Harvard's Endowment Chief Bets $5.25 Million on KKR After 30% Plunge

February 17, 2026 · by Fintool Agent

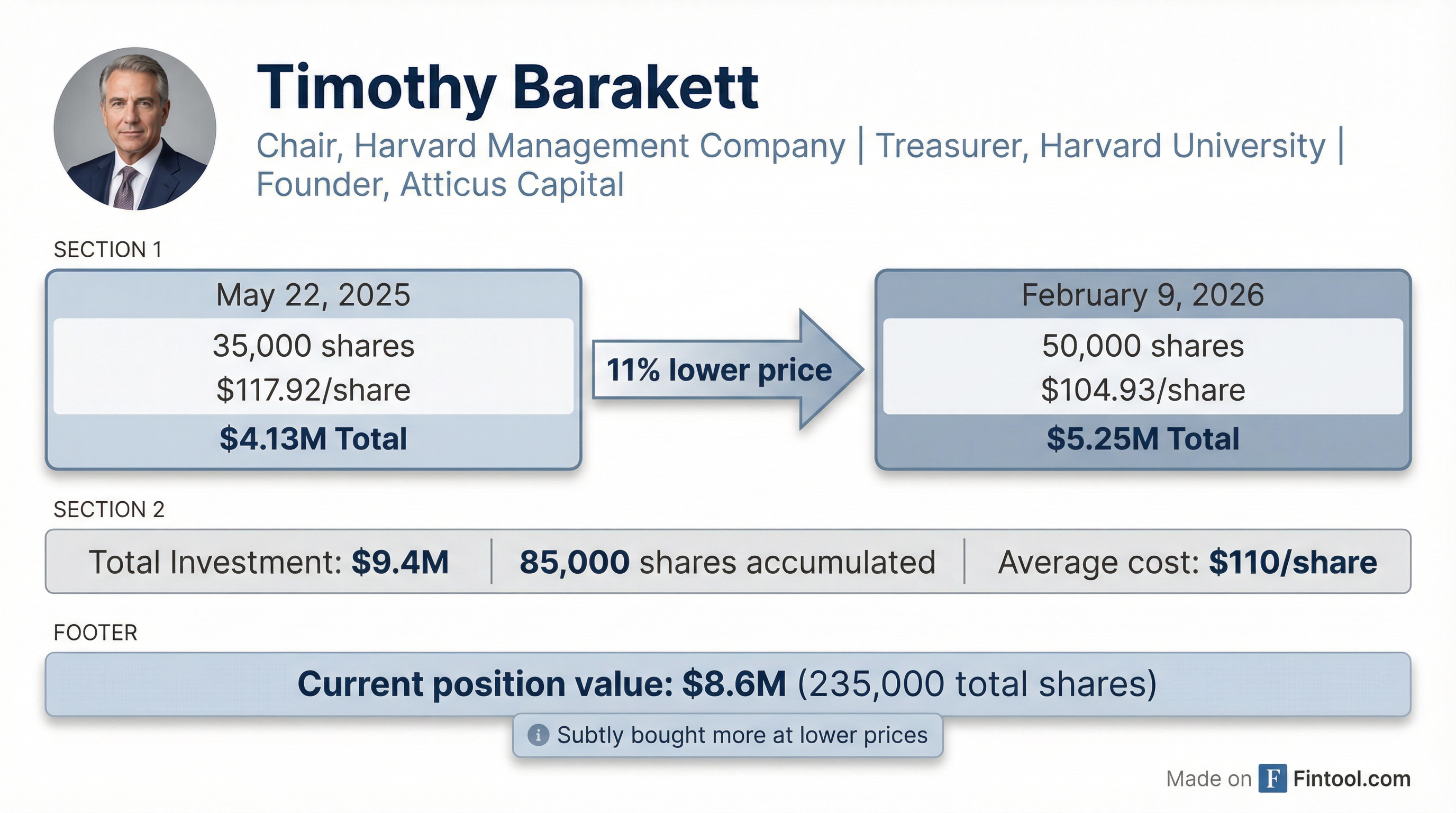

Timothy Barakett—the man who oversees Harvard University's $50+ billion endowment—just put $5.25 million of his own money into KKR stock, making it his second major purchase in nine months as shares trade near their lowest levels since early 2024.

The director acquired 50,000 shares on February 9, 2026 at an average price of $104.93—about 11% below his previous purchase price of $117.92 in May 2025. The timing is notable: Barakett bought just four days after KKR's stock plunged 7% following a slight earnings miss and questions about the firm's exposure to AI-related software risks.

For context, this isn't a board member fulfilling a perfunctory governance requirement. Barakett built one of the most successful hedge funds of his generation—Atticus Capital peaked at over $20 billion in assets—and now chairs the Harvard Management Company, where his job is quite literally to identify the best risk-adjusted returns across global markets.

The Double-Down

Barakett was appointed to KKR's board in March 2025. Since then, he's bought stock twice:

| Date | Shares | Price | Total Value |

|---|---|---|---|

| May 22, 2025 | 35,000 | $117.92 | $4.13M |

| February 9, 2026 | 50,000 | $104.93 | $5.25M |

| Total | 85,000 | ~$110 avg | $9.38M |

His total position now stands at 235,000 shares valued at approximately $24 million at current prices.

What makes this interesting: Barakett's first purchase is currently underwater by about 14%. Yet rather than wait for a recovery, he added more than $5 million at lower prices. This is textbook value investor behavior—averaging down on conviction.

Why the Stock Crashed

KKR shares have fallen roughly 30% from their October 2025 highs of nearly $154 to around $102 today. The catalyst was the February 5 earnings report, where several factors combined to spook investors:

Slight earnings miss: Adjusted net income per share came in at $1.12 versus the $1.16 consensus estimate—a 3% miss that normally wouldn't move the stock much.

$350 million clawback: The company took a charge related to carried interest repayment obligations on its Asia II private equity fund.

AI anxiety: Analysts pressed management on exposure to software companies that might be disrupted by AI. Co-CEO Scott Nuttall responded that only about 7% of AUM is tied to software—"well below industry averages"—and that KKR has "proactively reduced holdings vulnerable to AI disruption."

Sector contagion: Alternative asset managers broadly sold off as fears about software portfolio markdowns spread. Blackstone and Apollo also declined, though less dramatically.

But the Fundamentals Tell a Different Story

Look past the headlines and KKR's Q4 results were actually quite strong:

- Record fundraising: $129 billion raised in 2025—the highest in KKR's 50-year history, and "almost double where we were as a firm two years ago."

- Management fees up 24%: $1.1 billion in Q4, driven by deployment across all strategies.

- Record embedded gains: $19 billion of unrealized carry and balance sheet gains—up 19% year-over-year and 50% over two years.

- Fee-related earnings up 15%: $972 million in Q4 at a 68% margin.

- Insurance economics growing: Total Global Atlantic-related economics reached $1.9 billion in 2025, up 15%.

CFO Rob Lewin reiterated that KKR is "highly confident" it will meaningfully exceed its fundraising and fee-related earnings targets. On the $7+ EPS guidance for 2026: "We continue to feel confident that we can achieve that presuming a constructive monetization environment."

| Metric | Q4 2025 | YoY Change |

|---|---|---|

| Management Fees | $1.1B | +24% |

| Fee-Related Earnings | $972M | +15% |

| FRE Margin | 68% | +200 bps |

| Embedded Gains | $19B | +19% |

| Capital Raised (FY) | $129B | Record |

What Barakett Sees That the Market Doesn't

When the Chair of Harvard's endowment—a $50+ billion portfolio that employs some of the most sophisticated capital allocators in the world—puts nearly $10 million of personal capital into a single stock over nine months, it's worth examining his thesis.

Valuation compression: KKR trades at roughly 18x forward earnings, down from over 30x last year. For a business with 24% management fee growth and record AUM, that's historically cheap.

Permanent capital advantage: Unlike traditional asset managers, much of KKR's capital is long-duration. The Arctos acquisition brings $15 billion of AUM that's "as close to permanent capital as it gets in the asset manager space."

Insurance moat: Global Atlantic isn't just an earnings contributor—it's a captive buyer for KKR's asset-based finance products. The "flywheel" between insurance liabilities and KKR's credit origination creates sustainable competitive advantage.

Embedded value: That $19 billion of unrealized gains will eventually convert to cash. Even if realizations are delayed by market conditions, as CFO Lewin noted, "that would be in service of more earnings in 2027 and beyond."

The Signal

Peter Lynch famously said that "insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise."

Barakett isn't buying because he needs the position for corporate governance. He's not buying because his compensation package requires it. He's buying because a man who has made a career out of identifying mispriced assets believes KKR is mispriced.

The market is pricing in AI disruption risk, software portfolio markdowns, and a challenging monetization environment. Barakett—with full visibility into KKR's portfolio composition, fundraising pipeline, and strategic direction—sees something different: a market leader with record embedded value trading at the lowest multiple in years.

History suggests that when sophisticated insiders buy aggressively into weakness, the market eventually agrees with them.

Related: