Earnings summaries and quarterly performance for W.W. GRAINGER.

Executive leadership at W.W. GRAINGER.

Board of directors at W.W. GRAINGER.

Beatriz Perez

Director

Christopher Klein

Director

Cindy Miller

Director

E. Scott Santi

Lead Independent Director

George Davis

Director

Katherine Jaspon

Director

Lucas Watson

Director

Neil Novich

Director

Rodney Adkins

Director

Steven White

Director

Susan Slavik Williams

Director

Research analysts who have asked questions during W.W. GRAINGER earnings calls.

David Manthey

Robert W. Baird & Co. Incorporated

7 questions for GWW

Ryan Merkel

William Blair & Company

7 questions for GWW

Christopher Glynn

Oppenheimer & Co. Inc.

6 questions for GWW

Christopher Snyder

Morgan Stanley

6 questions for GWW

Jacob Levinson

Melius Research

6 questions for GWW

Patrick Baumann

JPMorgan Chase & Co.

5 questions for GWW

Sabrina Abrams

Bank of America

5 questions for GWW

Deane Dray

RBC Capital Markets

4 questions for GWW

Tommy Moll

Stephens Inc.

4 questions for GWW

Christopher Dankert

Loop Capital Markets

3 questions for GWW

Kenneth Newman

KeyBanc Capital Markets

3 questions for GWW

Thomas Moll

Stephens Inc.

3 questions for GWW

Chris Dankert

Loop Capital

2 questions for GWW

Connor Lynagh

Bernstein

2 questions for GWW

Guy Hardwick

Freedom Capital Markets

2 questions for GWW

Stephen Volkmann

Jefferies

2 questions for GWW

Jake Levinson

Melius Research LLC

1 question for GWW

Katie Fleischer

KeyBanc Capital Markets

1 question for GWW

Ryan Cooke

William Blair & Company

1 question for GWW

Recent press releases and 8-K filings for GWW.

- Grainger delivered 4.5% reported sales growth (4.9% daily organic constant currency) to $17.9 billion in 2025, with 15% operating margin, $39.48 adjusted EPS, $2 billion operating cash flow, and $1.5 billion returned to shareholders.

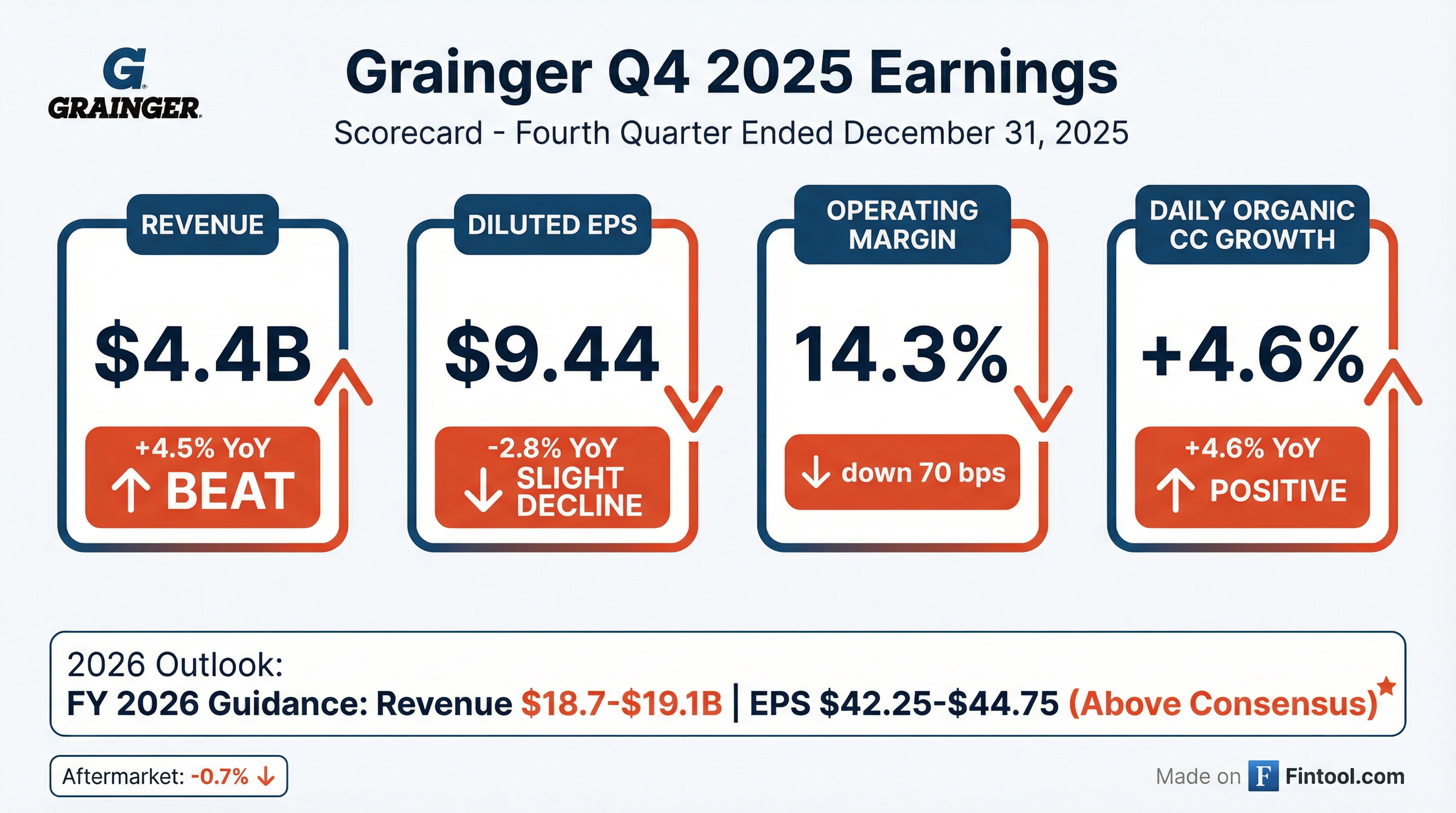

- In Q4 2025, total daily sales grew 4.5% reported (4.6% organic), gross margin was 39.5%, operating margin declined 70 bps, and diluted EPS was $9.44. High-Touch Solutions sales rose 2.2% (42.3% gross margin; 15.8% operating margin), while Endless Assortment grew 14.3% (15.7% organic) with operating margin up 200 bps to 10.6%.

- For 2026, Grainger expects revenue of $18.7–$19.1 billion, daily organic constant currency growth of 6.5–9%, High-Touch Solutions growth of 5–7.5%, Endless Assortment growth of 12.5–15%, and total operating margin of 15.4–15.9%.

- Capital allocation plans include $2.1–$2.3 billion in operating cash flow, $550–$650 million in CapEx, ~$1 billion in share repurchases, and a high-single to low-double digit dividend increase.

- Grainger reported Q4 2025 sales of $4.425 billion, a 4.5% increase year-over-year, with daily sales up to 69.1 (4.5% growth).

- Q4 operating margin declined to 14.3% (down 70 bps), gross profit margin was 39.5%, SG&A at 25.2% of sales, delivering diluted EPS of $9.44, down 2.8%.

- Full-year 2025 sales grew 4.5% (4.9% in daily, organic constant currency), operating margin held at 15.0%, ROIC at 39.1%, operating cash flow was $2.0 billion, returning $1.5 billion to shareholders.

- 2026 guidance includes net sales of $18.7–19.1 billion, daily organic constant currency growth of 6.5–9.0%, operating margin of 15.4–15.9%, and operating cash flow of $2.125–2.325 billion.

- For full year 2025, Grainger delivered 4.5% sales growth to $17.9 billion, 15% operating margin, $39.48 adjusted EPS, 39.1% ROIC, and generated $2 billion operating cash flow, returning $1.5 billion to shareholders.

- In Q4 2025, daily organic constant currency sales rose 4.6% (normalized to ~6.5%), with $9.44 diluted EPS; High-Touch Solutions grew 2.1% organic (42.3% gross margin) while Endless Assortment grew 15.7% organic with segment margin of 10.6%.

- 2026 guidance targets $18.7–$19.1 billion revenue (6.5–9.0% organic growth), 15.4–15.9% operating margin, and $42.25–$44.75 EPS, supported by $550–650 million CapEx and ~$1 billion of share repurchases.

- Continued strategic investments include net 85,000 SKU additions in merchandising, adding 110 new sellers, expanding KeepStock services, and advancing AI/ML capabilities across channels, alongside supply chain capacity expansions in the U.S. and Japan.

- Full-year 2025 sales reached $17.9 B, up 4.5% reported (4.9% daily organic constant currency); operating margin was 15%, EPS $39.48, and operating cash flow was $2 B, returning $1.5 B to shareholders.

- In Q4 2025, daily sales grew 4.5% (4.6% organic constant currency) and EPS was $9.44, down 2.8% year-over-year.

- High-Touch Solutions Q4 sales rose 2.1% organic constant currency with operating margin at 15.8% (down 120 bp), while Endless Assortment sales grew 15.7% organic constant currency and margin improved 200 bp to 10.6%.

- For 2026, Grainger forecasts revenue of $18.7 B–$19.1 B (6.5%–9% daily organic constant currency growth), operating margin of 15.4%–15.9%, and EPS of $42.25–$44.75.

- Delivered Q4 2025 sales of $4.4 billion, up 4.5% (4.6% daily, organic constant currency) and FY 2025 sales of $17.9 billion, up 4.5% (4.9% daily, organic constant currency)

- Reported Q4 diluted EPS of $9.44, down 2.8%; FY 2025 EPS of $35.40 (reported, down 8.6%) and $39.48 (adjusted, up 1.3%)

- Generated $2.0 billion in full-year operating cash flow and returned $1.5 billion to shareholders through dividends and share repurchases

- Issued 2026 guidance of $18.7–$19.1 billion in net sales, 6.5%–9.0% daily organic constant currency sales growth, $42.25–$44.75 diluted EPS, and $2.125–$2.325 billion in operating cash flow

- Net sales of $4.4 billion in Q4, up 4.5% (4.6% daily organic constant currency); full year sales of $17.9 billion, up 4.5% (4.9% daily organic constant currency).

- Operating margin of 14.3% in Q4, down 70 bps; diluted EPS of $9.44, down 2.8%. For FY, margin was 13.9% (15.0% adjusted) and EPS was $35.40 (adjusted $39.48).

- Generated $2.0 billion of operating cash flow and $1.3 billion of free cash flow in 2025; $1.5 billion returned to shareholders through dividends and share repurchases.

- 2026 guidance: net sales growth of 4.2%–6.7% (6.5%–9.0% daily organic constant currency), gross margin of 39.2%–39.5%, operating margin of 15.4%–15.9%, and EPS of $42.25–$44.75.

- Delivered $4.657 billion in sales, up 6.1% year-over-year, with diluted EPS of $10.21, up 3.4% versus Q3 2024.

- Generated operating cash flow of $597 million and returned $399 million to shareholders through dividends and share repurchases.

- High-Touch Solutions sales grew 3.4% to $3.635 billion, while Endless Assortment sales rose 18.2% to $935 million, with respective margin pressures and gains.

- Narrowed FY 2025 guidance to sales of $17.8 – 18.0 billion (+3.9% – 4.7%), gross margin of 38.9% – 39.1%, and adjusted EPS of $39.00 – 39.75.

- Tariff-related LIFO headwind of 0.8% – 0.9% on gross margin (~$140 – 160 million) expected to normalize by mid-2026, stabilizing run-rate at ~39%.

- Q3 sales of $4.7 billion (+6.1% reported, +5.4% constant currency), gross margin 38.6%, operating margin 15.2%, and diluted EPS $10.21 (+3.4%), with $597 million in operating cash flow and $399 million returned to shareholders.

- Agreed to divest UK-based Cromwell business and fully exit the UK market, refocusing on North America and Japan; expects ~$40 million of held-for-sale fourth-quarter revenues and ~20 bp annual operating margin benefit upon exit.

- High-touch Solutions segment sales up 3.4% with a 17.2% operating margin; Endless Assortment segment sales up 18.2% (Zoro U.S. +17.8%, MonotaRO +12.6%) driving operating margin to 9.8%.

- Tariff-related LIFO inventory valuation headwinds drove a 60 bp gross margin decline; company anticipates gross margin recovery to ~39% as LIFO impacts subside and pricing actions normalize.

- Grainger delivered Q3 sales of $4.7 billion (up 6.1% reported; 5.4% daily constant currency), with gross margin at 38.6%, operating margin 15.2%, and diluted EPS of $10.21 (up $0.34 or 3.4%).

- Results included tariff-related LIFO inventory valuation headwinds that were lighter than expected; excluding LIFO, operating margin would have risen year-over-year.

- The endless assortment segment achieved 18.2% reported sales growth (14.6% constant currency), with Zoro US up 17.8% and MonotaRO up 12.6%; segment operating margin improved 100 bps to 9.8%.

- Announced agreement to sell UK-based Cromwell business, fully exiting the UK to focus on North America and Japan.

- Updated 2025 outlook: daily organic constant currency sales growth of 4.4–5.1% and adjusted diluted EPS of $39.00–$39.75; Q4 implied organic growth ~4% and operating margin ~14.5% midpoint.

- Total company sales of $4.7 billion (+6.1% reported; +5.4% daily constant currency), gross margin 38.6%, operating margin 15.2%, and diluted EPS of $10.21 (+$0.34); operating cash flow of $597 million funded $399 million in dividends and share repurchases.

- High-touch solution segment sales +3.4% (driven by volume and price), gross profit margin 41.1% and operating margin 17.2%; endless assortment segment sales +18.2% reported (Zoro US +17.8%; MonotaRO +12.6%), operating margin 9.8%.

- LIFO inventory valuation headwinds totaled ~60 bps drag but were lighter than expected; implied FIFO margin would have grown year over year, and LIFO impacts are forecast to persist into 2026 until inflation cools.

- Updated full-year 2025 guidance: daily organic constant currency sales growth of 4.4–5.1% and adjusted EPS of $39.00–$39.75; Q4 implied sales growth ~4% with operating margin ~14.5%; long-term gross margins expected to stabilize around 39%.

Quarterly earnings call transcripts for W.W. GRAINGER.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more