Mondelez Warns of Muted 2026 as Cocoa Whiplash and Weak Consumers Collide

February 3, 2026 · by Fintool Agent

Mondelez International—the $76 billion snacking giant behind Cadbury, Oreo, and Toblerone—delivered a sobering 2026 outlook after the market close Tuesday, guiding to flat-to-2% organic revenue growth against a Street expecting nearly 4%. Shares fell approximately 4% in after-hours trading as the company warned of a "prudent" year ahead shaped by volatile cocoa, a battered U.S. consumer, and a one-time $500 million cost hit.

The guidance miss is stark: analysts expected 3.84% organic growth and 8.3% profit growth; Mondelez delivered a range of 0-2% revenue and flat-to-5% adjusted profit.

Q4 Beat Masks Underlying Pressure

The fourth quarter itself topped expectations. Revenue rose 9.3% to $10.50 billion, beating the $10.31 billion consensus, driven by 9 percentage points of pricing. Adjusted EPS of $0.72 edged estimates by 2 cents.

But volumes told a different story. Q4 volume declined 4.8 percentage points as price-sensitive consumers balked at multiple rounds of price increases implemented to offset soaring cocoa costs.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|---|

| Revenue ($B) | $9.60 | $9.31 | $8.98 | $9.74 | $10.50 |

| Gross Margin % | 38.6% | 26.1% | 32.7% | 26.8% | 28.2% |

The margin compression tells the cocoa story: gross profit margin collapsed from 38.6% in Q4 2024 to 28.2% in Q4 2025 as the company absorbed surging input costs without fully passing them through.

The Cocoa Whiplash Problem

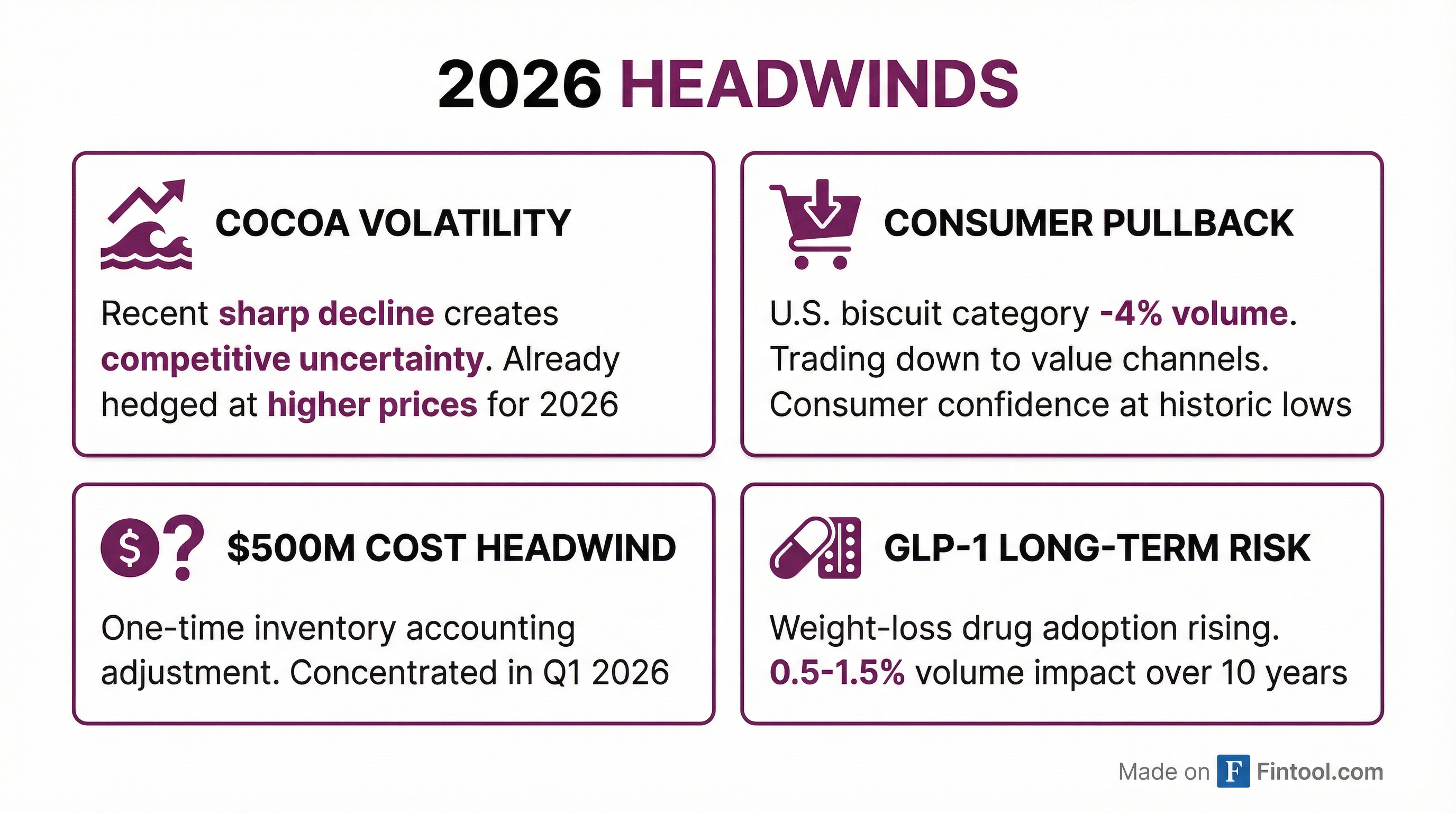

Cocoa prices staged one of the wildest commodity rallies in recent memory, surging 160% in 2024 before plunging in recent weeks. For Mondelez, the timing couldn't be worse.

The company already locked in its 2026 cocoa coverage—at prices "clearly higher than current cocoa spot," as CFO Luca Zaramella put it. That means Mondelez can't cut chocolate prices even as cocoa falls, while competitors who hedged at lower levels or left positions open might undercut them.

CEO Dirk Van de Put framed the challenge bluntly: "In the last two weeks, suddenly the cocoa price has declined more than anybody would have expected. This will have some short-term pressures... This could maybe give us some unexpected competitive reactions."

The guidance range—unusually wide at 0-2%—explicitly builds in flexibility for competitive disruption. "We don't quite know how that is going to play out in the market in 2026," Van de Put added.

U.S. Consumer in Retreat

Beyond cocoa, Mondelez faces a deeper structural challenge: American snackers are pulling back.

The U.S. biscuit category declined 4% in volume over the last three months and 3% for full-year 2025. Management expects this weakness to persist through at least H1 2026.

Van de Put painted a stark portrait of the American consumer: "Consumer confidence is near historic low. They're worried about overall affordability. They are fed up with the price increases. They don't feel good about their personal economic outlook. They doubt about job security."

The average shopping basket hasn't grown in 2-3 years. Within that flat basket, consumers are prioritizing "basics: milk, meat, bread," leaving discretionary snacking squeezed.

This isn't just a Mondelez problem. On the same day, Pepsico announced it would cut prices on Lay's and Doritos by up to 15%—a tacit admission that years of aggressive pricing have hit a wall.

Mondelez is taking a different approach: more brand investment and targeted price-pack architecture rather than outright cuts. "We don't necessarily think that we need to decrease our prices to the magnitude that I heard from another company," Van de Put said, in a clear reference to PepsiCo.

The $500 Million Q1 Hit

Adding to near-term pressure is a $500 million inventory accounting adjustment concentrated primarily in Q1 2026.

The mechanics: under Mondelez's inventory accounting, the company must reset inventory values on January 1 to reflect 2026 pipeline costs—which are lower than where inventory was valued exiting 2025. This creates a non-cash but earnings-impacting adjustment.

"That is a one-time adjustment that takes place on the inventory, and that is causing in the first two quarters, but predominantly in Q1, an impact that is $500 million," Zaramella explained.

Translation: expect Q1 2026 to be particularly ugly on the earnings front, with sequential improvement through the year.

The GLP-1 Elephant in the Room

Analysts continue to probe whether weight-loss drugs like Wegovy and Zepbound pose an existential threat to snacking. Van de Put offered Mondelez's most detailed assessment yet.

The company models GLP-1 impact quarterly, accounting for recent oral approvals and price declines. The conclusion: "We do not see a significant effect on our overall business... it could have a 0.5%-1.5% effect on our overall volumes" over a 10-year horizon, assuming 10-20% U.S. adoption.

Van de Put characterized current adoption as "very modest" with "relatively benign" calorie reduction among users.

The market may be skeptical—GLP-1 adoption is accelerating and insurance coverage expanding—but management is treating it as a manageable headwind rather than category-killer.

2027: The Recovery Year

The bull case for Mondelez centers on 2027. By then:

- Lower cocoa costs flow through: With 2026 hedges rolling off and spot cocoa at normalized levels, chocolate margins should "materially improve."

- Volume stabilizes: Price-driven elasticity fades as inflation anniversaries.

- Brand investments pay off: Mondelez is "substantially" increasing A&C (advertising and consumer) investment in 2026, targeting improved consumption frequency.

"We see our chocolate business in 2027 increase its margin in a considerable way," Van de Put said.

The company is also investing in supply chain modernization across North America—a multi-year program to improve efficiency and flexibility.

What to Watch

Near-term catalysts:

- CAGNY Conference (late February) - Management plans to detail chocolate strategy

- Q1 2026 results - Will show magnitude of inventory headwind

- European customer negotiations - Could drive further volume disruption

Key metrics to monitor:

- U.S. biscuit category volumes (Nielsen data)

- Competitor pricing moves (Hershey, Nestlé, private label)

- Cocoa futures for 2027 hedge levels

The core tension: Mondelez beat Q4 on execution but delivered guidance that crystallizes how many external forces are now working against it—volatile inputs, weakened consumers, and structural questions about snacking's future. 2026 looks like a year to endure, with the payoff pushed to 2027.

Related