units have commanded headlines and trillion-dollar valuations, a quieter crisis has been brewing in data storage. AI systems don't just need powerful chips to "think"—they need vast amounts of memory to store and rapidly access the enormous datasets required for training and inference.

NAND flash memory, the type of chip that holds information even when devices are turned off, has become a critical bottleneck. Market trackers estimate that demand for memory already exceeds supply by approximately 10%, creating shortages and pushing prices sharply higher. Buyers paid roughly 50% more quarter-over-quarter for standard DRAM in recent months, with rush orders costing multiples of that.

The shortage extends beyond AI, pushing up costs for smartphones, PCs, gaming devices, and other consumer electronics that rely on the same chips.

From Overlooked IPO to Market Leader

Kioxia's journey to the top wasn't preordained. When the company first came to market in December 2024—its third attempt at an IPO after years of private equity ownership—investors were nursing losses from a semiconductor downturn. Kioxia's heavy debt load and the memory industry's cyclical reputation made it an awkward fit for a market obsessed with GPU-fueled growth.

The company originated from Toshiba's memory division, which invented NAND flash memory in 1987. After being spun out in 2018 and rebranded as Kioxia in 2019, the company spent years in private equity hands before finally going public.

What changed wasn't sentiment toward Kioxia specifically—it was the realization that AI infrastructure requires memory at scale. As hyperscalers rushed to build out data centers, shortages emerged, and the "unglamorous" parts of the AI stack suddenly mattered.

The Hyperscaler Connection

Kioxia counts Apple+0.80% and Microsoft+1.90% among its customers, positioning it at the heart of the AI infrastructure supply chain. Its BiCS FLASH 3D technology underpins high-density storage solutions used in data centers worldwide.

The company has about 7.5 gigawatts of solar and storage in operation with another 8 gigawatts in its development pipeline, with much of that in data-center hot spots like Texas.

American Competitor Mirrors the Surge

The memory rally wasn't confined to Japan. Micron Technology+3.08% (NASDAQ:MU), the only U.S.-based memory manufacturer, delivered a 230% return in 2025—making it one of the best-performing large-cap stocks in America.

Micron's financials underscore the fundamental shift in memory economics:

| Metric | Q2 2025 | Q3 2025 | Q4 2025 | Q1 2026 |

|---|---|---|---|---|

| Revenue ($B) | $8.1 | $9.3 | $11.3 | $13.6 |

| Net Income ($B) | $1.6 | $1.9 | $3.2 | $5.2 |

| Gross Margin | 36.8% | 37.7% | 44.7% | 56.0% |

Revenue nearly doubled in four quarters while gross margins expanded by nearly 20 percentage points—a remarkable transformation driven by AI-related demand.

"AI has radically changed the landscape," Micron's Chief Business Officer Sumit Sadana said on the company's earnings call. "The data center has become more than half of the market and continues to outgrow the rest at very robust profitability levels."

Supply Tightness Set to Persist

The structural forces driving memory prices higher show no signs of abating. According to Micron's management, several factors will constrain supply growth:

- Extended node support: Industry must maintain D4 and LP4 production for end-of-life customers, limiting capacity for newer nodes

- Higher global costs: Building new wafer capacity has become significantly more expensive

- Lean inventories: Both supplier and customer inventories are running below historical levels

- CapEx concentration: Investment is flowing to high-bandwidth memory (HBM) production, limiting standard NAND expansion

"In calendar 2026, we anticipate further DRAM supply tightness in the industry and continued strengthening in NAND market conditions," CEO Sanjay Mehrotra said.

Micron plans to boost capital expenditure from $13.8 billion in fiscal 2025 to approximately $18 billion in fiscal 2026, with the vast majority dedicated to DRAM production.

Valuation Questions Emerge

The stratospheric gains haven't been without volatility. Kioxia tumbled more than 20% in a single session in November after quarterly results failed to meet lofty expectations, reviving concerns about overvaluation in AI-linked stocks.

With memory demand still far outstripping supply, however, analysts remain bullish. Citigroup initiated coverage with a Buy rating and a ¥12,000 price target, arguing the market has yet to fully price in Kioxia's profit potential.

"In tech, we go into 2026 mainly geared to memory, whether that's direct exposure to Kioxia or second derivative plays," said Amir Anvarzadeh, Japan equity strategist at Asymmetric Advisors.

What to Watch in 2026

The memory sector's 2025 performance raises critical questions for 2026:

1. Can pricing hold? Memory has historically been a brutally cyclical business. The current supply-demand imbalance favors producers, but any demand slowdown or capacity additions could reverse pricing gains.

2. Will hyperscalers diversify? Apple, Microsoft, and other major customers may seek to reduce supply chain concentration, potentially spurring investment in alternative suppliers.

3. How will HBM reshape the market? High-bandwidth memory commands premium pricing but requires different manufacturing capabilities. The mix shift toward HBM could benefit some producers more than others.

4. Does the AI capex cycle continue? Memory demand is a derivative of AI infrastructure spending. Any pullback in hyperscaler budgets would ripple through the supply chain.

For now, Kioxia's remarkable 2025 run stands as proof that the AI revolution extends far beyond the companies that dominate headlines—and that some of its biggest winners were hiding in plain sight.

Related Companies

- Micron Technology+3.08% - U.S. memory manufacturer