KKR on Track to Hit $22B for Americas Fund, Setting Strategy Record

January 20, 2026 · by Fintool Agent

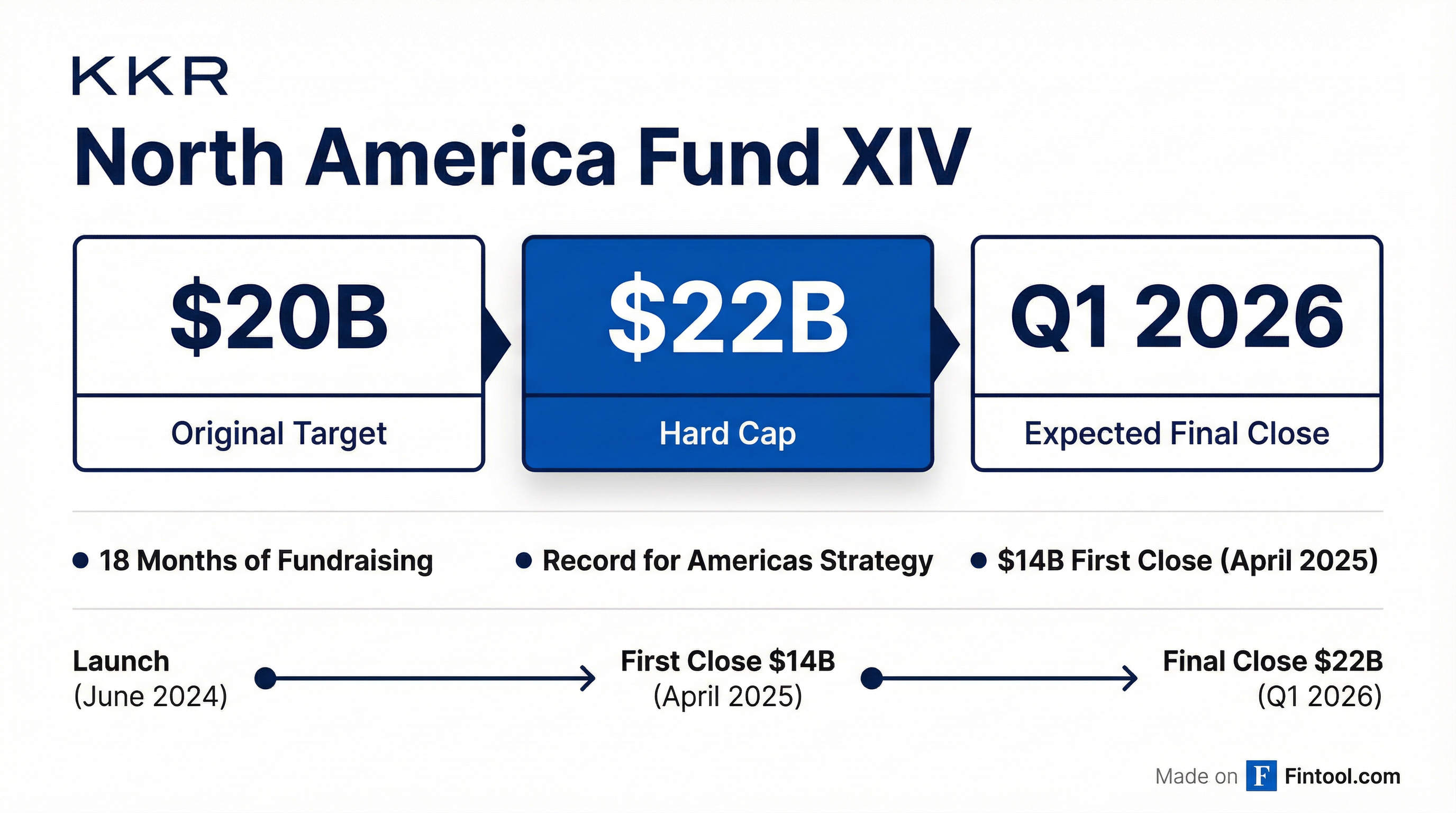

KKR+4.06% is on track to exceed its $20 billion target for its flagship Americas private equity fund and could hit the $22 billion hard cap when it wraps up fundraising in the first quarter, according to people familiar with the matter.

The close would mark a record for KKR's Americas private equity strategy and cement its position among the industry's elite at a time when fundraising is increasingly consolidating around mega-managers.

The Numbers

North America Fund XIV launched in June 2024 with a $20 billion target. By April 2025, KKR had completed an initial close at $14 billion—already 70% of target—thanks to strong investor demand.

"It's a great first step for us and reflects the strong investment returns we've delivered on behalf of our clients alongside a differentiated return of capital profile," CFO Rob Lewin said on the firm's Q1 2025 earnings call.

| Metric | Value |

|---|---|

| Fund Target | $20 billion |

| Hard Cap | $22 billion |

| First Close (April 2025) | $14 billion |

| Expected Final Close | Q1 2026 |

| Fundraising Duration | 18 months |

| Predecessor Fund (XIII) | $19 billion |

The $22 billion close would represent a 16% increase over Fund XIII's $19 billion close in 2022, continuing KKR's pattern of exceeding each successive vintage.

Why KKR Is Winning the Fundraising Game

KKR's success comes down to two key differentiators:

Regional focus over global funds. While competitors like Blackstone+2.25% and Apollo+5.51% often raise massive global buyout vehicles, KKR maintains separate flagship funds for North America, Europe, and Asia. This approach allows for more targeted deployment and diversified carry exposure.

"Our approach here stands in contrast relative to many in our industry as we raise traditional PE funds focused across North America, Europe and Asia compared to the global funds you often see from our competitors," Lewin explained. "This approach, we think, has allowed us to raise more capital."

Strong capital return profile. KKR has returned more capital to its North American private equity clients than it has called for eight consecutive years—a critical metric for LPs evaluating re-ups amid the industry's distribution drought.

Industry Consolidation: The Big Get Bigger

KKR's fundraising success reflects a broader trend: capital is flooding into the largest managers while smaller firms struggle.

In 2025, nearly 46% of all U.S. private equity capital raised went to the top 10 largest funds, up from 34.5% in 2024. The top three largest funds alone captured 23.3% of capital raised—up from 15% the prior year.

"The flight-to-quality trend among limited partners has left some middle market and lower middle market funds struggling," according to industry analysts.

| Fund | Size | Strategy |

|---|---|---|

| Carlyle U.S. Buyout (targeting) | $27B | Buyout |

| Thoma Bravo XVI | $24.3B | Tech Buyout |

| KKR North America XIV (expected) | $22B | Buyout |

| Blackstone Capital Partners IX | $21B | Buyout |

| Veritas Capital IX | $14.4B | Aerospace/Defense |

Global PE fundraising fell 12.7% to $480 billion in 2025, marking a third consecutive year of decline. Yet the top managers continue to outperform, benefiting from LP caution and the preference for established track records.

KKR's Broader Momentum

The Americas fund is just one piece of KKR's fundraising machine. The firm raised $114 billion in total new capital in 2024—its second-most active year ever.

Key growth drivers include:

- Private wealth: K-Series vehicles reached $22 billion in AUM (April 2025), up from $9 billion a year prior

- Infrastructure: Infra Fund V has raised over $11 billion toward its target

- Credit: Asset-based finance and direct lending continue to see strong inflows

- Insurance: Global Atlantic integration providing stable liability-driven capital

"Only 15% of our $114 billion of new capital raised was from our flagship funds," Lewin noted, highlighting the platform's diversity.

Market Reaction

KKR shares closed at $122.90 on Tuesday, down 6.5% amid a broad market selloff triggered by renewed tariff tensions. The decline reflected macro concerns rather than any company-specific news, with the Dow falling 870 points on President Trump's Greenland-related tariff threats.

| Metric | Value |

|---|---|

| Share Price | $122.90 |

| Daily Change | -6.5% |

| Market Cap | $109.5B* |

| 52-Week Range | $86.15 - $170.40 |

*Values retrieved from S&P Global

At current levels, KKR trades roughly 28% below its 52-week high of $170.40, potentially creating an opportunity for investors bullish on the alternatives space.

What to Watch

Near-term: The final close announcement, expected in Q1 2026, will confirm whether KKR hits the $22 billion hard cap.

Asia launch: KKR plans to launch fundraising for its flagship Asia strategy following the Americas fund close.

Infrastructure Fund V: The final close date hasn't been announced, but with $11.3 billion raised, KKR is progressing toward target.

Earnings: KKR's next quarterly report will provide updated color on fundraising momentum and deployment activity.

The successful close of North America Fund XIV would underscore KKR's ability to raise capital at scale even in a challenging environment—a competitive advantage that's increasingly difficult for smaller managers to replicate.

Related: