LKQ Puts Itself Up for Sale After Activist Pressure Mounts

January 26, 2026 · by Fintool Agent

LKQ Corporation announced today that its board has initiated a comprehensive strategic review that includes exploring a potential sale of the entire company, escalating what began as an activist campaign into a full-scale auction process for the $8.7 billion auto parts distributor.

The announcement comes after months of pressure from activist investor Ananym Capital, which has been pushing LKQ to divest its underperforming European business and focus on its more profitable North American operations.

"We have initiated a formal review of strategic alternatives to identify the best path forward to unlock value that is not reflected in our current valuation," said Board Chairman John Mendel.

LKQ shares opened sharply higher at $37.13 but gave back most gains to close at $34.28, up just 0.7% as investors digested the uncertainty around any potential transaction.

The Ananym Pressure Campaign

Ananym Capital, led by Charlie Penner—best known for his role in Engine No. 1's landmark campaign at ExxonMobil—has been in talks with LKQ management since mid-2025 and stepped up its push following the company's disappointing second-quarter results.

The activist has argued that keeping the European and North American businesses together makes little strategic sense and has pointed to LKQ's chronic underperformance versus peers. According to Ananym, LKQ's total shareholder return has lagged its proxy peers by:

- 33% over the last 12 months

- 113% over the last five years

- 253% over the last decade

Ananym has suggested that proceeds from selling the European business could fund a repurchase of up to 40% of outstanding shares, which combined with a re-rating of the North American business to historical multiples could generate 60%+ upside from current levels.

A Company in Transition

Today's announcement is the latest in a series of portfolio moves by LKQ. The company has been actively simplifying its business:

| Date | Action | Details |

|---|---|---|

| August 2025 | Self Service Sale | Sold to Pacific Avenue Capital Partners for $410M |

| December 2025 | Specialty Review | Initiated sale process for Keystone Automotive segment |

| January 2026 | Full Strategic Review | Exploring sale of entire company |

LKQ has engaged BofA Securities as its financial advisor and Wachtell, Lipton, Rosen & Katz as its legal counsel—a heavyweight combination that signals serious intent.

Segment Performance Divergence

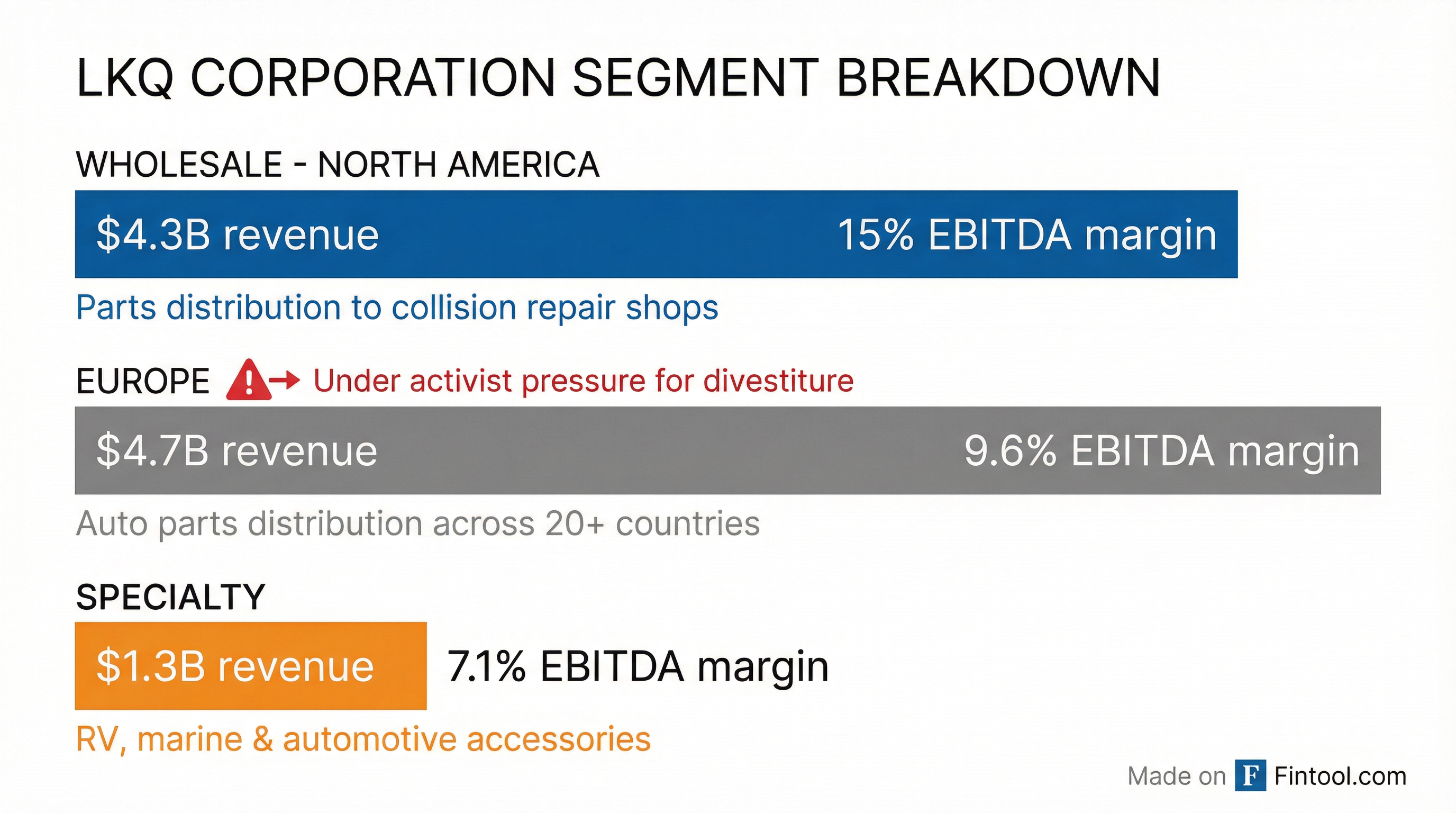

The core issue driving activist interest is the stark performance gap between LKQ's segments:

The company's latest quarterly filing reveals the magnitude of the divergence:

| Segment | YTD Revenue | EBITDA Margin | YoY Change |

|---|---|---|---|

| Wholesale - North America | $4.3B | 15.0% | -1.2 pts |

| Europe | $4.7B | 9.6% | -0.2 pts |

| Specialty | $1.3B | 7.1% | -0.5 pts |

The European segment has struggled with "difficult economic conditions and heightened competition in certain markets," management noted in the Q3 10-Q. Organic revenue declined 4.1% in the first nine months of 2025, partially masked by favorable currency translation.

Meanwhile, the North American Wholesale business, while also facing headwinds from lower repairable claims and increased competition, maintains significantly higher margins and is viewed as the company's core franchise.

Valuation Gap With Peers

LKQ trades at a substantial discount to its auto parts peers:

| Company | Market Cap | P/E Ratio | EV/EBITDA |

|---|---|---|---|

| Autozone | $55.8B* | 28.2x* | 15x |

| O'reilly Automotive | $69.7B* | 29.3x* | 16x |

| Genuine Parts | $19.5B* | 18.0x* | 13x |

| LKQ | $8.7B* | 13x | 7x |

*Values retrieved from S&P Global

Industrial distribution peers typically command mid-teens EBITDA multiples, while LKQ's messy conglomerate structure has kept it trading at a persistent discount. Even on a 10-year historical basis, LKQ has averaged 10x EBITDA—suggesting meaningful upside if the company can either simplify its portfolio or sell to a buyer willing to pay strategic value.

Stock Performance

LKQ shares have been volatile over the past year, trading between a 52-week low of $28.17 and high of $44.05:

The stock is down approximately 22% from its 52-week high, reflecting both operational challenges and broader market uncertainty about the company's direction.

Who Could Buy LKQ?

Potential acquirers fall into two categories:

Strategic Buyers:

- Autozone, O'reilly, and Genuine Parts could be interested in the North American operations, though anti-trust scrutiny would be significant

- European parts distributors might want the continental operations as a regional consolidation play

Private Equity:

- PE firms have been active in auto parts distribution and could take LKQ private

- A breakup scenario is attractive—buying the whole company, selling off pieces, and extracting the valuation discount

- Ananym noted that PE "feasts on these types of projects, using their operational and restructuring expertise" to unlock value

What to Watch

The strategic review has no deadline or fixed timetable. Key catalysts to monitor:

- Q4 2025 Earnings (February 19, 2026) - Management commentary on deal progress

- Specialty Segment Sale - Completion could signal pricing appetite for remaining assets

- Ananym's Next Move - Could push for board seats if process stalls

- PE Interest - Any reports of private equity engagement

- Strategic Bidders - Rumors of industry interest

LKQ stated it "does not intend to disclose or comment on developments related to this review unless further disclosure is appropriate or required by law."

The Bottom Line

LKQ's strategic review represents a capitulation to activist pressure after years of underperformance. The company has a strong North American franchise buried inside a conglomerate structure that markets have consistently undervalued. Whether through a full sale, European divestiture, or continued portfolio simplification, the board appears committed to addressing the valuation gap.

For investors, the key question is whether a buyer will emerge willing to pay a meaningful premium—and how long the process will take. With BofA and Wachtell engaged, the machinery is in place for a transaction. Now it's a matter of finding the right price.

Related: