Earnings summaries and quarterly performance for GENUINE PARTS.

Executive leadership at GENUINE PARTS.

William P. Stengel, II

President and Chief Executive Officer

Alain Masse

President, North America Automotive

Bert Nappier

Executive Vice President and Chief Financial Officer

Christopher T. Galla

Senior Vice President, General Counsel and Corporate Secretary

Naveen Krishna

Executive Vice President and Chief Information and Digital Officer

Board of directors at GENUINE PARTS.

Charles K. Stevens, III

Director

Court Carruthers

Director

Darren Rebelez

Director

Donna W. Hyland

Director

Jean-Jacques Lafont

Director

Juliette W. Pryor

Director

Laurie Schupmann

Director

Matt Carey

Director

P. Russell Hardin

Director

Paul D. Donahue

Non-Executive Chairman

Richard Cox, Jr.

Director

Research analysts who have asked questions during GENUINE PARTS earnings calls.

Bret Jordan

Jefferies

11 questions for GPC

Michael Lasser

UBS

11 questions for GPC

Scot Ciccarelli

Truist Securities

10 questions for GPC

Christopher Horvers

JPMorgan Chase & Co.

6 questions for GPC

Kate McShane

Goldman Sachs

6 questions for GPC

Gregory Melich

Evercore ISI

5 questions for GPC

Greg Malik

TD Securities

4 questions for GPC

Christian Carlino

JPMorgan Chase & Co.

3 questions for GPC

Chris Dankert

Loop Capital

2 questions for GPC

Chris Horvers

JPMorgan

2 questions for GPC

Christopher Dankert

Loop Capital Markets

2 questions for GPC

Greg Melich

Evercore

2 questions for GPC

Katharine McShane

Goldman Sachs Group, Inc.

2 questions for GPC

Mark Jordan

Goldman Sachs Group, Inc.

2 questions for GPC

Seth Basham

Wedbush Securities

2 questions for GPC

Carolina Jolly

Gabelli Funds

1 question for GPC

Recent press releases and 8-K filings for GPC.

- Raymond James upgraded GPC to Strong Buy with a $145 price target, implying roughly 25% upside from current levels.

- The firm’s sum-of-the-parts valuation assigns 15x forward EBITDA to Motion, 10x to North America Auto and 8x to International Auto.

- Separation of the Auto (NAPA) and Industrial (Motion) businesses is expected by Q1 2027, with investor days planned in 2H 2026.

- Key risks include continued weakness in the European auto aftermarket, North American pricing pressure or Motion trading at lower multiples.

- Brightpick formed a strategic partnership with NAPA (Genuine Parts) to deploy AI-powered warehouse robots across distribution centers, enhancing throughput and accuracy.

- Following a successful 2025 pilot, NAPA signed an agreement in early 2026 for an additional site deployment featuring over 100 Brightpick robots, with potential for further rollouts.

- This deal marks Brightpick’s first automotive sector engagement and its largest U.S. customer to date, demonstrating scalability with Fortune 500 companies.

- Brightpick’s goods-to-person robots will integrate with NAPA’s existing technologies to optimize order picking, buffering, consolidation, dispatch, and stock replenishment.

- NAPA operates nearly 6,000 Auto Parts stores in the U.S., supported by a nationwide distribution network and over 560,000 parts, reinforcing the partnership’s scale and impact.

- Plans to separate into two investment-grade, publicly traded companies—Global Automotive (NAPA) and Global Industrial (Motion)—targeting completion in Q1 2027 to unlock shareholder value and tailor strategies.

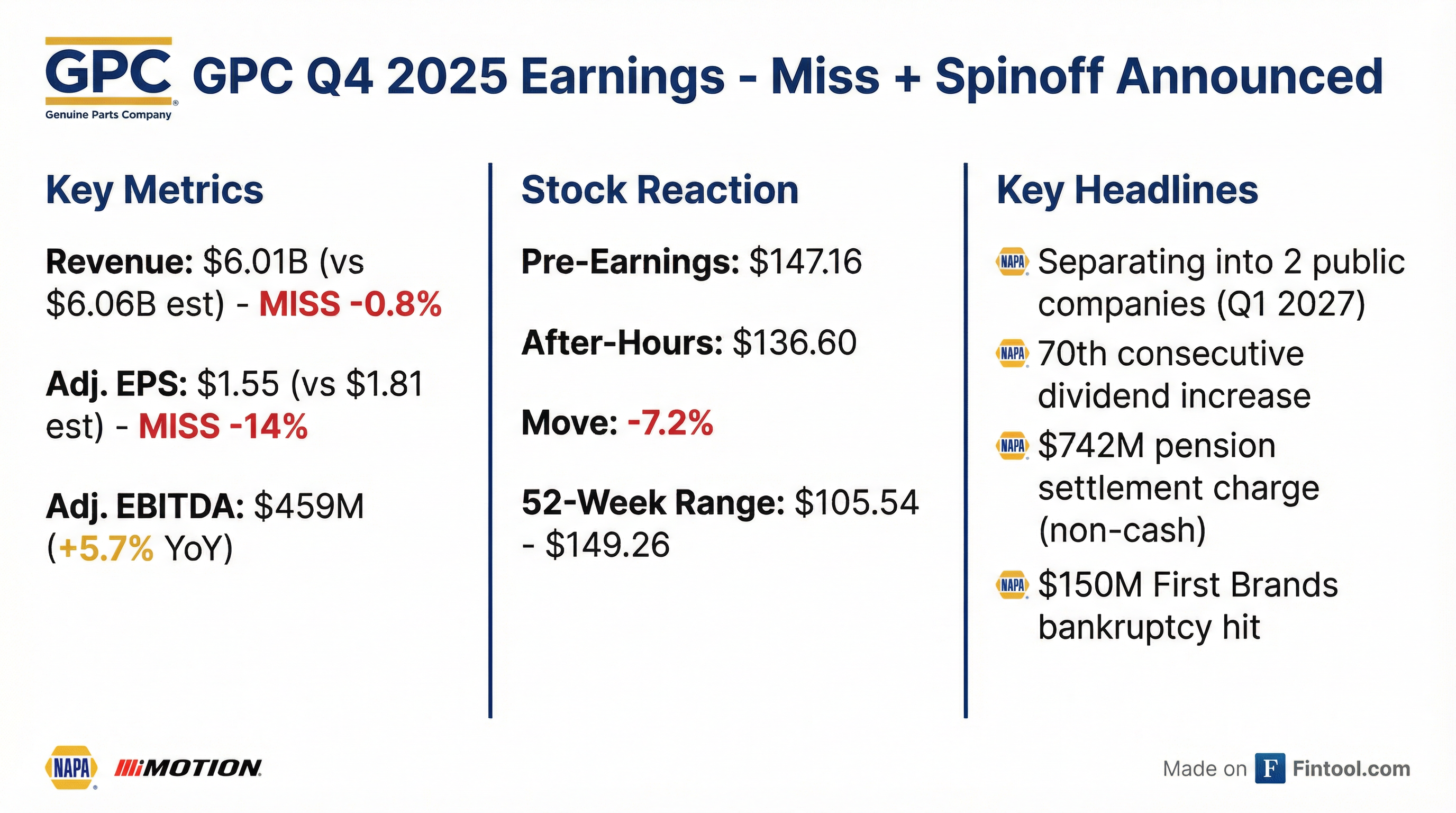

- Q4 2025 sales rose 4%, adjusted gross margin expanded 70 bps, and adjusted EPS was $1.55, with headwinds from depreciation, interest expense, and lost pension income.

- Full-year 2025 adjusted net income was $1.0 billion ($7.37/share), free cash flow was $421 million, and restructuring delivered $175 million of cost savings.

- 2026 guidance calls for adjusted EPS of $7.50–$8.00 (+5% at midpoint), total sales growth of 3%–5.5%, and adjusted EBITDA of $2.0 billion–$2.2 billion.

- Genuine Parts to separate into two independent, publicly traded companies: Global Automotive (NAPA aftermarket parts) and Global Industrial (industrial solutions).

- Q4 2025 sales grew 4% with adjusted gross margin expansion of 70 bps; adjusted EPS was $1.55, down due to depreciation, interest expense, and lost pension income.

- North America comp sales +4%; Europe sales down 2% (local currency) with comp sales down 3%; Asia Pacific sales and comp sales both +5% in Q4.

- 2026 outlook calls for adjusted EPS of $7.50–8.00 (+5% at midpoint vs. 2025), sales growth of 3–5.5%, and adjusted EBITDA of $2.0–2.2 billion, driven by gross margin expansion and restructuring savings.

- Full-year 2025 revenue totaled $24.3 billion with an 8.3% adjusted EBITDA margin, though results fell below expectations due to softer Q4 sales.

- The Board declared the 70th consecutive annual dividend increase, setting FY 2026 cash dividends at $4.25 per share (+3.2% year-over-year).

- Management reiterated plans to separate Global Automotive and Global Industrial into two independent public companies, targeting completion in Q1 2027.

- For 2026, GPC forecasts total sales growth of 3–5.5%, adjusted EBITDA of $2.0–2.2 billion, diluted EPS of $6.10–6.60, and free cash flow of $550–700 million.

- Q4 2025: $6.0 B sales (+4.1%), adjusted gross margin 37.6% (+70 bps), adjusted EBITDA $459 M (+5.7%), adjusted EBITDA margin 7.6% (+10 bps), adjusted EPS $1.55 (−3.7%)

- FY 2025: $24.3 B sales (+3.5%), adjusted gross margin 37.5% (+90 bps), adjusted EBITDA $2.0 B (+0.5%), adjusted EBITDA margin 8.3% (−20 bps), adjusted EPS $7.37 (−9.7%)

- Board approved plan to separate Global Automotive and Global Industrial into two independent, publicly traded companies

- 2026 outlook: total sales growth 3.0–5.5%, adjusted EBITDA $2.0–2.2 B, adjusted EPS $7.50–$8.00

- Announces intent to split into two publicly traded companies—Global Automotive (NAPA) and Global Industrial (Motion)—targeting completion in Q1 2027 to unlock value and tailor growth strategies.

- Reports full-year 2025 sales of $24.3 billion (+3.5%), with 37.6% adjusted gross margin in Q4; full-year adjusted net income of $1 billion ($7.37 EPS) and Q4 adjusted net income of $216 million ($1.55 EPS).

- 2025 segment revenue: Industrial sales $8.9 billion (+2%), North America Automotive sales +3% (comparable +0.5%), International Automotive sales +5% (comparable slight increase).

- 2026 outlook calls for 3%–5.5% total sales growth, adjusted EPS of $7.50–$8.00, 40–60 bps gross margin expansion and $2.0 billion–$2.2 billion adjusted EBITDA.

- Q4 2025 net sales of $6.0 billion, up 4.1% year-over-year, driven by 1.7% comparable sales, 1.5% acquisition growth and 0.9% favorable FX impact.

- GAAP net loss of $609 million (EPS $(4.39)) in Q4; adjusted net income of $216 million (EPS $1.55) with an adjusted gross profit margin of 37.6%, up 70 bps.

- Full-year 2025 net sales of $24.3 billion (+3.5%), GAAP net income of $66 million (EPS $0.47) and adjusted net income of $1.0 billion (EPS $7.37).

- Declared a 3.2% dividend increase, raising the quarterly payout to $1.0625 per share for Q1 2026—marking the 70th consecutive year of dividend hikes.

- Announced a tax-free separation into two independent public companies—Global Automotive and Global Industrial—targeted in Q1 2027.

- Genuine Parts Company will spin off its Automotive Parts Group (“Global Automotive”) and Industrial Parts Group (“Global Industrial”) into independent, publicly traded companies in a tax-free transaction expected to close in Q1 2027 .

- Global Automotive, under the NAPA brand, generated $15 billion in sales and $1.2 billion in EBITDA in 2025 across over 10,000 locations worldwide .

- Global Industrial (Motion) delivered approximately $9 billion in sales and $1.1 billion in EBITDA in 2025, serving over 180,000 customers with 10 million SKUs .

- Separation is intended to enhance strategic clarity, operational focus and financial performance, with each entity targeting investment-grade credit metrics and tailored capital structures .

- Q4 2025 sales of $6.0 billion, up 4.1% YoY; GAAP net loss of $609 million and adjusted net income of $216 million ($1.55/share).

- FY 2025 sales of $24.3 billion, up 3.5% YoY; GAAP net income of $66 million ($0.47/share) and adjusted net income of $1.0 billion ($7.37/share).

- 70th consecutive annual dividend increase to an annual rate of $4.25 per share (quarterly $1.0625), payable April 2, 2026.

- Announced plan to separate its Automotive and Industrial businesses into two independent, publicly traded companies.

- 2026 guidance: total sales growth of 3.0%–5.5% and adjusted EPS of $7.50–8.00.

Fintool News

In-depth analysis and coverage of GENUINE PARTS.

Quarterly earnings call transcripts for GENUINE PARTS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more