Lam Research COO Pat Lord Retires After 207% Stock Surge; Product Chief Sesha Varadarajan Takes Helm

February 03, 2026 · by Fintool Agent

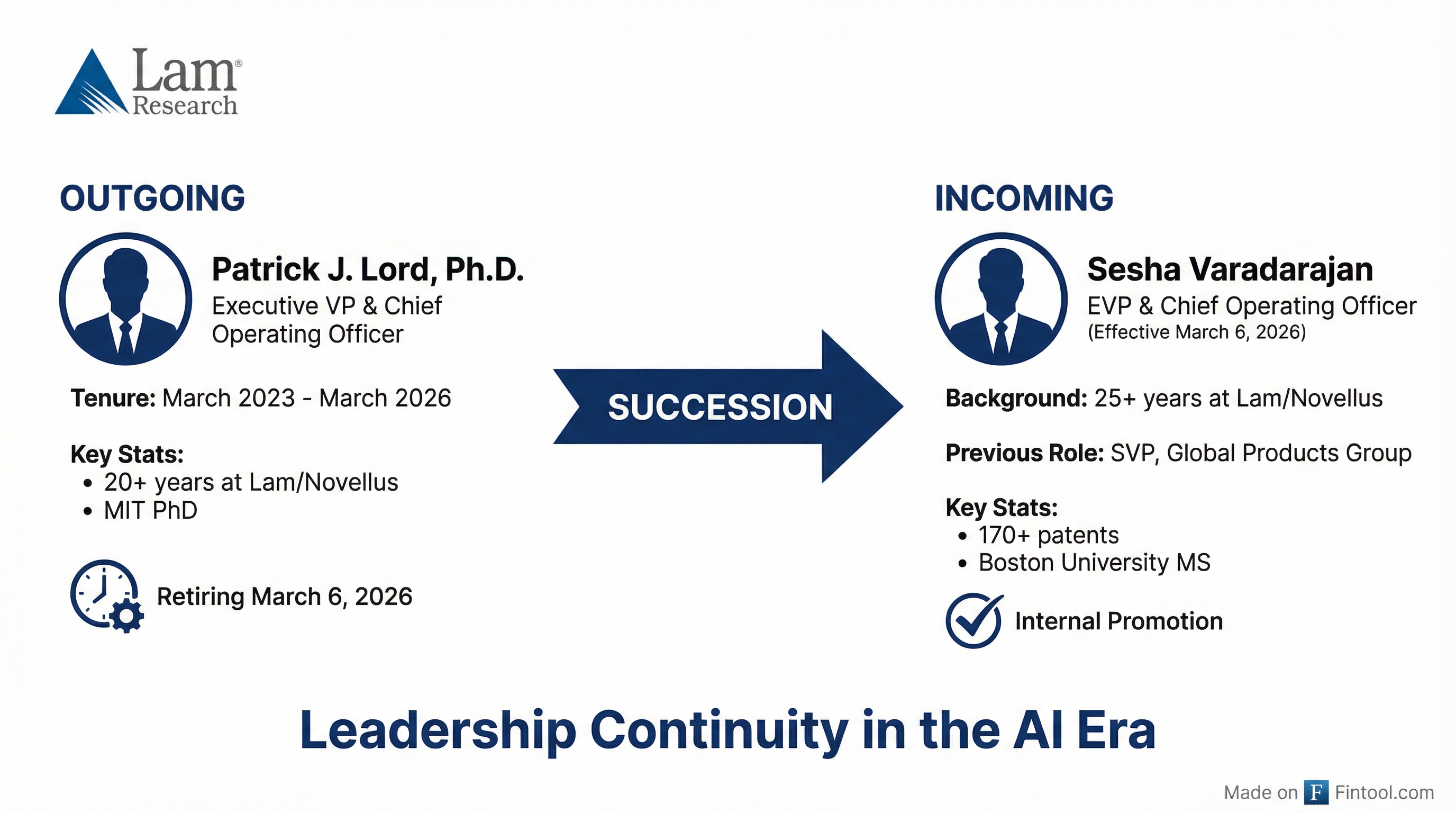

Lam Research announced today that Chief Operating Officer Patrick J. Lord will retire effective March 6, 2026, capping a three-year tenure at the helm of operations during which the semiconductor equipment maker's stock tripled in value.

Sesha Varadarajan, a 25-year company veteran currently serving as SVP of Global Products Group, will step into the COO role—an internal promotion that signals strategic continuity as Lam rides the AI-driven semiconductor supercycle.

LRCX shares fell 3.1% to $230.10 on the announcement, pulling back from a 52-week high of $251.87 reached just four days earlier. The decline appears tied to broader semiconductor sector weakness rather than specific concerns about the transition.

The Transition at a Glance

Pat Lord's Legacy: Operational Excellence Through the Cycle

Dr. Lord's tenure as COO coincided with one of the most dramatic periods in semiconductor equipment history. When he assumed the role in March 2023, Lam was navigating a memory downturn. By his departure, the company is projecting $135 billion in wafer fabrication equipment (WFE) spending for 2026, with AI applications driving unprecedented demand.

Financial Performance Under Lord's Watch:

| Metric | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|

| Revenue | $17.4B | $14.9B | $18.4B |

| Net Income | $4.5B | $3.8B | $5.4B |

| EBITDA Margin | 32.3% | 31.4% | 34.1% |

The COO's responsibilities spanned Global Operations, Customer Support, IT, Cybersecurity, Government Affairs, and Global Resilience—essentially Lam's entire operational backbone.

Lord joined Novellus Systems in 2001 and came to Lam through its 2012 acquisition. Before becoming COO, he ran the Customer Support Business Group (CSBG) and Global Operations. He holds a Ph.D. from MIT.

CEO Tim Archer praised Lord's contributions: "Pat's leadership has helped build the Lam we know today. We thank him for his many contributions and wish him well in his retirement."

Varadarajan: The Product Architect Steps Up

Varadarajan brings deep technical credentials to the COO role. He holds 170+ patents in semiconductor wafer processing and equipment design and has led Lam's product strategy through critical technology transitions.

His background is particularly relevant as Lam expands its served available market (SAM) through new deposition and etch technologies for AI chips. He previously ran the Deposition Business Unit—a critical segment as molybdenum (Moly) interconnects replace tungsten in advanced logic and memory devices.

Varadarajan's Career Progression:

| Period | Role |

|---|---|

| 1999-2004 | Process Engineer, Electrofill BU (Novellus) |

| 2012-2013 | Head, PECVD/Electrofill BU |

| 2013-2018 | Group VP, Deposition Product Group |

| 2018-2023 | SVP & GM, Deposition Business Unit |

| 2023-Present | SVP, Global Products Group |

"With Sesha's and Karthik's newly expanded roles, we are increasing velocity across our operations from product strategy and manufacturing to installation and maintenance to drive Lam's outperformance in the AI era," Archer said.

Stock Performance: Retiring at the Top

Lord's retirement comes at a remarkable moment for Lam shareholders. The stock has surged 207% since January 2024, dramatically outperforming the broader semiconductor equipment sector.

Key Price Milestones:

- 52-week high: $251.87 (January 30, 2026)

- 52-week low: $56.32 (April 7, 2025)

- Current price: $230.10 (down 8.6% from peak)

- 1-year return: +187%

The timing isn't entirely coincidental. Lord established a Rule 10b5-1 trading plan on October 29, 2025—often a precursor to planned executive departures—covering potential sales of 36,645 shares plus options and RSU vesting through October 2026.

Cadence CEO Joins Board: EDA Expertise for the AI Era

In a related move, Lam appointed Anirudh Devgan, CEO of Cadence Design Systems, to its board of directors.

Devgan brings deep expertise in electronic design automation (EDA), computational software, and AI applications—capabilities increasingly important as chip complexity accelerates. Under his leadership, Cadence has pioneered applying AI to engineering design.

Board Chair Abhijit Talwalkar noted Devgan's strategic value: "Anirudh is one of the industry's foremost authorities in EDA and virtualization, as well as an exceptional leader, with a proven ability to drive business growth into strategic new markets."

The appointment expands Lam's board by one seat and adds Devgan to the Innovation and Technology Committee.

Why This Matters for Investors

1. Continuity Over Disruption

This is a textbook succession—internal promotion, planned transition, no activist involvement or sudden departure. Varadarajan knows the products, the customers, and the strategy. The learning curve should be minimal.

2. Strong Position in AI Semiconductor Buildout

Lam is exceptionally well-positioned for the current cycle. Management has highlighted:

- 3x increase in metal deposition SAM for advanced gate-all-around nodes

- $40 billion NAND upgrade opportunity over the next 3-5 years

- Growing advanced packaging business as AI drives chip-on-wafer-on-substrate architectures

3. Operational "Velocity" Is the New Theme

The press release emphasized "velocity"—faster product innovation, quicker manufacturing ramp, more agile service delivery. Both Varadarajan and newly expanded SVP Karthik Rammohan (now overseeing manufacturing, supply chain, IT, and trade) are charged with accelerating execution.

Forward Estimates:

| Metric | Q3 2026E | Q4 2026E | Q1 2027E | Q2 2027E |

|---|---|---|---|---|

| Revenue* | $5.7B | $6.0B | $6.4B | $6.9B |

| EPS* | $1.35 | $1.42 | $1.58 | $1.75 |

*Consensus estimates from S&P Global

What to Watch

- March 6, 2026: Varadarajan officially assumes COO role

- Q3 2026 earnings: First quarter under new COO—watch for operational commentary

- China revenue mix: Management noted December quarter may see lighter China contribution

- Advanced packaging: Track SABER 3D market share gains in copper plating

The Bottom Line

Pat Lord exits on a high note—a 207% stock run, record revenues, and a company at the center of the AI infrastructure buildout. Sesha Varadarajan steps into a well-oiled machine with strong demand tailwinds.

The transition is low-drama by design: no activist pressure, no scandal, no strategic pivot. Lam is betting that promoting the architect of its product portfolio will maintain momentum through the AI-driven WFE cycle.

For shareholders, the risk is minimal. The question isn't whether Varadarajan can keep the ship on course—it's whether semiconductor equipment demand can sustain these extraordinary growth rates.